The shares of this electronics company just crossed its 50-day moving average—a bullish indicator.

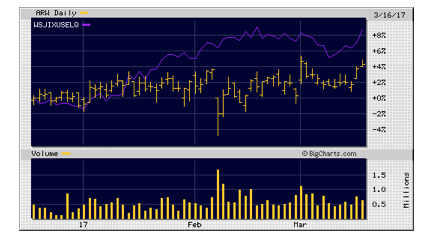

Arrow Electronics (ARW)

From AlphaProfit Sector Investors’ Newsletter

Arrow Electronics’ (ARW) focus on offering value-added services to small- and mid-size businesses is helping it fare well in the competitive electronics wholesaling space. Arrow managed to win $350 million in new business from competitors in 2016.

Arrow’s book-to-bill ratio of 1.1 extends some certainty to its 2017 performance. The Internet of Things should help Arrow grow sales faster than GDP. Its shares appeal to conservative investors seeking growth-at-a-reasonable-price. They trade at 10.4X-forecasted 2017 EPS versus prospects for EPS to grow 8% annually over the next five years.

Sam Subramanian, PhD, AlphaProfit Sector Investors’ Newsletter, www.alphaprofit.com, 281-565-6963, March 2017