This fitness equipment maker is due to release earnings tomorrow, now estimated at $0.31 per share. The company beat estimates last quarter, by three cents. On a personal note, I took delivery of the Bowflex Max Trainer right after Christmas and am loving it—the results are exactly what the company promised, which, in my opinion, further cements its reputation as a quality manufacturer.

Nautilus, Inc. (NLS)

From Cabot Benjamin Graham Value Investor

Nautilus, Inc. (NLS), the gym and exercise equipment manufacturer, is worth $5.5 billion in the U.S., and it’s led by major players such as Brunswick Corporation, Icon Health and Fitness and Amer Sports Corporation. However, the U.S. players are facing stiff competition from low-cost suppliers in China and elsewhere, which has caused the domestic industry to shrink over the past five years. Imports are around 65% of the U.S. demand and that’s expected to grow in the short-term.

Nautilus is one of the smaller players in the group, though it owns major brands including Bowflex, Octane Fitness, Universal and Schwinn, includes treadmills, ellipticals, cardio, strength products and exercise bikes. Around 85% of 2016 revenue came from consumer cardio products.

Nautilus was founded in 1986 and mostly sells through direct channels, with the remainder via retail channels.

The company (which was once called Direct Focus) has gone through drastic changes in the last 20 years. The company started its business as a direct marketing business, marketing its Bowflex fitness equipment and Nautilus Sleep Systems. It’s been diversifying itself into various new products such as cardiovascular, apparel and nutritional products.

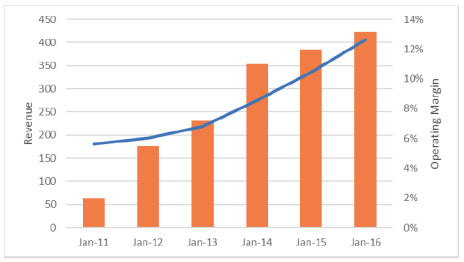

Nautilus went through a major restructuring in 2008 and 2009. In 2011, CEO Bruce Cazenave was brought. Cazenave and has taken the company back to profitability, as you can see in the chart below. The stock has soared from $2 per share to $20 per share in 2016, during Cazenave’s term.

Nautilus re-entered the commercial business (to supply gyms and health clubs) with the acquisition of Octane Fitness for $115 million in December 2015. Analysts were perplexed at the decision given that the company had exited this area during the 2008-2009 restructuring period. However, Cazenave highlights that Octane’s business model is quite different from the old Nautilus’s commercial business. Octane is asset light and gets 22% of its revenues from overseas. This will create good synergy with Nautilus, which has only 2% international exposure.

Revenues did flatten in 2016, and the trend continued in 2017; revenues are expected to have totaled about $405 million last year, basically flat with 2016. Because of the worries and flattening growth, the stock has taken a dive in recent months, with the recent market correction driving prices down to nearly 11 before bouncing a bit.

The stock could certainly see lower prices in the near-term, partially due to its own downward momentum and the previously mentioned worries and competition. Plus, after a big, multi-month advance, stocks could certainly cool off for more than just two weeks, which could drive NLS (and everything else) down more. But, from a long-term view nothing drastic has happened to the company. Bruce Cazenave continues to show excellent management skills with swift changes in strategies and focus.

There are three basic challenges that Nautilus has to overcome: 1) Get the right price point for their new product, HVT, and improve the ad conversion rate, 2) improve the sales of declining TreadClimber and, 3) improve synergy with Octane. It will likely take some time for growth to kick into gear.

However, as we focus on the margin of safety of the company, I am assuming a conservative long-term growth estimate of 5% per year. Even with such a forecast, the company looks around 20% undervalued. I think you can buy a small position in NLS around here, and look to piece your way into the stock should it remain under pressure.

Another reason to start slow: Q4 results which are likely to be released later in February (WSBI’s Editor’s Note: Earnings are due to be released February 20), which is always a risk. You may buy partially now and add further exposure after the Q4 earnings report. BUY.

Azmath Rahiman, Cabot Benjamin Graham Value Investor, www.cabotwealth.com, 978-745-5532, February 8, 2018