In the last few weeks, this energy company has also attracted Wall Street’s attention, with coverage of the shares initiated at both Credit Suisse (Outperform) and Citigroup (Buy).

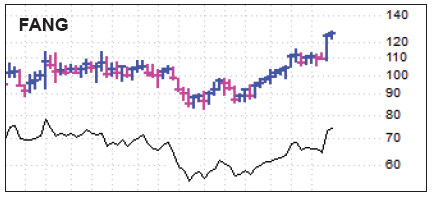

Diamondback Energy (FANG)

From Cabot Growth Investor

We normally don’t trade during the last week of the year, but the recent action of energy stocks as a whole—and Diamondback Energy (FANG) in particular—had us take the plunge.

While it wasn’t as bad as the 2014-2016 bear move in oil stocks, last year’s down-move in the sector was both tedious (XOP moved nearly straight down for nine straight months!) and severe (down 36% from high to low). But XOP bottomed in August, and after some gyrations, lifted to multi-month highs in the second half of December.

Similar to the 2016 upturn, most energy explorers are now coming up off their bottoms, like the sector itself. But Diamondback Energy looks like a major exception—as XOP crawled ahead in September and October, FANG bolted ahead nine weeks in a row (a sign of institutional accumulation). And now, after tightening up for a few weeks, Diamondback’s stock has shot ahead to all-time highs, even as XOP remains more than 50% off its 2014 apex.

Energy stocks are always fickle, with the price of oil and natural gas (and perception about economic growth overall) pushing and pulling the group as much as any single company’s fundamentals. But the market is an odds game, and after years in the doghouse, energy stocks appear to have bottomed out and Diamondback looks poised to lead a new uptrend.

The fundamentals are also top-notch—despite so-so oil prices (about 75% of the firm’s output is oil), Diamondback’s acreage is so lucrative and its operations are so efficient that the company was able to expand production by a whopping 80% last year! And that expansion was all self-funded, coming from its own cash flow! Diamondback is profitable as long as oil is north of $30 per barrel, and management said in the latest conference call that, at current production levels, every dollar that oil prices rise would boost its cash flow by $30 million per year.

Obviously, all bets are off if oil prices tank, but given the fundamentals and the recent breakout, we think buying FANG here presents a good risk-reward situation.

Michael Cintolo, Cabot Growth Investor, www.cabotwealth.com, 978-745-5532, January 3, 2018