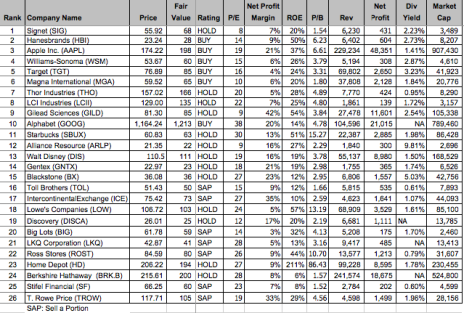

Major indexes remain positive, Hanesbrands (HBI) is up 6%, and Discovery Communications (DISCA), Big Lots (BIG) and Lowe’s (LOW) are up 5%. On the downside, Apple (AAPL) is down 3%.

Updates this Week

Many of our recommended stocks are nearing their fair values, but I recommend that you continue to hold them. As I introduce more undervalued stocks in the coming weeks, you may replace some of your fully valued stocks with the new stocks.

Magna International (MGA) continues to be the leader in complete vehicle contract manufacturing. A recent order to manufacture the new Mercedes G class now runs through 2023. Magna also manufactures Jaguar E-Pace and BMW 530e plug-in hybrid models. My recommendation of Magna was based on its ability to build complete vehicles, which may be attractive for ride-hailing startups looking to buy fleets of self-driving vehicles. I see this as a positive development for Magna. BUY.

Alphabet (GOOG) launched Chronicle Security, a new cybersecurity unit. Chronicle uses machine learning to analyze large internal data and identifies threats faster than traditional means. Chronicle has the potential to gain major market share in the $100 billion cybersecurity market, which is currently dominated by players like Symantec. Google’s entry into cybersecurity is a major milestone in its long-term strategy to enter enterprise markets. IBM, Amazon, and Microsoft are the key players in the enterprise cloud market. BUY.

Apple (AAPL) announced that it would be entering medical records to the health app in the next iPhone updates. Information on allergies, conditions, lab results, immunizations, medications, procedures and vitals from various sources will be available at users’ fingertips. Apple secured participation from Epic Systems, Cerner Corp. and AetnaHealth, thus providing access to more than 50% of medical-records management. Having access to medical records will give Apple an edge over other players in big data analysis, which is essential for the insurance and tech industries. BUY.

Gentex (GNTX) has reached its conservative fair value of 23, and its quarterly earnings release is due tomorrow. If you bought this for the short-term, I recommend selling a portion today as there might be a sudden downward movement in the stock price tomorrow in the event of an earnings miss. However, from a long-term perspective, Gentex is still a Hold. HOLD.