U.S. stock market indexes rose sharply on Tuesday, as investors became less concerned about the Trump administration’s ability to enact a tax overhaul and boost infrastructure spending.

Investors have become nervous anew as Congress will need to raise the nation’s borrowing limit and, separately, keep the government running when funding runs out at the end of September. The games will begin when members of Congress return from their August recess on September 5.

In my opinion, our boys and girls in Washington will avoid a shut-down at the last minute on September 30. Tensions will likely build to a feverish pitch by then. The drama will no doubt create some dizzying ups and downs during the next five weeks, so hang on and enjoy the ride!

In this Weekly Update, I summarize the latest news for eight companies. Max Buy and Min Sell Prices are the recent price targets appearing in the Cabot Enterprising Model Issue 277E, for which you received the link on August 10. I have included a pertinent question from a subscriber with my response. Results are for the quarter ended July 31 unless otherwise stated. Prices appearing after each stock symbol in this Update are the closing prices on Thursday, August 24, 2017.

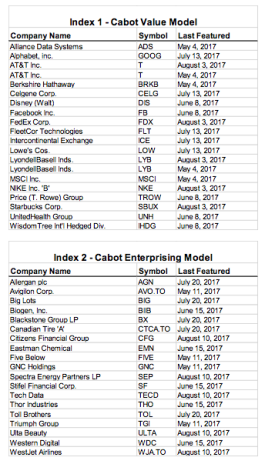

Also, in this Update, I present two Indexes. These list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months. The Indexes identify the companies and indicate when my reviews of the companies were published. Reading the list alphabetically by company name, you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

• Thursday, August 31, Cabot Value Model issue 278V

• Friday, September 1, Weekly Update

• Thursday, September 7, Cabot Enterprising Model issue 278E

• Friday, September 8, Weekly Update

• Wed-Fri, September 13 - 15, Cabot Conference, Salem

• Friday, September 15, No Weekly Update

• Friday, September 22, Weekly Update

• Tuesday, September 26, Wall Street’s Best Daily

• Wednesday, September 27, Wall Street’s Best Daily

• Friday, September 29, Weekly Update

Company Reports

Big Lots (BIG 50.09) reported another strong quarter. For the three months ended July 29, sales rose 2% and EPS jumped 29% after sales declined 1% and EPS increased 46% in the prior quarter. Same-store sales advanced 1.8% after falling 0.9% in the previous quarter. Management raised its earnings guidance for the remainder of 2017. The earnings beat and improved guidance wasn’t enough. BIG shares are falling 6% in pre-market trading today, August 25. Hold.

Blackstone (BX 31.62) announced the acquisition of Harvest Fund Advisors, adding $10 billion of energy investments to Blackstone’s assets under management. Harvest invests in companies involved in the transportation and storage of crude and refined petroleum products. Blackstone previously invested about $7 billion in natural gas by investing in drilling fields, pipelines and a gas export terminal.

In other news, Blackstone is considering an initial public offering of Gates Corp. for about $9 billion. Gates manufactures power transmission belts and fluid power products for cars. Blackstone paid about $5 billion for Gates three years ago. Buy at 34.30 or below.

Johnson Controls (JCI 38.59) will make several management changes in an effort to speed up the integration of the September 2016 merger with Tyco International. The slow progress forced management to lower its sales and earnings forecast for the remainder of 2017. Investors cheered the management change. Hold.

Lowe’s Companies (LOW 72.61) results came in a tad light for the quarter ended August 4. Sales advanced 7% and EPS rose 15% after increasing 11% and 18% in the previous quarter. Same-store sales climbed 4.5% after increasing 2.0% in the prior quarter. Home Depot reported almost identical results last week.

U.S. homebuilders’ higher wage and material costs have pushed new home prices up and encouraged homeowners to remodel their homes rather than buy new ones. Lowe’s is benefiting from this trend and will add store employees and stretch employee hours to meet demand and offer better service.

The added labor costs could pinch earnings during the next couple of quarters, which sent LOW shares slightly lower in response. The reduced stock price, though, presents a good buying opportunity. Buy at 79.50 or below.

Royal Bank of Canada (RY.TO 92.92) recorded solid results for the quarter ended July 31. Revenue fell 3% and EPS dipped 2% after increasing 8% and 11% in the prior quarter. Wealth management net income surged 25%. Strong growth in many of Royal Bank’s segments was partially offset by lower results in Capital Markets primarily due to less favorable market conditions. Royal Bank’s board of directors increased the quarterly dividend to 0.91 from 0.87. The resulting yield is now 3.9%. Hold.

Toll Brothers (TOL 37.00) reported excellent sales and EPS for the quarter ended July 31. Sales climbed 18% and EPS popped 43% after increasing 22% and 43% in the prior quarter. The number of homes delivered rose 26%, contracts grew 24% in units, and backlog increased 21% in both dollars and units, compared to year ago results. The average price of homes delivered was $791,400, compared to $842,700 a year ago, due to management’s decision to cater to entry-level homebuyers as well as high-end buyers.

Toll Brothers’ cash at the end of the quarter increased to $946 million, which will allow the company to pay off a large chunk of debt and reduce common stock by a noticeable amount. The move will expand earnings in future quarters.

The company will deliver 150 fewer homes than expected in the current quarter due to a floor joist recall by a major lumber manufacturer that affected many builders. The delay will boost sales in subsequent quarters, though. The current dip in the stock price presents an excellent buying opportunity. Buy at 40.58 or below.

Ulta Beauty (ULTA 233.71) produced outstanding results for the quarter ended July 29. Sales rose 21% and EPS surged 28% after increasing 22% and 41% in the previous quarter. Same-store sales climbed an impressive 12% and e-commerce sales soared 72%, after increasing 11% and 71% in the prior quarter.

Ulta opened 20 new stores after opening 18 stores in the previous quarter. The company now operates from 1,010 stores. Management raised its sales and earnings forecast for the remainder of 2017.

Why did Ulta shares fall 4% to $224 after quarterly results were released on Thursday, August 24? Analysts forecast same-store sales growth of 12.1% for the quarter compared to the 11.7% actually achieved. Analysts were also hoping Ulta would beat sales and earnings estimates by a wider margin. I am more than satisfied with Ulta’s results and believe the drop in its stock price presents an outstanding chance to buy Ulta at a reasonable price. Buy at 258.58 or below.

Williams-Sonoma (WSM 44.96) reported improved results for the quarter ended July 30. Sales advanced 4% and EPS climbed 5% after increasing 1% and 2% in the prior quarter. Same-store sales rose 2.8% after being unchanged in the previous quarter. E-commerce sales rose 5% after increasing 2% in the prior quarter. E-commerce now generates 52% of total company sales. Sales growth will likely accelerate further during the remainder of 2017. After the report was released on August 23, WSM shares surged 6% in after-hours trading. Hold.

Questions and Answers

Question: I looked over your value call to buy Fleetcor Technologies (FLT) at a max buy price of $148.63 particularly with all the negative headlines around the stock. Are you not concerned about management’s excessive compensation practices or the alleged deception when it comes to fees?

Please see the below Bloomberg article:

https://www.bloomberg.com/news/articles/2017-06-06/fleetcor-called-ceo-s-personal-atm-after-paying-him-300-million

I would appreciate your thoughts on this matter. I am trying to reconcile these things (the cheap valuation and the validity of the claims against the company) in my mind. (from subscriber P.B.)

Roy: Fleetcor Technologies (FLT 142.45) has struggled during the past 3 years even though sales and earnings have been advancing at a rapid clip. During the past 5 years, FLT has produced annual growth of 21% in sales and 31% in EPS. That’s impressive.

The Bloomberg article that you sent to me (thank you!) explains why investors have been avoiding FLT. I was unaware that CEO Ronald Clarke is a problem.

Mr. Clarke’s heavy-handed style is is a turn-off for many investors. However, the company is dealing with big oil companies and trucking companies, which requires a tough business approach. Charging ancillary fees has become commonplace these days, as evidenced by the myriad of fees charged by airlines. I believe the complaints about fees by short sellers is unwarranted, and is aimed at pushing FLT’s stock price lower to enhance their short sales.

I am concerned about Mr. Clarke’s compensation, though. His greed is apparent, but shareholders voted to keep members of the compensation committee on the board of directors at the annual meeting in June. It appears that Mr. Clarke’s huge compensation package will continue for another year at the least. The only good thing is that the company continues to produce a high profit margin (30%) and return on equity (20%).

I recommend avoiding Fleetcor if you are uncomfortable with Ronald Clarke’s management style and his excessive pay. I will probably continue to recommend FLT in my Cabot Value Model, though, because sales and profits continue to rise under Mr. Clarke’s administration. A majority of Wall Street analysts maintain a buy rating for the stock, and EPS estimates continue to rise.

Index of Latest Summaries – Recommendations featured in recent issues.