The U.S. stock market is beginning to show signs of gaining momentum to the upside, as evidenced by the Nasdaq’s new all-time high set yesterday. The weakness in value stocks during the past couple of weeks has created some excellent buying opportunities. In my recent answer to a subscriber’s question (see below), I list several of these attractive opportunities.

This Weekly Update includes only one of my Benjamin Graham companies which reported quarterly financial results during the past week. The prices appearing after the stock symbol is the closing prices on Thursday, March 30, 2017.

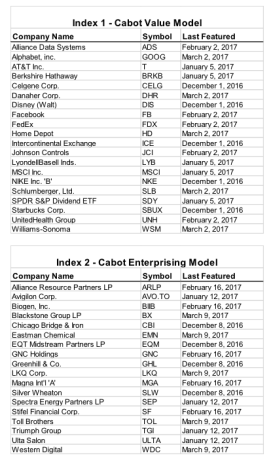

Also, in this Update, I present two Indexes. These list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months. The Indexes identify the companies and indicate when my reviews of the companies were published. Reading the list alphabetically by company name, you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next four weeks will be:

• Tuesday, April 4, Wall Street’s Best Daily

• Thursday, April 6, Cabot Value Model issue 273V

• Friday, April 7, Weekly Update

• Tuesday, April 11, Wall Street’s Best Daily

• Thursday, April 13, Cabot Enterprising Model issue 273E

• Friday, April 14, Weekly Update

• Friday, April 21, Weekly Update

• Friday, April 28, Weekly Update

Company Reports

Korn/Ferry International (KFY 31.48) produced solid results for the quarter ended January 31. Sales rose 10% and EPS gained 2% after increasing 42% and 16% in the prior quarter. Sales and earnings were affected by Korn’s acquisition of Hay Group on December 1, 2015. Management’s modest forecast for the current quarter included a 3% decline in sales and a 3% advance for EPS. Growth will likely accelerate as the Hays Group expansion and cost efficiencies kick in. Hold.

Questions and Answers

Q. Can you give me a couple suggestions for getting exposure to other than US stocks? Most of what I have seen seems expensive. Looking for something under the radar. I have a medium to high risk tolerance. (from subscriber W.N.)

A. I agree with you that U.S. stocks are generally expensive. I don’t follow foreign stocks for a couple of reasons. First, my databases include only companies from the U.S. and Canada, and second, Cabot offers an emerging market letter, which follows foreign stocks. The editor Paul Goodwin is an expert in foreign markets.

My suggestion would be to look at Europe ETFs. Several articles I have read lately indicate that Europe’s economies are beginning to look better than the U.S. economy, and European stocks are cheaper than U.S. stocks, too.

Q. My wife and I would again appreciate your input. We have money to invest in our “rainy day” account and are looking at putting it into 2 or 3 stocks. As of today what would your suggestion be for this money whether it be stocks, ETF’s or otherwise? (from subscriber B.W.)

A. Blue chip stocks that look attractive right now include:

Berkshire Hathaway ‘B’ (BRK.B)

Biogen (BIIB)

Schlumberger Ltd. (SLB)

LyondellBasell Industries (LYB)

AT&T Inc. (T)

Starbucks Corp. (SBUX)

FedEx Corp. (FDX)

UnitedHealth Group (UNH)

Medium Risk stocks that will likely perform well under the new Republican administration include:

Alliance Resource (ARLP)

Blackstone Group LP (BX)

Chicago Bridge & Iron (CBI)

Stifel Financial (SF)

Triumph Group (TGI)

Silver Wheaton (SLW)

Index of Latest Summaries

Stock recommendations featured in recent issues.