The U.S. stock market took a hit this week as concerns about high oil inventories and the fragile fate of President Trump’s first major legislation foray weighed on investor’s bullish bent. The vote on the new healthcare bill has now been delayed—which is not good. If the delay is extended, investors will question whether any of the Trump policies will see the light of day.

Congressional inaction could jeopardize not only the healthcare bill, but also the tax cut proposal, deregulation and even infrastructure spending. Hopefully, cooler heads will prevail and the new healthcare bill will pass with beneficial amendments. A nay vote will send stocks tumbling, but a yea vote will provide the spark to push stock prices higher. Stay tuned!

This Weekly Update includes summaries for six Cabot Benjamin Graham Value Investor companies that reported quarterly financial results or other important news during the past week. Prices appearing after each stock symbol are the closing prices on Thursday, March 23, 2017.

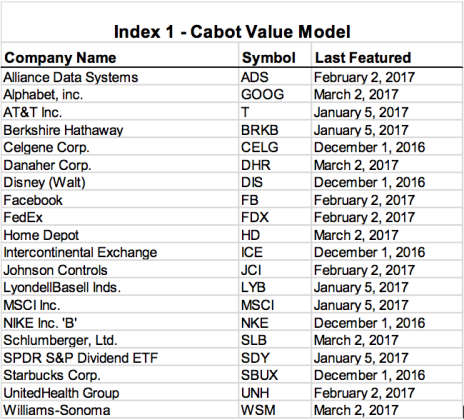

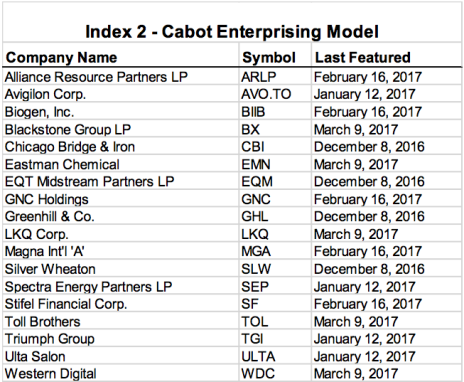

Also in this Update, I present two Indexes that list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months so you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

- Friday, March 31, Weekly Update

- Tuesday, April 4, Wall Street’s Best Daily

- Thursday, April 6, Cabot Value Model issue 273V

- Friday, April 7, Weekly Update

- Tuesday, April 11, Wall Street’s Best Daily

- Thursday, April 13, Cabot Enterprising Model issue 273E

- Friday, April 14, Weekly Update

- Friday, April 21, Weekly Update

- Friday, April 28, Weekly Update

Company Reports

Alphabet (GOOG 817.58) stock price fell 4% this week after AT&T, Verizon and Johnson & Johnson announced they are suspending advertising on YouTube and other sites in Google’s network. The trio cited the risk of having ads placed next to objectionable content. Google vowed to step up its efforts to better police its network and is working on other measures to “safeguard” customers’ brands.

It is too soon to gauge how long the standoff will last and how any changes Google makes will correct the problems. Google’s dominance in the rapidly-growing field of digital advertising makes it difficult for advertisers to ignore Google platforms, although Google’s advertising effectiveness for large companies has long been debated. AT&T, Verizon and Johnson & Johnson will likely rejoin Google soon because they need multi-media exposure. Buy at 834.52 or below.

FedEx (FDX 189.19) reported mixed results for the quarter ended February 28. Sales advanced 19% and EPS fell 6% after increasing 20% and 9% in the prior quarter. FedEx said some of its largest retail customers shipped fewer packages during the holiday season than forecast, after the delivery giant had ramped up spending and staffing in anticipation of a surge in deliveries.

“We provided capacity that went unused,” FedEx CFO Alan Graf said on a conference call. Profit margins fell due to a 26% rise in fuel costs and investments to keep up with e-commerce growth. FedEx cut its profit projection for the year, but the company expects ground operation investments to pay off over the next three years.

With more people shopping online, the added volume is forcing FedEx to spend heavily to expand package-sorting centers and to automate facilities to handle the extra deliveries more profitably. Management said the integration of the Dutch parcel delivery company TNT Express, acquired last year for $4.8 billion, is progressing smoothly. Buy at 198.53 or below.

Johnson Controls (JCI 41.50) will sell its Scott Safety division to 3M for $1.8 to $1.9 billion. The unit makes respiratory protection equipment, gas and flame detection devices, and thermal imaging products. JCI’s products are sold to fire and police departments and customers in the industrial, oil and gas, chemical, military and homeland defense industries. Scott Safety reported 2016 revenue of $570 million.

Johnson Controls expects to collect between $1.8 billion and $1.9 billion in cash. Management said the sale will allow the company to focus on its two core businesses, building control systems and energy controls. The company will use the money to pay down part of $4 billion in debt resulting from its September merger with Tyco International. Hold.

Nike (NKE 55.37) recorded strong results but gave a tepid outlook for sales growth. Sales rose 5% and EPS jumped 24% after increasing 6% and 11% in the previous quarter. Futures orders were down 4% year over year, which disappointed investors. Management said the shift to online shopping has made traditional brick-and-mortar retailing more difficult. More promotions and larger discounts are required to attract customers.

Nike is facing stiff competition from Adidas, the German sportswear maker, which reported stronger sales growth and profitability after aggressively refocusing its efforts on the North American market. Nike will refocus on being more innovative, bringing products to market more quickly, and increasing direct contact with consumers. Nike is launching new running shoes within the next week and has more products in the pipeline. Buy at 56.90 or below.

Penske Automotive (PAG 46.19) has been in a steady decline since early February. Sales and earnings results have been solid, but carmakers’ heavy discounting and aggressive use of leasing to boost sales has created a supply glut hurting lenders, car dealers and rental-car companies. Concern is mounting over falling used-car values.

Consumers have turned to leasing more than ever to lower their monthly payments on new vehicles that have been selling at record high prices in the U.S. Surging numbers of vehicles coming off leases is fueling a supply glut and dragging down used auto prices.

The National Automobile Dealers Association’s Used Car Guide index declined 3.8% in February, the eighth consecutive decline and the steepest drop since November 2008. Penske is less affected by the used-car glut because the company specializes in luxury automobiles which are leased less often.

Car loans are sitting at an all-time high and could also become troublesome. Car buyers are taking on higher loan amounts with longer payment durations. Higher loan rates and higher delinquencies could adversely affect businesses throughout the auto industry, including car manufacturers, auto dealers, lenders and auto parts manufacturers. A stronger U.S. economy in 2017 and 2018 could avert further problems and provide a boost to the auto industry. I’ll keep an eye on further developments. Hold.

Silver Wheaton (SLW 20.61) reported excellent fourth-quarter sales and earnings. Sales surged 29% and EPS climbed 27% after increasing 52% and 58% in the prior quarter. Silver prices advanced 15% and gold prices added 10% from a year ago.

Management forecast that production during the next five years will be similar to 2016s production because of the expiration of several contracts. However, new acquisition and new agreements will likely boost sales and earnings significantly. Higher sales prices could also bolster results. Silver Wheaton’s board of directors increased the company’s quarterly dividend to $0.07 from $0.06. The resulting yield is now 1.4%.

The Board of Directors has recommended changing the company’s name to Wheaton Precious Metals Corp. to better align the corporate identity with the company’s diverse portfolio of both silver and gold assets. In 2016, Silver Wheaton derived 50% of its revenue from silver and 50% from gold. The company plans to seek shareholder approval for the proposed name change at its annual shareholder meeting in May. Hold.

Index of Latest Summaries – Recommendations featured in recent issues.