Stock market action this week has been a bit sloppy, but the good news is the market has not sold off in reaction to oil’s 7% dance to the downside. The Federal Reserve, without a doubt, will raise interest rates next Wednesday, but this too will likely transpire without disrupting stock prices. The trend is bullish and will stay bullish for a while longer. Buy the dips.

This Weekly Update includes just one summary, Ulta Salon, which reported quarterly financial results during the past week. I also include questions from subscribers along with my answers. Prices appearing after each stock symbol are the closing prices on Thursday, March 9, 2017.

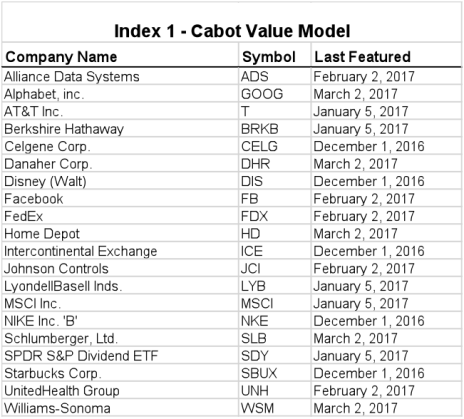

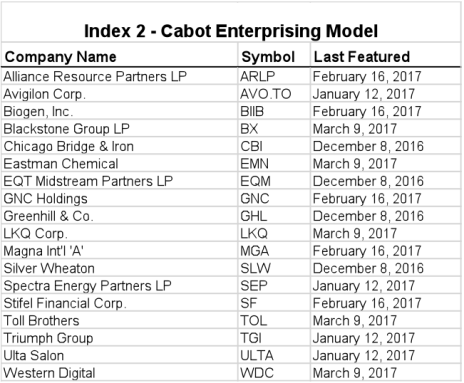

Also in this Update, I present two indexes, which list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months so you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

- Friday, March 17, Weekly Update

- Tuesday, March 21, Wall Street’s Best Daily

- Wednesday, March 22, Wall Street’s Best Daily

- Friday, March 24, Weekly Update

- Friday, March 31, Weekly Update

- Thursday, April 6, Cabot Value Model issue 273V

- Friday, April 7, Weekly Update

- Thursday, April 13, Cabot Enterprising Model issue 273E

- Friday, April 14, Weekly Update

Company Reports

Ulta Salon (ULTA 273.77) delivered excellent results for the quarter ended January 28, but management offered a softer outlook for 2017. Sales surged 25% and EPS jumped 33% after increasing 24% and 26% in the prior quarter. Sales and earnings growth has accelerated during the past couple of quarters. Same-store sales advanced an impressive 16.6%, and e-commerce sales skyrocketed 63%. The company opened 25 new stores, increasing its store count to 974.

For 2017, management forecasts same-store sales growth of 8% to 10% with an EPS increase of 20% or so. The estimates are lower than current analyst estimates, but the company has a history of setting low estimates that are easily beatable.

My latest opinion for Ulta was Hold because the stock price was too high. However, Ulta’s stock price has dipped due to management’s modest 2017 forecast and now offers a golden opportunity to buy below my Max Buy Price of 263.45. Therefore, I am changing my Hold opinion to Buy at 263.45 or below.

Questions and Answers

Question: I have been following your recommendations for a few years. I have done very very well (my portfolio is up 238% since a zero start in May 2010 with additional contributions through this month). I’m not really paying attention to the Models per se, but based on your record, I figure in order to match your performance, I should buy, sell and hold everything you recommend, when you recommend it. I presently have about 90 stocks.

I think I’m doing this right? Comments? (from subscriber D.L.)

Answer:

Congratulations! You are doing very well with your investments.

The goal of my presentation of two models with 16 stocks in each is to provide a list of stocks to choose from. Subscribers can then hold the stocks that they choose, whether it’s five stocks or all 32 stocks, and wait until I issue a sell recommendation either because the stock has reached its Min Sell Price or I have determined that the fundamentals and outlook of the company are deteriorating and a sale should be made.

I like your method of investing in all stocks because investing in a wide mix of stocks lowers your volatility.

Currently, I have 66 stocks on my Buy and Hold lists plus another six ETFs. The list of Buy and Hold stocks can be found each month in the Top 275 Google drive on the cloud along with a list of sell stocks with dates of when the buys and sells were made.

Question: In light of the multiple offers of class actions against CBI, do you still think CBI is ok? I was planning to add to my initial position. (from subscriber D.L.)

Answer: I still like Chicago Bridge & Iron (CBI. 30.26; Max Buy Price 37.34). The class action suits occur for every company when there is bad news. The company reported terrible fourth-quarter results. The company’s customers are delaying engineering and construction projects until President Trump’s new policies begin to receive Congressional approval.

Management forecast a substantial increase in new contracts in the second half of 2017, which is good news. Exxon will begin several new projects in the U.S. before the end of 2017, which bodes well for CBI’s large energy division. In my opinion, the current price presents an excellent opportunity to add to your CBI holding.

Index of Latest Summaries – Recommendations featured in recent issues.