In yesterday’s Cabot Enterprising Model issue on page 1, I summarized part of what I learned at the MoneyShow in Orlando, Florida. The investors I spoke with there were bullish but cautious. President Trump will likely accomplish a lot of his initiatives but not on the scale he is seeking regarding tax reductions, changes in regulations and added infrastructure spending.

According to a consensus of opinion at the MoneyShow, the following sectors of the economy will likely benefit from economic and political changes in 2017 and 2018:

Energy companies will perform well. Oil prices will fluctuate near $50 per barrel, and the President and Congress will loosen regulations and grant more permits. Beneficiaries could include Alliance Resource Partners LP (ARLP), EQT Midstream Partners LP (EQM) and Spectra Energy Partners LP (SEP).

Financial Services companies and banks will benefit from higher interest rates, an improving economy, fewer regulations and a robust stock market. Stocks to consider: Berkshire Hathaway (BRKB), Blackstone Group LP (BX), Greenhill & Co. (GHL), IntercontinentalExchange (ICE), MSCI Inc. (MSCI) and Stifel Financial (SF).

Materials companies will do well, spurred by added infrastructure spending and added demand for materials used in construction. LyondellBasell Industries (LYB) is likely to perform well.

Industrial companies could benefit from additional infrastructure spending and a more vibrant economy. Chicago Bridge & Iron (CBI) will likely perform well.

Consumer Discretionary including Retail will benefit from a faster-growing economy. Stocks to buy in this sector: Disney (DIS), Johnson Controls (JCI), Magna International (MGA), TRI Pointe Group (TPH), Home Depot (HD) and Starbucks (SBUX).

Technology companies will do well in a growing consumer-oriented economy. Alliance Data Systems (ADS), Alphabet (GOOG) and Facebook (FB).

Healthcare companies will perform well because everybody needs healthcare. The President and Congress will continue to combat high drug prices, though. UnitedHealth Group (UNH) is likely to continue its climb.

Precious Metals companies could perform well because the President and Congress will produce a more volatile environment. Buy Silver Wheaton (SLW) to hedge heightened fear.

The stock market has scored hefty gains during the past five days and achieved record levels as measured by the Dow Jones Industrial Average, the Standard & Poor’s 500 Index and the Nasdaq Composite Index. The Dow now sits at 20,620 as of the February 16 close, which exceeds the upper end of my projected trading range of 20,546. If the Dow remains above this level, I will change my allocation mix to four stocks and 12 defensive positions in the Cabot Value Model. Defensive positions are stocks, bonds, ETFs and cash, which are less volatile and will protect your portfolio from severe fluctuations.

My objective for portfolio allocation is to increase the defensive holdings in the Cabot Value Model when the market rises and becomes overvalued, and decrease the defensive holdings in the Model when the market declines and becomes undervalued. I believe my strategy of increasing or decreasing the number of defensive positions will help to reduce your risk and enhance your profits.

In this Weekly Update, I include summaries of 10 Cabot Benjamin Graham Value Investor companies that have reported quarterly financial results or other noteworthy news during the past week. I also describe two stocks, Fortress Investment (FIG) and Quest Diagnostics (DGX), which I recommended to be sold during the past week. Prices appearing after each stock symbol are the closing prices on Thursday, February 16, 2017.

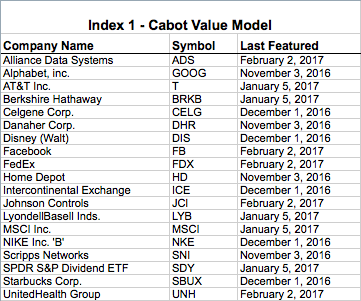

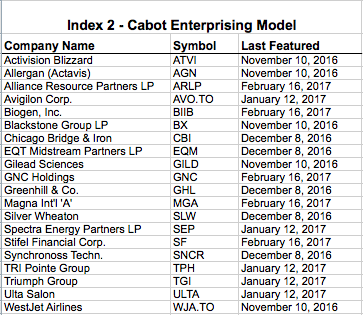

In addition, in this Update, I present two indexes that identify when my reviews of the companies in the Models were published.

My schedule for the next five weeks will be:

- Friday, February 24, Weekly Update

- Monday, February 27, Wall Street’s Best Daily

- Tuesday, February 28, Wall Street’s Best Daily

- Thursday, March 2, Cabot Value Model issue 272V

- Friday, March 3, Weekly Update

- Thursday, March 9, Cabot Enterprising Model issue 272E

- Friday, March 10, Weekly Update

- Friday, March 17, Weekly Update

- Tuesday, March 21, Wall Street’s Best Daily

- Wednesday, March 22, Wall Street’s Best Daily

- Friday, March 24, Weekly Update

Company Reports

Alliance Resource LP (ARLP 24.05) shares rose 1.9% on Thursday, February 16 after President Trump signed a measure that rolls back a rule aimed at stopping the coal mining industry from dumping waste into nearby waterways. Both the House and Senate previously approved the measure. The President and Congress will likely ease additional rules that hamper the coal mining industry. Buy at 25.50 or below.

Cisco Systems (CSCO 33.60) reported solid results for the quarter ended January 28. Sales fell 3%, the same as the prior quarter, and EPS were flat after increasing 3% in the previous quarter. The company’s sales increased in new segments such as security, up 14%, but weak customer spending for routing and switching gear caused total revenue to decline for the fifth straight quarter. Sales in Europe were weak, but U.S. sales are strong.

Cisco will acquire AppDynamics for $3.7 billion in the current quarter. AppDynamics monitors the performance of applications of customers, which include airlines and banks. Cisco’s board of directors increased the quarterly dividend to $0.29 from $0.26, boosting the yield to 3.4%. Hold.

Fortress Investment (FIG 7.97) will be acquired by Japan’s SoftBank for $8.08 per share, all cash. SoftBank is preparing to launch the world’s largest private equity fund and will utilize FIG investing expertise to help manage the fund’s assets. The price far exceeds my Min Sell Price of 7.12. The deal is expected to close in the second half of 2017.

I recommend that you sell your FIG shares because my sell target has been reached, and the shares are selling very close to the cash offer of $8.08. Fortress was originally recommended in the June 2013 Cabot Benjamin Graham Value Investor at 7.30 and, after many wide swings, has gained 9.04% during the past 44 months compared to an increase of 36.59% for the Standard & Poor’s 500 Index during the same time period. Sell your FIG shares now. Sell.

General Motors (GM 37.03) exceeded analysts’ sales and earnings forecasts. Sales surged 11%, and EPS fell 8% after increasing 10% and 15% in the prior quarter. Robust sales of SUVs and pickup trucks in North America buoyed sales and earnings. Management expects to at least match the 2016 EPS of $6.12 in 2017. Management’s 2017 estimate is higher than Wall Street’s $6.00 forecast.

In other news, GM is in talks to sell its Opel division to Peugeot. Opel is based in Germany whereas Peugeot is headquartered in France, which could spark a few political and regulatory disagreements before approvals are finalized. A sale of Opel would essentially end the company’s business in the world’s third-largest automobile market. The sale likely would boost margins and free up money for improving GM’s position in more profitable markets and pursuing future technologies, such as self-driving cars. Opel has lost money every year since 1999. Hold.

Gilead Sciences (GILD 70.31) reported weak fourth-quarter results. Sales fell 14% and EPS dropped 26% after decreasing 10% and 19% in the previous quarter. Management revealed that sales of the company’s hepatitis C drugs could plummet 40% to 50% in 2017, causing total Gilead sales to fall more than 20%.

Gilead has a huge cash hoard of $32 billion ($24 per share), much of which is sitting in overseas accounts. If President Trump declares a tax holiday to repatriate overseas funds, Gilead will become a major beneficiary. In addition, Trump will likely allow the FDA to fast-track new drugs, which could help Gilead bring new drugs to market.

At 7.1 times current EPS, a PEG ratio of 0.55, and with a recently increased dividend yield of 3.0%, Gilead shares are super cheap. The company is a good candidate to be acquired because of Gilead’s expanding HIV drug sales and several additional drugs in development that could add significant sales in future years. Buy at 76.44 or below.

GNC Holdings (GNC 7.72) shares dropped 7.2% after the company released disappointing fourth-quarter results and suspended dividends. Sales fell 8% and EPS plummeted 87% after declines of 7% and 13% in the previous quarter. Same-store sales dropped 12%. Poor sales and earnings results were expected, but the dividend suspension was shocking. Management stated that the dividend omission will enable the company to pay down debt in 2017. In addition, GNC took a huge $6.92 per share charge to write down asset impairments. The charge was not included against the per-share fourth-quarter profit of $0.07.

New management initiated simplified, more competitive pricing and new loyalty programs at the end of December. Early results from the changes are positive and could signal that a turnaround is quite possible in 2017. At 4.4 times my lowered 2017 EPS forecast of $1.70, GNC shares are clearly oversold. Buy at 10.61 or below.

Penske Automotive (PAG 51.94) reported mixed results. Sales receded 1% but EPS climbed 12% after increasing 3% and 7% in the prior quarter. Same-store sales fell 3.8%. Excluding foreign exchange, total revenue increased 5.7%, driven by a 1.8% rise in total retail automotive sales to 112,129 units.

Penske is continuing its active acquisition strategy and closed two purchases that will add $0.15 to EPS in 2017. During 2016, the company repurchased 5.2% of its stock at an average cost of $37.31. The company increased its quarterly dividend for the 28th consecutive quarter by $0.01. The $0.30 quarterly dividend will provide a new yield of 2.3%. Hold.

Quest Diagnostics (DGX 95.30) reached my Min Sell Price of 94.87 on February 15 and should now be sold. The diagnostic testing equipment maker now sells at 18.5 times current EPS, which is too high. Quest was initially recommended in the September 2015 Cabot Benjamin Graham Value Investor at 65.54 and has surged 44.75% during the past 17 months compared to an increase of 11.45% for the Standard & Poor’s 500 Index during the same time period. I advise selling your DGX shares now. Sell.

Spectra Energy Partner LP (SEP 45.07) reported solid results. Revenue rose 5% and EPS edged 1% higher compared to an increase of 3% and decline of 25% in the previous quarter. Spectra brought six projects online, with a total investment of $1.5 billion, which bodes well for continued growth in 2017.

Spectra increased its dividend for the 37th consecutive quarter. The 1.25-cent increase boosts the quarterly dividend to $0.68875, which will generate a dividend yield of 6.1%. Buy at 46.33 or below.

Synchronoss Technologies (SNCR 33.67) reported disappointing results. Sales were unchanged from a year ago after an increase of 17% in the prior quarter. EPS fell 10% after increasing 17% in the previous period. The company completed its acquisition of Intralinks Holdings during the quarter, as well as the divestiture of its carrier activation business. Management forecast slow growth in 2017 as Synchronoss integrates Intralinks. The current drop in the stock price has created an excellent buying opportunity. The company operates in the fast-growing cloud business. Buy at 38.30 or below.

Indexes of Latest Summaries – Recommendations featured in recent issues.