Twelve of my Benjamin Graham companies reported quarterly financial results or other noteworthy news during the past week. In addition, I have included questions from subscribers along with my answers. Prices appearing after each stock symbol are the closing prices on Thursday, February 2, 2017.

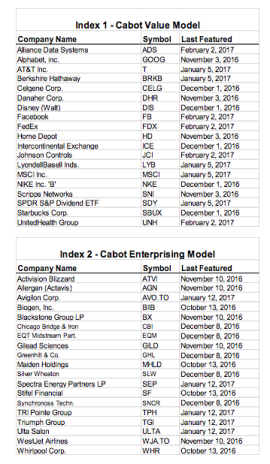

I also present two indexes, which list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months so you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

• Friday, February 10, No Weekly Update – MoneyShow in Orlando

• Thursday, February 16, Cabot Enterprising Model issue 271E

• Friday, February 17, Weekly Update

• Friday, February 24, Weekly Update

• Monday, February 27, Wall Street’s Best Daily

• Tuesday, February 28, Wall Street’s Best Daily

• Thursday, March 2, Cabot Value Model issue 272V

• Friday, March 3, Weekly Update

• Thursday, March 9, Cabot Enterprising Model issue 272E

• Friday, March 10, Weekly Update

Company Reports

Aflac (AFL 67.83) reported mixed fourth quarter results. Revenue increased 12% but EPS dropped 6% after increasing 13% and 17% respectively in the third quarter. The falling Japanese yen boosted reported revenue by 11%. Aflac scaled back child-endowment policies, which caused the division to suffer a 60% drop in revenue. Management stated that the company remains on track to attain its long-term growth objectives. Management expects earnings to rebound in 2017. Hold.

Apple (AAPL 128.52) easily beat forecasts. Sales rose 3% and EPS advanced 2% after dropping 9% and 15% in the previous quarter. Revenue from iPhones, Services, Mac computers and Apple Watch set records. Apple stock surged 6% following AAPL’s quarterly report. Investors were relieved that the company’s sales slump might be over. Management provided an upbeat forecast for the next several quarters, citing promising new products in the company’s pipeline. Hold.

Blackstone Group LP (BX 30.79) reported exceptional results. Revenue surged 79% and EPS skyrocketed 84%. Growth was fueled by robust investment returns on all investment funds. Strong growth also was powered by increased fee income. The superior investment returns attracted substantial capital inflows, driving assets under management significantly higher. Blackstone declared a quarterly distribution of $0.47, higher than the prior quarter, but lower than the year ago quarter. Based on the latest dividend, the expected yield is an impressive 6.1%, although the yield based on the last four distributions is only 4.9%. I expect Blackstone to pay at least $0.47 per quarter in 2017. Hold.

Bristow Group (BRS 17.06) delivered encouraging results. Sales were down 20% after declining 21% in the prior quarter. Bristow ran a deficit of $0.62 per share compared to a profit of $0.09 a year ago. Bristow has rung up four consecutive quarterly deficits. Management, though, revealed that demand for flight services in certain offshore regions is perking up. In addition, new contracts for Bristow’s medevac and search and rescue flight operations will help 2017 sales and earnings. This is the first good news for a long time, and investors responded by sending BRS’s shares up 21%! Hold.

Celanese (CE 87.70) reported improved results. Sales dipped 2% but EPS surged 22% after sales declined 6% and EPS increased 12% in the prior quarter. A weak business environment hurt sales, although earnings received a boost from management’s strict cost-cutting programs. Sales and earnings growth will gain considerable momentum in 2017

Celanese agreed to acquire Nilit Plastics’ nylon compounding division, which will enhance CE’s polymer portfolio and CE’s ability to serve customers more comprehensively. Hold.

Danaher (DHR 83.70) reported solid fourth quarter results. Sales advanced 6% and EPS rose 15% after increasing 18% and 23% in the prior quarter. Danaher’s spinoff of its automotive seating unit, Fortiv, and its purchases of Cepheid and Phenomenex are transforming DHR into a global science and technology innovator with better growth potential. Danaher’s transition is producing better than expected results and is ahead of schedule. Hold.

EQT Midstream Partners (EQM 80.12) reported mixed results. Sales surged 14% but EPS gained only 4% after increasing 15% and 10% in the previous quarter. Maintenance costs were elevated in the quarter, but will return to normal levels in 2017. Management expects rapid growth in 2017, which could receive a boost from the Trump administration if pipeline construction restrictions are loosened. Buy at 77.91 or below.

Fortress Investment Group (FIG 5.79) announced that its affiliate, New Residential Investment, will purchase the servicing rights from Citigroup of about 780,000 mortgages backed by Fannie Mae and Freddie Mac. Fortress will pay $980 million for the rights.

Fortress’s stock price reached my January Min Sell Price soon after my Cabot Value Investor was sent to subscribers on February 2. The February Min Sell Price is 7.12, so you should continue to hold FIG. Hold.

Johnson Controls (JCI 42.30) results were greatly affected by the company’s merger with Tyco and the spinoff of its Adient automotive business. Sales soared 51% and EPS fell 43% after increasing 17% and 10% in the prior quarter. After excluding transaction and integration costs, JCI’s earnings per share rose 15%. Management expressed confidence that benefits from the combination with Tyco will boost profits significantly in 2017. Buy at 44.62 or below.

MSCI (MSCI 88.91) easily beat analysts’ estimates. Revenue climbed 7% and EPS surged 30% after increasing 7% and 15% in the previous quarter. Management’s cost cutting program aided profits. Revenue momentum could accelerate in 2017 as new products and services are introduced. MSCI’s stock price surged 10% following its earnings report. Buy at 83.88 or below.

Triumph Group (TGI 27.45) produced weak results, as expected. Sales fell 8% and EPS dropped 27% after declining 8% and 23% in the prior quarter. Triumph is reducing costs and will divest two businesses in 2017. The moves will streamline TGI’s business and strengthen TGI’s balance sheet. Buy at 30.26 or below.

Zimmer Biomet Holdings (ZBH 117.62) delivered solid fourth results. Sales and EPS advanced 4% and 2% respectively after increasing identical amounts in the previous quarter. Investors were relieved to learn that Zimmer’s knee and hip replacement business rebounded in the quarter after weak sales in several previous quarters. Three recent small acquisitions bode well for 2017 sales and earnings growth. Hold.

Questions and Answers

Q. Wondering where you stand on “UUP”. I bought it a while ago and no longer see it listed. (from subscriber L.D.)

A. Power Shares US Dollar ETF (UUP 25.79) is included in the Cabot Value Issue as a Hold on page 7. The US dollar has weakened a bit in 2017, but I believe it will strengthen noticeably during the remainder of 2017. UUP is a defensive holding that should rise slowly without a lot of volatility. Hold.

Q. Could you give me the details on BIIB/buy and CELG/buy? (from subscriber B.P.)

A. I believe biotech stocks will face some headwinds in 2017, which will suppress investor enthusiasm.

Biogen, Inc. (BIIB: 264.23; Max Buy Price 281.45; Min Sell Price 374.89)

Biogen reported disappointing fourth quarter results. Sales rose only 1% and EPS slipped 3% after increasing 6% and 13% in the prior quarter. The stock rose 2%, though, because the company reiterated that several promising new drugs are in the process of being introduced. Management expects EPS to rise 10% in 2017, in line with analysts’ estimates.

Encouraging clinical trials for Biogen’s treatment for Alzheimer’s could become a game changer, but FDA approval remains several years away.

Biogen will spin off its hemophilia division to BIIB shareholders on February 1, 2017. For each share of Biogen, stockholders will receive two shares of the new company, called Bioverativ (BIVV). George Scangos, chief executive officer of Biogen, will head the new company. A special cash dividend will be paid to BIVV stockholders on February 3.

Bioverativ will inherit two very successful hemophilia drugs which generated $847 million in sales in 2016, an increase of 53% from 2015 – the first full year after the 2 drugs were launched in 2014. BIVV will start with $325 million cash and minimal debt. Buy.

Celgene Corp. (CELG: 115.54; Max Buy Price 117.48; Min Sell Price 170.94)

Celgene reported solid fourth quarter results. Sales advanced 16% after increasing 28% in the prior quarter. Fourth quarter EPS surged 36% from a year ago. Sales from Revlimid, Celgene’s flagship myeloma treatment, rose 16%. The drug now makes up 61% of total Celgene sales, down from the 66% contribution in the prior quarter. Sales generated by Pomalyst/Imnovid and Otezla soared 29% and 67% respectively from a year ago. Management forecast another banner year in 2017 with profits increasing 20%. Buy at 117.48 or below.

Q. Should I add to my position in CTSH right here? (from subscriber B.M.)

A. I continue to like Cognizant Technology (CTSH 51.68) even though the stock has stalled. I expect CTSH to put its payment problems in India behind it soon, which should enable the stock to move up. CTSH will likely benefit from probable upcoming changes in the healthcare industry.

The healthcare industry needs more sophisticated computer systems, and Cognizant is the leading provider of these services. The increase in mergers in the healthcare sector will also require added consulting services to companies who need help in assimilating two different technology systems.

In the financial sector, Mr. Trump will likely be successful in loosening current regulations, which will lead to changes forcing banks to comply with the changes. CTSH has been the leading consulting firm offering helpful financial services.

If Trump’s new policies provide a boost to the U.S. economy, Cognizant’s business will increase. Also, if cash repatriation taxes are lowered, CTSH has a lot of cash sitting overseas which can be put to better use in the U.S.

Indexes of Latest Summaries - Recommendations featured in recent issues.