What is high-probability options trading?

I am often amazed by the lack of common sense when it comes to investing. Investors seek the best possible information, but unfortunately most turn to the wrong sources.

For starters, turning on the television for investment advice, in most cases, is a big no-no. Yet, how many people listen intently to the daily drivel coming out of screaming mouths on CNBC?

Investors, particularly traders, should know that every trade spouted from these sources have, at best, a 50% chance of success. Add in transaction costs and the probability declines even further. Yet, the majority of investors and newbie traders take this approach, mostly because they are not privy to any other form of investing. Individual investors are not aware that there are investment strategies based purely on probabilities, not gut-driven analysis.

[text_ad use_post='261460']

Which leads me to high-probability trading.

So, what exactly is high-probability options trading? And why is it so appealing to statistically inclined traders?

Well, the foundation of high-probability trading is based on two simple laws of statistics: the law of large numbers and the law of probability. It’s that simple.

Of course, trading around these statistical truths takes a bit more knowledge and skill, but the foundation is clear. And as always, you must have a disciplined risk-management plan in place which I will begin to discuss in greater detail over the next several weeks.

Let’s take a look at a potential candidate for a high-probability trade using the high-probability mean reversion indicator as our tool for order entry.

As you can see below, the VanEck Vectors Semiconductor ETF (SMH) has surged higher recently. The result? A near extreme overbought reading in the RSI (2) and RSI (5). Typically, when we see this type of reading, the underlying security mean-reverts, or the trajectory of the current trend starts to wane.

Given the mechanics of the high-probability strategy we use, either way is fine by us. Because we understand that the security has moved several standard deviations from its mean and we are just trying to capture the mean-reversion that typically occurs by using a variety of high-probability options strategies.

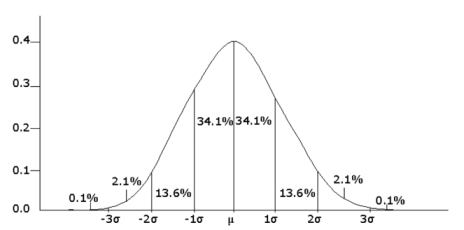

Try to think about the move in SMH in terms of a standard bell curve. When we see an extreme reading hit, we must understand that the security, in this case SMH, has moved to the tail end of the curve.

And when a security hits the tail end of the curve, well, we know we are experiencing an anomaly of sorts.

As a result, I want to take advantage by applying a high-probability options strategy that inherently gives me some room for error. If the security moves lower, stays the same or even continues to trend slightly higher I will still have a profitable trade on my hands.

A Trade in VanEck Vectors Semiconductor ETF (SMH)

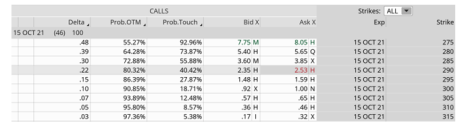

We know that SMH is currently overbought. So, let’s look at an expiration cycle between 30 and 45 days until expiration. The October 15, 2021 options expiration cycle is one day outside my preferred range, but that’s okay for this example. As always, the goal is to take off well before expiration.

If you look at the left side of the options chain you will notice a percentage-based number. This is the “Prob.OTM” or the probability that the underlying, in this case SMH, will expire out of the money at expiration.

For example, if you look at the 290 strike you will notice that the probability of SMH expiring below 290 is 80.32%. That means that if I sell this strike, the chance that SMH will close below the 290 strike is roughly 80% with only 46 days left until October expiration.

The probability of success is arguably the most powerful number the market offers options traders and stock traders alike.

So, with SMH trading for 272.98, we can sell the 290 strike and buy the 295 strike for a net credit of $0.90, or $90 per bear call spread.

Our probability of success on the trade stands at just over 80%. The probability of experiencing a max loss is less than 14%. Remember, SMH would have to push above the 295 strike at expiration to give us a max loss.

Our potential return on the trade: 22.0%.

High-probability mean reversion trading takes some patience, but as I have stated before the rewards can be great over the long term. Take a security that is already extended and wrap a high-probability options strategy around that overbought/oversold security and you have a winning formula for success.

The law of large numbers and the law of probability allow it. Sounds easy, but there are a few other key factors (sequence risk, risk management, position size, adjustments) that you must understand before you go full throttle. I’ll be discussing all of these elements in upcoming articles and a few upcoming videos that I’m excited about.

As always, if you have any questions, please feel free to email me or post your question in the comments section below.