Trader’s Toolbox: High-Probability Mean Reversion Indicator

Let’s get this straight from the onset. There is no holy grail when it comes to indicators. You are not going to find an indicator that is completely foolproof. It doesn’t exist.

However, there are certainly helpful indicators out there to assist you in your trading endeavors. But the indicators you choose truly depends on the strategy you use. And fortunately, for those that use high-probability trading strategies, the high-probability mean reversion indicator can be incredibly useful for trade entry and exit signals.

[text_ad use_post='261460']

Some may average together various RSI readings, like the 2-day, 3-day and 5-day, but that makes absolutely no sense. We look at various levels of overbought and oversold over different time frames and use these readings, again, as a way to help decide when to enter and exit a trade.

I like to use three different RSI readings, the 2-day, 5-day and the standard 14-day. Each timeframe gives me a different idea as to how a security has performed over the short, intermediate and long term.

Once I have this information and see that an extreme is hit, I can then apply a high-probability options strategy around the extreme reading. I like to use various credit spreads like bear calls spreads, bull put spreads, iron condors and several others. The reason I like to use these strategies is because they give me even more room for error just in case the security I’m trading continues to trend in one direction.

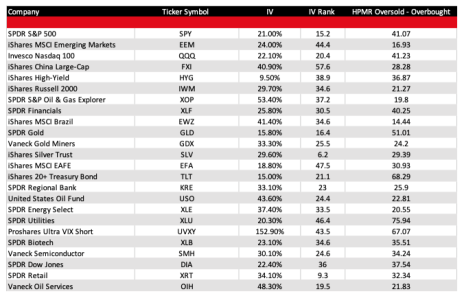

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

- Very Overbought – an RSI reading greater than or equal to 90.0

- Overbought – greater than or equal to 80.0

- Neutral – between 20.0 and 80.0

- Oversold – less than or equal to 20.0

- Very Oversold – less than or equal to 10.0

Below is an example of what to look for each week and a quick trade example how I might use the indicator to place a trade.

High-Probability Mean Reversion Indicator (Heading into the week of August 23-27)

So, what exactly is high-probability trading?

And why is it so appealing to mathematically inclined traders?

Well, the foundation of high-probability trading is based on two simple laws of statistics; the law of large numbers and the law of probability. It’s that simple.

Of course, trading around these statistical truths takes a bit more knowledge and skill, but the foundation is clear. And as always, you must have a disciplined risk-management plan in place which I will begin to discuss in greater detail over the next several weeks.

Let’s take a look at a potential candidate for a high-probability trade using the high-probability mean reversion indicator as our tool for order entry.

As you can see below the SPDR Materials Sector (XLB) has surged higher recently. The result, a near extreme overbought reading in the RSI (2) and RSI (5). Typically, when we see this type of reading, the underlying security mean-reverts, or the trajectory of the current trend starts to wane.

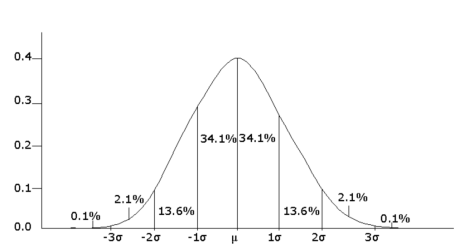

Given the mechanics of the high-probability strategy we use, either way is fine by us. Because we understand that the security has moved several standard deviations from its mean and we are just trying to capture the mean-reversion that typically occurs by using a variety of high-probability options strategies.

Try to think about the move in XLB in terms of a standard bell curve. When we see an extreme reading hit, we must understand that the security, in this case XLB, has moved to the tail ends of the curve.

And when a security hits the tail end of the curve, well, we know we are experiencing an anomaly of sorts.

And as a result, I want to take advantage by applying a high-probability options strategy that inherently gives me some room for error. If the security moves lower, stays the same or even continues to trend slightly higher I will still have a profitable trade on my hands.

A Trade in SPDR Materials Sector (XLB)

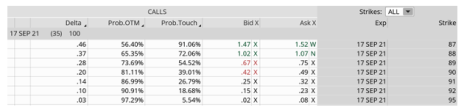

We know that XLB is currently overbought. So, let’s look at an expiration cycle between 30 and 45 days until expiration. The September 17, 2021 options expiration cycle fits the bill.

If you look at the left side of the options chain you will notice a percentage-based number. This is the “Prob.OTM” or the probability that the underlying, in this case XLB, will expire out of the money at expiration.

For example, if you look at the 89 strike you will notice that the probability of XLB expiring below 89 is 73.69%. That means that if I sell this strike, the chance that XLB will close below the 89 strike is roughly 74% with only 35 days left until September expiration.

The probability of success is arguably the most powerful number the market offers options traders and stock traders alike.

So, with XLB trading for 86.49, we can sell the 89 strike and buy the 92 strike for a net credit of $0.50 or $50 per bear call spread.

Our probability of success on the trade stands at just under 74%. The probability of experiencing a max loss is less than 10%. Remember, XLB would have to push above the 92 strike at expiration in order to experience a max loss.

Our potential return on the trade: 20.0%.

High probability mean reversion trading takes some patience, but as I said before the rewards can be great over the long term. Take a security that is already extended and wrap a high-probability options strategy around that overbought/oversold security and you have a winning formula for success. The law of large numbers and the law of probability allows it. Sounds easy, but there are a few other key factors (sequence risk, risk management, position-size, adjustments) that you must understand before you go full throttle. I’ll be discussing all of these elements in upcoming articles and yes, a few upcoming videos that I’m excited about.

As always, if you have any questions, please feel free to email me or post your question in the comments section below.