I’ve been enjoying discussing various earnings trades this earnings season. Next week I plan on delving into risk-defined strategies like iron condors with a few examples. However, this week I’m going to stock with another short strangle, this time in Microsoft (MSFT). The company is due to announce earnings next Tuesday, October 26 after the closing bell.

I hope that by going through a few examples of various options strategies during every earnings season, we can start to build a solid foundation on how to appropriately apply options selling strategies with a focus on high-probability trades.

[text_ad use_post='261460']

A Short Primer on Short Strangles

As I’ve said numerous times in the past, statistically speaking, when it comes to options strategies it doesn’t get much better than a short strangle.

A short strangle is a neutral, range-bound options strategy (short call and short put) that has undefined risk and limited profit potential. Typically, a short strangle has little to no directional bias. And, like most options selling strategies, short strangles benefit from a decline in implied volatility (IV) and passage of time (time decay).

Short strangles require more capital because theoretically, the strategy has undefined risk because we are selling naked call and put options. But please, don’t let that scare you.

In return for the larger capital outlay, an options trader is rewarded with one of the highest probability options strategies in the investment universe. I’m talking an 85% probability of success. But hey, that’s one of the great things about selling options using defined or undefined options strategies: You get to choose your probability of success on every trade you place.

But there is one important caveat when trading short strangles.

Short strangles only work for the disciplined options trader. If you are not disciplined when it comes to risk management, naked options aren’t for you. I would suggest looking at iron condors. Iron condors are risk-defined.

I can’t emphasize enough: If you have the capital (taking position size into account) and look at yourself as a risk manager first and options trader second, well, this could be your new favorite strategy. There is a reason short strangles are the bread-and-butter options strategy for most professional options traders.

Let’s look at a potential earnings trade for next week and more importantly, how short strangles work.

As I said before, strangles, like all options selling strategies, benefit from a decline in implied volatility (IV) and passage of time (time decay). So the first step is finding a highly liquid stock or ETF that has a heightened level of implied volatility.

Look no further than the current IV rank and IV percentile of the stock.

IV rank tells us if the current level of volatility in a stock is higher compared to the levels over the past year. Since we are selling options in the form of a short strangle, we prefer options prices to be inflated.

IV percentile tells us the percentage of days that implied volatility has traded below its current level of implied volatility over the past year.

Short Strangle Earnings Trade in Microsoft (MSFT)

Microsoft (MSFT) is due to announce next week. So let’s take a look at a potential trade.

The stock is currently trading for 309.22.

The next item is to look at MSFT’s expected move for the expiration cycle that I’m interested in.

The expected move or expected range over the next 7 days can be seen in the pale orange colored bar below. The expected move is from 300 to roughly 320, for a range of $20.

Knowing the expected range, I want to, in most cases, place the short call strike and short put strike of my short strangle outside of the expected range, in this case outside of 300 to 320.

This is my preference most of the time when using strangles. I want my short strangle to have a high probability of success.

If we look at the call side of MSFT for the October 29, 2021 expiration, we can see that the 322.5 call strike offers an 87.95% probability of success and the 320 strike offers us an 82.70% probability of success. For this example, I’m going with the more conservative strike, which is the 322.5 strike.

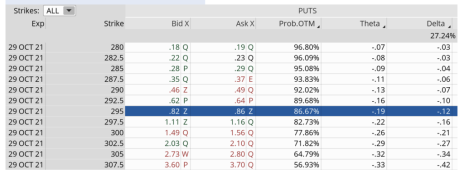

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 300. The 295, with an 86.67% probability of success, works.

We can create a trade with a nice probability of success if MSFT stays between our 27.5-point range, or between the 322.5 call strike and the 295 put strike. Our probability of success on the trade is 87.95% on the upside and 86.67% on the downside.

I like those odds.

Here is the trade:

Simultaneously:

Sell to open MSFT October 29, 2021 322.5 calls

Sell to open MSFT October 29, 2021 295 puts for roughly $1.50 or $150 per strangle

Our margin requirement is $4,925 per short strangle.

Again, the goal of selling the MSFT short strangle is to have the underlying stock, in this case MSFT, stay below the 322.5 call strike and above the 295 put strike immediately after MSFT earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 87.95% (call side) and 86.67% (put side)

- The max return on the trade is the credit of $1.50, or $150 per strangle

- Break-even level: 293.50 – 324.00

- The maximum loss on the trade is in theory unlimited. Remember, we always adjust, if necessary, and always stick to our stop-loss guidelines. Position size, as always, is key.

In Summary

I would prefer to see a bit more premium in the trade, but the probabilities are still high and the short strangle we’ve created is well outside the expected move. Of course, I prefer to make these trades the day before earnings are announced, so I would expect to see the premium a bit lower than it is now due to decay. So premium could be an issue at the time of the trade. But I like to see where potential trades stand the week prior, so I have a good understanding what stocks look appealing for a potential trade around earnings, which is why I go through this exercise with the stocks on my weekly earnings watch list.

Short strangles offer options traders one of the highest probability strategies out there. And that’s why they are one of the strategies of choice among professional options traders. Undefined risk strategies can be scary for the uninitiated. But if you understand the risk of the strategy and are diligent with your risk management a whole new world of trading has just opened up.