The S&P has been grinding higher for almost 200 days without a 5% pullback.

According to esteemed analyst Jason Goepfert, “The S&P 500 has gone 189 days – nine consecutive months – without being more than 5% from a 52-week high. And it recorded its 43rd day with a 52-week closing high. Dating back to 1927, this long of a streak has been rarely exceeded. The current one is now the 3rd-longest in five decades.”

[text_ad use_post='261460']

Of course, we could see this type of bullish price action for months to come, no one has a crystal ball, but I don’t mind taking on a hedge-based trade at these levels. And, when I have the ability to still allow for a little upside in case the market continues to run higher from here, that’s okay, I still have the ability to make some nice profits.

Now before I go further, there are plenty of ways to hedge positions and portfolios. I’ve discussed collars and other hedge-based options strategies in the past and will dig deeper into some more complex VIX-based options strategies I like to use going forward. But for now, I want a more simplistic options strategy that seems to be appropriate for this current market.

The Trade

With the S&P 500 (SPY) trading for 448.16 I want to place a short-term bear call spread going out 53 days. My intent is to take off the trade well before the October 15, 2021 expiration date. For this trade, my preference is go with a trade that has around an 80% to 85% probability of success.

The Trade

Let’s start by taking a look at the options chain for SPY with 53 days until expiration. Once we choose our expiration cycle (it will differ in duration depending on outlook and strategy), we begin the process of looking for a call strike within the October 15, 2021 expiration cycle that has over an 80% probability of success. If you don’t have access to probabilities of success on your trading platform look towards the delta. Without going into too much detail look for a call strike that has a delta below 0.20.

Next I want to know what the expected move or expected range is for SPY during the October 15, 2021 expiration cycle. The range is currently from 430 to just under 466. Since we are focused on using a bear call strategy we only care about the upside at the moment.

By knowing that the market anticipates SPY going as high as 466 by October expiration in 53 days, it allows us to choose a short call strike around that number. This will define our probability of success on the trade.

The 463 call strike with an 81.46% probability of success works. It’s not outside of the expected range, but we can adjust accordingly if needed. I want to have an opportunity to bring in roughly 20%, while keeping my probability of success above 80%.

The short 463 call strike defines my probability of success on the trade. It also helps to define my overall premium or return on the trade. Basically, as long as SPY stays below the 463 call strike at October 15, 2021 expiration in 53 days we will make a max profit on the trade. But, as I stated before, my preference to take off profits early and in most cases reestablish a position if warranted.

Also, time decay works in our favor on the trade, so as we get closer and closer to expiration our premium will erode at an accelerated rate. As a result, we should have the opportunity to take the bear call spread off for a nice profit prior to expiration--unless of course SPY continues to spike to the upside over the next 53 days. But still, that doesn’t hide the fact that with this trade, we can be completely wrong in our directional assumption and still make a max profit.

Once I’ve chosen my short call strike, in this case the 463 call, I then proceed to look at the other half of a 3-strike wide, 4-strike wide and 5-strike wide spread to buy.

The spread width of our bear call defines our risk/capital on the trade.

The smaller the width of our bear call spread the less capital required, and vice versa for a wider bear call spread.

When defining your position size knowing the overall defined risk per trade is essential. Basically, my spread-width and my premium increase as my chosen spread-width increases.

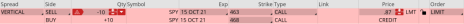

October 15, 2021 463/468 Bear Call Spread

Now that we have chosen our spread we can execute the trade.

Simultaneously:

Sell to open SPY October 15, 2021 463 strike

Buy to open SPY October 15, 2021 468 strike for a total net credit of roughly $0.87 or $87 per bear call spread

- Probability of Success: 81.46%

- Total net credit: $0.87, or $87 per bear call spread

- Total risk per spread: $4.13, or $413 per bear call spread

- Max Potential Return: 21.1%

As long as SPY stays below our 463 strike at expiration in 53 days, I have the potential to make 21.1% on the trade. In most cases, I will make slightly less, as the prudent move is to buy back the bear call spread prior to expiration. Again, I look to buy back a spread when I can lock in 50% to 75% of the original credit. Since we sold the spread for $0.87, I would look to buy it back when the price of my spread hits roughly $0.44 to $0.22.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration lead the way for our decisions. But, taking off risk, or at least half the risk, by locking in profits is never a bad decision and by doing so we can take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I also tends to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 463/468 bear call spread for $0.87, if my bear call spread reaches $1.74 to $2.61 I will exit the trade.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below.