Nvidia (NVDA), Costco (COST) and several other names are due to report next week. Be on the lookout for a few follow-up posts with trades in Costco and possibly several others. Stay tuned!

As I say each week, taking the conservative approach continues to be consistent and profitable. Remember, it’s all about allowing the Law of Large Numbers to work for you.

Risk management is the real key to successfully trade earnings. Get in, get out, move on. In almost every case, adjusting is a frivolous task and only leads to additional losses. Allow the Law of Large Numbers to work in your favor by simply keeping your position size at reasonable levels (1% to 5%), which allows you to endure bouts of sequence risk. Moreover, understand that more trades do not equate to more profits. Be patient. Allow the opportunities to present themselves, then take action by applying an options selling strategy that allows you to have a high probability of success. Understand that you might only have 1-3 real opportunities each week.

I will be sending out my weekly “Top Earnings Options Plays” every Saturday throughout the earnings season so stay tuned!

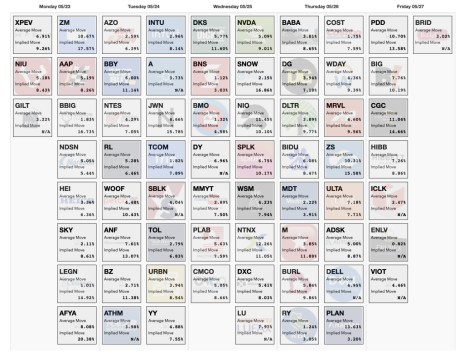

Here are a few other top earnings options plays for next week (5/23 to 5/27):

Courtesy of Slope of Hope

Due to the uncertainty around earnings announcements, both speculators and hedgers create a huge demand for options around a company’s earnings announcement. This increase in demand for the options for that stock increases the implied volatility, which ultimately increases the price of the options.

Basically, options prices are inflated around earnings announcements, and as sellers of options, our goal is to take advantage of these price discrepancies.

We can always create a trade with a nice probability of success using a variety of options selling strategies. At the top of the food chain would be the undefined-risk options strategy known as the short strangle. Of course, if you wish to use a risk-defined trade, check out the price of an iron condor at various strike widths. I normally use short strangles or iron condors outside of the expected move and with a probability of success typically above 80%.

The reason I go outside of the expected move or range is because we know through extensive research that 80% of stocks trade within their expected move immediately following earnings.

Again, if you have any questions, please feel free to email me or post your question in the comments section below. And don’t forget to sign up for my Free Weekly Newsletter for weekly education, research and trade ideas.