Top Earnings Options Plays for the Week (10/25 – 10/29)

The Week Ahead

Earnings season is over. But there are always a few companies that report outside of the standard earnings window. Here are 14 companies that I think could offer some interesting opportunities next week.

- Facebook (FB)

- General Electric (GE)

- Microsoft (MSFT)

- Visa (V)

- Twitter (TWTR)

- Coca-Cola (KO)

- Boeing (BA)

- General Motors (GM)

- Mastercard (MA)

- Merck (MRK)

- Amazon (AMZN)

- Starbucks (SBUX)

- Apple (AAPL)

- Exxon (XOM)

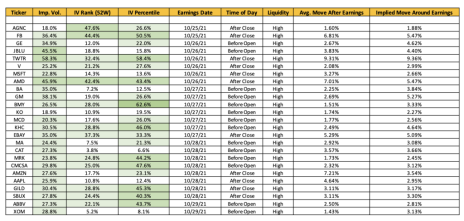

Below you will find the implied volatility (IV), IV rank, IV percentile, average past price movements around earnings, expected move (implied move) and a few other key items to help you with any potential trades.

[text_ad use_post='261460']

I use the following list as a guide for any potential earnings season trades. If you have any questions on the information provided below don’t hesitate to email me or ask in the comment section below. And don’t forget to sign up for my Free Newsletter for weekly education, research and trade ideas.

(click images to enlarge)

Here are a few other top earnings options plays for next week (10/25 to 10/29).

Courtesy of Slope of Hope

Due to the uncertainty around earnings announcements, both speculators and hedgers create a huge demand for options around a company’s earnings announcement. This increase in demand for the options for that stock increases the implied volatility, which ultimately increases the price of the options.

Basically, options prices are inflated around earnings announcements, and as sellers of options our goal is to take advantage of these price discrepancies.

We can always create a trade with a nice probability of success using a variety of options selling strategies. At the top of the food chain would be the undefined risk options strategy known as the short strangle. Of course, if you wish to use a risk-defined trade, check out the price of an iron condor at various strike widths. I normally use short strangles or iron condors outside of the expected move and with a probability of success typically above 80%.

The reason I go outside of the expected move or range is because we know through extensive research that 80% of stocks trade within their expected move immediately following earnings.

Again, if you have any questions, please feel free to email me or post your question in the comments section below.

And don’t forget to sign up for my Free Newsletter for weekly education, research and trade ideas.