The key to finding the best ETFs for options trading centers solely around liquidity. In fact, the foundation for all of your options trading endeavors, regardless of the options strategy, starts with your watchlist of highly liquid options, both stocks and ETFs.

We only want to use the most efficient products the market has to offer and thankfully, there are quite a few ETFs that fit the bill. I say, “most efficient” because we never want to be in a situation where we must make back 5% to 15% at the onset of trade just to get back to breakeven. It’s not a logical approach.

Remember, when taking a statistical approach to trading we must allow the probabilities, the law of large numbers, to work in our favor. And if we are using inefficient products, we don’t stand a chance over the long term, regardless of the options strategies we use.

[text_ad use_post='261460']

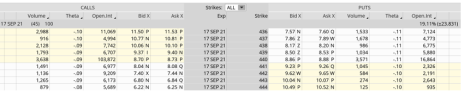

Let’s look at an example of what would be considered one of the best ETFs for options trading, the SPDR S&P 500 ETF (SPY).

SPY is trading for 441.15. If you look at the strikes just outside the at-the-money strikes you will notice a tight bid-ask spread of roughly $0.03.

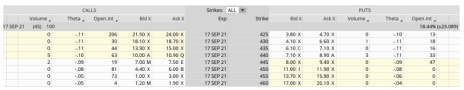

Now let’s compare the efficiently priced SPY, with another similarly priced ETF, iShares Trust Core S&P 500 (IVV).

As you can see, the bid-ask spread is anywhere from $3.50 to, at best, $0.50. Using a risk-defined strategy like a bear call spread, bull put spread, iron condor and others, just isn’t realistic. Yes, you could make a trade, but your pricing would be highly inefficient going into the trade, but particularly when you go to exit the trade, when you are at the mercy of the market marker.

The Best ETFs for Options Trading

I’ve created the list below for anyone that wishes to create a similar watchlist. Of course, the list will evolve over time, as such, I will update regularly. Moreover, I plan to add an overbought/oversold indicator, implied volatility and several other statistics to give us a better idea as to where each ETF stands over the short to intermediate term.

As I said before, if you truly want to be a successful option trader you must start with a foundation of stocks and ETFs with highly liquid options. The ETFs above are a great place to start.

I’ll be creating a similar list with stocks, stay tuned!

As always, if you have any questions, please feel free to email me or post in the comments section below.