Another bull market is upon us…this time in volatility.

The IV rank graph below shows just how high volatility is at the moment in comparison to the last 10 years.

Typically, when the IV graph is shaded pale green or higher, options selling strategies become far more appealing. But when we see IV rank pegged, like it is today, well, it’s time to open up the playbook.

Now, I use options selling strategies almost exclusively. Yes, I will use debit spreads from time to time, but my true focus relies on having a statistical advantage with each and every trade I place. Therefore, options selling strategies remain at the forefront of my quiver at all times.

And now we have a bull market in volatility, which directly impacts options premium, to the benefit of options sellers. And should go without saying that the best way to take advantage of the inflated premium is to use options selling strategies.

Let’s do a quick comparison between options premium during normal levels of volatility and heightened levels of volatility. This will allow you to see the true benefits of using options selling strategies when IV is above normal levels.

The images below represent a snapshot of the option chain going roughly 50 days until expiration (dte) S&P 500 ETF (SPY) during low levels of volatility versus today’s high levels of volatility.

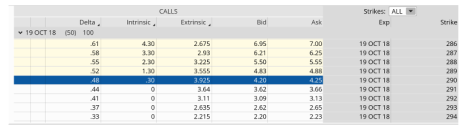

August 30, 2018

The VIX was 13.53 at the time. SPY was trading for 290.30.

As you can see, options premium is significantly less due to the low implied volatility in SPY. Yes, SPY was trading for less than it is now, but options premium, is only going for approximately $4.20 to 4.25. Extrinsic value is $3.925.

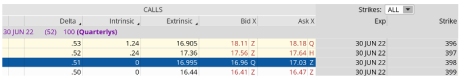

May 9, 2022

The VIX is trading for 35.01, close to three times as high as the example above. SPY is trading for roughly 398.

As you can clearly see, options prices are significantly higher at $16.96 to $17.03.

Look at the extrinsic value, or options premium as well.

Extrinsic value is the difference between the market price of an option, also knowns as its premium, and its intrinsic price, which is the difference between an option’s strike price and the underlying asset’s price. Extrinsic value rises with an increase in market volatility.

Extrinsic value in the June 30, 2022 398 call strike with 52 days left until expiration is $16.995.

Prices are inflated across the board. This is what happens when volatility reaches higher levels and why we always want to use options selling strategies during these periods.

It could be argued that even with a market that has seen lower prices for roughly five months, we could be in the early stages of a bull market in volatility. Since the pandemic hit the market, IV has been significantly higher than the previous nine to ten years. The market had become complacent. And even though I was still selling premium during this period, the opportunities weren’t as plentiful.

Times have changed.

The VIX has now found a base at 15, not 10. Doesn’t seem like a lot, but on a percentage basis it makes a huge difference on how it impacts options premium. And you can clearly see from the examples above the impact of heightened levels like what we are seeing at the moment.

Bull markets in volatility tend to last 5 to 8 years. One thing is for certain, I sure hope it comes to fruition.