As I’ve mentioned time and time again, one of my favorite options strategies is the covered call. Simple, straight-forward and easy to manage. Covered calls allow you to lower the cost basis on stocks you already own or, alternatively, give you the opportunity to generate a steady stream of income. But today, I don’t want to discuss covered calls. I want to discuss what is, in my opinion, a much better alternative to a basic covered call strategy…a poor man’s covered call.

And with the New Year not far off, I like to establish new positions over various portfolios, including my Dogs of the Dow portfolio that I have been running using poor man’s covered calls over the past five years. I also run a growth/value portfolio based on James O’Shaughnessy approach and a straight up growth portfolio modeled after Martin Zweig’s approach. My plan is to add a few more approaches to the mix going forward.

But I digress.

[text_ad use_post='261460']

The great aspect of poor man’s covered calls is that it doesn’t require buying 100 shares of stock. Poor man’s covered calls allow you to use far less capital, while still receiving the same benefits of a covered call strategy. And it’s an alternative that gives you a far greater return on your capital.

Again, the strategy is known as a “poor man’s covered call” or, in options mumbo jumbo, a long call diagonal debit spread. The name poor man’s covered call comes from the lower capital requirement needed to establish a position compared to a standard covered call.

In fact, in most cases, it costs 65% to 85% less to use a poor man’s covered call strategy. The savings in capital required should be reason enough to at least consider using the strategy. And I’m certain after reading this you will indeed find the strategy appealing enough to consider.

A poor man’s covered call is an inherently bullish strategy that is the same in every way to that of a covered call strategy, with one exception. Rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

My Approach to Poor Man’s Covered Calls

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration.

For example, let’s take a look at one the Dogs of the Dow stocks and one that will likely be a candidate for 2022, Chevron (CVX). It’s a fairly expensive stock and that can be a huge deterrent for many investors, not with a poor man’s covered call.

As you can see in the chart below the stock is currently trading for 118.30.

Now, if we followed the route of the traditional covered call we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $11,830. Certainly not a crazy amount of money. But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Apple (AAPL), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards…and that’s unfortunate.

But with a poor man’s covered call strategy you can typically save 55% to 85% of the cost of a covered call strategy.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date around two years. Some options professionals prefer to only go out 12-16 months, but I prefer the flexibility the two-year LEAPS offers.

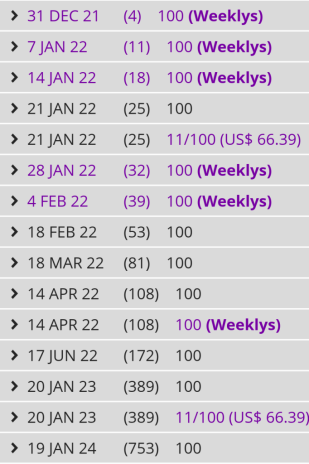

The image below shows every expiration cycle available for CVX. Again, I want to go out roughly two years in time. The January 19, 2024 expiration cycle with 753 days left until expiration is the longest dated expiration cycle and would be my choice.

So, when my LEAPS reach 10-12 months left until expiration I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

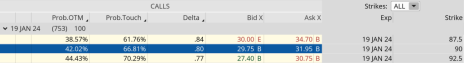

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at CVX’s option chain I quickly noticed that the 90 call strike has a delta of 0.80. The 90 strike price is currently trading for approximately $30.75. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $31.95.

So, rather than spend $11,830 for 100 shares of CVX, we only needed to spend $3,075. As a result, we saved $8,755, or 74.0%. Now we have the ability to use the capital saved to diversify our premium amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 90 strike, we then begin the process of selling calls against our LEAPS.

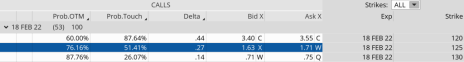

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 125 call strike with a delta of 0.27 falls within my preferred range.

We could sell the 125 call option for roughly $1.65.

Our total outlay for the entire position now stands at $29.10 ($30.75-$1.65). The premium collected is 5.4% over 53 days.

If we were to use a traditional covered call our potential return on capital would be less than half, or 1.4%.

And remember, the 5.4% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8 – 12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Again, I will be issuing my ten Dogs of the Dow and Small Dog trades during the first week of 2022. If you wish to receive my 10 trades please make sure to sign up for my Free Newsletter for education, research and trade ideas.