Poor Man’s Covered Call Strategy

Last week I discussed the benefits of selling covered calls for monthly income. And while I am a huge proponent of using covered calls, my preference, particularly when dealing with higher-priced securities, is to use a strategy known as the poor man’s covered call strategy.

A poor man’s covered call strategy is essentially a long call diagonal debit spread that is used to imitate a covered call position, but for far less capital.

As I stated last week, investors are constantly seeking the holy grail of income strategies and while one doesn’t exist, selling covered calls and poor man’s covered calls for monthly income might be the closest we have, as investors, to the perfect income strategy.

[text_ad use_post='261460']

Today, I’m going to focus on selling poor man’s covered calls for monthly income.

Like I did with covered calls last week, I’m going to go through a few current examples to show you what to expect given the level of risk you wish to take. Conceptually, poor man’s covered calls are similar to covered calls, with only a few exceptions.

The main difference: poor man’s covered calls require far less capital. The strategy doesn’t require buying 100 shares of stock. In fact, no shares are needed. As an alternative to purchasing 100 shares, poor man’s covered calls require far less capital.

In most cases, it costs 65% to 85% less to use a poor man’s covered call strategy. The savings in capital required should be reason enough to at least consider using the strategy. And I’m certain after reading this you will indeed find the strategy appealing.

Like a covered call strategy, a poor man’s covered call is an inherently bullish options strategy. But again, rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

The initial barrier to entry when it comes to selling poor man’s covered calls comes is security selection. Simply stated, implied volatility (IV) is one of the main keys to security selection. Implied volatility tells us how much risk and return we should expect to see over a 20-to-45-day time frame, so that we can form a realistic plan for creating monthly income.

Next is the price of the security. Just because the IV of a stock fits within our range doesn’t mean that the stock works. We must be able to establish a position while maintaining proper position size in our overall portfolio.

I’m going to keep the price of each security to a limit of $75 per share, or $7,500 per covered call. Also, I’m going to sell at-the-money calls to keep things consistent. Oftentimes I like to sell calls with a delta between 0.20 and 0.40, but again to keep the comparisons fair and consistent I want to use the at-the-money calls for each example.

Moreover, I’m going to keep the securities the same as when I discussed covered calls last week, so again, we have a fair comparison between using a covered call strategy versus a poor man’s covered call strategy.

And as I stated last week, I will write another post going over how to use the major market ETFs, like the SPDR S&P 500 (SPY), SPDR Dow Jones (DIA), Invesco Nasdaq 100 (QQQ), or even iShares Russell 2000 (IWM) using poor man’s covered calls.

Implied Volatility 10 to 25

Merck (MRK) is currently trading for 77.82 and has an implied volatility (IV) of 20.33%. Moreover, the stock has a beta of 0.42.

If we followed the route of the traditional covered call we would need to buy at least 100 shares of the MRK. At the current share price, 100 shares would cost $7,782. Certainly not a crazy amount of money.

But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Apple (AAPL), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards.

But, as I said before, with a poor man’s covered call strategy you can typically save 55% to 85% of the cost of a covered call strategy, making the benefits of a covered call strategy far more affordable.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

If we go with the longest-dated expiration cycle in Merck we are left with the January 20, 2023 expiration cycle with 522 days until expiration. My preference would be to go out at least 2 years in duration, but I want to keep my examples consistent with last week for a fair comparison.

You can see the expiration cycles currently offered for MRK below.

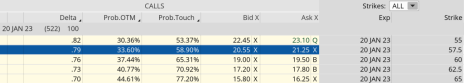

Once I have chosen my expiration cycle, in this case the January 20, 2023, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at MRK’s option chain I quickly noticed that the 65 call strike has a delta of 0.79. The 65 call strike price is currently trading for approximately $14.10. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $14.30.

So, rather than spend $7,782 for 100 shares of MRK, we only need to spend $1,410. As a result, we are saving $6,372, or 81.9%. Now we have the ability to use the capital saved to diversify our premium or income stream amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 65 call strike, we then begin the process of selling calls against our LEAPS.

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

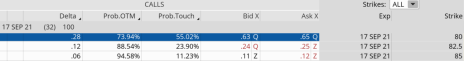

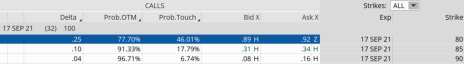

As you can see in the options chain below, the 80 call strike with a delta of 0.28 falls within my preferred range.

We can sell the 80 call option for roughly $0.63.

Our total outlay for the entire position now stands at $1,347 ($1,410 - $63). The premium collected is 2.1% over 32 days. Certainly, not a ton of premium, but remember, we are only going out 32 days and using a stock that has, by most comparisons a low level of implied volatility (IV). So, knowing that IV is fairly low, we shouldn’t expect to receive a significant amount in premium. I’ll go over some higher IV examples below.

But, if we were to use a traditional covered call our potential return on capital would be less than half, or 0.8% over 32 days.

And remember, the 2.1% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position until there is roughly 10 to 12 months of life left in the LEAPS, thereby generating additional income or lowering our cost basis even further.

As ab aside, an alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Poor Man’s Covered Call Trade:

- Buy Merck (MRK) January 20, 2023 65 LEAPS call contract for roughly $14.10

- Sell MRK September 80 calls (32 days until expiration) for $0.63, or $63 per contract

Static or Return on Premium: 2.1% over 32 days

Breakeven: $13.47, or $1,347

So, as you can see above, we have the potential to create 2.1% every 32 days, or approximately 23.1% a year using a fairly conservative stock like MRK. This is our baseline and should be our expected return in premium for stocks with a fairly low IV.

Implied Volatility 25 to 40

Micron Technology (MU) is currently trading for 70.30 and has an implied volatility (IV) of 39.55%. Moreover, the stock has a beta of 1.30.

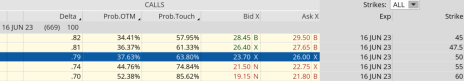

When looking at MU’s option chain I quickly noticed that the 50 call strike has a delta of 0.79. The 50 call strike price is currently trading for approximately $25.00. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $26.00.

So, rather than spend $7,030 for 100 shares of MU, we only need to spend $2,500. As a result, we are saving $4,530, or 64.4%. Now we have the ability to use the capital saved to diversify our premium or income stream amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 50 call strike, we then begin the process of selling calls against our LEAPS.

Again, my preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

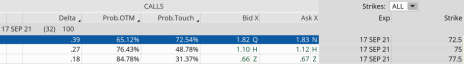

As you can see in the options chain below, the 72.5 call strike with a delta of 0.39 falls within my preferred range.

We can sell the 72.5 call option for roughly $1.82.

Our total outlay for the entire position now stands at $2,318 ($2,500 - $182). The premium collected is 7.3% over 32 days. Notice the increase in our return in comparison to the more conservative MRK. This is due to the higher IV in MU.

But, if we were to use a traditional covered call our potential return on capital would be less than half, or 2.6% over 32 days.

Poor Man’s Covered Call Trade:

- Buy Micron (MU) June 16, 2023 50 LEAPS call contract for roughly $25.00

- Sell MU September 72.5 calls (32 days until expiration) for $1.82, or $182 per contract

Static or Return on Premium: 7.3% over 32 days

Breakeven: $23.18, or $2,318

So, as you can see above, we have the potential to create 7.3% every 32 days, or approximately 80.3% a year using a Micron.

Implied Volatility 40+

Ebay (EBAY) is currently trading for 75.19 and has an implied volatility (IV) of 45.60%. Moreover, the stock has a beta of 1.04.

When looking at Ebay’s option chain I quickly noticed that the 57.5 call strike has a delta of 0.79. The 57.5 call strike price is currently trading for approximately $21.00. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $21.25.

So, rather than spend $7,519 for 100 shares of EBAY, we only need to spend $2,100. As a result, we are saving $5,419, or 72.1%. Now we have the ability to use the capital saved to diversify our premium or income stream amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 57.5 call strike, we then begin the process of selling calls against our LEAPS.

Again, my preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 80 call strike with a delta of 0.25 falls within my preferred range.

We can sell the 80 call option for roughly $0.90.

Our total outlay for the entire position now stands at $2,010 ($2,100 - $90). The premium collected is 4.3% over 32 days.

But, if we were to use a traditional covered call our potential return on capital would be less than half, or 1.2% over 32 days.

Poor Man’s Covered Call Trade:

- Buy Ebay (EBAY) January 20, 2023 57.5 LEAPS call contract for roughly $21.00

- Sell EBAY September 80 calls (32 days until expiration) for $0.90, or $90 per contract

Static or Return on Premium: 4.3% over 32 days

Breakeven: $20.10, or $2,010

So, as you can see above, we have the potential to create 4.3% every 32 days, or approximately 47.3% a year using a Ebay.

Quick Summary of Poor Man’s Covered Call Strategy

As you can see, implied volatility offers great insight into how much premium you should expect to receive. And while the IV of stocks changes due to certain events (earnings, etc.), it is a wonderful guideline for how much premium (potential income) you should expect to receive.

I like to take a diversified approach, using stocks that fall into different levels of IV, but risk is in the eye of the beholder, and I just want to make everyone aware of the choices out there so that we can make the most informed decisions possible given our own risk tolerance and investment goals.

As always, if you have any questions, please feel free to email me or post in the comments section below. And if you haven’t had a chance, please sign up for my free newsletter where I offer options education, research, and trade ideas.