Note: I will be issuing my ten Dogs of the Dow and Small Dog trades during the first week of 2022. If you wish to receive my 10 trades, please make sure to sign up for my Free Newsletter for education, research and trade ideas.

Five years ago, I decided to wrap one of my favorite strategies around one of the easiest and consistently successful investment strategies the market has to offer investors … the Dogs of the Dow.

Since then, I have made incredible returns, typically outperforming the Dogs of the Dow and the Small Dogs of the Dow by roughly 3 to 5 times their annual returns. Of course, the bullish nature of the market has certainly helped boost our returns, but by using my strategy of choice we have the ability to make a return in bullish, neutral or slightly bearish environments. And more importantly, we do not have to commit the capital to buy 100 shares of stock.

[text_ad use_post='261460']

A Short History of the Dogs of the Dow

As I said before the Dogs of the Dow is a simple strategy and one that any investor can utilize to diversify their overall market approach. Oftentimes, I find that investors overcomplicate their approach, searching for the latest and greatest strategies, only to find frustration when the approach fails.

Well, that’s simply not the case for the Dogs of the Dow. The strategy has a long-term track record of success. In fact, the strategy has consistently outperformed the Dow Industrials over the last 90 years.

And that’s my goal. To find simple, conservative, investment strategies that have a long-term track record of success and wrap conservative options strategies around them. Because there aren’t bonus points for complicated strategies, or taking aggressive, highly volatile approaches. It all comes down to returns, but returns based on calculated risk, otherwise known as a risk-adjusted return.

So, before I get to the actual options strategy and how I approach the Dogs, let’s discuss a little bit about how the Dogs of the Dow works.

The process is simple. Pick the 10 highest-yielding stocks out of the 30 Dow stocks. Most equally weight their positions, but this isn’t necessary, in my opinion, if you at least diversify in each position. In our case, we typically initiate a position with one LEAPS position in each stock, but I’ll get to that in a moment.

After the initial set-up, all you will need to do is adjust the portfolio at the beginning of each year. An incredibly easy process and, more importantly, one that has proven successful over the long term.

Historically, the Dogs of the Dow strategy have outperformed the larger Dow by approximately 3% a year. Doesn’t sound like much, but when you triple, quadruple or even quintuple that percentage on an annual basis the returns add up over time.

Again, one of the key attractions of using the conservative strategy is that it requires very little time doing research.

Simply take the 10 highest-yielding Dow Industrial stocks at the start of the year and 12 months later the whole process starts over. Oftentimes, most of the stocks will remain on the list from one year to the next, simplifying things from an accounting perspective and helping to lower commission costs.

But, I have a unique alternative that is far more cost-effective, and in most cases, more profitable than purchasing the 10 stocks that make up the Dogs of the Dow.

The strategy is known as a poor man’s covered call. Otherwise known as a long call diagonal debit spread.

A poor man’s covered call is similar to a traditional covered call strategy, with one exception in the mechanics. Rather than buying 100 or more shares of stock, an investor simply buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it.

LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. LEAPS are no different from short-term options, but the longer duration offered through a LEAPS contract gives an investor the opportunity for long-term exposure.

The positions in the portfolio are delta positive. This simply means that each position is inherently bullish, and it is my focus to make sure each position remains delta positive at all times. And even though the positions are delta positive, we still have the opportunity to make money if the market remains flat or even drops slightly, but the portfolio does best when the stocks that reside in the portfolio trend higher.

When initiating a position, I buy LEAPS with a delta of .80 and selling a call against my LEAPS contract with a delta of roughly .20 to .30. So, my overall delta is typically between .50 to .60 when a position is initiated. Of course, the delta continually fluctuates with the price of the underlying stocks, but I have the ability to manage each position so that the delta remains in a positive state.

Below is an example of a previous trade posted back in July. While not a Dogs of the Dow trade, it is a good example of how I approach poor man’s covered calls and more specifically, the Dogs of the Dow.

My Approach to Poor Man’s Covered Calls

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration.

For example, let’s take a look at tech behemoth, Apple (AAPL). It’s an expensive stock, yet one of most consistent performers the market offers. But the cost can be a huge deterrent for many investors; not with a poor man’s covered call.

As you can see in the chart below the stock was trading for 146.79.

Now, if we followed the route of the traditional covered call, we would need to buy at least 100 shares of the stock. At that share price, 100 shares would cost $14,679. Certainly not a crazy amount of money. But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Amazon (AMZN), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards … and that’s unfortunate.

But with a poor man’s covered call strategy you can typically save 55% to 85% of the cost of a covered call strategy.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date around two years. Some options professionals prefer to only go out 12-16 months, but I prefer the flexibility the two-year LEAPS offers.

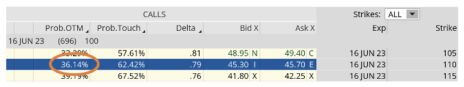

The image below shows every expiration cycle available for AAPL. Again, I want to go out roughly two years in time. The September 15, 2023 expiration cycle with 787 days left until expiration is the longest dated expiration cycle, but I don’t want to go out that far in time. The June 16, 2023 with 696 days until expiration works for me.

So, when my LEAPS reach 10-12 months left until expiration I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at AAPL’s option chain I quickly noticed that the 110 call strike has a delta of 0.79. The 110 strike price is currently trading for approximately $45.60. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $45.70.

So, rather than spend $14,679 for 100 shares of AAPL, we only needed to spend $4,560. As a result, we saved $10,119, or 68.9%. Now we have the ability to use the capital saved to diversify our premium amongst other securities, if we so choose.

After we purchased our LEAPS call option at the 110 strike, we then began the process of selling calls against our LEAPS.

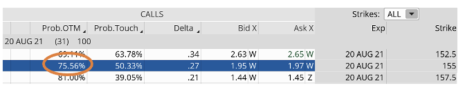

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 155 call strike with a delta of 0.27 fell within my preferred range.

We could sell the 155 call option for roughly $1.95.

Our total outlay for the entire position now stands at $43.65 ($45.60-$1.95). The premium collected is 4.3% over 31 days.

If we were to use a traditional covered call our potential return on capital would be less than half, or 1.3%.

And remember, the 4.3% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8 – 12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Again, I will be issuing my ten Dogs of the Dow and Small Dog trades during the first week of 2022. If you wish to receive my 10 trades please make sure to sign up for my Free Newsletter for education, research and trade ideas.