The Collar Options Strategy

After the recent market pullback, more and more readers are once again asking the question, “How do I protect my profits using options?” So today, I’m going to go over one of my favorite options strategies, step by step, for protecting profits without giving up potential future returns on the most liquid ETF in the market, SPDR S&P 500 ETF (SPY).

Just remember, SPY was up 31.29%in 2019, 18.25% in 2020 and is up 15.25% so far in 2021. The bullish run has been amazing. So, protecting at least a portion of your hard-earned profits, while still having some exposure to additional gains, should at least be a consideration. And, if anything, learning the strategy will certainly be beneficial in your future trading endeavors.

[text_ad use_post='261460']

The Protective Collar – The Basics

A protective collar’s goal is to preserve capital, while simultaneously allowing a position to continue making profits, albeit limited.

Unfortunately, greed deters individual investors from using collars. Hedge funds and even large institutional managers frequently use collars, so why don’t most individual investors?

It’s because most investors don’t realize that collars not only protect their unrealized profits, they also allow you to hold a position that you don’t want to sell, but want some downside protection for just in case the stock takes a fall. Think earnings surprises or if you own a stock that pays a healthy dividend that you want to keep holding. Or maybe investors don’t realize it is one of the cheapest, most effective ways to reduce risk.

It doesn’t really matter the reason; it only matters that you start using this strategy to keep risk in hand. Because the most important aspect to successful, long-term investing is a disciplined approach to risk management. Without it, even the best strategies are inevitably doomed.

A collar options strategy requires an investor who already owns at least 100 shares of a stock to purchase an out-of-the-money put option and sell an out-of-the-money call option.

Think of it as a covered call coupled with a long put.

- Long Stock (at least 100 shares)

- Sell call option to finance the purchase of the protective put

- Buy put option to hedge downside risk

*Collar Option Strategy: long stock + out-of-the-money long put + out-of-the-money short call

That’s right, you read bullet point three correctly. You can actually finance most of your protection, so the cost of a collar is limited, if not free. Again, this is why intelligent investors and professional traders use collars habitually.

The Trade – An Example Using the S&P 500 ETF (SPY)

Let’s say you own a basket of ETFs and want to protect your return going forward--or at least produce a bit of income from your positions while simultaneously hedging against a pullback.

Yes, you may have to forgo some upside profits in the process, that is if your position rockets higher, but you also have the reassurance that your profits are being protected over the short to intermediate term. And again, you are still able to make a decent profit if the ETF continues to trend higher.

Again, let’s say you own 100 shares of SPY and would like to protect your return going forward. You still want to hold the position and participate in further upside. But you also realize that the ETF has had an incredible run and want some downside protection, specifically over the short to intermediate-term.

The ETF is currently trading for 467.47.

- With SPY currently trading for 467.47, you want to sell an out-of-the-money call as your first step in using a collar option strategy.

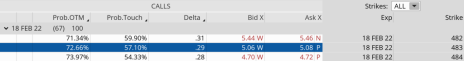

I typically look for a call that has roughly 30-60 days left until expiration. So, to keep things simple, I am going with the February options that are due to expire in 67 days, just outside of my 30-60-day window.

I don’t want to sell calls that are too far out-of-the-money because I want to bring in a decent amount of premium to cover most, if not all, of the protective put I’m going to buy. But, of course, ultimately the choice depends on your personal agenda.

As a result, let’s say I try to sell a call with a delta somewhere around 0.30. The SPY 483 February call option with a delta of 0.29 fits the bill. We can sell the SPY 483 call option in February for $5.06, or $506 per call. We can now use the $506 from the call sold to help finance the put contract needed to achieve our goal of protecting returns.

- The next and final step is to find an appropriate protective put to purchase. There are many different ways to approach this step, mostly centered around which expiration cycle to use. Should we go out 30 days in expiration? 60 days? 120 days? It really is up to you to decide.

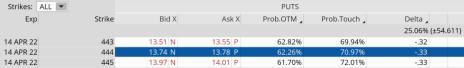

I prefer going out as far as I can without paying too much for my protective put. In this case, I want to protect the position from a decline of 5% or greater. By taking this action, we would be protected below $444.

I’m going to go out to the April expiration cycle with 122 days left until expiration. I plan on buying the 444 puts for roughly $13.77, or $1,377 per put contract.

This means that 36.7% of the entire cost of the April 444 puts will be covered by selling the February 483 calls.

Total Cost: April 444 210 puts ($1,377) – February 483 calls ($56) = $871 debit

And, we can actually add to our $506 by selling more calls in March and April while still maintaining protection through April 14, 2022. The hope is that by selling more calls the cost of protection will be essentially free through April expiration.

So, as it stands our upside return is limited to $483 over the next 67 days. If SPY pushes above 483 per share, at February expiration, our ETF would be called away. Basically, you would lock in any capital gains up to the price of 483. With SPY currently trading for roughly 467.50, you would tack an additional $15.50, or 3.3% to your overall return.

But the key reason to use the strategy is not about making additional returns, it’s about protecting profits. And through using a collar options strategy, in this instance you are protected if SPY falls 5% lower or below 444 (where we purchased our put option).

Collars limit your risk at an incredibly low cost and allow you to participate in further, albeit limited, upside profit potential. I’m certain you won’t regret adding this easy yet effective options strategy to your investment toolbelt.

Again, if you have any questions, please feel free to email me or post your question in the comments section below. And don’t forget to sign up for my Free Newsletter for education, research and trade ideas.