I’ve had a few questions recently on how to calculate an iron condor max loss and max profit. So, I thought I would spend a little time today on how to easily calculate not only the max loss and max profit for an iron condor, but for any spread-based options trade.

Iron condors are a neutral or range-bound options strategy that is made up of two types of vertical credit spreads, a bear call spread, and a bull put spread.

Let’s go through a quick example, step by step, to further explain the process of calculating the max loss of an iron condor.

[text_ad use_post='261460']

Calculating an Iron Condor Max Loss and Max Profit

Let’s use the SPDR S&P 500 ETF (SPY) for our example.

The major-market ETF is currently trading for 442.04.

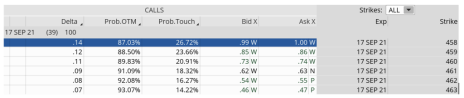

If we look at the expected move or expected range for SPY for an expiration going out 39 days, the range is from roughly 427.00 to 457.00 for a 30-point range.

As a result, we want to place our iron condor just outside the expected move.

Call Side of the Iron Condor

Let’s say we decide to go with a 5-strike-wide spread on both the call and put side of the trade.

For instance, if we choose the 458/463 bear call spread our credit on this side of the call side of the iron condor is $0.52.

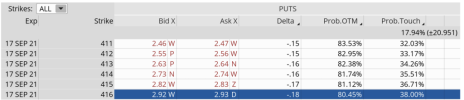

Put Side of the Iron Condor

Staying consistent with our spread width of $5, let’s choose the 416/411 bull put spread. Our credit for the spread is $0.45.

Our total credit for both spreads is $0.97 ($0.52 + $0.45). This is our max profit on the trade.

Once we have our total credit, in this case $0.97, we then take that amount and subtract it from our spread width of $5 to attain the iron condor max loss.

Max Loss: $5 - $0.97 = $4.03

Max Profit: $0.97

Knowing the max loss ahead of time gives us the ability to manage our risk through proper position size. For instance, if we typically allocate $2,500 per trade we know, through the calculations above, that we can trade six iron condors to stay within our position-size parameters. Our total risk would be $2,418 ($403 x 6) for the trade.

Iron condors are risk-defined, so it’s important to take advantage of their risk-defined nature by staying consistent with your position size for every trade you place. Knowing how to calculate an iron condor max loss is the first major step in understanding how much money you have at risk. And understanding your risk prior to placing a trade is one of the most important aspects of trading successfully over the long term.

Remember, it’s all about the law of large numbers.

I hope this helps clear up a few of the questions I have been receiving lately.

And as always, if you have any questions, please feel free to email me or post your question in the comments section below.