I have another potential “outside the earnings window” trade today.

As I stated last week and will continue to repeat with each potential earnings trade, I’ve been thoroughly enjoying our discussions on various earnings trades over the past six months.

Through the process of discussing the trade I’m going to focus on my strategy of choice, iron condors, and how I apply them around earnings announcements.

[text_ad use_post='261460']

I hope that by going through numerous examples of options strategies during various market environments, we can start to build a solid foundation of how to appropriately apply options selling strategies with a focus on high-probability trades in any type of market environment.

Iron Condor Earnings Trade in FedEx (FDX)

FDX is due to announce after the close Thursday. So let’s take a look at a potential trade.

The stock is currently trading for 240.04.

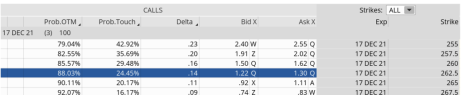

The next item is to look at FDX’s expected move for the expiration cycle that I’m interested in, which in this case is the December 17, 2021 expiration cycle.

The expected move, or expected range, over the next seven days can be seen next to the pale orange colored bar below, under the “strike” column. The expected move is from 225 to roughly 255, for a range of $30.

Knowing the expected range, I want to, in most cases, place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 225 to 255.

This is my preference most of the time when using iron condors. I want my iron condors to have a high probability of success.

If we look at the call side of FDX for the December 17, 2021 expiration, we can see that the 255 call strike offers a 79.04% probability of success and the 262.5 call strike offers us an 88.03% probability of success. For this example, I’m going with the more conservative strike, which is the 262.5 strike.

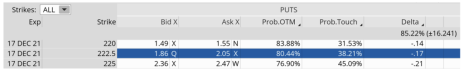

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 225. The 222.5 put strike, with an 80.44% probability of success, works.

We can create a trade with a nice probability of success if FDX stays between our 30-point range, or between the 255 call strike and the 225 put strike. Our probability of success on the trade is 88.03% on the upside and 80.44% on the downside.

I like those odds.

Here is the trade:

Simultaneously:

Sell to open FDX December 17, 2021 262.5 calls

Buy to open FDX December 17, 2021 265 calls

Sell to open FDX December 17, 2021 222.5 puts

Buy to open FDX December 17, 2021 220 puts for roughly $0.70, or $70 per iron condor

Our margin requirement is $180 per iron condor.

Again, the goal of selling the FDX iron condor is to have the underlying stock, in this case FDX, stay below the 262.5 call strike and above the 222.5 put strike immediately after FDX earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 88.03% (call side) and 80.44% (put side)

- The maximum return on the trade is the credit of $0.70, or $70 per iron condor for a 38.9% return

- Break-even level: 221.80 – 263.20

- The maximum loss on the trade is $180 per iron condor. Remember, we always adjust if necessary, and always stick to our stop-loss guidelines. Position size, as always, is key.

Remember, I prefer to make these trades the day before earnings are announced, so I would expect to see the premium a bit lower than it is now due to decay. So premium could be an issue at the time of the trade. But I like to see where potential trades stand the week prior, so I have a good understanding what stocks look appealing for a potential trade around earnings, which is why I go through this exercise with the stocks on my weekly earnings watch list.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below. And don’t forget to sign up for my Free Newsletter for education, research and trade ideas.