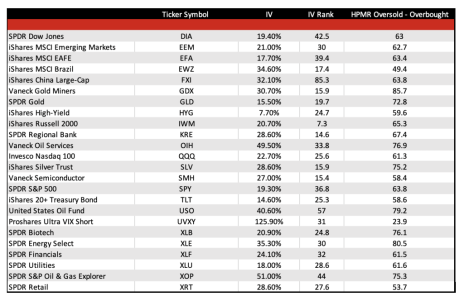

Below is my list of ETFs with the most liquid options for the week of October 18.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

Very Overbought – an RSI reading greater than or equal to 90.0

Overbought – greater than or equal to 80.0

Neutral – between 20.0 and 80.0

Oversold – less than or equal to 20.0

Very Oversold – less than or equal to 10.0

I will provide this information for the following ETFs on a weekly basis going forward. Stay tuned!

[text_ad use_post='261460']

Some may average together various RSI readings, like the 2-day, 3-day and 5-day, but that makes absolutely no sense. We look at various levels of overbought and oversold over different timeframes and use these readings, again, as a way to help decide when to enter and exit a trade.

I like to use three different RSI readings: the 2-day, 5-day and the standard 14-day. Each timeframe gives me a different idea as to how a security has performed over the short, intermediate and long term.

Once I have this information and see that an extreme is hit, I can then apply a high-probability options strategy around the extreme reading. I like to use various credit spreads like bear call spreads, bull put spreads, iron condors and several others. The reason I like to use these strategies is because they give me even more room for error just in case the security I’m trading continues to trend in one direction.