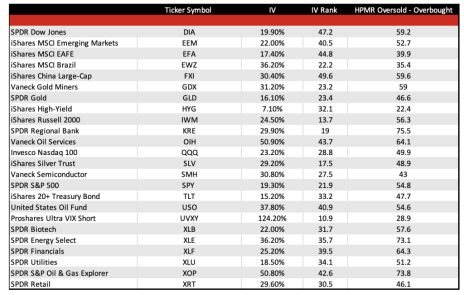

Below is my list of ETFs with the most liquid options for the week of October 11.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

Very Overbought – an RSI reading greater than or equal to 90.0

Overbought – greater than or equal to 80.0

Neutral – between 20.0 and 80.0

Oversold – less than or equal to 20.0

Very Oversold – less than or equal to 10.0

I will provide this information for the following ETFs on a weekly basis going forward. Stay tuned!

[text_ad use_post='261460']

Some may average together various RSI readings, like the 2-day, 3-day and 5-day, but that makes absolutely no sense. We look at various levels of overbought and oversold over different time frames and use these readings, again, as a way to help decide when to enter and exit a trade.