Three Inflation Options Strategies

Inflation, inflation, inflation!

Every day on my 35-minute drive to drop off my oldest daughter at school, the two of us (one begrudgingly) listen to Bloomberg radio. And for months, the hot topic in the morning for the financial pundits has been inflation, and the various scenarios that could play out.

Now, I’m not going to get into the lengthy details on my inflation stance. As a quant-based options trader, I fully understand my opinion on the matter means little; it’s more about the strategy I employ that truly allows me to make a return. So today I’m going to focus on several options strategies that take advantage of a few different inflation scenarios.

Inflation and interest rates typically go hand in hand. And with rates near historic lows and interest rates on the rise, whether transitory or not, banks should benefit. If interest rates continue to linger near historic lows, in theory, the economy should continue to expand, and banks will continue to benefit from business growth. Regardless, banks should benefit.

[text_ad use_post='261460']

So, as a result, I am going to present a few trade ideas centered around the financial sector using SPDR Financial ETF (XLF) as my underlying. Hopefully, the following will not only give you a few trade ideas, but educate you on how to apply a few different high-probability options strategies and give you some insight into how strategy can impact your overall risk/reward. I hope this helps.

Bull Put Spread

A bull put spread, otherwise known as short put vertical spread, is one of my favorite risk-defined options strategies.

As the name of the strategy implies, a bull put spread is a bullish-leaning strategy. But it is important to note that the strategy doesn’t require the security to move higher to make money. With bull put spreads you not only have the ability to make a return when a security moves higher, you can also make money if the stock stays flat or even if the stock pushes slightly lower.

The first step in placing a bull put spread, or any trade, is making sure the security we are interested in is highly liquid. We always want to use the most efficient products possible. It just doesn’t make sense to have to make 5% to 15%, possibly more, to get back to breakeven.

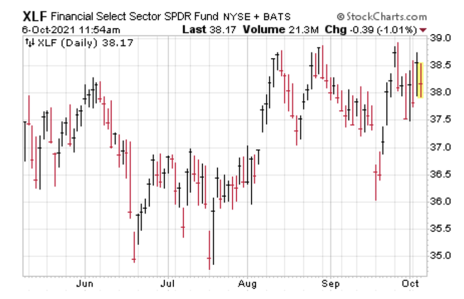

XLF is a highly liquid product, and as a result we can move forward with a potential bull put trade. With XLF trading for 38.17 and near all-time highs I want to place a bull put spread with a high probability of success.

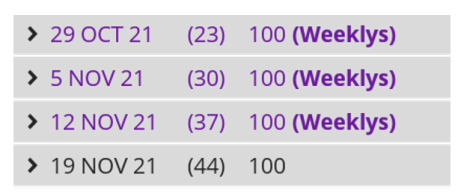

Let’s take a look at the options chain for XLF going out 20-50 days until expiration.

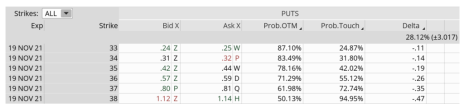

It looks like the November 19, 2021 expiration cycle, with 44 days left until expiration, fits the bill. As a result, let’s take a look at the put strike with approximately an 80% probability OTM (out-of-the-money), otherwise known as the probability of success on the trade.

It looks like the 36 put strike, with an 71.29% probability of success, is where I want to start. The short put strike defines my probability of success on the trade. It also helps to define my overall premium, or return, on the trade.

Once I’ve chosen my short put strike, in this case the 36 put, I then proceed to look at a 3-strike wide, 4-strike wide and 5-strike wide bull put spread to buy.

The spread width of our bull put helps to define our risk on the trade. The smaller the width of the spread the less capital required. When defining your position size, knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For example, let’s take a look at the 3-strike, 36/33 bull put spread.

The Trade: XLF 36/33 Bull Put Spread

Simultaneously:

Sell to open XLF November 19, 2021 36 put strike

Buy to open XLF November 19, 2021 33 put strike for a total net credit of roughly $0.33 or $33 per bull put spread

- Probability of Success: 71.29%

- Total net credit: $0.33, or $33 per bull put spread

- Total risk per spread: $2.67, or $267 per bull put spread

- Max Potential Return: 12.36%

As long as XLF stays above our 36 strike at expiration in 44 days, I have the potential to make 12.36% on the trade.

In most cases, I will make slightly less, as the prudent move (and all research backs this up) is to buy back the bull put spread prior to expiration. Typically, I look to buy back the spread when I can lock in 50% to 75% of the original credit. Since we sold the spread for $0.33, I want to buy it back when the price of my spread hits roughly $0.10 to $0.15.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But taking off risk by locking in profits is never a bad decision and by doing so we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor; it also allows you to sleep well at night.

After using a proper position size based on my own personal risk-tolerance guidelines, I look to set a mental stop-loss at 1 to 2 times the original credit. Since I brought in a credit of $0.33, I would look to buy it back if losses in my bull put spread reached $0.66 to $0.99

Covered Strangle

Several weeks ago, I wrote about short strangles and how they offer investors one of the highest-probability strategies on the market. If managed correctly, short strangles are an incredible strategy. But the capital required can be steep, so most investors shy away. Plus, the thought of being naked on both sides of a trade (call and put) can potentially lead to a few sleepless nights—that is, if managing risk is an afterthought.

Placing trades is easy; it’s knowing when to hold ’em and fold ’em that separates traders/investors that fall on their face from those that continually trend their accounts higher over the long-term.

But I digress.

A short strangle is an undefined risk option strategy that benefits when the asset of your choice stays between your short call and short put strike. In most cases, it’s a neutral strategy with a large price range for the underlying stock to move around in. At least, that’s the way I use short strangles.

A covered strangle, on the other hand, offers an investor a completely different type of high-probability opportunity. A covered strangle is simply a covered call strategy coupled with a short put–or just buying a stock and wrapping a short strangle around it. Either way, it’s a covered strangle.

Investors want to use a covered strangle when they wish to enhance the returns on a long position (stock or ETF) by two to four times, while also having the opportunity to buy even more shares at a price of their choosing. It’s a great income strategy to use on stocks you already own or wish to acquire.

Let’s go through an example to really get down to the nitty-gritty of how a covered strangle works.

With XLF trading for 38.17, we are going to buy 100 shares for $3,817.

Once we’ve purchased at least 100 shares we then will sell a delta neutral short strangle around the shares. Since XLF is trading for roughly 38, we will look to sell a short strangle that has a delta of roughly 0.10 to 0.30 for both the call and put. Moreover, I will look to go out 20 to 50 days. My preference is to go with a shorter duration for my short strangle, but the amount of premium I can bring in will define my choice of expiration cycle.

Here are our choices for expiration cycles. I’m going to use the November 19, 2021 expiration cycle with 44 days left until expiration.

Once I’ve chosen my expiration cycle, I then must decide which strikes I wish to use for my short strangle.

In most cases, I want to sell a short strangle that has an 80%+ probability of success, or a delta of roughly 0.20 or less.

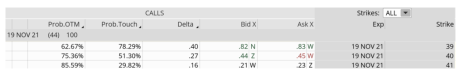

On the call side:

We can sell the 40 call strike for roughly $0.44. The 40 call strike has a probability of success of 75.36%, or a delta of 0.27.

On the put side:

We can sell the 35 put strike for roughly $0.42. The 35 put strike has a probability of success of 78.16%, or a delta of 0.19.

The Trade

Simultaneously:

- Sell out-of-the-money call

- Sell out-of-the-money put

Sell to open XLF November 19, 2021 40 call

Sell to open XLF November 19, 2021 35 call for a total credit of $0.86

Premium Return: $0.86 ($0.44 for the call + $0.42 for the put)

Breakeven Price: 37.31 (38.17 - $0.86)

Maximum Profit Potential: $269 ($40 short call strike – $37.31 breakeven)*100

A Few Possible Outcomes

XLF Pushes Above Short Call Strike

If XLF pushes above the 40 short call strike, no worries, we get to keep the put premium of $0.42, the call premium of $0.44 and we make roughly $2 on the stock. Overall, our gain would be $269, or 7.05% over 44 days.

XLF Stays Within the Range of 35 to 40

If XLF stays between our short put and short call we get to keep the entire premium of $0.86, or 2.25% over 44 days. We can use the covered strangle strategy roughly seven more times over the course of the year for a total annual return (just premium) of approximately 18%.

XLF Pushes Below our Short Put Strike

If XLF pushes below our short put strike of 135 we still get to keep our overall premium of $0.86. But we would be issued 100 shares of the ETF for every put sold. Our breakeven on the newly issued shares would be $34.14, a discount of 10.56%.

To sum up a covered strangle options strategy, if you wish to enhance a the return of a position or wish to buy more shares at a lower cost, consider this often overlooked but highly flexible covered strangle.

Wheel Strategy

The wheel options strategy is an inherently bullish, mechanical options income strategy known by various names. The covered call wheel strategy, the income cycle, and the options wheel strategy are just a few of the many names that investors use. Regardless of what you call it, the systematic approach remains the same.

More and more investors are choosing to use the wheel options strategy over a buy and hold approach because of the ability to create a steady stream of income on stocks you want to or already own.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

Basically, find a highly liquid stock that you are bullish on and have no problem holding over the long term. Once you find a stock that you’re comfortable holding, sell out-of-the-money puts at the price where you don’t mind owning the stock.

Keep selling puts, collecting even more premium, until eventually you are assigned shares of the stock, again, at the strike price of your choice. Once you have shares of the stock in your possession begin the process of selling calls against your newly issued shares. Basically, you are just following a covered call strategy, collecting more and more premium, until the stock pushes above your call strike at expiration. Once that occurs, your stock will be called away, thereby locking in any capital gains plus the credit you’ve collected.

Let’s go through an example to show you exactly how the wheel options strategy works.

My preference is to look for low-beta high-quality stocks, household names, that I feel comfortable holding over the long term. I’ve found that dividend aristocrat stocks work well with the wheel options strategy because they have a history of stability, strength and a proven ability to weather market turbulence.

Again, XLF is trading for 38.17.

Let’s say we decide to go with the 35 put strike.

We can sell to open the 36 puts for roughly $0.57.

But before I go any further, I want to point out an important aspect of placing a trade. Never sell at the bid price and never use a market order. Always use a limit order. All research shows that taking this approach will tack on a significant percentage to your account over the long haul. Be efficient and don’t give up easy returns; work your orders!

By selling the 36 puts for $0.57 our return is 1.49% cash-secured, or 7.47% on margin over 44 days.

If XLF stays above our 36 put strike at expiration we begin the process of selling puts again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in a conservative 1.49% every 44 days, and we can sell puts roughly eight times (minimum) over the course of a year (if the stock stays above our chosen short put strike) our annual return is 11.92% on a cash-secured basis … or 59.76% on margin. Again, it bears repeating, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position.

But what if XLF closes below our short put strike?

No biggie. We are issued or assigned shares at the price where we wanted to buy the ETF. Think about it for a second. We collect a premium to wait for a stock to hit our chosen price.

So, let’s say XLF closes below our 36 put strike at expiration. If so, we are issued 100 shares at 36.00 for every put contract we’ve sold.

Once we have shares in our possession, we begin the process of selling out-of-the-money calls against our shares, which begins the covered call portion of the wheel options strategy on XLF.

Wheel Options Strategy – Step Two

Now the question is which strike to choose. Again, ultimately it just comes down to preference. My preference is focusing on call strikes that have a probability of success ranging from 68% to 85%.

Let’s say we decide to sell the 40 calls against our newly issued XLF shares for roughly $0.44 per call contract. Our probability of success on the 40 calls stands at 75.36%

Our static return or return on capital is 1.15% over 44 days.

If XLF stays below our 40 call strike at expiration we begin the process of selling calls again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in a conservative 1.15% every 44 days, and we can sell calls roughly eight times over the course of a year (if the stock stays below our chosen short call strike) our annual return is 9.2%. And once again, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position.

But what if XLF closes above our short call strike?

No big deal. Our shares are called away, so of course, we keep our $44 per call contract, plus we are able to reap any capital gains from our stock. In this case, we would keep the $44 plus an additional $1.83 per share, or $183 per 100 shares, for a 5.94% gain.

Once our shares are called away, the wheel options strategy cycle ends, and the decision has to be made whether or not to continue using the strategy with the same stock.

The wheel options strategy is a wonderful strategy for those wanting to generate steady income, with lower risk compared to most options strategies. It also gives the investor an opportunity to lower the overall cost basis of a position.

The strategy isn’t a get rich quick strategy; rather, it’s a methodical, systematic approach to trading options that generates consistent returns, month after month, on stocks that you want to hold in your portfolio over the long term.

As always, if you have any questions, please do not hesitate to email me.