The market has bounced higher since hitting a year-to-date low back on June 17.

As a result, several major ETFs have pushed into a short-term overbought state, so now could be a decent time to look at a potential bear call spread. Volatility, as seen through the VIX, is still hovering around 27-28, so the investor’s fear gauge is still somewhat inflated.

Moreover, it seems as though everyone is in full agreement that the market is going to go higher. Even a few bearish friends of mine are calling for a target of 440 on the S&P 500 ETF (SPY).

I stay away from prognosticating because I don’t have a crystal ball. Yes, I can “guess” where I think the market is going, but it’s only a guess. No one knows where the market is headed, particularly over the short-term. No one!

And that’s OK. We can still make sound trades, without “knowing” where the market is headed next.

[text_ad use_post='262603']

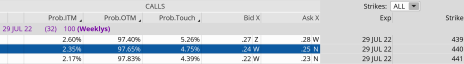

If we take a look at what Mr. Market thinks about the 440 that most are calling for on SPY we can see that going out roughly 30 days there is only a probability of 4.75% that SPY reaches 440.

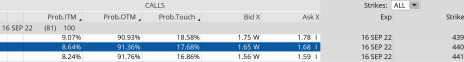

What about in roughly 80 days? The probability increases to 17.68%, still well below a coin flip.

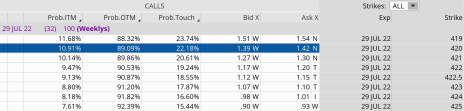

And if we take a look at the expected move for SPY for the July 29, 2022 expiration cycle (32 days) the expected move or range is from roughly 366 to 411.

So given the short-term overbought reading in the S&P 500 coupled with an alarming number of market participants predicting a sharp move to 440, I’m going to look at a potential contrarian set-up that still allows for a margin of error, just in case a low probability move to 440 comes to fruition.

SPY Bear Call Spread: A Contrarian Options Trade

SPY is trading for 388.59 as of this writing, so let’s take a look at a potential trade using a bear call spread, focusing on the mechanics of the trade.

Below is the SPY options chain for the July 29, 2022 expiration cycle with 32 days left until expiration.

The SPY 420 call strike with an 89.09% probability of success is a very conservative trade and it’s where I want to start. By choosing the 420 call strike, not only is our probability of success well over 80%, our margin of error is over 30 points. Basically, SPY can move as high as 420 (as indicated by the orange line on the chart) and we can still have the potential to make a profit on the trade. The short call strike defines my probability of success on the trade. It also helps to define my overall premium or return on the trade.

Once I’ve chosen my short call strike, in this case the 420 call, I then proceed to look at a 3-strike wide, 4-strike wide and 5-strike wide spread to buy.

The spread width of our bear call helps to define our risk on the trade. The smaller the width of the spread, the less capital required. When defining your position size knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For our example, let’s take a look at the 5-strike, 420/425 bear call spread.

Trade Example: 420/425 Bear Call Spread

Simultaneously:

Sell to open SPY July 29, 2022 420 strike

Buy to open SPY July 29, 2022 425 strike for a total net credit of roughly $0.50, or $50 per bear call spread

- Probability of Success: 89.09%

- Total net credit: $0.50, or $50 per bear call spread

- Total risk per spread: $4.50, or $450 per bear call spread

- Max Potential Return: 11.1%

As long as SPY stays below our 420 strike at expiration, I have the potential to make 11.1% on the trade. In most cases, I will make slightly less, as the prudent move is to buy back the bear call spread prior to expiration. Typically, I look to buy back the spread when I can lock in 50% to 75% of the original credit. However, with the probability of success over 90% there is a good chance I might hold this one a bit longer, possibly through expiration. As always, I allow the probabilities and time to expiration to lead the way for my decisions. But taking off risk by locking in profits is never a bad decision and by doing so, we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor…it also allows you to sleep well at night.

I also tend to set a stop-loss that sits 1 to 2 times my original credit. In my example, I sold the 420/425 bear call spread for $0.50. As a result, if my spread reaches $1.00 to $1.50 I will exit the trade.