Last week I wrote an article about the shorter-term overbought state in the S&P 500 (SPY). At the time, the SPY was trading for 429. As a result, I decided to look at the September 16, 2022 447/451 bear call spread, which was trading for $0.72. Now, with the market lower by a few percentage points and SPY trading for 413.50, the 447/451 bear call spread is trading at $0.11 for an 18.0% return.

Today I’m looking at another potential opportunity for a bear call spread, this time with an oil options trade in the SPDR S&P Oil & Gas Explorer ETF (XOP).

Short-Term Overbought State in XOP

This oil options trade is for educational purposes only.

With XOP now trading for roughly 143.50 and strong overhead resistance at 170, I’m looking at a potential opportunity for a short-term bear call spread going out 60 days. More importantly, I can place my bear call spread right at the high (170) set back on June 8, 2022, so I have an 18.4% margin of error.

[text_ad use_post='262603']

As always, my intent is to take off the trade well before my chosen expiration cycle, in this case the October 21, 2022, expiration date with 60 days left until expiration.

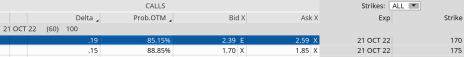

Once we choose our expiration cycle (it will differ in duration depending on outlook, strategy and risk), we begin the process of looking for a call strike within the October 21, 2022, expiration cycle that has around an 80% probability of success.

If you don’t have access to probabilities of success on your trading platform look towards the delta of the various strikes on your trading platform. Without going into too much detail, look for a call strike that has a delta around 0.15 to 0.20, as seen below.

Since we are focused on using a bear call spread, we only care about the upside risk at the moment.

The 170 call strike, with an 85.15% probability of success, works. I want to have an opportunity to bring in 16.6% over the next 60 days, while keeping my probability of success at the onset of the trade to around 80% or higher.

The short 170 call strike defines my probability of success on the trade. It also helps to define my overall premium, or return, on the trade. Basically, as long as XOP stays below the 170 call strike at the October expiration in 60 days we will make a max profit on the trade. But, as I stated before, my preference is to take off profits early and, in most cases, reestablish a position if warranted, much like I have over the past several months.

Also, time decay works in our favor on the trade, so as we get closer to expiration our premium will erode at an accelerated rate. As a result, we should have the opportunity to take the bear call spread off for a nice profit prior to expiration–unless, of course, XOP spikes to the upside over the next 60 days. But still, that doesn’t hide the fact that with this trade we can be completely wrong in our directional assumption and still make a max profit.

Once I’ve chosen my short call strike, in this case the 170 call, I then proceed to look at the other half of a 3-strike-wide, 4-strike-wide and 5-strike-wide spread to buy.

The spread width of our bear call defines our risk/capital on the trade.

The smaller the width of our bear call spread the less capital required, and vice versa for a wider bear call spread.

When defining your position size, knowing the overall defined risk per trade is essential. Basically, my premium increases as my chosen spread width increases.

The Oil Options Trade: Bear Call Spread in XOP

Bear Call Spread: October 21, 2022, 170/175 Bear Call Spread or Short Vertical Call Spread

Now that we have chosen our spread, we can execute the trade if we so choose. Remember, this is more about learning the mechanics of how I approach a bear call spread when a stock has reached an overbought state.

Simultaneously:

Sell to open XOP October 21, 2022, 170 strike call.

Buy to open XOP October 21, 2022, 175 strike call for a total net credit of roughly $0.71, or $71 per bear call spread.

- Probability of Success: 85.15%

- Total net credit: $0.721, or $71 per bear call spread

- Total risk per spread: $4.29, or $429 per bear call spread

- Max Potential Return: 16.6%

Again, as long as XOP stays below our 170 strike at expiration in 60 days, I have the potential to make a max profit of 16.6% on the trade. In most cases, I will make less, as the prudent move is to buy back the bear call spread prior to expiration.

Again, I look to buy back a spread when I can lock in 50% to 75% of the original credit. Since we sold the spread for $0.71, I would look to buy it back when the price of my spread hits roughly $0.35 to $0.30, if not less.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But, taking off risk, or at least half the risk, by locking in profits is never a bad decision, and by doing so we can take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I also tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 170/175 bear call spread for $0.71, if my bear call spread in this oil options trade reaches approximately $1.42 to $2.13, I will exit the trade.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

[author_ad]