When I got my first “real” job—while I was putting myself through college—one of the benefits I received was employer-paid life insurance and health insurance policies. I didn’t really pay much attention to any of it, and I can’t even tell you the amount of life insurance or what was covered in my health insurance plan. When you’re that young, the last thing you think about is getting sick or your mortality, isn’t it?

But as we age—and especially if we marry and have children—those subjects become more important.

Today, insurance—both health and life—are much more complicated than they were when I entered the workforce. Back then, most insurance was employer-paid. Today, the majority of us has to pay the lion’s share of premiums, and the options are seemingly limitless. And wading through all the minutiae of so much information is more than most people want to do or have the time to investigate.

So, with this article, I’m going to try to sort through and organize the major insurance offerings, and help you determine which policies you may need—at each stage of your life, which ones you don’t need or should avoid, and explain the different types of policies available so you can decide the products that are right for you and your family.

Let’s Start with Life Insurance…

There are scores of different types of life insurance policies—some that terminate when you reach a certain age, others whose premiums rise as you get older, many that offer cash value options, and additional products that combine insurance and investment strategies.

Most people don’t have a good understanding of life insurance. Yet, 54% of everyone in the U.S.—according to the Life Insurance Marketing and Research Association (LIMRA)—actually owns a life insurance policy. And 85% of companies offer that benefit to their employees.

Through the first part of my career, I had life insurance benefits at each of my jobs, and I just took them for granted. It wasn’t until I became self-employed that I began researching and understanding life insurance (among many other types of insurance that I didn’t know about)!

First, let’s talk about why you may need a life insurance policy. Here are the top reasons:

- Are married, or plan to wed

- Have children, or are planning to become a parent

- Owe money on student loans

- Have excessive debt

- Are fully or partially responsible for supporting your aging parents

- Are self-employed

- Have a high-risk job or dangerous hobbies

For people who fit the above categories, life insurance can enable your heirs and those for whom you are financially responsible to maintain the lifestyle to which they are accustomed, if you should pass away.

Unfortunately, most people don’t think about life insurance until later in life. But—just like investing—the younger you are when you start, the more financial sense it makes. In investing, of course, compound interest, accruing over decades, will give you a nice nest egg when you retire. And in the case of insurance, the younger you are when you buy it, the cheaper it is—in terms of premiums.

Consequently, if you fall into one of the above categories, the best time to begin buying life insurance is when you are young, preferably in your 20’s.

Now, let’s look at who doesn’t need life insurance. This category includes people who:

- Are retired

- Have no dependents

- Have plenty of assets that will cover your death costs as well as any debts that will outlive you

There are many types of life insurance.

Term insurance is the most common, as it fits most families’ needs. These policies are written for a specific number of years, generally one, five, 10, 15, 20, 25 or 30 years. It is designed to help your family should you pass away during your income-producing years. You can buy coverage up to millions of dollars. With level premium term life insurance, your rate is locked in for the length of the policy. Annual renewable term life is a renewable, one-year policy that is often used for policy holders who have short-term debts or need coverage for a specific and short period of time. If you die before your term expires, the insurance pays out to your beneficiaries. If you outlast the time period, the policy expires, and there is no payout.

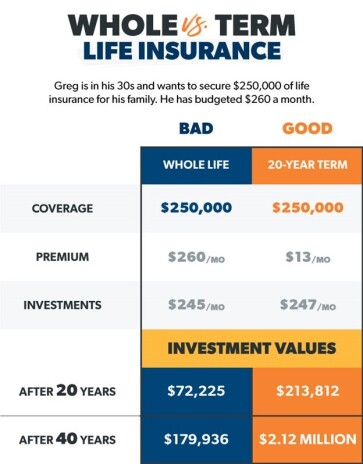

Permanent insurance covers you for your entire life and usually comes with a cash value component, which usually has a provision that enables you to borrow against it during your lifetime. Now, many financial advisers don’t recommend insurance with cash value. Most agree that the purpose of life insurance is to provide security, protection and peace of mind for your family upon your death. Further, they believe that insurance is insurance and investing is investing. And truthfully, if you took that money you put into a cash value policy and actually earmarked it for investing, you would be better off.

The following is a chart from financial guru Dave Ramsey, which demonstrates this point.

Source: Dave Ramsey

However, I say, “never say never,” as many folks who would buy life insurance are never going to invest or save money. Also, there are times in people’s lives when a cash value policy comes in handy, which I’ll discuss in a moment.

Whole life insurance policies are in force as long as you live, provided your premiums are paid up. In general, the premium stays the same throughout your life, you receive a minimum guaranteed rate of return based on the cash value of the policy, and the death benefit remains constant. The good thing about whole life is it does build cash value, but be aware that it is also more expensive than term life insurance.

Variable life insurance is similar to whole life in that the premiums are usually fixed, and the death benefit is guaranteed. But the cash value differs from whole life policies as it is tied to investment accounts. Each life insurance company will offer different variable life products, and since it is an investment product, I would recommend that you seek the advice of your financial adviser to help you decide which policy and company works best for you.

I invested in a variable life product when I was in my late 30s. My dad had recently died, and I helped support my mother for the rest of her life, and believed this policy would give me a lot of flexibility. If something happened to me, my mother would have enough money to make her golden years a bit easier. That, fortunately, did not have to be put to the test. However, my investments did very well over the years, and I borrowed a couple of times against the cash value in that policy—once to buy a home and one time to buy a business. I finally cashed it out a few years ago, as I no longer needed a life insurance policy.

With my policy, I was able to change the makeup of my investments on a regular basis. When I was younger, I leaned heavily toward small-cap stocks, which did very well over time. As I got older, I became more conservative.

Note that there’s a hybrid version of these policies—variable universal life—which includes adjustable premiums.

However, a big downside to such a policy is that it does include surrender fees that will be incurred if you cash it out in the early years. Usually, after seven to ten years, those fees go away. But make sure you read the fine print before you buy.

Guaranteed universal life insurance consists of a guaranteed death benefit and premiums, and usually doesn’t include cash value. You choose the age to which you want the death benefit guaranteed. These policies are usually cheaper than other life insurance policies since they don’t have cash value. But … if you miss a payment, the policy will be forfeited.

Indexed universal life insurance is also an investment product, but you don’t get to choose the investments like you would with a variable product. Instead, the cash value in this type of policy is linked to a stock market index like the S&P 500. Your returns are determined by a participation rate formula, and may include caps on gains, as outlined in the policy. For example, a 70% participation rate means if the S&P 500 rises by 10%, you would receive a 7% gain. However, if the index declines, you won’t suffer a loss; you just won’t add to your cash value. And if your cap is 10% and the index rises 30%, you still gain only 10%. There is some flexibility to adjust your death benefit amounts as your life stage or financial situation changes. You may also be able to adjust your premium payments, but be aware if your cash value doesn’t cover your costs/fees, your policy could lapse.

In addition to these specific types of policies, there are also options when it comes to qualifying for life insurance. The one you choose will determine your premiums, based on your age, gender, health, length of coverage and amount of coverage. The different options include:

Fully underwritten life insurance requires disclosure of any medical condition for which you are either currently being treated, or for which you have ever been treated by a doctor in the past. Those conditions will be excluded from your policy. But if you are healthy, these policies will be the least expensive options. And they are also policies that you might want to buy when you are young—before you develop any serious medical conditions. The healthier you are, the lower the premiums.

Simplified issue life insurance does not require a medical exam. However, you will still need to answer health questions, and you could be denied coverage due to your answers. In a recent study, Forbes reported that a typical policy would run $28 a month for a 10-year simplified issue policy of $100,000.

Guaranteed issue life insurance requires no medical exams and no health questions. You are guaranteed approval, as long as you are within the eligible age range, usually 40 to 85. But premiums are higher and policy values are usually low. Also, death benefits may be “graded,” meaning that if you pass away within the first few years of buying the policy, your heirs may receive only a partial payout. These policies are often used by high-risk folks who haven’t been able to get insurance or who just need a policy that’s large enough to cover their funeral expenses. You’ll see a lot of these products advertised on television, targeted toward seniors who are primarily looking for burial coverage.

A typical policy for a 50-year-old would cost $20-$55 per month for $10,000 of coverage. If you’re 60, the monthly outlay ranges from $30–$70.

Instant-approval life insurance policies cater to folks who love to do everything online. You complete a quick, online health questionnaire, and big data and algorithms determine approval/non-approval, premiums, and coverage amounts. Once you apply, you are giving permission for the insurance company to investigate your medications, driving record, and health conditions, using a variety of databases, including the MIB Group which maintains a database of information from insurance applications.

Monthly premiums are about $65 per month for $500,000 in coverage for a 20-year term.

Group life insurance is provided by employers as part of your overall benefits. The premiums are calculated, based on the group’s claims records. This coverage is usually offered for free to employees, with minimal or non-medical underwriting. And the amount of coverage is usually low, from $25,000 to some multiple of your annual salary.

Employers will often also offer additional supplemental policies that you can buy. The biggest downside of group life insurance policies is that when you leave your employer, your policy no longer exists.

Here’s a little chart to help you keep these types of policies straight in your mind.

Common types of life insurance policies

| Type of life insurance | Term | Permanent |

| Term life insurance | ✓ | |

| Whole life insurance | ✓ | |

| Universal life insurance | ✓ | |

| Variable life insurance | ✓ | |

| Indexed universal life insurance | ✓ | |

| Simplified issue life insurance | ✓ | ✓ |

| Guaranteed issue life insurance | ✓ | ✓ |

| Group life insurance | ✓ | ✓ |

Additionally, there are a few more types of life insurance options you need to know about:

Mortgage life insurance or PMI, is insurance you are required to purchase if you get a home loan for 80% or more of the value of your home. PMI will cost you an additional few hundred dollars added to your monthly mortgage payment. It actually covers your lender—not your beneficiaries—in the amount of the current balance of your mortgage, in case you die. The good news is that once your mortgage balance falls below 80% of your home’s value, you can ask your lender to remove this insurance (sometimes, it falls off automatically; check with your lender).

Credit life insurance covers your balance on specific loans, such as automobile or home equity loans, and is also paid to your lender, should you pass away. I usually don’t recommend this type of insurance as it is pretty expensive, but your lender will try very hard to get you to buy it (they make pretty decent commissions for selling it to you).

Accidental death and dismemberment insurance covers you if you die in an accident, or lose a limb, your sight or hearing. Premiums can run $7 to $10 per month per $100,000 of coverage, depending on your age. The older you are, the higher the premium. This is probably a good idea if you have a high-risk job or adventurous hobbies.

How Much Life Insurance Do You Need?

Now that you are conversant with the different types of life insurance, you need to determine how much life insurance you need. The quick answer that most insurance experts recommend is 10 times your annual salary.

There are plenty of calculators available on the internet, including:

https://www.bankrate.com/insurance/life-insurance/life-insurance-calculator/

https://www.fidelity.com/calculators-tools/life-insurance

https://www.ramseysolutions.com/insurance/term-life-insurance-calculator

But you can also do a manual calculation, as outlined below by Nerdwallet.com:

Determine your financial obligations:

- Your annual salary multiplied by the number of years you want to replace that income

- Your mortgage balance

- Any other debts

- Any future needs such as college fees and funeral costs

- The cost to replace services that a stay-at-home parent provides, such as child care, if applicable

Subtract your liquid assets, including savings, existing college funds, 401k funds available for your spouse, and current life insurance policies.

The result is the amount of life insurance you need.

Let’s do a quick example:

Annual income: $50,000. You’re 35 years of age and you want to provide funds for your family for 10 years. So, $50,000 x 10 = $500,000

Debt:

Mortgage balance: $200,000

Auto loan balance: $35,000

Future college and funeral costs: $100,000

That totals $335,000. Add that to your replacement income of $500,000 and you get $835,000. Now, subtract your liquid assets; say those are $140,000. That gives you $695,000. That’s the amount of life insurance you need.

The 10 Best Term Life Insurance Companies

There are lots of websites that rank insurance companies. Here is just one example of the latest ranking from Nerdwallet:

The Best Term Life Insurance Companies

| Insurance company | NerdWallet rating | Term lengths available |

| Haven Life | ***** | 5, 10, 15, 20, 25 or 30 years. |

| Guardian Life | ***** | 10, 15, 20 or 30 years. |

| AARP | ***** | No traditional term lengths — all policies expire at age 80. |

| Fabric | ***** | 10, 15, 20, 25 or 30 years. |

| MassMutual | ***** | 1, 10, 15, 20, 25 or 30 years. |

| New York Life | ****1/2 | 1, 10 or 20 years. |

| Pacific Life | ****1/2 | 10, 15, 20, 25 or 30 years. |

| State Farm | ****1/2 | 10, 20 or 30 years. |

| Lincoln Financial | ****1/2 | 10, 15, 20 or 30 years. |

| Northwestern Mutual | ****1/2 | 1, 10 or 20 years. |

| USAA | ****1/2 | 10 to 30 years. |

Life Insurance Settlement Companies—Yes or No?

Like guaranteed issue life insurance policies, the life insurance settlement companies are some of the most-advertised insurance products—especially on late-night television.

Since life insurance is an asset or property, it can be sold—to life insurance settlement companies, who are considered third parties. But like all insurance policies and options, it’s not for everyone. However, if you have an insurance policy that you’ve been paying on for years and no longer need or can’t afford, this might be a great option for you—cash out now and use those funds for something else, such as investing in your retirement or long-term care.

Here’s how it works: you contract with the life insurance settlement companies to purchase your policy at an agreed-upon amount. Then that company takes over your premiums. And when you pass on, the life insurance settlement company cashes in your death benefit.

It’s all perfectly legal. In fact, the U.S. Supreme Court ruled in 1911 that life insurance is, indeed, private property. But the settlement industry didn’t really get going until the AIDS epidemic in the 1980s, when patients began selling their policies to third parties, then called viatical settlements.

As you can imagine—just like in almost any new financial industry—fraud abounded. But since then, the industry has become very regulated.

Your age and your health will determine if you qualify for a life insurance settlement. Most of these companies prefer to settle with folks who are older (65 years of age, at least) or are not expected to live long (no more than a 20-year life expectancy). In other words, they want to get the death benefit in a reasonably short time period. Some states even require that the policy owners must be terminally ill with less than two years life expectancy, or so chronically ill that they can’t perform at least two activities of daily living, such as eating, bathing, dressing, etc.

A report from the London Business School estimates that life settlement proceeds are about four times more, on average, than cash surrender values. And Magna Life Settlements estimated that the average policy face value in life settlements was $1.24 million in 2018.

There are a few more things about life insurance settlements that you need to know:

- Many settlement companies prefer policies with higher payout amounts, $500,000 or more. But I’ve seen several with minimum policy requirements as low as $100,000.

- Experts report that the typical life settlement pays out 10% to 25% of the policy benefit. So, if your life insurance is for $250,000, you might receive $25,000 to $62,500.

- You can sell a term life or permanent life policy. But the majority of policies sold are universal life, especially those that had adjustable premiums that the policyholder can no longer afford.

- Out of the 43 states that regulate life insurance settlements, 30 of them have a mandated two-year waiting period before a life insurance policy is eligible for sale. 22 states require a five-year waiting period. Selling the policy before the waiting period is allowed under certain circumstances, such as terminal illness, divorce, physical or mental disability, chronic illness, or retirement.

- The proceeds from the sale of your policy will probably be taxed as ordinary income.

Most policies are sold through brokers, who are licensed and have a fiduciary duty to the policy owner. They put your policy in an auction and take bids, and are compensated through a commission, usually around 8% of the face amount of your policy or 30% of your life settlement payment, according to settlement broker Suncrest Benefits. Note that these commissions vary, so make sure you know exactly what you are being charged (in writing!).

You can also work directly with licensed buyers (providers), and not be subject to a commission. Here’s a link to the Life Insurance Settlement Association’s membership list: https://www.lisa.org/find-an-ls-professional/

This table sums up the advantages and disadvantages of the settlements:

Pros and Cons of Life Settlements

| Pros | Cons |

| The life settlement payment is higher than the cash surrender value of a policy | Your beneficiaries won’t get a payout when you die (unless you retained a portion of the death benefit) |

| The cash payout is higher than the accelerated death benefit | The payout might prevent you from qualifying for Medicaid |

| The cash from a payout can be used however you want | Proceeds from the sale of a policy likely will be taxed |

Source: Forbes.com

If you decide that a life insurance settlement may be in your future, here are a few sites that will help you calculate your estimated proceeds:

https://www.magnalifesettlements.com/calculator/

https://abacuslifesettlements.com/

https://mrefinance.com/free-life-settlement-calculator/

Note that these calculators belong to life settlement companies, so be prepared to receive a flurry of phone calls!

Here’s a list of the Top 5 Life Settlement companies, courtesy of https://www.top10lifesettlements.com/.

Coventry Direct is the pioneer of the industry and is the largest life settlement company, having sold $30 Billion in life insurance policies to date.

Ovid partners with institutional investors to purchase life insurance policies.

LifeSettlements.com is not a buyer of life insurance, but the company can help you determine whether you qualify and will submit your info to a licensed life settlement provider.

Life Equity works with professional advisors and institutional investors to purchase life insurance policies. Great if you want to work with a professional advisor.

Green Settlements matches policy owners with a qualified and licensed buyer, Good if you would like help with shopping your policy to different settlement companies.

Next, let’s look at another way of profiting from life insurance—investing in the companies that issue the insurance.

The Top 5 Life Insurance Stocks

It’s not so easy to find companies anymore that are pure-play life insurance businesses. Today, most insurance companies sell a wide range of insurance products, including life, health, property and casualty, long-term care, supplemental insurance, as well as investment products like annuities.

When I was a kid, the life insurance industry was in its heyday. In the 60s, my brother-in-law had just completed his service in the army and discovered that his pre-service manufacturing job at NCR had been moved out of Ohio while he was overseas. So, he went hunting for a new job, and landed one as a green life insurance salesman at Prudential.

I’m telling you; it was brutal!

Night after night, he spent hours on the telephone calling names from the obituary, divorce, and marriage columns in the local newspaper. Fortunately, he really could sell just about anything to anybody, and he spent his life in the insurance industry, making a fortune.

And along the way, when offered, he invested in a big chunk of Prudential stock.

Investors today can still do that. There are 15 life insurance companies listed on the New York Stock Exchange and 6 on the NASDAQ—all ready and waiting for your investment dollars.

Life Insurance Stocks Trading on the New York Stock Exchange (NYSE)

| S.No. | Company Name | Ticker | Country |

| 1 | AEGON N.V. | AEG | Netherlands |

| 2 | American Equity Investment Life Holding Company | AEL | USA |

| 3 | American International Group Inc. | AIG | USA |

| 4 | Athene Holding Ltd. | ATH-A | Bermuda |

| 5 | China Life Insurance Company Limited | LFC | China |

| 6 | Citizens Inc. | CIA | USA |

| 7 | CNO Financial Group Inc. | CNO | USA |

| 8 | Genworth Financial Inc | GNW | USA |

| 9 | Globe Life Inc. | GL | USA |

| 10 | Lincoln National Corporation | LNC | USA |

| 11 | MetLife Inc. | MET | USA |

| 12 | Primerica Inc. | PRI | USA |

| 13 | Prudential Financial Inc. | PRU | USA |

| 14 | Prudential Public Limited Company | PUK | United Kingdom |

| 15 | Reinsurance Group of America Incorporated | RGA | USA |

Life Insurance Stocks Trading on the NASDAQ

| S.No. | Company Name | Ticker | Country |

| 1 | American National Group Inc. | ANAT | United States |

| 2 | Atlantic American Corporation | AAME | United States |

| 3 | GWG Holdings Inc | GWGH | United States |

| 4 | Midwest Holding Inc. | MDWT | United States |

| 5 | National Western Life Group Inc. | NWLI | United States |

| 6 | Vericity Inc. | VERY | United States |

Source: Topforeignstocks.com

I reviewed each of these stocks as well as some other insurance companies that were heavy on life insurance but didn’t make the lists above because they aren’t exactly pure plays.

I studied fundamental elements such as earnings, growth prospects, debt outlays, and technical parameters to make sure their stocks were trading at buyable levels. After winnowing down the list, I came up with my three favorites listed in the following table.

| Company (Symbol) | Price | P/E | Dividend Yield | Ranking |

| Unum Group (UNM) | $33.23 | 7.36 | 3.73% | Buy |

Reinsurance Group of America, Incorporated (RGA) | $117.88 | 19.39 | 2.53% | Buy |

| Globe Life Inc. (GL) | $99.54 | 13.9 | 0.84% | Buy |

Let’s dig a little deeper.

Unum Group (UNM) provides financial protection benefit solutions primarily in the U.S., the United Kingdom, and Poland, offering group long-term and short-term disability, group life, and accidental death and dismemberment products; supplemental and voluntary products, such as individual disability, voluntary benefits, and dental and vision products; and accident, sickness, disability, life, and cancer and critical illness products. It also provides group pension, individual life and corporate-owned life insurance, reinsurance pools and management operations, and other products. The company’s earnings estimates have recently been boosted by Wall Street analysts who expect it to grow at an annual rate of 13.85% over the next five years.

Reinsurance Group of America’s (RGA) portfolio includes individual and group life and health insurance products, such as term life, credit life, universal life, whole life, group life and health, joint and last survivor insurance, critical illness, disability, and longevity products; asset-intensive and financial reinsurance products; and other capital motivated solutions. The company also provides reinsurance for mortality, morbidity, lapse, and investment-related risk associated with products; and reinsurance for investment-related risks. In addition, it develops and markets technology solutions and provides consulting and outsourcing solutions for the insurance and reinsurance industries. The company serves life insurance companies in the United States, Latin America, Canada, Europe, the Middle East, Africa, Australia, and the Asia Pacific. Recently, four analysts have raised their earnings estimates for the company and they expect triple-digit growth during the next five years.

Globe Life (GL) provides a range of life and supplemental health insurance products, and annuities to lower middle to middle income households in the United States. It offers whole life, term life, and other life insurance products; Medicare supplement and supplemental health insurance, such as critical illness and accident plans; and single-premium and flexible-premium deferred annuities. The company was formerly known as Torchmark Corporation and changed its name to Globe Life Inc. in August 2019. Analysts expect five-year annual growth for the company to be 14.72%, and two analysts have recently increased their EPS estimates for the company.

Well, I think that just about covers the life insurance industry. Next month, I’ll take a deep dive into health insurance to help you try to determine where you can get the most bang for your buck—in the polices and in health insurance stocks.