Writing this Top Picks Mid-Year Update issue is sort of like opening a Christmas present. While I continually keep my eyes on the stocks, I’m always excited to find out the final results—which contributors—and stocks—not only came in on top in terms of returns but also beat the averages.

Wall Street’s Best Dividend Stocks 298

[premium_html_toc post_id="136122"]

Top Picks Mid-Year Updates

When our 2017 Top Picks issue was published in January, we had already seen a nice spike in the markets after the November election. At the time, most market prognosticators were shaking their heads, not exactly sure why the Dow Jones Industrial Average had leaped by more than 1,500 points from November 7 until the end of the year.

And certainly, those same forecasters—as well as millions of investors—are grateful that the fun has continued. Since the beginning of the year, the broad markets have surprised us with some tremendous gains:

• Dow Jones Industrial Average—up 8.4%

• S&P 500—gains of 8.2%

• NASDAQ—a rise of 14.3%

And the sentiment remains bullish, with both investment advisors and individual investors expressing confidence that the markets remain on track, especially now that we are seeing real economic improvement.

Of course, we know that earnings are the most important driver of the markets, and corporate America continues to produce attractive results, which boosts investor sentiment. For the first quarter, 75% of the companies in the S&P 500 reported earnings greater than Wall Street had forecast. And second quarter is looking good too, with analysts predicting an earnings growth rate of 6.5%, on average.

But I believe that this current market optimism is not only fueled by good earnings, but also by a change in the mindset of investors. For the first time since the recession, I’m seeing and hearing investors express real hope that the economy has finally not just turned the corner, but is actually making progress. And we have plenty of statistics to support that notion.

Very importantly, the unemployment rate paints a cheerful picture, with significant progress being made on the jobs front since this time last year.

Housing is another bright spot. Here are the latest figures from the U.S. Census Bureau:

• Building Permits: 1,168,000

• Housing Starts: 1,092,000

• Housing Completions: 1,164,000

Those numbers have been very steady over the past year. Home prices, certainly, are increasing, but not in an alarming manner.

They’ve risen much higher in the large metro areas, but in pockets of the country such as rural USA—where I live—we are just beginning to see rising home prices.

Inflation remains very low, and the Federal Reserve is trying to maintain the status quo, having pushed up interest rates twice this year so far. And most economists expect one more increase before the end of 2017.

And those statistics bode very well for continued market gains for the rest of the year.

Top Five Picks Year to Date

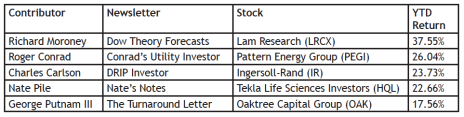

So far, our Top Picks are standouts. Our Top Five stocks average returns of 25.5%—pretty impressive, and more than three times the gains of the Dow Jones Industrial Average and the S&P 500 Index! Congratulations to our contributors—fantastic work!

And the winners are well-diversified, hailing from the technology, energy, industrial, healthcare and financial sectors.

The gold medal—so far in 2017—goes to Richard Moroney, editor of Dow Theory Forecasts, whose pick climbed 37.55%.

As always, I like to look back at our Top Picks and sort out the combinations of attributes that contributed to their successes. And in each of the above cases, each company had specific strategies that helped boost its stock, including market leadership, expansion of distribution, potential merger opportunities, excellent cash flow that provided the catalyst to increase dividend payments to shareholders, diversification and unique market niches. To give you a peek behind their reasoning for selecting these stocks, here are brief excerpts from our contributors’ original recommendations in January.

Lam Research (LRCX 154 - yield 1.20%)

From Richard Moroney, Dow Theory Forecasts

Lam Research (LRCX) has consistently outgrown the overall semiconductor-equipment market due to its high exposure to 3D NAND flash memory. The 2017 estimate rose 7% as 76% of analysts became more optimistic. The consensus now projects profit growth of 32% over the next 12 months and 15% annually over the next five years.

Lam’s rank of 91 out of 100 in our proprietary Quadrix Earnings Estimates is tops among its six category scores. The P/E ratio of 12 is 32% below its industry average.

Pattern Energy Group (PEGI 24 - yield 7.00%)

From Roger Conrad, Conrad’s Utility Investor

Priced to yield more than 8%, Pattern Energy Group (PEGI) trades 14% below its IPO price of $22 per share.

There are at least three powerful potential catalysts to generate hefty capital gains: more distribution growth, an improvement in dismal investor perceptions of yieldcos and prospects for renewable energy, in particular, and a potential takeover by Pattern’s parents Riverstone and Carlyle, which each own 19.39% of the company.

Ingersoll-Rand Plc (IR 93 - yield 1.70%)

From Charles A. Carlson, DRIP Investor

Ingersoll-Rand PLC (IR) is involved in heating and air conditioning systems, commercial and residential building services, and temperature-controlled transports solutions to fluid-management equipment, power tools, and golf and utility low-speed vehicles.

Ingersoll-Rand is coming off a decent third quarter in which profits and revenue beat the consensus estimates. The firm recently boosted its dividend 25%. It was the second dividend hike in the last 12 months and highlights the company’s confidence in its future.

Ingersoll-Rand raised its guidance for 2016 overall, and a strengthening economy bodes well for accelerated revenue growth in 2017.

Tekla Life Sciences Investors (HQL 21 - yield 7.80%)

From Nate Pile, Nate’s Notes

Tekla Life Sciences Investors (HQL) is a closed-end fund that invests in a variety of both public and private companies doing work in the life sciences sector and, in my opinion, represents an outstanding way for investors who want to be involved with biotech—but don’t like the high levels of stress that is sometimes come into play when owning individual stocks—to participate in the growth of this important industry without having to endure as much volatility.

Along with this exposure to the biotech space, the fund has a policy that permits it to make quarterly distributions at a rate of 2% of the fund’s net assets to shareholders each quarter.

And, unless someone specifically needs the cash flow from the payout, we recommend that shareholders have the payout reinvested in new shares in order to maximize the returns that can be achieved over longer periods of time in the sector.

Oaktree Capital Group (OAK 47 - yield 5.40%)

From George Putnam III, The Turnaround Letter

Oaktree Capital Group (OAK) is an investment management firm that focuses on alternative strategies. The firm is known for its contrarian approach with many of its products concentrating on distressed assets and turnaround situations. Fee-related products provide a steady base of income, yet what produces its real long-term value are the profits it generates from illiquid and complicated investments in distressed bonds, real estate and other alternative assets.

Oaktree also holds a 20% stake in DoubleLine Capital, the highly successful bond manager with over $100 billion in assets.

As the corporate debt binge that we’ve experienced since 2009 comes to an end, Oaktree will benefit from a growing number of restructurings and bankruptcies that are its specialty, boding well for Oaktree’s future profits. While waiting to participate in the substantial value that the firm can realize over time, investors are nicely compensated with the stock’s generous dividend yield.

I think you’ll find a lot to choose from in this issue—reasons to continue to invest in our Top Picks, as well as a variety of additional ideas from our contributors.

To read the rest of this month’s issue, download the PDF.

THE NEXT Wall Street’s Best Dividend Stocks WILL BE PUBLISHED August 9, 2017

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.