Roy introduces two new stocks that hold great promise: one is poised to start producing better sales and earnings this year and next, and the other is taking advantage of strong demand for digital storage created by the cloud computing revolution.

Why You Should Stay Fully Invested—BGE

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="127527"]

Why You Should Stay Fully Invested

One of my philosophies is to stay fully invested at all times. Warren Buffett, one of the best investors of all time, agrees.

Too many investors try to time the market by selling when the stock market dips or their individual stocks begin to slide. And then those investors almost always take too long to get back into stocks after the market begins to recover. Selling late and buying late will lead to poor performance in most instances.

During the financial crisis of 2007 to 2009, my Cabot Enterprising Model lost 52% and Warren Buffett’s Berkshire Hathaway lost 44%, but we both quickly recovered. Several of the most recognized and successful investors during the past 40 years stay fully invested at all times, and this philosophy has worked wonders for their investors.

You might complain when the stock market is declining, but your complaints will turn to cheers when your stocks take off in the early stages of a vigorous rebound.

You are probably familiar with Warren Buffett’s quip, “My holding period is forever.” Mr. Buffett’s statement brings up an important point: don’t sell too soon. The Cabot Benjamin Graham Value Investor’s average holding period is 27 months. The mistake that many investors make occurs when they sell too soon. Even when they choose the right stock in which to invest, many investors sell before the stock has a chance to blossom. My advice—based on my nearly 50 years of investing—is to hold onto your stocks until they reach their Minimum Sell Price targets or the company’s financial fundamentals and outlook turn negative.

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time. —Warren Buffett

Cabot Enterprising Model

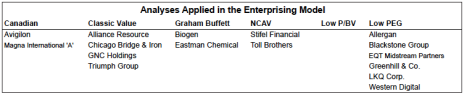

My Enterprising Model is composed of 16 stocks, which I have selected by using one of six analyses. The analyses I utilize are Undervalued Canadian, Classic Value, Graham Buffett, Low NCAV, Low P/BV and Low PEG. The Model is well diversified, represents many industry sectors, and is composed of stocks of undervalued companies that are expected to produce consistent growth. The analysis used to select the each Enterprising Model stock is included in each summary and in the Analyses table below. For additional details, please email me at roy@cabotwealth.com.

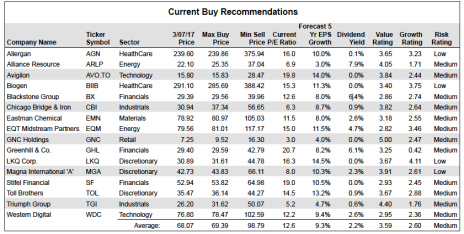

Usually stocks in the Enterprising Model are purchased at their current prices, but because of the current stock market volatility, I now recommend that Enterprising Model stocks be purchased at or below my Maximum Buy Price. Enterprising Model stocks should still be sold at their Minimum Sell Prices. For an explanation of how my Max and Min Prices are calculated, you may email me at roy@cabotwealth.com.

Model Buy Recommendations

The Enterprising Model on page 3 contains 16 stocks with five new stocks: Allergan (AGN), Eastman Chemical (EMN), LKQ Corp. (LKQ), Toll Brothers (TOL) and Western Digital (WDC). Five stocks transition out of the Model: Gilead Science (GILD), Silver Wheaton (SLW), Synchronoss Technologies (SNCR), Spectra Energy Partners LP (SEP) and TRI Pointe Group (TPH).

Gilead, Silver Wheaton and Spectra Energy are now listed on page 7 in the table of Hold and Sell Recommendations. These three stocks remain excellent investments, and should continue to be held. The remaining two stocks, Synchronoss and TRI Pointe, were recommended to be sold during the past three weeks. I am also now changing my opinion on Bioverativ from Hold to Sell, and repeating my Sell opinion on Convergys, which reached its Min Sell Price in February. My Sell recommendations are explained more fully on page 7.

Keep your Hold-rated stocks until your selection reaches its Min Sell Price, at which time I will issue a sell alert by email, in the Value Investor or Enterprising editions, or in the Weekly Update. I will also indicate that you should sell when a disappointing performance or adverse condition affects any company.

I now recommend that all stocks in the Enterprising Model be purchased at or below their Max Buy Prices—the same as Cabot Value Model stocks. Enterprising Model stocks should be sold when they achieve their Min Sell Prices.

Because I use six different analyses to find stocks for my growth-oriented Enterprising Model, these stocks are quite different from the stocks in my conservative Cabot Value Model. I base my choices for Enterprising stocks on favorable shorter-term market and sector trends and find a variety of stocks in many sectors. In addition, I have not applied my defensive risk allocation, which I apply to my Cabot Value Model, because the objective of the Enterprising Model is to provide choices to help you diversify your portfolio. Enterprising Model stocks carry more risk than Cabot Value Model stocks.

Prices indicated in the Enterprising Model are the closing prices on March 7, 2017.

Prices indicated in the Enterprising Model are the closing prices on March 7, 2017.

Blackstone Group LP (BX) Industry: Financials–Asset Management

& Custody Banks; Medium Risk; 6.4% Yield; Low PEG Ratio Analysis

Blackstone Group LP (BX: Current Price 29.39; Max Buy Price 29.56) offers alternative asset management. Blackstone raises capital for, invests in and manages various investment vehicles, including private equity, real estate and hedge funds. BX also provides financial advisory services. Blackstone is a limited partnership and passes income, gains and losses through to investors. The income, gains and losses are reported on IRS Schedule K-1 sent to investors after each year-end. Blackstone’s K-1 is complicated. You may need to seek professional tax help if you buy BX shares.

Blackstone reported exceptional fourth-quarter results. Growth was fueled by robust investment returns on all investment funds. Strong growth also was powered by increased fee income. The superior investment returns attracted substantial capital inflows, driving assets under management significantly higher.

Blackstone’s revenue and earnings vary wildly from quarter to quarter, depending on gains and losses from asset sales and fees earned. The company has been actively selling some of its major real estate holdings, with a focus on hotels, to institutional investors in China. These sales will generate substantial revenue and earnings in 2017. Revenue will likely advance 19% in 2017 and EPS (earnings per share) will jump 30%.

At 12.6 times current earnings with a PEG ratio of 0.87, BX is clearly undervalued. The dividend yield stands at 6.4%, which is very attractive. Earnings will receive an additional boost if interest rates rise, inflation increases, and/or financial regulations are eased by the Trump administration. However, Blackstone’s’ transactions with Chinese investors could become difficult. Blackstone’s stock price will likely rise 36% to my Min Sell Price of 39.96 within two years. Buy at 29.56 or below.

Eastman Chemical (EMN) Industry: Materials–Diversified Chemicals; Low Risk; 2.6% Yield; Graham-Buffett Analysis

Eastman Chemical (EMN: Current Price 78.92; Max Buy Price 80.97 is a leading manufacturer of a broad range of chemicals, plastics and fibers used in consumer and industrial products. International operations accounted for about 58% of sales in 2015. Eastman Chemical was founded in 1920 to produce chemicals for Eastman Kodak.

Eastman is the second largest supplier of acetate cigarette filter tow and the leader in acetate yarn for use in apparel, home furnishings and industrial fabrics. The company also manufactures chemicals for the transportation, building and construction, industrial, personal care and agrochemical markets. Lastly, Eastman makes cellulose films, adhesive resins and plasticizers.

The company leads the market in innovative products including durable plastics for consumer goods, additives used to improve tire quality and adhesives for hygiene products. These will fuel EPS growth in 2017 and 2018. Eastman’s plan to sell some of its commodity-oriented businesses could lead to reduced EPS volatility. Chemical manufacturers will benefit from the expected pickup in U.S. infrastructure spending under the new Republican administration. In addition, higher inflation will enable Eastman to raise prices on its chemicals.

Revenue will likely rise 2% in 2017 and EPS could rise 23% to $7.20 after a two-year slump. Higher sales volumes could be partly offset by lower or flat prices. Eastman is well-positioned in emerging markets to meet higher demand for chemicals. Product innovation and possible acquisitions could also bolster results.

At 11.5 times current EPS, 8.1 times cash flow and with a dividend yield of 2.6%, EMN shares are surprisingly undervalued. Eastman’s stock price will likely rise 33% to my Min Sell Price of 105.03 within one to two years. Buy at 80.97 or below.

LKQ Corp. (LKQ) Industry: Consumer Discretionary–Distributors; Low Risk; No Dividend; Low PEG Ratio Analysis

LKQ Corp. (LKQ: Current Price 30.89; Max Buy Price 31.61) is one of the largest providers of recycled automotive replacement parts with 100 sales and processing centers in North America and Europe. LKQ buys wrecked cars at auctions, salvages the reusable parts, and sells the parts to collision repair shops. The company primarily serves collision and mechanical repair shops, new and used car dealerships, metal recyclers, and retail customers. LKQ was founded in 1998 and is headquartered in Chicago, Illinois.

LKQ has established an enviable record of steady 20% sales and earnings growth during the past decade through its aggressive acquisition program. The company’s recent purchases, in the U.K., Ireland and The Netherlands, are typical acquisitions that will help diversify LKQ’s operations and add profits in 2017 and beyond.

Acquisitions have played an important part in LKQ’s success, but LKQ’s existing operations have added significant growth, too. LKQ’s vast distribution network provides the company with key competitive advantages, including faster delivery and more in-stock parts than competitors. The industry’s shift to replace automotive parts with used components versus new components will continue.

Sales climbed 24% and EPS advanced 27% in 2016. Acquisitions and much-improved sales in Europe bolstered results, while sales in the U.S. slumped a bit. Lower scrap prices hurt earnings and will likely put a dent in next 12-month results, as well. Sales and EPS are predicted to climb 14% in 2017, but new acquisitions could drive sales and earnings higher than my forecast. Also, LKQ pays a high 35% tax rate, so any reduction in the tax rates for corporations will benefit LKQ.

At 16.3 times current EPS, LKQ shares are quite reasonable, the balance sheet is very strong, and growth is steady and rapid. The company does not pay a dividend. LKQ’s 1.12 PEG ratio is a little modest, and the company’s projected 16% sales and earnings growth during the next five years is worth the premium. I expect LKQ’s stock price to advance 45% to my Minimum Sell Price of 44.78 within one to two years. Buy at 31.61 or below.

Toll Brothers (TOL) Industry: Consumer Discretionary–Homebuilding; Medium Risk; 0.9% Yield; Price to NCAV Ratio Analysis

Toll Brothers (TOL: Current Price 35.47; Max Buy Price 36.14) designs, builds and markets single-family and condominium homes usually in luxury residential communities. The company also arranges financing for its homes and condos. Toll has added lower priced homes, currently in high demand, to its repertoire to attract first-time buyers. The company also develops, owns and operates golf courses and country clubs associated with its master-planned communities. The company operates in 19 states in the U.S. Toll Brothers was founded in 1967 and is headquartered in Horsham, Pennsylvania.

Sales surged 25% and EPS rose 15% during the 12-month period ending January 31, 2017. Toll’s sales will likely increase another 11% during the next 12 months, while EPS could rise 30% to $3.18. The company’s January 31 backlog value rose 14% from a year ago, which bodes well for the remainder of 2017. Selling prices will probably drop slightly.

TOL shares sell at 14.5 times current EPS, and the company maintains a very strong balance sheet with lots of cash to fund future operations. Net current asset value per share (NCAV) is 17.33. TOL’s price to NCAV is 2.01 indicating that TOL shares are clearly undervalued. Net current asset value is calculated by subtracting all liabilities from current assets and dividing the result by the number of shares outstanding.

I expect TOL to rise 25% to my Min Sell Price of 44.27 within 12 to 18 months. Buy at 36.14 or below.

Western Digital (WDC) Industry: Information Technology–Technology Hardware Storage & Peripherals; Medium Risk; 2.6% Yield; Low PEG Ratio Analysis

Western Digital (WDC: Current Price 76.80; Max Buy Price 78.47) designs, develops, manufactures and sells hard disk drives. The company’s hard drives are used in desktop personal computers, notebook computers, enterprise servers, network attached storage devices, and consumer electronics products such as personal/digital video recorders, and satellite and cable set-top boxes.

Western Digital’s hard drive products include 3.5-inch and 2.5-inch drives with capacities ranging from 30 gigabytes to four terabytes, and rotation speeds up to 15,000 revolutions per minute. During the next five years, demand for hard drives will outpace the personal computer market. This shift is based on three factors: the growth of alternative products such as consumer electronics devices; the expansion of the external hard drive market, which allows for a more convenient way to store music and photos; and the increased use of multiple hard drives to deal with capacity constraints and safety issues.

In May 2016, Western Digital acquired SanDisk for $15.8 billion. The combined company is now positioned to meet the rapidly growing demand for data storage. Western Digital expects to obtain annual cost synergies of $500 million by the end of 2017.

After dropping 17% in 2016, Western Digital’s EPS are forecast to soar 49% to $8.10 in 2017, as the acquisition of SanDisk begins to add significant earnings. WDC sells at a very modest 12.2 times current EPS, and 7.1 times cash flow. WDC claims a dividend yield of 2.6% and a PEG ratio of 1.00. I expect WDC to rise 34% to my Min Sell Price of 102.59 within 12 months. Buy at 78.47 or below.

Hold and Sell Recommendations

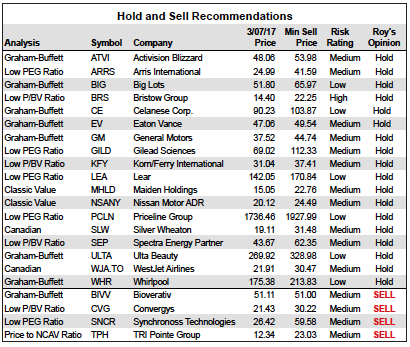

The stocks in the table below were previously recommended in the Cabot Enterprising Model and I now recommended that you hold them until their prices rise to my Min Sell Prices.

Sell Changes

I recommended selling three Enterprising Model stocks during the past month. Bioverativ is a new Sell recommendation today.

Bioverativ (BIVV 51.11) was spun off from Biogen on February 2 and began trading at 44.98. During the past five weeks, the stock has climbed 14%. Earnings per share are forecast to increase 10% to $2.58. At 21.7 times current EPS and 19.8 times analysts’ 2017 forecast, BIVV shares are not cheap. I advise selling your BIVV shares now, although the stock has been strong and waiting a few days to sell could prove to be beneficial. SELL.

Convergys (CVG 21.43) reported lackluster results. Sales advanced 1% but EPS fell 11% after sales were flat and EPS rose 2% in the previous quarter. Management forecast flat sales growth and flat EPS growth in 2017 disappointing investors. CVG fell 9% in reaction. After solid sales and earnings gains in the first half of 2016, Convergys has fallen into a mild slump which will likely continue through the end of 2017. Therefore, I recommend selling your CVG shares now.

Convergys was first recommended in December 2014 in the Cabot Enterprising Model using my low price to book value analysis. The stock has gained 12.2% during the past 26 months compared to an increase of 17.9% for the Standard & Poor’s 500 Index. SELL.

Synchronoss Technologies (SNCR 26.42) was the subject of an February 24 investigative report published by the Southern Investigative Reporting Foundation. The in-depth report was forwarded to me by my colleague Jacob Mintz, Chief Analyst of the Cabot Options Trader and by one of my subscribers, P.R.

Synchronoss’s proposed purchase of IntraLinks and sale of the company’s Activation unit is troublesome. The

price paid for IntraLinks is high, and the amount received for the Activation division is low. The transactions are

clouded by the SNCR executives and friends involved. These insiders will be highly rewarded by the purchase

and the sale at the expense of Synchronoss shareholders. I recommend selling your SNCR shares now. SELL.

TRI Pointe Group (TRI 12.34) reported disappointing fourth-quarter results. Sales declined 12% and EPS dropped 31% after decreasing 11% and 29% in the previous quarter. TRI Pointe’s backlog units increased 3%, but the dollar value of its backlog decreased 5%. The average sales price in backlog at quarter end fell 8% to $554,000.

Management is optimistic that the company can deliver 10% more homes in 2017 than in 2016 at an average

price of $570,000, an increase of 3% over 2016. Compared to the company’s backlog, management’s forecast

seems unachievable. Therefore, I advise selling your TPH shares now. SELL.

Buy and Hold Changes

From Hold to Buy:

Allergan plc (AGN)

LKQ Corp. (LKQ)

Toll Brothers (TOL)

From Buy to Hold:

Gilead Sciences (GILD)

Silver Wheaton (SLW)

Spectra Energy Partners (SEP)

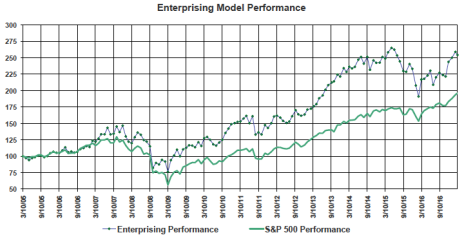

Enterprising Model Performance

During the three weeks ended March 7, 2017, the Enterprising Model declined 1.79% compared to an increase of 1.32% for the S&P 500 Index. Performance was dragged down by Arris, Bristow Group, and Maiden Holdings.

The Model is up 17.3% during the past 12 months compared to an increase of 19.7% for the S&P 500. During the past five years, the Model has advanced 57.1% compared to an increase of 72.8% for the S&P 500.

Since inception on March 10, 2005, the Enterprising Model has provided an impressive return of 154.5% compared to a return of 96.2% for the S&P 500 Index.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

THE NEXT XXX WILL BE PUBLISHED XXX XX, XXXX

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]