This month’s Cabot Enterprising Model contains 16 companies that offer you a mix of “low” and “moderate” risk stocks to add to your portfolio, including a new company that operates entirely within Canada.

Cabot Benjamin Graham Enterprising 276E

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="136480"]

Surging and Sinking

In the five weeks since the Cabot Enterprising Model was last published on June 15, many stocks have endured wild rides. The major indexes failed to show the internal turmoil, but some stocks surged on good news, while other stocks sank when the news was not so good.

Big gainers in our Buy and Hold list of Enterprising stocks included GNC Holdings (GNC), Chicago Bridge & Iron (CBI), Gilead Sciences (GILD) and WestJet Airlines (WJA.TO), all of which gained more than 10%. These stocks had taken a beating in 2017, and I’m hopeful that the rebound for these and others has just begun. Ulta Salon (ULTA) was our only stock down more than 10%. Ulta could become very attractive again if it falls to my Max Buy Price of 253.10 or below.

My new stock in this month’s Cabot Enterprising Model is a Canadian company. Canadian Tire (CTCA.TO) is a diversified retailer with $13 billion in sales. The company’s name is misleading, because Canadian Tire derives most of its sales from sports merchandise, apparel, home décor, real estate and financial services. The Canadian economy is improving, and now is the right time to seek out Canadian stocks. Buy Canadian Tire now, you’ll be glad you did!

“Before you invest, you must ensure that you have realistically assessed your probability of being right and how you will react to the consequences of being wrong.” —Warren Buffett

Cabot Enterprising Model

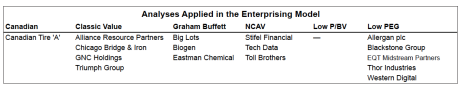

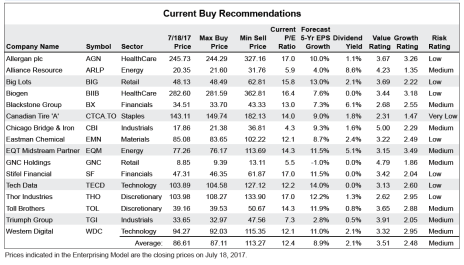

My Enterprising Model comprises 16 stocks which I have selected by using one of six analyses: Undervalued Canadian, Classic Value, Graham Buffett, Low NCAV, Low P/BV and Low PEG. The Model is well-diversified, represents many industry sectors, and is composed of the stocks of undervalued companies that are expected to produce consistent growth. The analysis used to select the Enterprising Model stocks is included in each summary and in the Analyses table below. For additional details, please email me at roy@cabotwealth.com.

Usually stocks in the Enterprising Model are purchased at their current prices, but because of the current stock market volatility, I now recommend that Enterprising Model stocks be purchased at or below my Maximum Buy Price. Enterprising Model stocks should still be sold using my Minimum Sell Price. For an explanation of how my Max and Min Prices are calculated, you may email me at roy@cabotwealth.com.

Model Buy Recommendations

The Enterprising Model contains 16 stocks with three new stocks: Big Lots (BIG), Canadian Tire (CTCA.TO) and Chicago Bridge & Iron (CBI). Three stocks transition out of the Model: Five Below (FIVE), LKQ Corp. (LKQ) and Ulta Beauty (ULTA).

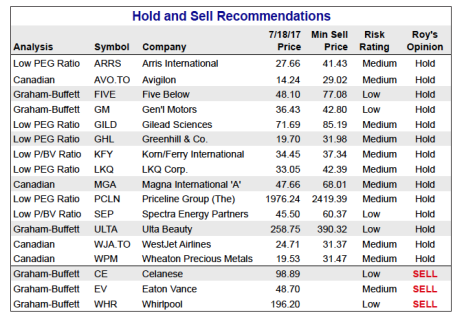

Five Below, LKQ and Ulta Beauty are now listed in the table of Hold and Sell Recommendations. These three stocks remain excellent investments and should continue to be held. Keep your “Hold” stocks until your selection reaches its Min Sell Price, at which time I will issue a sell alert by email, in the Value Investor or Enterprising edition, or in the Weekly Update. I will also indicate that you should sell when a disappointing performance or adverse condition affects any company.

All Enterprising Model stocks are now recommended to be purchased at or below their Max Buy Prices—the same as Cabot Value Model stocks. Enterprising Model stocks should be sold when they achieve my Min Sell Price.

Because I use six different analyses to find stocks for my growth-oriented Enterprising Model, these stocks are quite different from the stocks in my conservative Cabot Value Model. I base my choices for Enterprising stocks on favorable shorter-term market and sector trends and find a variety of stocks in many sectors. I do not apply my defensive risk allocation, which I apply to my Cabot Value Model, to Enterprising Model stocks because the objective of the Enterprising Model is to provide choices to help you diversify your portfolio. Enterprising Model stocks carry more risk than Cabot Value Model stocks.

Allergan (AGN) Industry: HealthCare–Pharmaceutical Drugs; Low Risk; 1.1% Yield; Low PEG Ratio Analysis

Allergan Corp. (AGN: Current Price 245.73; Max Buy Price 244.29) is a leading manufacturer of generic drugs. The company’s goal is to create difficult to produce off-patent drugs. Allergan (formerly Actavis) has grown rapidly in recent years by acquiring large companies in the pharmaceutical sector.

Allergan’s sales and EPS (earnings per share) have tripled during the past five years, bolstered by the steady stream of acquisitions. On February 1, Allergan acquired LifeCell, a leading aesthetic and regenerative medicine business in plastic surgery, for $2.9 billion. On April 28, Allergan then purchased ZELTIQ Aesthetics, the maker of fat-reducing treatments, for $2.4 billion. LifeCell and ZELTIQ will add noticeable sales and earnings during the remainder of 2017 and beyond.

Allergan’s first-quarter results met forecasts. Sales rose 5% and EPS climbed 10%. The company’s leading brands, led by Botox, performed well, and new products enjoyed successful introductions. Allergan reported that nine new drugs are scheduled to launch in 2017. Management raised its sales and earnings forecast for the remainder of 2017 by a small margin.

Sales will likely advance 9% and EPS will climb 17% to 17 in the 12 months ending June 30, 2018. With a price to earnings ratio (P/E) of 17.0 times current EPS and a PEG ratio of 1.52, AGN shares are undervalued. I calculate PEG by dividing the current P/E of 17.0 by the sum of the forecast five-year EPS growth rate (10.0%) and dividend yield (1.1%).

I expect AGN to rise 33% and reach my Min Sell Price of 327.16 within one to two years. Buy at 244.29 or below.

Big Lots (BIG) Industry: Retail–General Merchandise; Low Risk; 2.1% Dividend Yield; Low PEG Ratio Analysis

Big Lots (BIG: Current Price 48.13; Max Buy Price 48.49) is a discount retailer selling closed out brand-name merchandise at prices 20% to 40% below most discount retailers. The company sells beverages and groceries, candy and snacks, specialty foods, health and beauty products, and pet food and supplies. Big Lots also sells home décor goods, small appliances, furniture and seasonal merchandise. Big Lots was founded in 1967, is headquartered in Columbus, Ohio, and operates 1,425 stores in 47 states.

Management is focused on improving merchandising and marketing within the core U.S. business. Underperforming stores are being closed, existing stores are receiving upgrades, and coolers and freezers are being installed in many stores. Big Lots is expanding its e-commerce platform, which will also add future sales.

Big Lots reported solid results and raised guidance. Sales for the quarter ended April 29 declined 1%, same store sales dipped 0.9%, and EPS jumped 46%. Same-store sales were weak in February due to extensive store renovations, but rebounded in March and April. Management raised its earnings forecast for the remainder of 2017.

Sales will likely increase 5% during the next 12 months ending July 31, 2018. EPS will rise 1% to $4.44, although management’s ambitious initiatives could help push sales and earnings even higher.

The current 15.8 P/E is easily justified by Big Lots’ new growth prospects. The company’s high 24% return on equity will produce plenty of cash flow per share ($7.15 in 2017). Standard & Poor’s awards Big Lots its highest Fair Value rating of 5 and Stars rating of 4, along with an above average Quality rating of B+. I expect Big Lots to establish a record of steady sales, earnings and dividend growth now and in future years. BIG shares will likely rise 30% and reach my Min Sell Price of 62.81 within one to two years. Buy at 48.49 or below.

Blackstone Group LP (BX) Industry: Financials–Asset Management & Custody Banks; Medium Risk; 7.3% Yield; Low PEG Ratio Analysis

Blackstone Group LP (BX: Current Price 34.51; Max Buy Price 33.70) offers alternative asset management and raises capital for, invests in, and manages various investment vehicles, including private equity, real estate and hedge funds. The company also provides financial advisory services. Blackstone is a limited partnership and passes income, gains and losses through to investors. The income, gains and losses are reported on IRS Schedule K-1 sent to investors after each year-end. Blackstone’s K-1 is complicated and may require that you seek tax help if you buy BX shares.

Blackstone easily beat estimates for the first quarter, as the company sold $16.6 billion of investment assets. Revenue doubled and EPS rocketed 165%. Blackstone took advantage of buoyant markets to sell private equity, real-estate and other assets. The company’s buyout and private-equity segments sold $12.9 billion during the quarter at an average 2.6 times what the firm paid for the investments.

Meanwhile, Blackstone invested $11.7 billion in the first quarter, making it the second-biggest quarter ever for putting new money to work. The quarterly dividend, which is based on income, was boosted to $0.87 per share, up sharply from $0.28 paid a year ago. Blackstone’s dividend yield, based on latest 12-month dividends, is 6.1%.

Blackstone’s revenue and earnings vary wildly from quarter to quarter, depending on gains and losses from asset sales and fees earned. The company has been actively selling some of its major real estate holdings, with a focus on hotels to institutional investors in China. These sales will generate substantial revenue and earnings during the next six to 12 months. Revenue will likely advance 9%, and EPS will climb 18% to $2.66. First-quarter results indicate that Blackstone could exceed my estimates by a wide margin.

At 13.0 times current earnings with a PEG ratio of 0.75, BX shares are clearly undervalued. Blackstone’s dividend yield stands at 6.1%, which is very attractive. Earnings will receive an additional boost if interest rates rise, inflation increases or financial regulations are eased by the Trump administration. However, Blackstone’s’ transactions with Chinese investors could become difficult if U.S. and China political relations diminish. BX will likely rise 26% to my Min Sell Price of 43.33 within 12 months. Buy at 33.70 or below.

Canadian Tire ‘A’ (CTCA.TO) Industry: Consumer Staples–Retail; Very Low Risk; 1.8% Yield; Undervalued Canadian Analysis

Canadian Tire ‘A’ (CTCA.TO: Current Price 143.11; Max Buy Price 149.74; U.S. Over-the-Counter CDNAF 113.20; Max Buy Price 116.95) is a buy recommendation best suited for Canadian investors. U.S. investors can buy the shares in the Over-the-Counter market using the symbol CDNAF, but the shares trade sparsely with average daily volume of 4,400 shares.

Canadian Tire sells various products and services through several retail store names in Canada. The company’s retail segment, under the Canadian Tire, SportChek and Mark’s store names, sells apparel and home décor, home improvement, sports and automotive goods. Canadian Tire is Canada’s largest sporting goods retailer. The company also operates a chain of 91 automotive parts specialty stores under the PartSource banner; and sells gasoline through a network of 296 gas stations under the Petroleum product line.

The company’s REIT segment operates a real estate investment trust that owns, develops and leases income producing commercial properties. Canadian Tire’s Financial Services segment offers Canadian Tire-branded credit cards, various insurance and identity theft products, interest savings accounts and guaranteed investment certificates. The company was founded in 1922 and is headquartered in Toronto, Canada.

First-quarter sales rose 8% and EPS spiked 38% after increasing 8% and 15% in the previous quarter. Apparel and sporting goods bolstered sales. The results were impressive considering the challenging retail backdrop that currently exists in Canada. However, the Canadian economy is beginning to heat up as evidenced by first-quarter GDP growth which was double that of the U.S.

Sales will likely expand 7% and EPS will rise 10% to $10.75 during the 12 months ending June 30, 2018. Results could easily improve further if the Canadian economy continues to grow at a better than 3% pace. At 14.0 times current EPS and with a dividend yield of 1.8%, CTCA.TO shares are undervalued. Canadian Tire boasts a strong balance sheet, and has compiled an enviable record of steady sales, earnings and dividend growth during the past decade.

Canadian Tire’s stock price will likely rise 27% to my Canadian dollar Min Sell Price of 182.13 or my U.S. dollar Min Sell Price of 142.24 within one year. Buy at or below 149.74 Canadian or 116.95 U.S.

Toll Brothers (TOL) Industry: Consumer Discretionary–Homebuilding; Medium Risk; 0.8% Yield; Price to NCAV Ratio Analysis

Toll Brothers (TOL: Current Price 39.16; Max Buy Price 39.53) designs, builds, markets and arranges financing for single-family homes and condominiums in luxury residential communities. The company also develops, owns and operates golf courses and country clubs associated with its master-planned communities; develops and sells land to other builders; and develops, operates and rents apartments. The company operates in 20 states in the U.S. Toll Brothers was founded in 1967 and is headquartered in Horsham, Pennsylvania.

Toll’s high concentration of communities in the luxury market segment and its valuable land holdings provide a solid base for future growth. Toll Brothers, unlike its competitors, sells before building new homes which minimizes inventory. TOL is gaining market share because of superior construction and marketing.

Toll Brothers exceeded first-quarter expectations by a wide margin. Sales advanced 22% and EPS surged 43%. Currently, demand for new homes exceeds supply. Toll’s backlog of homes to build surged 19%, which bodes well for additional gains during the next several quarters. Toll’s sales will likely increase another 17% during the next 12 months, while EPS could jump 23% to $3.37.

TOL shares sell at 14.3 times current EPS, and the company maintains a very strong balance sheet with lots of cash to fund future operations. Net current asset value per share (NCAV) is $17.66, and TOL’s price to NCAV is 2.22. These numbers indicate that TOL is clearly undervalued. Net current asset value is calculated by subtracting all liabilities from current assets and dividing the result by the number of shares outstanding. The price to NCAV is calculated by dividing NCAV by the current price.

I expect TOL to rise 29% to my Min Sell Price of 50.67 within 12 to 18 months. Buy at 39.53 or below.

Hold and Sell Recommendations

The stocks in the table below were previously recommended in the Cabot Enterprising Model. “Hold” stocks are recommended to be held until their stock prices rise to my Min Sell Prices. “Sell” stocks should be sold now.

Sell Changes

I have three sell recommendations.

Celanese (CE 98.89) reached its Minimum Sell Price of 96.66 on June 19. First-quarter sales and earnings were mixed, but the stock received a boost when the company announced favorable price increases for many of its products. CE surged 58% during the past nine months and is now overvalued.

Celanese was first recommended in April 2014 at 55.03. The company was featured in the Cabot Enterprising Model using the Graham-Buffett analysis. CE advanced 75.65% in the past 38 months compared to a gain of just 34.34 % for the Standard & Poor’s 500 Index during the same time period. SELL.

Eaton Vance (EV 48.70) reached its Min Sell Price of 48.49 near the close on July 13. The company produced excellent results for the quarter ended April 30. Revenue rose 16% and EPS surged 29%. Assets under management increased 22%, aided by the company’s acquisition of Calvert Investments. Management expects strong results during the remainder of 2017.

Eaton is an excellent company with good growth prospects, but at 20.5 times current EPS, its shares are overvalued. Eaton Vance was first recommended in the June 2014 Cabot Enterprising Model issue at 36.51 and has climbed 32.81% during the past 37 months. The Standard & Poor’s 500 Index gained only 26.51% during the same time period. I recommend selling your EV shares now. SELL.

Whirlpool (WHR 187.50) fell briefly after London investigators concluded that the Grenfell Tower fire started in a Hotpoint fridge freezer, manufactured by a subsidiary of Whirlpool. Crista Huff, Chief Analyst of Cabot Undervalued Stocks Advisor picked up the story early and issued a sell advisory to her subscribers.

The manufacturer of the external cladding on the building will also be held accountable after the cladding failed safety tests. Both Whirlpool and the cladding maker could face severe penalties after 80 victims died in the tragedy. Whirlpool’s liability cannot be determined this soon, and the investigation and settlements could take many months. I recommend selling your WHR shares now. SELL.

Buy and Hold Changes

I have five new changes.

Big Lots (BIG 48.13) Hold to Buy. Sales are rebounding from store restoration disruptions. Buy.

Chicago Bridge & Iron (CBI 17.86) Hold to Buy. Big win in legal battle against Westinghouse will enable CBI to get back on track. Buy.

Five Below (FIVE 50.31) Buy to Hold. The stock needs to settle down after a volatile month. Hold.

LKQ Corp. (LKQ 65.15) Buy to Hold. Recent rise in stock price places LKQ above its Max Buy Price of 31.87. Hold.

Ulta Beauty (Ulta 258.75) Buy to Hold. Recent rise in stock price places ULTA above its Max Buy Price of 253.10. Hold.

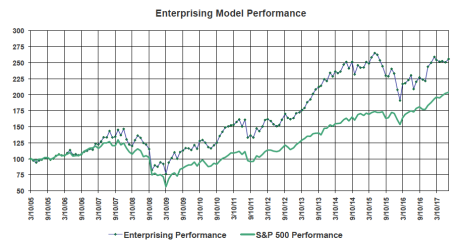

Enterprising Model Performance

Value stocks are beginning to gain investors’ attention. During the five weeks ended July 18, 2017, the Enterprising Model advanced 2.06% compared to an increase of 0.83% for the S&P 500 Index. Performance was bolstered by GNC and Chicago Bridge & Iron.

The Model is up only 2.34% in 2017 compared to an increase of 8.45% for the S&P 500. During the past five years, the Model advanced 67.4% compared to an increase of 81.4% for the S&P 500.

Since inception on March 10, 2005, the Enterprising Model has provided an impressive return of 155.9% compared to a return of 103.9% for the S&P 500 Index.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]