The emails have been rolling in of late.

Everyone wants to know some of the best options strategies to use during high implied volatility environments, much like what we are witnessing right now.

Well, you could try bear call spreads, bull put spreads and really anything where we are selling premium.

But today, I want to talk about iron condors, with a potential trade idea.

Quick Preview

There is no doubt that volatility has increased across the board. And as volatility increases trading opportunities increase, which opens up the options playbook significantly.

[text_ad use_post='262603']

Iron condors using highly liquid ETFs are one of my favorite defined risk, non-directional options strategies in a high implied volatility environment. As for the name “iron condor,” well, the name makes perfect sense when you look at the profit/loss chart below.

The strategy consists of a short call vertical spread (bear call spread) and short put vertical spread (bull put spread).

Sample Trade: Iron Condor Nasdaq 100 (QQQ)

The IV rank and IV percentile in QQQ are hitting extremes not seen in years. As a result, now is the perfect time to start selling some premium in QQQ, and most of the highly liquid ETFs like SPY, IWM and others.

Let’s say we decide to place a trade in the highly liquid Nasdaq 100 (QQQ) going out roughly 25 days until expiration.

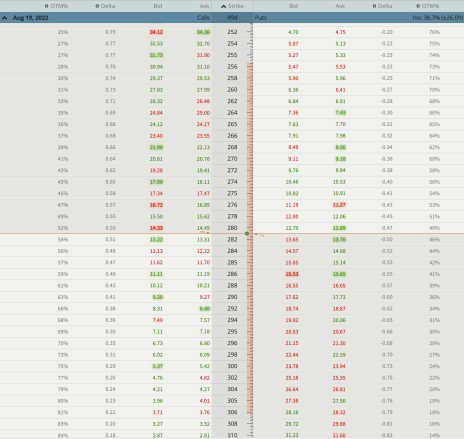

The expected move, also known as the expected range, is from roughly 256 to 356 for the August 19, 2022 expiration cycle.

In most cases, my goal is to place the short strikes of my iron condor outside of the expected move. Moreover, I prefer to have my probability OTM, or probability of success around 75%, if not higher, on both the call and put side.

Choosing Expiration Cycle and Strike Prices

Since I know the expected range for the August 19, 2022 expiration cycle is from 256 to 306, I can then begin the process of choosing my strike prices.

Put Side of the Iron Condor:

The low side of the expected range is, again, 256 for the August 19, 2022 expiration cycle, so I want to sell my short put strike just below the 256 strike, possibly lower.

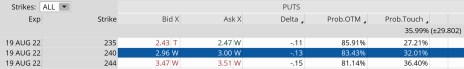

As you can see above, the 240 strike with an 83.43% probability of success fits the bill. In fact, it is a very conservative approach to the trade.

Now, once I’ve chosen my short put strike, in this case the 240 put strike, I then begin the process of choosing my long put strike. Remember, buying the long put strike defines my risk on the downside. For this example, I am going with a 5-strike-wide iron condor, so I’m going to buy the 235 strike.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with QQQ trading for roughly 280, the underlying ETF can move lower roughly 14.3% over the next 49 days before the trade is in jeopardy of taking a loss.

Call Side of the Iron Condor:

The high side of the range is, again, 306 for the August 19, 2022 expiration cycle, so I want to sell the short call strike just above the 306 strike, possibly higher.

As you can see above, the 320 strike with a 90.77% probability of success fits the bill. Once I’ve chosen my short call strike, I then begin the process of choosing my long call strike. Remember, buying the long strike defines my risk on the upside of my iron condor. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 325 strike.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with a range of $80 (240-320) and QQQ trading for roughly 280, the underlying ETF can move higher or lower by roughly 14.0% over the next 50 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open QQQ August 19, 2022 320 calls

- Buy to open QQQ August 19, 2022 325 calls

- Sell to open QQQ August 19, 2022 240 puts

- Buy to open QQQ August 19, 2022 235 puts

We can sell this QQQ iron condor for roughly $0.90. This means our max potential profit sits at approximately 22.0%.

Again, I wanted to choose an iron condor that was outside of the expected move and has a high probability of success. This is why I sold the 320 calls and the 240 puts.

Remember, when approaching the market from a purely quantitative approach, it’s all about the probabilities. The higher the probability of success on the trade, the less premium I’m able to bring in, but again, the tradeoff is a higher win rate. And when I couple a consistent and disciplined high probability approach on each and every trade I place, I allow the law of large numbers to take over. Ultimately, that is the true path to long-term success. I’m not trying to hit home runs. I understand the true, consistent opportunities, particularly when seeking income, come with using high probability options strategies coupled with a disciplined approach to risk management—the latter being the most important.

Managing the Iron Condor Trade

I typically close out my trade for a profit when I can lock in 50% to 75% of the original premium sold. So, if I sold an iron condor for $0.90, I would look to buy it back when the spread reaches roughly $0.45 to $0.20. However, since we are so close to expiration, I might ride the trade out until it expires worthless, thereby reaping a full profit. As always, the market will dictate my actions.

If the underlying moves against my position I typically adjust the untested side. Most roll the tested side, but all research states that rolling the untested side higher/lower allows me to bring in more premium and thereby decrease my overall risk on the trade. Moreover, I look to get out of the trade when it reaches 1 to 2 times my original premium. So, in our case, when the iron condor hits $1.80 to $2.70.

Of course, the aforementioned numbers will change drastically if I’m able to sell a bear call spread over the next several days. Stay tuned!

Ultimately, position size is the best way to truly manage a trade. We know prior to placing a trade what we stand to make and lose on the trade, therefore we can adjust our position size to fit our own personal guidelines. Iron condors are risk-defined, so it’s important to take advantage of their risk-defined nature by staying consistent with your position size for each and every trade you place.

[author_ad]