Get this Investor Briefing now, All You Need to Prepare for a Happy—and Rich—Retirement, and you’ll learn about the the best ways to prepare for a prosperous retirement. From when to start taking Social Security to choosing low-risk stocks during the pandemic … from the best fixed-rate bonds to REIT investing for retirement … and from understanding retirement plans to the best investments for after retirement. All You Need to Prepare for a Happy—and Rich—Retirement, is your best guide to ensuring a wealthy and enjoyable retirement through financial independence and security.”

Supercharge Your 401k

My dad didn’t worry too much about retirement. He was a truck driver, and the Teamsters offered a pension plan. He figured that with Social Security in his future, he didn’t need to spend too much time fretting about money for his golden age.

My, how times have changed!

The 1980s were the halcyon days of pensions. Some 38% of workers had a pension back then. They mostly were defined benefit plans in which the company contributed a certain amount of money toward their employees’ retirement. I think I worked for one company that had a pension, but I didn’t stay there long enough to vest.

Today, many government workers can still count on pensions, but only about 18% of us in the private sector have a pension, according to the Bureau of Labor Statistics. Part of that decline is due to employee turnover (you usually have to remain with an employer for at least 3-5 years before you are fully vested in a plan, and today, employee turnover is about 40% annually), but the advent of the 401k plan, to which employees and many employers contribute (under a defined contribution plan)—as well as pension fund mismanagement—actually sounded the death knell on the defined benefit plan.

Even if you are lucky enough to have a pension, you may not be able to count on it being there when you retire. I mentioned mismanagement, and that’s a big issue. According to Mercer’s 2020 Defined Benefit Outlook, only 85% of pension plans have the funds necessary to meet their obligations. Mercer lays the blame on “poor investment decisions and greedy assumptions.” But to be fair, one can also blame historically low interest rates that haven’t returned the gains predicted in the funds.

Mercer also projects that “63% of companies with defined-benefit pensions are considering termination of the plan within half a decade. That would mean the pensions would be closed off to future participants.” Ouch!

For those of us still working—with or without a pension—the reality is that we had better take control of our own retirement. There are lots of vehicles to save for retirement, including IRAs, Roth IRAs, Simplified Employee Pensions (SEPs), Keough’s, and 401ks. Today, I want to focus on 401ks because most of those plans offer you “free” money.

401ks – Don’t Pass up Free Money

I’ll get to the free money in a minute, but first, I want to explain how the 401k came about. The 401k was an incidental creation, spawned when Congress passed the Revenue Act of 1978. That act included a provision that was added to the Internal Revenue Code—Section 401(k)—that allowed employees to avoid being taxed on deferred compensation.

Two years later, a benefits consultant named Ted Benna was trying to design a more tax-friendly retirement program for a client and he referred to this Section 401(k) in his research. From that, he created a plan that allowed employees to save pre-tax money in a retirement plan, and, at the same time, allowed employers to match the funds. His client didn’t want to do it, but his company—the Johnson Companies—liked the idea, and it became the first company to provide a 401k plan to its workers. The 401k was originally designed to be a supplement to pensions, but, today, it has mostly replaced them.

Then, in 1981, the IRS decided that employees could use payroll deductions to fund their 401k, which really boosted the plan’s popularity. And according to the Employee Benefits Research Institute, within the next two years, nearly half of all big companies were offering—or considering—401ks.

How a 401k Works

A 401k is an employer-sponsored savings plan specifically designed for retirement. One of its big benefits is that you don’t pay taxes on the money you’ve saved until you withdraw it (unless you have a Roth 401k; more on that in a minute). And, at that time, most of us will be in a lower tax bracket, so our withdrawals should be taxed at a lower rate than when we contributed to our plans.

Not every employee can join a 401k. You must be eligible. In general, you need to:

- Be 21 years of age or older

- Complete 12 months of service

- Work more than 1,000 hours per year or have worked at least 500 hours in three consecutive years. (This was a change as a result of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, effective in 2020, which broadened eligibility requirements)

Almost every year, the IRS changes the employee contribution limits for 401ks. They did not, however, for 2021, and your individual contribution for this year is capped at $19,500. If you are age 50 or over, you can also contribute a “catch up” amount of $6,500.

In addition to your tax-friendly contributions, the IRS allows businesses to match the employee contributions as long as the total amount funded (by you and your employer) is the lower of $58,000 ($64,500 if you are catching up) in 2021 or 100% of an employee’s compensation (up to a maximum of $290,000 in 2021).

Fidelity reports that on average, employers match about 4.7% of their employees’ contributions. That employer contribution is what I call “free money.” If you don’t already know how much your employer matches, find out immediately! Then all you have to do to receive it is to join your employer’s 401k plan and make contributions to it.

And remember, the higher your contribution, the more your employer contributes (up to the limits), and that match of free money will help you grow your retirement fund at a faster rate. So, if you contribute the maximum $19,500 each year, and your employer matches 100%, you are getting another $19,500 for free! Now, why wouldn’t you want to do that? Believe me, when I worked as an employee and 401ks became available, I didn’t hesitate!

I mentioned Roth 401ks earlier. You should know that not every employer who offers a 401k also offers a Roth 401k. But if they do, you may want to consider this option. With a Roth 401k, your contributions are “after-tax.” The contribution limits and employer limits remain the same. The question you must ask yourself is this—do you expect your income to be higher in retirement than it is now? If the answer is no, contribute to the regular 401k, as you will be taxed at a lower rate than you are subject to now. But, if the answer is yes, you think your income will be higher during your golden years, then contribute to a Roth 401k if your employer makes it available. That way, you are being taxed today on your contributions, and then when you withdraw them, you will pay no income tax.

In 1983, about one-half of large firms offered 401ks to their employees. Today, the U.S. Census Bureau says 59% of employed Americans have access to a 401k, but only 32% of them actually contribute to one.

But, as you can see from the following graph, the assets in the plans are significant and are steadily growing.

401(k) Plan Assets

Billions of dollars, end-of-period, selected periods

Choosing Your Investments

Now that you know what you need to do to be eligible for a 401k and how much you can contribute, you need to find out which investments your 401k offers.

According to the Investment Company Institute, the average 401k plan offers 13 mutual funds, with more than half of the assets invested in U.S. stock funds and target-date funds. Some 401ks offer ETFs too. I love 401ks, so don’t take this in the wrong light. But in my opinion, there are two issues with 401ks—they don’t offer enough investment choices and employers skimp when it comes to educating employees on those choices and investment strategies in general.

There’s not much you can do about the first issue, other than to make recommendations to your employer to expand your plan. But I was so fed up with the second problem that in the last company in which I was an employee, I developed a short course for the other employees to thoroughly explain our 401k options. You may also want to suggest to your employer that they do something similar.

In the meantime, let me give you some ideas of what your choices and strategies may be. Since I don’t know the details of your plans, I’m just going to give you some general information and some common scenarios.

First of all, you need to understand how much risk you are willing to take with your investments. Most investors will fit into one risk category (although a blended approach can work as well).

Investor Risk Profiles

Conservative: As a conservative investor, you are less willing to accept market swings and significant changes in the value of your portfolio in the short- or long-term. Capital preservation is your primary goal, and you may plan on using the principal from your investments in the near-term, preferably as a steady income stream. The average level of return you expect to see is 5%-10%, annually.

Moderate: As a moderate investor, you seek longer-term investment gains. You are comfortable with some swings in your portfolio’s performance, but generally seek to invest in more conservative stocks that build wealth over a substantial period of time. The average level of return you expect to see is 10%-25% annually.

Aggressive: As an aggressive investor, you primarily seek capital appreciation and are open to more risk. Swings in the market, whether short term or long term, do not impact your investment decisions and you have confidence that volatility is necessary to achieve the high return-on-investment you are looking for. You typically expect a 25%+ return annually, though you do not need your principal investment immediately.

In general, the younger you are, the more aggressive you can afford to be, as you have a long time span before retirement. But that also depends on your personal situation—health, family, salary, etc. A few years ago, I devised a simple survey to help you determine your risk profile. You can find it here.

Your 401k plan will generally offer you a variety of risk scenarios. They may be called conservative, moderate, and aggressive. Or they may be labeled Equities, Income, or Balanced. In that case, Equities would be the most aggressive. But understand that different funds—even if they are mostly comprised of stocks (equities) may have varied risk profiles. For example, a small-cap only equity fund will be much more volatile (riskier) than a large, blue-chip equity fund. An income fund will most likely be made up of dividend-paying companies and/or bond funds. And a balanced fund should have some equities and income investments in it.

As you can see, it would behoove you to know the exact investments that comprise each fund. That way, you can determine the risk level for yourself.

Types of Mutual Funds

Mutual funds offer a number of categories, investing styles and strategies. The most popular are equity funds. They are just what they sound like: Funds that invest in stocks. They are categorized as follows:

- Large cap (>$10billion)

- Mid cap ($2 - $10 billion)

- Small cap (<$2 billion)

Additionally, each of these categories may be further divided into:

Index funds are for investors who want funds that follow the broader markets, have lower operating expenses, and lower turnover. These funds offer portfolios constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500).

Value funds include equities that are priced low, relative to their earnings potential, their peers, or that meet certain criteria as specified by the fund manager (which could include price-to-earnings requirements, or other fundamental criteria).

Growth funds consist of companies with high growth, but also are more volatile and riskier than value stocks and generally priced at a higher premium.

Blended funds are a combination of both value and growth equities.

Sector funds concentrate on one particular sector of the economy. There are sector funds for just about any industry or subsector of any industry. Oil, energy, financial, pharmaceutical, semiconductors, hardware, software—you name it—there’s probably a sector fund for it. While the concentration in one industry can bring fabulous rewards, it can also cause significant losses, making these funds more appropriate for investors who can handle higher-than-average risk.

Bond funds, which invest in fixed-income securities, are also very popular, especially for investors who are more conservative with their money. These funds are available in short-term (< 5 years), long-term (>10 years) or intermediate-term (5 - 10 years) maturity periods.

Balanced funds may include a combination of equities and fixed income investments, “balancing” out risk, but also reducing returns.

Foreign funds offer investors the opportunity to own stocks and bonds of companies outside the U.S.

Additionally, earlier I mentioned that your 401k may include Target-Date Funds (also called Life-Cycle Funds). A target-date chooses assets based on a formula that assumes you will retire in a certain year and adjusts the asset allocation as you get closer to retirement. The target year is identified in the name of the fund. So, for instance, if you plan to retire in or near 2045, you would pick a fund with 2045 in its name.

Target-Date Funds usually offer you a Conservative, Moderate, or Aggressive portfolio, based on your risk tolerance. As you age, you will probably want to monitor and change your allocation to become more conservative.

Key Factors when Choosing a Mutual Fund

Risk is not the only factor you need to consider. As with any investment, you must examine several critical issues:

Performance: The funds’ actual returns (investment appreciation + dividends) are key comparison measures. In a great market, a large percentage of mutual funds will do well; that’s why it is extremely important to look at a fund’s returns over a multi-year period. I would suggest that you compare returns on a 3-year, 5-year and 10-year basis. And it is best to look at the annual numbers, not the cumulative figures, as they will disguise the true fund returns and won’t tell you a thing about the consistency of the performance. For example, if the fund had one really great year, but nine so-so years, the 10-year return might look pretty good, but that would not give you the accurate story of the fund.

Morningstar.com offers ratings (1 to 5 stars) on mutual funds, based on how well they’ve performed against funds in the same category (after adjusting for risk and accounting for sales charges).

There are many websites that offer these statistics, but Morningstar’s is one of the best.

Importantly, please be aware that—just like any other investment—past performance is not a guarantee of future success.

There are several Costs & Expenses associated with mutual funds:

Loads: Some funds charge front-end loads, ranging from 3.75%-5.75% of the monies you initially invest. Note that funds may also charge a front-end load for reinvesting your dividends back into the fund.

Back-end loads may range from 4-5.75% of the funds you redeem or cash out, in the 1st year of ownership, but then may subsequently decline until they reach zero, in about the 6th year.

Some funds do not have front- or back-end loads and are called No-load funds.

Expense ratios: These expenses are the cost of doing business and include administrative and management fees. They are calculated as a percentage of net assets managed. And while they have been declining (mostly due to the proliferation of less expensive ETFs), the current average for actively managed funds is 0.5%-1.0%, but may go as high as 2.5%.

12b-1 fees: These fees are marketing and distribution expenses. They are included in the fund’s expense ratio, but often separated out as a point of comparison. They are charged in addition to loads, and even no-load funds may have them.

Taxes: When a fund manager sells a stock from the fund at a profit, the gain is taxable (if you hold that fund outside of a tax-advantaged retirement account). Short-term gains (for investments held less than one year) are taxed higher, at your individual income tax rate, while long-term gains (for investments held more than one year) are currently taxed at a 15%-20% rate, depending on your income. Many investors tend to forget about taxes on funds since they aren’t privy to the fund manager’s everyday buying and selling of investments and the losses and gains accrued and are often surprised by the tax bite at the end of the year. Consequently, it would be wise to pay attention to the next important item on our list…

Turnover. This refers to the frequency of trading undertaken by the fund manager. The more buying and selling he or she does, the higher the turnover, and the greater the potential tax bite. This is another area in which index funds are advantageous, as their managers generally trade less than actively managed funds, so they usually accrue lower tax bills.

I mentioned that some 401ks also offer a choice of Exchange-traded funds (ETFs). ETFs and mutual funds are both strategies for pooled investing—where your monies are “pooled” with other investors so that you can invest in a basket of stocks. There are approximately 7,602 ETFs around the globe, according to statista.com. And there are almost 8,000 mutual funds, offering investors many choices. Which begs the question—why do companies only offer a choice of 13 funds???

Additionally, both types of investments can be broken down into smaller categories, such as sectors, investing strategy, market capitalization, and others. But there are differences…

ETF expenses are significantly less than most mutual funds. Trading in ETFs does require a broker and their commission. However, the total expenses (unless you are an active trader—and if that’s the case—you shouldn’t be in ETFs), are, on average, much lower than the expenses of mutual funds investing in similar asset categories. The annual expense ratio for mutual funds is 0.50%-2.0% according to thebalance.com), and for ETFs is 0.05% to about 1.00%.

Liquidity and transparency: ETFs can be traded all day long, instead of just once daily for mutual funds. You buy and sell them just like stocks. And unlike mutual funds, with ETFs, you can use limit orders; you can sell them short; and you can trade options.

Less capital gains distributions: Investment turnover in ETFs is not as frequent as in mutual funds, lending themselves to lower capital gain distributions; hence, a smaller tax bite for most investors.

And there are also some advantages that mutual funds have over ETFs, including:

- Wider variety.

- No commission fees, unlike ETFs.

- Less leverage risk. Mutual funds do not generally carry the leverage of some ETFs, so that might make many of them less risky than their comparable ETFs.

What to Do After You Start Your 401k Plan

Wow! You’ve come this far. You’ve (hopefully) maximized your contribution to get that free money and you’ve chosen your investment allocation. So, do you just sit back and watch it grow?

Absolutely not! Like any investment, you need to monitor it. As we all know, life sometimes throws us a curveball or two, and those challenges may mean that you need to change your retirement strategy.

Here’s what I recommend: at least once a year, go back and review your 401k. And when you get a raise or a bonus, pop at least some of that extra money into your plan.

But every year, ask yourself, is my 401k growing the way I hoped? Do I have too much money allocated to a specific investment or strategy? Do I need to add a little risk to increase my returns?

What if You Change Jobs?

Most of us will change jobs more than 6-7 times in our lifetimes. And what happens to your 401k when you take a different career path? Fortunately, you have a few choices. But #1 is this—DO NOT CASH IT IN! I know it looks tempting, but if you do that, you are going to pay a big penalty—10% of your withdrawal.

And you will be severely hampering your retirement plans. So, instead…

Take it with you—You might be able to roll your current 401k over into your new employer’s 401k. If you do, make sure to make a direct transfer to it, so there are no penalties.

Roll it into an individual IRA—You can set this up with your brokerage firm, but again, make sure to directly transfer your 401k funds into the IRA.

Keep your 401k with your previous employer—This may be possible, but I don’t recommend it. Since you will no longer be at that company, you may not always be informed when the employer makes changes to the plan. Better to have it under your control.

Can I Borrow from My 401k?

In some cases, the answer is yes. Some plans will allow you to borrow up to 50% of your vested account balance, up to $50,000. The loan usually has to be paid back within five years, or you may be penalized. And if you leave the company with an outstanding loan, you may be required to pay it back immediately.

When Do I Get My Money?

In general, you can begin withdrawing money penalty-free at 59 ½.

And Don’t Forget about IRAs

I’ll talk more about individual retirement accounts (IRAs) in a future issue, but I just want to remind you that once you have fully funded your 401k, don’t forget to fund your IRA. IRAs also provide tax advantages.

If you’re company matches your 401k contributions, that account is usually going to grow faster than your self-funded IRA, because of the free money that comes with most 401ks.

Below is an example of a person who contributes $2,000 annually to a retirement fund, over a 10-year period. It shows a $2,000 contribution to his 401k with his company matching dollar for dollar, up to 3% of his $50,000 salary (which equals $1,500), compared to his contributing the $2,000 to an IRA.

You can see that his 401k has grown to more than $45,000, whereas his IRA is around $25,000.

That is significant! But it doesn’t mean you should neglect to fund an IRA. That way, you’ll be maximizing your retirement accounts.

Can a Self-Employed Person Have a 401k?

Fortunately, the answer is Yes!

There are several retirement accounts available to the self-employed. In addition to IRAs, those of us who don’t draw a salary can open a Simplified Employee Pension Plan (SEP), a Keough, and a Solo 401k. I’ll talk more about the first two in a future issue and focus on the Solo 401k plan today.

Solo 401ks are also called individual or self-employed 401k plans. These are generally considered a better option than SEPs for a solo practitioner, due to:

- Employee deferrals. Solo 401ks allow separate employee contribution as well as a profit-sharing contribution, up to $19,500 into the plan for 2021, even if the business loses money in those years. SEPs do not.

- Catch-up contributions. A solo 401k allows the same catch-up contributions as a regular 401k, for those aged 50 and older. SEPS do not.

- Roth contributions. Solo 401(k) plans allow for post-tax Roth contributions, whereas SEPs only allow pretax contributions.

- Loan provisions. As with regular 401ks, solo 401ks allow loans, also equal to the lesser of 50% of the plan balance or $50,000. Loans are not available with SEP plans.

In a solo 401k plan, you can make both employee and employer contributions—up to $19,500 as an employee (or $26,000 if 50 or older), and 20% of your net self-employment income as an employer, up to a total of $57,000 for both types of contributions in 2020.

As for the investments you choose to place in your solo 401k, you have a wide variety, including real estate, precious metals, private equity, private lending, startups, Bitcoin, and other cryptocurrencies... in addition to stocks, bonds, and ETFs.

However, to start conservatively, I would recommend that you first fund your plan with stocks, bonds, ETFs, and mutual funds. And if you’ll allow me to shamelessly promote my own newsletters, you’ll find a variety of ideas in our monthly Wall Street’s Best Digest, Wall Street’s Best Stocks, and Wall Street’s Best ETFs newsletters. If you want to learn more about each of these publications, just visit Financial Freedom Federation, or drop me a line at nancy@financialfreedomfederation.com. I’ll be happy to help you get started.

I hope these guidelines help you decide to go for it—get your 401k established, contribute the maximum to it, and then change your strategy as needed as your life needs evolve.

As always, these are general guidelines; please consult your financial planner, accountant, or attorney, for any questions or advice about your particular circumstances.

How to Invest After Retirement

Investing for retirement is one thing, but what about investing after retirement, when you no longer have a steady paycheck or a company-supported 401(k) or IRA? That can be a bit scary if you don’t have a plan.

Fortunately, the “plan” doesn’t have to be complicated. Really, there are two strategies that can help alleviate the fear factor of investing after retirement: crash-proofing your portfolio and developing a sell strategy. Let’s tackle these one at a time.

Crash-Proofing Your Portfolio

The best time to buy an umbrella is before it starts to rain. So even though I’m not predicting a market crash anytime soon despite this bull market getting a bit long in the tooth, it’s still important for all investors to have a crash contingency plan in place—especially if you’re a retiree who depends partly on your investment income to cover living expenses.

If you’re investing after retirement, you need to ensure that that income will continue even during periods of major price declines. Most dividend stocks fit the bill, but take a hard look at any income-focused funds you hold. Are they just passing on dividend income, or are they generating income through some price-reliant strategy like covered calls or return of capital? You don’t necessarily need to sell these holdings now, but figure out if you can live without that income in the event of a market crash. If not, figure out how you’re going to replace it.

Stock dividends can remain a great source of income in almost all market environments. Over the past 80 years, between 30% and 40% of stocks’ total returns have come from dividends, not price appreciation. Morningstar has crunched the numbers going back to 1927 to show that dividend income accounts for 41% of the annualized total return from large-cap stocks, 35% of the total return from mid-cap stocks and 31% from small-cap stocks.

Plus, dividend-paying stocks are less volatile than other stocks. Data collected by Eugene T. Fama and Kenneth R. French shows that dividend paying stocks are 5% to 20% less volatile than other stocks. Their volatility does increase when overall volatility increases (as it has in recent years), but dividend payers are generally much calmer (measured by looking at the average standard deviation of trailing monthly returns).

Resilient, cash-rich dividend payers are the best vehicle for maintaining a steady income during troubled times in the stock market. They lose less of their value during corrections, they’re less volatile overall and they keep paying you regardless of what their stock prices are doing.

Market collapses can come in many varieties. The 2008 crash hit all stocks hard, but the worst damage was done to stocks of financials, housing-related companies and businesses with high debt or business models based on borrowing. The 2000 crash hit tech companies particularly hard, which was especially devastating for investors who owned mostly dot-coms.

Look at your holdings individually. What type of event would be the worst-case scenario for each one? Do you have other holdings that would also be devastated in this situation? Be frank with yourself. If you have too many holdings with similar risk factors, you probably need to diversify.

Developing a Sell Strategy

Even in the absence of a full-fledged crash, you need to have a sell strategy that you can apply to all your stocks individually. Though income investing is mostly a buy-and-hold proposition, that doesn’t mean buy-and-hold-on-for-dear-life, whatever happens. And it certainly doesn’t mean buy and hold regardless of how far the stock falls.

I require that stocks meet several criteria to maintain a Buy or Hold rating. These criteria include benchmarks for payout ratio, cash flow growth, dividend growth rate and other factors that are important to the company’s continued ability to pay its dividend. When one of these factors falls below our required level, we change our rating to Sell.

Looking for these “red flags” gets us out of stocks that don’t have the strength to hold up to a big crash. (It also keeps us concentrated in the best stocks with the best future potential.) You can create your own simple sell discipline by writing down rules for yourself like, “If a stock cuts its dividend, sell.” This won’t get you out at the top (dividend cuts are usually last-ditch moves, after all), but it will keep you from holding on to losers forever.

The simplest sell rules are those based on price. Ask yourself: What type of losses (percentage-wise) am I willing to absorb? Cabot’s growth advisories suggest you employ a 10% to 15% loss limit, but you’ll probably choose to give some of your income-generating holdings more leeway.

Coca-Cola (KO), for example, lost 30% from the 2007 market peak to the 2009 trough. A growth investor would have (and should have) sold. But the company never cut its dividend. In fact, it raised its dividend on schedule in 2008 and 2009. And the blue chip recovered its 30% hit by the end of 2010, and has continued to thrive since.

The bottom line is that if you’re holding a diversified-enough portfolio that includes the right kind of dividend stocks, you’ll be able to ride out crashes without batting an eye. Even if you don’t have a steady paycheck to fall back on.

REIT Investing for Retirement

Real estate investment trusts, or REITs, are special purpose entities with special tax status, that own real estate and pass along most of the income from that real estate (rents or mortgage payments) to shareholders. They can own any type of real estate, and many specialize in one type, like apartment buildings, malls, office buildings, self-storage facilities or hotels.

A REIT that owns property directly and gets most of its income from its tenants’ rents is called an equity REIT.

A mortgage REIT, on the other hand, is a REIT that doesn’t own property directly. Instead, it owns property mortgages and mortgage-backed securities. Its income comes from the interest it’s paid on the mortgages. Mortgage REITs are sometimes called mREITs.

There are also hybrid REITs that own a mix of assets.

The Pros of REITs

Both types of REITs are exempt from taxation at the trust level as long as they pay out at least 90% of their income to investors. That means that while any retained income will be subject to regular corporate-rate taxes, the REIT doesn’t have to pay taxes on current income (rents or interest payments from the current period) that is distributed to unitholders (the trust version of shareholders).

Essentially, the REIT is treated as a “pass-through” entity, collecting the rents or interest payments and then passing them on to investors. It’s as if you own a sliver of the properties or mortgages themselves.

But that doesn’t mean REITs have zero growth potential. While they don’t retain much money to reinvest in their business, REITs often borrow money to make new acquisitions or improve properties. They can also earn more by raising rents or improving occupancy rates.

REIT performance tends to be more correlated to the real estate market than the overall stock market (and mortgage REITs are strongly affected by interest rates and credit conditions).

The Cons of REITs

REIT investing does have some tax consequences, however. Most of your REIT distributions will be classified as ordinary income because you are treated as a part-owner of the assets the REIT owns, and thus income from those assets is treated as your income. However, when some portion of a REIT’s distribution did not come directly from that quarter’s real estate ownership activities—for example, if it sold a building and distributed part of the proceeds to investors—you may be taxed differently on that portion of the distribution.

The REIT will tell you after year-end how that year’s dividends should be treated. Options include ordinary income, qualified dividend income, long-term capital gains and return of capital. Any portion of the distribution that is treated as return of capital will reduce your cost basis in the REIT, and then you’ll be taxed on the difference between your purchase price and your adjusted cost basis when you sell the REIT.

On average though, about 70% of REIT distributions are taxable as ordinary income.

This can be a good reason to own REITs in a tax-advantaged account like an IRA.

Whether you’re investing for retirement or looking to generate a steady flow of income now, REIT investing is a great way to do it.

What Does a Safe Stock Look Like?

Market corrections occur when the broad market (S&P 500, Nasdaq and the Dow Jones Industrial) declines at least 10%. In a correction, many stocks will decline even more than that, especially stocks that were overvalued or extremely popular prior to the correction.

But not everything goes down during corrections! Some safe haven investments become more popular during corrections, and see their prices rise as investors move money from riskier places to safer places. These safe investments vary from the nearly loss-proof, like short-term treasury bills, to the countercyclical, like consumer staples stocks.

But let’s get a bit more specific…

Fixed income investments are the classic safe haven, and the bond market often moves opposite the stock market. However, many individual investors—those investing through retirement plans, for example—will already have a fixed income allocation in their portfolio. Where can you turn when the market gets rocky other than fixed income?

Luckily, many institutional investors can’t (or won’t want to) move all their funds to cash or fixed income either. Actively managed equity funds, for example, may want to reduce risk, but they’re limited by their mandate to primarily invest in equities. Their only option is to shift their money to safer stocks. Many institutional investors are in similar situations, and these inflows can make the safest stocks go up when most other stocks are going down!

These types of stocks can come from almost anywhere, but they tend to have a few commonalities. Here are a few of the traits that can make a stock act like a safe haven during turbulent times.

Low Volatility

Volatility is basically a proxy for risk. Stocks that are more volatile have larger price swings, percentage wise. Beta, while not a perfect science, is one measurement of volatility: it compares the average prices moves of a stock to the average moves of a benchmark (usually the S&P 500). A beta of less than 1 means the stock is less volatile than the benchmark, while a beta of more than 1 means the stock moves more than the benchmark. A negative beta means the stock is negatively correlated to the benchmark: they move in opposite directions more often than not.

Industry

Some stocks are more cyclical than others, meaning they’re tied to industry or economic cycles. Oil stocks, for example, are very cyclical. Stocks that are closely tied to economic growth or the health of financial markets will often fall more than the broad market during downturns. Conversely, countercyclical stocks will fall less than the market during downturns. Classic countercyclical industries are consumer staples and utilities, because demand for their products is highly independent of economic conditions.

Dividends

Many stocks that act as safe havens are also attractive as long-term investments because they pay reliable dividends. Dividends are an indicator of reliability: they mean the company’s business generates predictable income during a variety of economic conditions. They also attract long-term investors who are more focused on income than stock prices.

All investors enjoy bull markets. Investing is a lot more fun—and easier—when the market is going up. But nothing goes up forever, and all investors will inevitably live through some market pullbacks, corrections, and even a few bear markets. That’s why it’s essential to have a few safe investments in your portfolio.

5 Low-Risk Stocks for Pandemic Investing

There are enough things to stress you out these days. Your investment portfolio shouldn’t be one of them. Hopefully, by now, you’ve sold out of your worst-performing stocks, and haven’t bailed on your biggest winning stocks. Perhaps you’re even looking to do some new buying, now that the market seems to be stabilizing at least a tad. But you don’t feel like taking any unnecessary risks. Reliable, low-beta stocks are the best place to turn.

Beta, as I’m sure many of you know, is a measure of a stock’s volatility. If a stock is just as volatile as the overall stock market, its beta is 1. If it’s more volatile than the market, it’s higher than 1 – anything above a 2 right now is a red flag, given that the market is already volatile enough. But if a stock’s beta is less than 1, that means it’s been less subject to the wild mood swings that have infected the market over the past six weeks.

Those types of low-beta stocks are worth owning. You don’t have to check on them every hour, worrying that they might suddenly fall off a cliff in response to the latest horrific news headline. They won’t keep you up at night. You can buy them (I’d start with small positions), stash them away in your portfolio, and trust that they’ll hold steady through the worst of this global pandemic—and perhaps morph into steady (if unspectacular) gainers when the clouds finally part.

Here are five low-beta stocks you can trust right now, in descending order of market cap:

Microsoft (MSFT)

- Beta: 1.09

- Year-to-Date Performance: +2%

Johnson & Johnson (JNJ)

- Beta: 0.66

- YTD Performance: -5.8%

Walmart (WMT)

- Beta: 0.28

- YTD Performance: +3.5%

Costco Wholesale Corp. (COST)

- Beta: 0.75

- YTD Performance: +0.75%

Gilead Sciences (GILD)

- Beta: 0.69

- YTD Performance: +18%

None of those should shock you. Johnson & Johnson has always been a reliable, low-beta stock, and is a Dividend Aristocrat to boot, having raised its dividend payouts for 57 years straight. It has a 2.8% yield, which is a nice cushion against the modest dip so far this year. And as a developer of medical devices, pharmaceutical equipment and essential consumer staples like baby shampoo, Band-Aids and Tylenol, Johnson & Johnson is in the right industry for a global pandemic.

Costco and Walmart are also no-brainers. Both are among the rare brick-and-mortar stores that provide essential goods right now, and people have flooded the stores of both companies to stock up on food, paper towels, toilet paper and other supplies to help sustain them through weeks of social distancing. Both companies pay dividends too, though Walmart’s is higher yielding (1.8% vs. 0.9%).

Microsoft is benefitting from essentially the entire world working, watching and playing at home. Whether it’s their personal computers, Surface Pro laptops or Xbox video game consoles used in the home, or its fast-growing Azure cloud-computing platform used by businesses for analytics, storage and virtual computing, Microsoft’s products have plenty of demand right now. As a result, MSFT stock (despite a slightly-higher-than-average beta) is up 2% so far this year.

And then there’s Gilead Sciences, the one true healthcare stock of the bunch, and the best performer by far. The company has a drug called remdesivir that was previously used to treat Ebola patients, and is now being tested on COVID-19 patients; it has already treated more than 1,700 patients with the deadly virus. That number is likely to expand substantially in the coming weeks and months, which will be huge for Gilead’s sales. Chances are, its run is far from over.

The Bottom Line

Uncovering stocks that can make you rich is typically the goal of any investor. But in times like these, when uncertainty is extremely elevated due to a rare global catastrophe (truth be told, only a handful of people alive have seen something like this), your main investing goal should be not to lose money.

These beta stocks might not make you rich in the long run. But they’re good, reliable stocks to have in your portfolio—in good times and bad.

When to Start Taking Social Security

For all the concerns about the viability of the Social Security system, it is still a very important part of most people’s retirement planning. But when and how you access those benefits can make a big difference. Tracking your SS account and projected benefits. Pros and cons of taking benefits as soon as possible. As late as possible. What to look out for. Watch out for scams. Preparing for what SS won’t cover. Government contact information and free resources that can help. Possibly a calculator/assessment tool.

The Birth of Social Security

Most of us probably think that Social Security was the first economic plan to bolster incomes for the masses. But such programs were documented as far back as medieval Europe, when feudal lords were responsible for the economic survival of the serfs working on their estates. Those were followed by merchant guilds and fraternal organizations that provided some sort of economic security to certain segments of society.

In America, government got into the act when the early colonists brought their ‘poor laws’ from England, a form of taxation on the wealthier folks to help support the destitute. As our country developed and our ancestors immigrated to our shores, the strain on that system led to almshouses and poorhouses. Then, during and after the Civil War, the government created a program to help war vets and their families. And by 1882, the first company-provided ‘old age’ pensions were created by piano and organ manufacturer, the Alfred Dolge Company.

State welfare pensions came into being around 1930, and some 30 states had developed them by 1935, but they were woefully inadequate. When the stock market crashed in 1929, the unemployment rate rose to more than 25%; 10,000 banks failed; and our economy tanked, creating the Great Depression. That had widespread devastating consequences, but especially on the elderly, half of whom didn’t have enough income to support themselves.

That economic catastrophe was exacerbated by the changes in America due to:

- The Industrial Revolution, as machines began to replace workers, leading to increasing unemployment

- The urbanization of America—family farms began to disappear, and workers migrated to cities, breaking up ‘extended families’ who, traditionally, cared for their senior elders

- Medical science enabled us to live longer, therefore, using up more resources. In 1929, average life expectancy for Americans was 57.1 years; today, that number—while decreasing the last few years (due to a rise in drug overdoses, suicides, and liver disease) that number is 81 or women and 76 for men.

Those events led to a variety of state and local government programs to help stabilize the economy, create jobs, and support the elderly. Several welfare programs were enacted, and many more were proposed. But in 1934, President Franklin D. Roosevelt introduced his economic security pan based on social insurance rather than welfare assistance. The plan was to create a work-related, contributory system in which workers would provide for their own future economic security through taxes paid while employed. The Social Security Act was adopted in 1935.

The plan has evolved over the years, with changes to the retirement age in the 1983 Amendments, which provided for a phasing-in of a gradual increase in the age for collecting full Social Security retirement benefits—from 65 to 67. Social Security has been threatened with extinction, yet it remains a source of supplemental—and sometimes, the only income—for folks in their golden years.

Additional Tips

#1: Know your Social Security Facts

Take this quiz from AARP to see how Social Security-savvy you are!

https://www.aarp.org/work/retirement-planning/info-06-2012/ready-for-retirement-quiz.html#quest1

#2: Tips for Couples

- If your incomes are similar and your life expectancy is long, consider delaying your claims to maximize your lifetime benefits

- If your incomes are vastly different, determine if your spousal benefit is better than claiming your own

- If your life expectancies are shorter than average, you may want to consider claiming earlier

#3: Pay Attention to Social Security Law Changes

For example, the payroll tax earnings cap went up from $128,400 in 2018 to $132,900 for 2019. That means, once you’ve reached that earnings level, your Social Security tax stops for that year.

#4: Will your State Tax your Social Security Benefits?

These 13 states do: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia.

Fun Facts about Social Security!

- The first monthly Social Security check was sent out in 1940 to Miss Ida May Fuller of Brattleboro, Vermont. And she received the grand sum of $22.54 (that adds up to about $414 today)

- When you die, so does your Social Security number

- Last year, 67.9 million people received some type of Social Security benefit

- In 2018, 5.6 million people began receiving benefits

- Women comprise 55% of adult Social Security beneficiaries

- Annual Social Security benefits are equal to the size of Mexico’s economy—around a trillion dollars

- If you decided you took your benefits too early, you can undo your claim within the first 12 months of enrolling…if you pay back every cent you’ve received from Social Security

- Social Security is not broke yet! Last year, the program ran a $2.89 trillion surplus, but all other things being equal, benefits may have to be decreased by some 25% by 2034

Source: https://www.fool.com/retirement/2019/12/02/a-foolish-take-how-much-does-social-security-pay.aspx

92% of workers currently in their 40s say they expect to continue working part-time in retirement, according to a survey from TD Ameritrade, and 52% of those in their 70s are still working in at least some capacity.

A survey conducted by Nationwide found a full 92% of Americans couldn’t identify the factors that would give them the maximum benefit

Costly Social Security Mistakes

- Receiving benefits too early

- Remarrying without understanding the consequences

- Not knowing your spousal benefits

- Failure to double-check you Social Security earnings

Medicare for 2020

Find out what your Medicare options are in your state:

4 Primary Plans

Part A — Free hospital coverage for the first 60 days, with a $1,354 deductible for 2019

Part B — Doctors and outpatient services, which come with a $135.50 monthly premium this year (can be higher, if your income exceeds $85,000) and a $185 annual deductible. You are responsible for 20% of your costs.

Part C — Medicare Advantage plans provided by private insurers, and which often bundle together parts A and B and most likely D into one comprehensive plan. Some cover dental and vision care; some provide for wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices. Most provide prescription drug coverage. The plans are generally health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

Part D — Prescription drugs, available through private insurers and require some premiums and other out-of-pocket costs, copays for each medication, and may include an annual deductible.

A Richer Retirement

Retirement is an exciting goal: time to pursue your passions, relax, and enjoy everything you’ve worked for your whole life. But it also brings new challenges—not the least of which is figuring out how to fund your new lifestyle when you’re no longer receiving paychecks every month. Most retirees rely on investments to fund at least part of their retirement, and investing success can mean the difference between scraping by and living it up in your golden years. This handbook is designed to help you secure a better, longer, richer retirement for yourself by making the most of your savings both before and during retirement.

How Will Your Goals Change In Retirement?

Often, people first become interested in investing as they approach retirement, or after retiring, when they have more free time and a more direct interest in how their investments are faring. Even people who have been saving for retirement their whole lives often leave the investing up to their 401(k) or IRA manager during their working years. If you’re one of these investors, you’re in good company and can get up to speed quickly.

On the other hand, if you’ve been an investor your whole life, you might be wondering what will change once you retire, or how you should adapt your strategies to retirement. This guide can help you there too.

How Is Investing For Retirement Different?

If you’ve been investing for a long time already, you’ve probably pursued capital appreciation as your primary goal. That means buying investments that you believe will go up in price, then selling at some point, once your initial investment has increased in value.

Capital appreciation is still important for retirees, but most will also have an additional goal: income.

You may have used an investment account to save and earn money for a big purchase in the past, like a house or college education. Once you had enough—or it was time to send your kids to college—you withdrew a big chunk of money. But most of the time, investing when you’re still earning is more about making money than taking money out.

In retirement, you still want to make money, but you also probably want to cash in some of your investments to pay for things. That can mean selling a chunk of stock so you can afford a luxury cruise, or just withdrawing a little bit every month to pay the bills. Or both.

For investors who’ve spent all their lives adding to their nest egg every month, helping it grow by carefully choosing the best investments, it can be stressful, disorienting and even a little scary to suddenly start doing the opposite. Even with the money there, you might not be sure how much you can use, and that might keep you from going on that cruise, or make you anxious about paying your bills every month.

Especially if you’ve invested for a long time, and are used to having capital appreciation as your number one goal, actually using the money you’re earning can be difficult to reconcile with your investing strategy.

That’s why this guide presents investments and strategies that are just for retirees and those planning for their retirement. It can help you be as comfortable using your savings as you are investing them. I’ve included detailed information on a variety of investments that make it easy to fund your post-paycheck life by generating passive income every month or quarter. I’ll also introduce strategies for adapting your portfolio to your life situation, so it can meet your needs at every stage of pre-retirement and retirement.

With the right strategy and the right investments, your retirement can be richer, less stressful, and more fun.

How Much Income Do You Need?

Before we get to the nuts and bolts of creating that income-generating portfolio, you’ll want to set some goals for your investments. There are many different ways to approach this, each with their strengths and weaknesses. We’ll begin with an approach you’ve probably seen before: the “retirement calculator.”

Many advisors think these calculators have more weaknesses than strengths, and we won’t argue. Most use an average annual return on investment to calculate investment returns, which can create unrealistic projections. They also assume that you can roughly estimate your annual spending for the next 30-plus years. But even using generous assumptions, it’s hard to account for unanticipated expenses, like medical bills. It also oversimplifies retirees’ spending habits—many retirees can and do adjust their spending when their circumstances change, which the calculators don’t account for.

But despite their drawbacks, running some numbers through a retirement calculator can give you a good starting point for deeper planning.

If you’ve already used one of these calculators, feel free to plug in those numbers in this exercise. If not, the retirement calculator below accounts for more variables than most, including “modern” retirements where you’re still earning some income. Give it a try here:

http://financialmentor.com/calculator/best-retirement-calculator

Some of these numbers are almost guaranteed to change, but filling out the worksheet will give you a starting place for your income investing.

How Much Income Can You Expect?

While retirement spending calculators can give you an idea of how much income you’ll need to generate in retirement, they also make a lot of assumptions. Expenses are very difficult to predict—especially health-related expenses—and these calculators usually don’t take into account retirees’ ability to adjust for changes in life circumstances. If you have higher medical expenses one year, for example, you may choose to cut back elsewhere rather than dip into your savings.

Another thing you can’t control is the market. Over a long enough period of time, the stock market’s trend is up, but it’s impossible to predict what it will do from year to year. Even expected equity returns based on historical averages are just guesses.

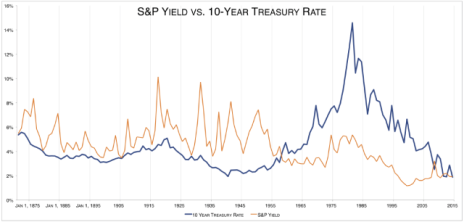

Bond yields introduce more uncertainty: many calculators still assume today’s “unusually” low bond yields will return to their historical averages sooner or later, but there’s no reason to believe that will be the case. Many analysts forget that until the mid-1950s, the dividend yield on the S&P 500 exceeded the yield on 10-year treasury bonds for decades. It’s easy to assume the next 50 years will look more like the 1960-2010 period than the 1900-1950 period, but there’s no inherent reason that should be the case.

All these uncertainties can make planning for retirement seem futile. But don’t despair. You don’t have to know exactly what’s going to happen in the future to make a solid plan.

When you pack for a vacation, you don’t know exactly what the weather will be like, but you can still plan fairly well based on forecasts. If you’re going to San Francisco in June, you can find out that the average high that month is 66º and the average low is 53º, and be reasonably sure you don’t need a heavy coat, but you’ll probably want a jacket. If the weather turns out to be unseasonably warm during your trip, at worst, you’ll regret the wasted space the jacket took up in your luggage. You can also look at the average number of rainy days in June and decide whether to bring a raincoat or umbrella. In San Francisco, it rains about 13% of the time in June. If you decide not to bring a raincoat, and it rains one day of your trip, you’ll probably think you made the right call. If it rains every day of your trip, you’ll wish you’d brought a raincoat and umbrella! But the odds of that happening are so small, the possibility of it happening doesn’t necessarily make it worth packing the extra items.

Retirement planning is, believe it or not, similar. It’s impossible to know exactly how your portfolio will perform over the next 10, 20, 30 or more years, but you can predict a range of likely situations, and position yourself accordingly.

Vanguard has made a valuable tool available on its website that runs a Monte Carlo simulation on your current retirement savings to generate a range of possible outcomes and probabilities for each. A Monte Carlo simulation approximates the probability of certain outcomes by running multiple simulations on your inputs and measuring the frequency of each. You can access the tool at the address below:

http://retirementplans.vanguard.com/VGApp/pe/pubeducation/calculators/RetirementNestEggCalc.jsf

Tools like this avoid predicting exactly what will happen, but can give you an idea of a reasonable expectation for your investments.

Required Minimum Distributions (RMDs)

Another useful prediction tool is the IRS’s own regulations governing RMDs, or Required Minimum Distributions. The IRS requires holders of most retirement accounts to withdraw a certain amount of the balance each year. The RMD rules apply to all employer-sponsored retirement plans including traditional IRAs, profit-sharing plans, 401(k) plans, Roth 401(k) plans, 403(b) plans and 457(b) plans. However, the RMD rules do not apply to Roth IRAs while the owner is alive. The IRS requires holders of these accounts to start taking RMDs in the year they turn 70½ (unless you’re still working).

Even if your plan isn’t subject to RMDs, the IRS’s guidance can be useful in determining how much you can spend each year without depleting your principal. That’s because the IRS calculates RMDs by dividing the year-end balance by a life expectancy factor (listed in IRS Pub 590) so they’re responsive to the changes in your account balance each year.

You can find out how much the IRS recommends you withdraw each year using FINRA’s RMD calculator, available at:

http://apps.finra.org/Calcs/1/RMD

This tool is also useful because it calculates the return you have to achieve over the next 12 months to maintain your current account balance.

For example, a 75-year-old retiree with $400,000 in her IRA at the beginning of the year would be required to withdraw $17,467.25 this year. After the withdrawal, she’d have to achieve a 4.57% return on her investments that year in order to maintain her account balance. Of course, some investors will want or need to withdraw more than the RMD each year, which will change the rate of return needed to maintain the account balance.

Most investors won’t generate exactly the target rate of return every year—in some years your returns may be better, and in some they may be worse. But if your returns average close to the target rate over time, the RMD calculator can help make sure you don’t run out of money partway through retirement.

Calculating this rate can also help you target an annual yield for your portfolio. Many retirees, unsure how much income they actually need, buy the highest-yielding investments they can find, often taking on more risk than they’re comfortable with in the process. If you know how much yield you need from your portfolio, it can help you choose investments that will fulfill that quota.

Do note that some sources say the IRS’s calculations are on the conservative side for younger retirees.

Determining Your Risk Tolerance

Running simulations like the one above can give you some idea of how much risk you’re willing to introduce into your portfolio. We often hear from retirees who assume that because of their age, they should be investing very conservatively, in the lowest-volatility investments they can find. But we’ve also talked to retirees in their 80s who love fast-growing, hit-or-miss momentum stocks. And the fact is, if you’re already retired but know you still need to be focused on growing your nest egg, the safest, lowest-volatility investments are simply not going to meet your needs.

The most important consideration when choosing what type of investments you will buy is your personal investing style. Some investors love buying cheap stocks and waiting patiently for them to go up. Others get bored waiting around for value stocks to get moving and would much rather buy an “expensive” but fast-moving stock and sell it after a few months.

Financial advisors will try to tell you that you have to invest a certain way based on your age or your portfolio size... or whatever products they’re selling. But knowing what type of investing you’re best at and most comfortable with is invaluable knowledge. If you’re a round peg, trying to force yourself into a square hole is going to be both counterproductive and costly.

A Monte Carlo simulation like the one run by Vanguard gives you a different way to look at risk. Rather than assuming you should only be investing in conservative, low-risk investments because of your age, running such a simulation can help you quantify actual risks of various investment strategies.

The lowest-risk strategy, of course, is keeping your savings 100% in cash. The only variable in this simulation is inflation (putting aside variables on the cost side like unanticipated expenses and how long you live), so there are few risks to account for. If you’ve saved $2 million, for example, Vanguard’s calculator assures you that you can spend $50,000 per year and still have 100% confidence that your savings will last 30 years in cash. On the other hand, if you start with only $1 million in cash, you’re guaranteed to run out before 30 years are up.

Both these situations minimize risks, technically, but only one is a viable retirement strategy. It’s important to wrap your head around the concept of risk as more than the concept of the unknown.

Risk can be quantified, and sometimes you will choose to take risks. The investor who has saved $1 million and wants to spend $50,000 a year for 30 years would be much wiser to take some risks with his money than to try and eliminate risk altogether. Using this situation again but allocating 60% of the $1 million to stocks, 30% to bonds and 10% to cash, the Vanguard simulator calculates a 79% chance that his money lasts 30 years. That’s not a low-risk situation—his money ran out in 21% of simulations—but it’s certainly preferable to guaranteed poverty. (As a side note, even with 100% of the money in stocks—what most investors would consider a “higher-risk” allocation—the Vanguard simulator still finds that the money lasts in 78% of simulations. But with 100% in “low-risk” bonds, the money lasts in only 32% of simulations. So risk doesn’t always work how you’d expect.)

Set Goals for Growth

As discussed in the previous section, the “safest” course isn’t always the most desirable. Most investors will be more like the man who has saved $1 million than the one who has saved $2 million. In other words, you’ll need and want to keep your nest egg growing in retirement, even while you’re simultaneously using it for expenses.

The Monte Carlo simulation we ran above uses historical returns to approximate the growth of your portfolio every year. Rather than using an average historical return like many retirement calculators, the simulation chooses a random year’s stock, bond and cash returns to use for each year of each simulation. So each simulation includes the returns from 30 random but historical years. Some simulations will include bumper years like 1995 when the stock portion of your portfolio grows by 30% or more, and others will include years like 2008, where it shrinks by over 30%.

While that’s a sophisticated way to model possible returns in a variety of market conditions, it’s not a constructive way to think about your own investing. Unless you plan to invest exclusively through broad market indexes, you can target much more nuanced returns in your own portfolio.

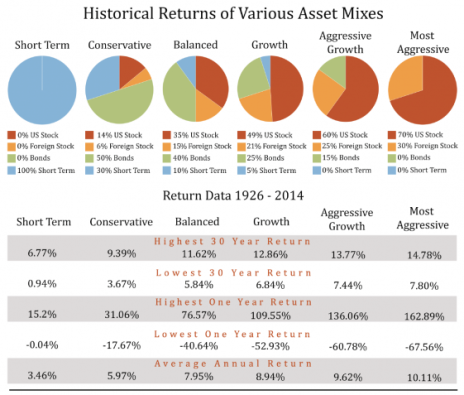

Below is a graphic based on allocation models created by Fidelity, which offers some useful retirement planning tools on their website. Although the allocation models are simply suggestions, considering the average historical returns of the range of asset allocations is a very good idea.

The average returns, visible in the last row of the bottom table, range from 3.46% to 10.11%. This is a fairly realistic range of target returns for the average investor.

Of course, the higher the return you target, the more variability you’re likely to see from year to year. No one achieves a 10% return consistently, year after year. But you can average 10% over time if you make 163% in your best year and -67% in your worst year, as the table shows for the “most aggressive” allocation.

Based on the numbers you generated using the retirement calculators above (or your actual spending and income, if you’re already retired), you should have an idea of what kind of return your investments need to be generating. Now take a look at the best and worst annual returns in that column, to get an idea of the kind of volatility that comes with targeting that annual return. Most investors well into their retirement can’t afford to lose 40% a year (the worst annual return for the “balanced” mix), even if it will eventually be offset by a good year (the worst 30-year return for that strategy is still 6%.) That’s why older investors invest heavily in conservative securities with lower volatility, which generate more predictable returns, even if they are lower overall.

In the next section, we’ll help you combine this knowledge with what you know about yourself to figure out what strategy you should follow and what kind of investments you should own, now and in the future.

Allocation and Diversification

Now that you have some idea of your goals for retirement, it’s time to get down to the nuts and bolts of accomplishing those goals.

In all likelihood, you will use a variety of investments and strategies, and you’ll probably change and adapt your strategy and allocations several times. Most investors want to invest more aggressively in pre-retirement, so they can build up as large a nest egg as possible, and then gradually become more conservative over time as their margin for error decreases. But not all investors will follow this pattern: You might have begun retirement in a very conservative position, concerned about living on your savings, but maybe you’ve done well and are now ready to get more aggressive.

Wherever you are, there’s an investing system that can help you accomplish your goals. The next section will help you find it.

Find The Right Investing System For Your Goals

Your goals are likely to change over time, but, beginning in the present, let’s try to match the goals you determined above to the right investing system. Note that you may wind up mixing and matching investing systems to prioritize different goals in different parts of your portfolio. The following table is simplified but will give you an idea of which systems are most appropriate for which goals.

Your goals are likely to change over time, but, beginning in the present, let’s try to match the goals you determined above to the right investing system. Note that you may wind up mixing and matching investing systems to prioritize different goals in different parts of your portfolio. The following table is simplified but will give you an idea of which systems are most appropriate for which goals.

First, find your primary goal on the left, then follow the rows across to see which systems can help you accomplish it over the short, medium and long term. (For our purposes, short-term strategies focus on returns in the next 12 months or less, medium-term investors invest for roughly the next six months to three years, and long-term investors focus on returns over multiple years or even decades.)

Understanding Retirement Plans

My parents and many of their contemporaries didn’t have to worry too much about saving for their retirement years, since many of them were covered by defined benefit plans funded by their employers.

How times have changed! Fewer and fewer employees are that lucky today. Instead, most of us are solely responsible for funding our golden years. Fortunately, Uncle Sam has provided several vehicles, in addition to social security, that make it easy to save—and, sometimes, they come with significant tax advantages.

The 401(k) Plan

The first is a defined contribution plan—the 401(k), a savings and investing plan that Congress created via the Revenue Act of 1978. In this plan, the individual makes contributions, deducted from your paycheck—on a pre-tax basis—according to a stipulated formula. And then your employer may elect to match part or all of your contributions—in essence giving you free money.

For 2022, the 401(k) contribution limit goes up by $1,000, to $20,500. If you are age 50 or over, the catch-up contribution limit stays the same at an additional $6,500.

The “all sources” maximum contribution (employer and employee combined) rises to $61,000, up $3,000 (excluding catch-up contributions). And plan participants who contribute to the limit in 2022 can receive up to $40,500 from match and profit-sharing contributions ($61,000 minus $20,500).

One of the best attributes of the 401(k) is this: because your contributions are on a pre-tax basis, you are not taxed on them until you begin to withdraw them—ideally upon retirement, when your tax rate will be smaller than during your working years.

And since your contributions are deducted from your paycheck, contributing becomes automatic. Think of it as a forced savings plan, in which you don’t spend it because you don’t see it! 401(k) plans are tremendous savings vehicles, but unfortunately, they are not often used to their maximum abilities. Here’s why:

Most 401(k) plans are underfunded, usually because folks think they can’t afford to sock money away. If you fall into this category, you are making a big mistake. Chances are, you won’t even miss those pre-tax dollars coming out of your paycheck. An easy way to do this is by consistently and immediately increasing your contributions by a portion of any raises and bonuses you receive. Hey, how can you miss it if you never had it?

Additionally, most employers offering 401(k) plans at least partially match your funds, and that amounts to free money! Add in the beauty of compounding interest—i.e. making interest on interest—and before you know it, you have a real retirement account.

It’s understandable that when you first open your 401(k) you may be unsure about the level of your contributions. So, if you don’t think you can afford much, start with just 1% or 2% of your income. Then make a commitment to increase that rate every year until you hit the maximum amount.

Once you’ve decided how much to invest, your next step is to choose among the investments your employer’s plan offers, which will usually be an assortment of mutual funds and Exchange-Traded Funds (ETFs). And that requires a bit of effort on your part. Your employer will most likely invite the plan administrator in to give you an overview of the plan, but you will need more assistance than that. So, just refer back to section 7 for help in choosing the right funds or ETFs for you.

And don’t forget—your plan need not be stagnant. As you become more used to directing your own retirement funds, you may find that you will want to change your investment strategy from time to time. Fortunately, most 401(k) plans are now set up to accommodate those changes.

Before we leave the subject of 401(k)s, I want to caution you about two common scenarios that will adversely affect your ultimate goal of a sunny retirement.

- Make sure you roll your funds over when you change jobs. Many folks who change jobs make the mistake of taking the cash out of their 401(k) plans. This is a terrible idea! One, you’ll probably spend it on something you don’t need. Worst of all, when you get the money in your hands, you have just subjected yourself to significant early withdrawal penalties as well as hefty income taxes. And that doesn’t even address the opportunity cost of losing the ability to compound the returns on that money you just withdrew. A better idea: Roll the money over into your new employer’s plan or into an individual IRA that you can set up easily at your bank or brokerage firm.

- Don’t borrow money from your 401(k) unless it’s a dire emergency. Here’s why: 1) You’ll have less in the account compounding for your future; and 2) you may find it hard to pay back the loan and keep contributing at your current rate. If you absolutely need money, look for other loan alternatives. But keep your retirement out of reach!

If your company offers a 401(k) plan, my advice is to contribute as much as you can to it, consistently. You’ll be amazed at how quickly the funds can build up over time.

Traditional IRAs

The second retirement vehicle you should utilize—after you have maximized your 401(k) contributions—is an Individual Retirement Account (IRA). Individual Retirement Accounts were created in 1974, to help folks who had no company retirement plan or those of us who realized that, lo and behold, retirement was sneaking up on us and we needed money in the bank!

Almost everyone is familiar with traditional Individual Retirement Accounts. Like 401(k) plans, traditional IRAs let you save with certain tax advantages. The concept is simple: If you meet income guidelines, you contribute pre-tax dollars, yearly, to an account, and the money compounds over time.

For 2022, traditional IRAs annual contribution limits remain $6,000,. And the additional catch-up contribution remains $1,000.

As for the amount you can contribute, pre-tax, here’s the new IRS guidelines per the balance:

“The IRA deduction is phased out if you have between $66,000 and $76,000 in modified adjusted gross income (MAGI) as of 2021 if you’re single or filing as head of household. This increases to $68,000 and $78,000 in 2022. You’ll be entitled to less of a deduction if you earn $68,000 or more, and you’re not allowed a deduction at all if your MAGI is over $78,000 in 2022.

The IRA deduction is phased out between $109,000 and $129,000 in 2022 if you’re married and filing jointly, or if you’re a qualifying widow(er). Those with MAGIs over $129,000 aren’t allowed a deduction. These thresholds are up from $105,000 and $125,000 in 2021.”

The amounts differ if you are not covered by a workplace retirement plan. Please ask your accountant or financial planner for the specific details that apply to your situation.

Bottom line, if you fit the above guidelines, you can erase $6,000 of your taxable income, and if you’re in the 24% tax bracket, that $6,000 becomes a $1,440 tax savings ($6,000 x 24%)—enough for a small vacation or maybe a new smartphone! (I know I’m being a smart aleck, but who would have ever believed a cell phone could cost so much?)

Roth IRAs

To further sweeten retirement savings, in 1998, Congress created Roth IRAs, which offer several advantages over traditional IRAs. And for 2022, like traditional IRAs, Roth IRAs’ annual contribution limits are $6,000. And the additional catch-up contribution is $1,000.

Roth IRAs are funded with after-tax dollars rather than pre-tax dollars, unlike a traditional IRA. But because of this, you owe no taxes on your withdrawals (including earnings), as long as the withdrawals are qualified (primarily meaning after age 59 ½, and if you have owned the IRA for at least five years). So, while you forfeit any tax advantages in the current year, you should more than make up for them by avoiding taxes on your principal and earnings when you withdraw them.

Additionally, special circumstances, such as the first-time purchase of a home, qualified education expenses, unreimbursed medical expenses or health insurance may allow you to make tax-free and penalty-free withdrawals from a Roth IRA. This makes the Roth IRA an attractive investment vehicle for many other uses in addition to retirement and savings.

And because the annual income levels used for determining your ability to make contributions are much higher for a Roth IRA than in a traditional plan, more folks can participate. The modified adjusted gross income (MAGI) for singles in 2021 must be under $140,000; contributions are reduced starting at $125,000. For married filing jointly, the MAGI is less than $208,000, with phaseout starting at $198,000.

Lastly, unlike a regular IRA, the Roth IRA doesn’t require minimum withdrawals when you reach age 70 ½ .

My advice: If you are eligible for a 401(k) plan, fund it first. Unfortunately, not all employers offer 401(k) plans. But nearly everyone is eligible to have an IRA. And an IRA does have the advantage of offering you a wider choice of investment options than what you will find in your company’s 401(k) plan.

If you don’t Meet the Income Qualifications…

Now, even if you don’t meet the above income qualifications, you may still open a traditional, non-deductible IRA or opt for a Roth IRA.

But you may ask, if it’s not deductible, why should I bother? Because…

- Your money compounds over time, which makes the next advantage even more important...

- Your earnings and deductible contributions are not taxed until you withdraw the money. And for non-deductible contributions, just part of the withdrawal will be subject to taxation. But there’s one more big plus: Taxes are assessed at ordinary income tax rates, and since you probably won’t be working in your retirement years, your tax bracket should be lower than it is now. Consequently, your tax bite will also be less, probably considerably so.

Bottom line: You can accumulate a significant sum of money from now until you need it—money that will most likely be reduced by just minimal taxes at that time.

Now, many investors think: I have a company-sponsored 401(k) plan—either through my current employer or a previous employer(s). Why do I need an IRA?