Get this Investor Briefing now, How to Become a Master Stock Investor for Life, and you’ll learn all the investing essentials you need to ensure your own financial freedom and security. From the basics about investing styles and sectors to stock-market seasonality and cycles … from protecting your portfolio to key investing resources for you … and from knowing when to buy, sell, and hold stocks to getting specific stock recommendations. How to Become a Master Stock Investor for Life is your best guide to a good foundation for achieving and maintaining your financial freedom.

The Do’s and Don’ts of Investing in Real Estate

Real estate investing has created fortunes for many people, including the top three richest real estate investors:

1. Donald Bren: Estimated net worth: $15.5 billion

Bren made his fortune by purchasing a big stake in Irvine Company, which controlled 93,000 acres of land in Southern California, known as Irvine Ranch. That was in 1977; he became the sole owner of Irvine in 1996 and now owns more than 115 million square feet of real estate, primarily in Southern California.

2. Sun Hongbin: Estimated net worth: $9.2 billion

Although an American citizen, Sun Hongbin has made his fortune from investments outside the U.S. His Sunac China Holdings is one of China’s largest real estate developers, focusing on developing large-scale, medium- to high-end residential properties, as well as the Wanda Group’s hotel and tourism portfolio.

3. Stephen Ross: Estimated net worth: $7.6 billion

Stephen Ross began his real estate investing foray by developing affordable housing, then expanded into the Hudson Yards Redevelopment Project in NYC, a development that features eight structures that house residences, offices, a hotel, retail space, and a cultural center. Ross is also the owner of both the Miami Dolphins and Sunlife Stadium.

But it’s the Little Guy who Owns the Most Rental Properties

You might now be thinking that real estate investing is only for the rich. But you would be dead wrong. The truth, according to the U.S. Census Bureau, is that individual real estate investors account for 74.4% of rental properties in the United States. And the average real estate investor owns just three properties.

And even if you start out small (which I wholeheartedly recommend!), you can do very well by investing in real estate. When I was in my 30s, I worked in banking, and one of my fellow managers—with his wife—had started buying townhomes in Florida right after they were married. By the time I met them, they owned four properties. Now, they have a very large inventory of rentals and a booming property management business!

Of the 140 million housing units in the U.S., some 80 million are single-family homes, and about 15 million of those are rental properties. Here are some more fun facts about real estate investing, courtesy of Getflex.com:

- 6 million Americans earn income from rental properties

- Landlords have an average income of $97,000 a year

- Half of all landlords manage their own properties

- Landlords have raised rent rates an average of 31% since 2010

- Just 6% of rental properties are unoccupied

- Landlords handle 6 repair calls a year from tenants

- “Mom and pop” landlords own 22.7 million rental units

- Half of single-property landlords purchased the property as a primary residence

- Evicting a tenant may cost a landlord up to $10,000

The Rental Market is on Fire

The rental market is growing, and also becoming pretty lucrative—in terms of rents collected. Realtor.com reports that rental costs increased in 66% of U.S. counties between March and April 2019. And the market is even hotter today! Feeding the rise in rentals is an interesting statistic. According to RentCafe, as Baby Boomers continue to retire, many are choosing to rent, instead of buying a smaller home. In fact, the number of over-60 renters increased by 43% between 2007 and 2017.

Not surprisingly, the most expensive rental market is San Francisco, with an average rental rate of $3,690, according to Zumper. Zillow says San Fran is also one of the most expensive places to buy a home, with the average home coming in at $1,477,442.

According to Pew Research Center, rentals in the U.S. are at their highest percentage—36.6%— since 1965.

Renters are Getting Pickier

As the rental market grows, so do the expectations of the tenants. The top ten rental amenities desired, according to Zumper, are:

- Air Conditioning

- In-Unit Washer/Dryer

- Dishwasher

- On-Site Laundry

- Assigned Parking

- Central Heat

- Furnished

- Balcony

- Garage Parking

- Hardwood Floors

And the least-searched amenities were:

- Roof-Top Deck

- Package Service

- Concierge Service

- Residents Lounge

- Dry Cleaning Service

However, if you want to invest in luxury rental properties, these last five amenities will become very valuable. A Venturebeat survey reports that 63% of renters want smart home security, 63% desire smart home climate controls, 58% expect smart lighting, and 56% want safety devices like carbon monoxide detectors and nightlights.

So, keep these wish lists in mind as you search for potential properties to buy.

The Top 5 Criteria for Zeroing in on the Right Investment Property

Investing in real estate requires some serious research. You’ll need to study your market, know the demographics, look at housing trends, understand how to maximize the property value, and very importantly, figure out when to exit the property.

But before you do all that research, first pay special attention to the following criteria, which are the essential elements of real estate investing:

I’m sure you’ve heard this frequently spouted mantra regarding buying a home: “location, location, location.” That is still true—whether it’s your personal home or your investment property. Location can mean different things to different people. You may want to live in a home close to your work or your children’s school. Or you might desire a home with acreage, rather than a location in the suburbs. Some folks like to live in a thriving downtown.

Those are all personal preferences. But when it comes to real estate investing, they are major considerations. A professional real estate investor knows that choosing the right location can have a big impact on your investment returns. For example:

Big city or small town? Highly developed cities will be more expensive than less-populated areas. There’s no room to expand; they usually have a large number of vacant homes—many in disrepair—that may provide investment opportunities. However, be aware that large cities can also see rapid population declines, as was the case during the COVID pandemic.

According to the Brookings Institute, “Among the 10 largest cities, eight registered lower growth in 2019-20 than in 2018-19; six displayed their lowest growth in the last decade; and five lost population. The latter include New York, Los Angeles, and San Jose, Calif. (displayed in Figure 2), as well as Philadelphia and Chicago.”

You can see the results in the following graph.

Accessibility, appearance, amenities, and safety are the hallmarks of a good neighborhood. You want your property to be close to major highways, with several egress points. Also, where applicable, consider how close you are to public transportation for commuters.

A nice-looking neighborhood is also desirable. Neatly kept lots, large trees, and nice landscaping are a plus. One way to gauge if a neighborhood is desirable is to look at the turnover. It’s a good sign if homes don’t stay on the market long.

Amenities such as parks or community spaces, restaurants, grocery stores, schools, fire stations, hospitals, and other retail shops, should be conveniently located. Schools are another important amenity.

Lastly, make sure the neighborhood has a low crime rate. You can usually find that out from your local law enforcement.

Determine if future development is on tap. Are their current plans for new schools, hospitals, public transportation, other civic infrastructure, or commercial or residential development that might improve property values?

Is it a good lot? Lots on busy streets or near noisy roads or highways are harder to resell. Likewise, a lot close to a commercial property is not usually desirable. Most of you know that I also own a real estate company, and I’ll give you a couple of examples of properties that had challenging locations. One was a gorgeous, all-brick, custom-built 3,600-square-foot home on five acres. It sat right next to a junkyard, and although there was a nice border of very tall trees between the house and the salvage yard, it took years—and a very reduced price—before it sold. Another property I showed a few months ago, was a great commercial building on a lovely tree-lined lot. However, right next door was a juvenile detention center. The building is still on the market.

On the other hand, lots that are near or on water or golf courses, wooded, or with mountain views are more likely to increase in value.

Choosing the right house is essential. Do you take your chances with a fixer-upper or buy “move-in-ready?” That depends on how much you think it’s going to cost to renovate, if you have the skills to do it yourself, or if you are going to have to pay someone else to do the reno and what your expected returns will be. But I’ll get into more detail on that in a minute.

Just know that choosing the right location is critical. In the choice between a fixer-upper on a better lot, compared to a decent house in a less desirable location, I would opt for location first.

All of these criteria are important when choosing properties to buy. And yes, you must keep reselling in mind before you make a real estate investment. A home that appreciates in value and doesn’t take long to sell will make your total profit picture much rosier.

Are you a Flipper, or a Long- or Short-Term Real Estate Investor?

Individual real estate investors come in three flavors: 1) folks who want to buy low and flip; 2) investors who buy vacation properties to rent out on a short-term basis; and 3) buyers who buy and rent homes over a long period of time, reaping the rewards of long-term income.

Note that in each of these scenarios, some renovations will most likely be required to outfit the property for resale or rentals.

So, you Want to be a Flipper of Properties?

Flipping properties sounds romantic, doesn’t it? And if you are a fan of HGTV or DIY (like me!), you are privy to scads of shows illustrating the “fun” of buying real estate for almost nothing, doing a few renovations, and then selling for a very nice price—usually within 8-12 months following your purchase.

Certainly, there are plenty of people who are really good at flipping. But, unfortunately, the reality of flipping properties is much less romantic. You’ll note that one or more of the stars of each home remodeling series is either a designer, craftsman, or general “can do anything” type of handyman. Now, if you are or have access to one or more of those types of people, you’ll be well ahead of the game. If not, your costs, time, and frustration are going to mount up.

To be an effective flipper, you’ll need to have some spare cash. The general consensus is the 70% rule, which states that an investor should pay no more than 70% of the after-repair value (ARV) of a property, minus the repairs needed. After the home is repaired/renovated, the ARV is what it is worth to buyers.

Next, it’s imperative that you create a budget; you need to know exactly how much money you have to 1) purchase the home, 2) renovate/repair it, and 3) cover marketing, real estate commissions, and other selling costs. A recent study from Harvard University reports that HGTV is doing its job—spending on remodeling reached $350 million by Q3 2019, up $20 million over the same period in 2018.

Here are a few ideas to help you reduce your cash outlay as you renovate:

- Carefully choose which home features are worth spending a little bit more on—such as upgraded appliances, wide woodwork, elegant doors, etc.

- If you can find them, use recycled or previously used materials you get from salvage sales or associates

- Buy your supplies with a cash-back credit card, or a credit card with good rewards points

Also, don’t put funky features or designs in the home you want to flip. Vanilla is good; gilt is not. You want to attract the normal, mid-stream buyer, so stay true to classic designs that will easily resell.

If you need to take on a contractor to do the reno, secure references and get written estimates.

If you must get a mortgage loan to purchase the property, you’ll have to add the carrying costs (interest, closing fees, appraisal, credit check, etc.), into your expenses.

Determine how you are going to advertise the home once renovations are complete. To be on the multiple listing service (MLS), you’ll need to work with a Realtor. You can also list the home for sale on Zillow, but you will then be responsible for setting up and attending showing appointments and dealing with the mountainous paperwork. You can also hold open houses and advertise in the local newspaper. Note that all of these efforts will require some investment of your money and time.

Lastly, if you intend to make a business of flipping homes, you might consider getting your real estate license so you can at least save on commissions. One added benefit: Realtors have access to some of the best contractors, suppliers, and lenders to help you through your entire flipping process.

Are you in it for the Long Term?

This is a great way to build long-term passive income—buying properties and collecting rent over a number of years.

Besides the cash flow, landlords have some very nice tax deductions. Per nerdwallet.com, landlords can deduct mortgage interest (because it’s a business expense), depreciation of the property (usually over 27.5 years), property taxes and certain repairs.

When your tenant calls you in the middle of the night because the toilet is leaking, cheer yourself up by knowing you can deduct the repair! Now, there are lots of rules about what can be deducted immediately vs. what is a capital expense to be deducted over time. For example, adding a room on would be a capital expense. The IRS (Publication 527) also considers the following repairs to be capital expenses: landscaping and sprinkler systems, storm windows, new roofs, security systems, heating and A/C systems, water heaters, flooring, and insulation.

You may also be able to deduct transportation expenses associated with collecting rent, managing your rental or maintaining it; costs of advertising your rental; insurance on your rental; and utilities.

The IRS says you cannot deduct costs associated with travel between your home and the rental property (unless your home is your principal place of business), uncollected rent (but this depends on the accounting method you’re using for your rental income), and lost income during periods when your rental was vacant.

Lastly, be aware that most banks will not lend on long-term rentals unless they are move-in-ready. They generally will not provide rehab funds.

Do you Want to Buy Short-Term Vacation Rentals?

It sounds exciting to own a vacation/rental home, doesn’t it? I’ve done it before, and it was very lucrative. I was able to use a ski home in New Hampshire for an occasional vacation and rented it out via a property manager during the rest of the year. I held it about four years and sold it at a nice profit. And I learned a lot about owning a vacation rental!

First of all, you need to make sure that the home is in a popular location with lots of demand. Make sure to investigate your local city and county regulations to ensure they allow vacation rentals in that neighborhood. My friend was all set to buy a short-term rental in one of Nashville’s regentrified neighborhoods but learned that the city would not allow any more short-term rentals in that neighborhood.

Next, you’ll want to own properties for which you can steadily increase the rent year after year. And lastly, the home should be a good bargain when you buy it and have plenty of appreciation potential. This tool can help you determine value vs. income.

As with all real estate, there are pros and cons. These are from mashadvisor.com:

Pros of Buying Short-Term Rentals

- Higher rental income than longer-term rentals. In some resort areas, you could make as much as $5,000 for a weekly rental.

- Pricing flexibility; you set the rates.

- Flexibility in use: you have the opportunity to vacation at your own property.

- Unlike long-term rentals, you will be able to check on your short-term rental regularly, clean it, and do required maintenance.

Cons of Buying Short-Term Rentals

- Managing is time-consuming, but you can also do as I did—hire a property manager. More on that later.

- Your property will probably not be rented 365 days a year. Ski rentals are popular in the winter. Cabins on northern lakes get a lot of use in the summer. This seasonality is important to consider when calculating your cash flow.

- More risk—you can expect more damage, theft, or nuisance calls from neighbors when the renters’ parties get too loud.

- Legal restrictions. As I mentioned above, some governmental regulations may not be favorable for short-term rentals.

Again, location is paramount. Here are some of the most popular places to own vacation rentals, according to airdna.com:

- Palm Springs, CA

- Sevier County, TN (my neck of the woods: think Pigeon Forge and Gatlinburg)

- Lake Tahoe

- Augustine, FL

- Panama City Beach, FL

- Flagstaff, AZ

- Big Bear Lake, CA

- Las Vegas, NV

- Sedona, AZ

- Savannah, GA

Of course, you may have a favorite place you like to visit; if so, check out the demographics to make sure there’s enough demand to keep you in steady cash flow.

Do you Need a Property Manager?

When I bought my New Hampshire ski home, I was very fortunate to have a property manager who handled most of the vacation rentals in the area. It was a very small town (Mt. Washington), and the monthly fees were reasonable. But, again, there are pros and cons of doing it yourself or hiring a property manager. These tips are from tsquareproperties.net:

The Pros of Self-Managing Your Rental Property

- You’ll have 100% control over your investment.

- You don’t need to pay the 7%-15% per month to a property manager.

- You’ll get the chance to learn and gain experience in the rental property industry.

- You’ll probably take better care of your property than a property manager would.

The Cons of Self-Managing Your Rental Property

- The job is often very demanding and time-consuming. You are the person the tenant calls when the A/C stops working; the roof leaks; or the toilet stops up. That means you have to take care of the job or have a handyman on call.

- You have to spend time collecting the rent.

- You may not screen tenants properly and end up with a tenant that is consistently late; is a nuisance to neighbors; doesn’t take care of your property; and that you may have to evict.

However, if you employ a professional property manager who has the skills to screen tenants, knows how to collect rent, and has an iPhone filled with handymen and contractors, it may just be worth the monthly nut.

Do you Need a Loan to Buy Your Rental Investment?

There are several ways to finance rental properties:

Your cash.

Conventional Mortgages from banks and credit unions. Loans for investment properties generally require a 20% down payment. Before you apply for a loan, you will need a healthy credit score, of at least 650 or more; a debt-to-income ratio of 43% or lower; a financial statements for at least a couple of years listing your income, expenses, and assets; the ability to pay for any existing mortgage on top of your investment property’s mortgage; and six months of mortgage payments in the bank

Hard Money Loans. These are individuals or private companies that accept property or an asset (not necessarily the home you are buying) as collateral. They are usually short-term loans often used by residential developers. The term “hard money lending” doesn’t refer to how difficult it is to apply for; it refers to firmer financing terms when compared to other types of lending.

Hard money lenders are generally private investors or companies that deal specifically in this type of lending. Instead of looking at your credit score, they look at the value of the property—the after-repair value (ARV) in determining if they will make the loan.

These loans are usually a lot quicker to obtain than bank financing, and their loan terms are more flexible. But you will only have a short period in which to repay the loan (good for mostly flippers). And you’ll pay a higher interest rate. Hard money lenders will usually ask for about 11% to 15% and about five points (additional upfront percentage fees based on the loan amount).

To find a hard money lender, you can ask around, or just Google the term. I found pages of them in Tennessee. But make sure you check them out!

Private Loans. These are the ones you borrow from friends, relatives, business associates, or accredited investors. Terms are flexible, but these loans are also difficult to find.

How Much Money can you Make with Rental Properties?

Now, it’s time to put all this together and find the bottom line—how do you figure out if a property is worth your hard-earned money?

First, let’s start by defining some common terms used in rental property financing.

Net Operating Income (NOI) is how much money you make from a given investment property. To calculate it, take your total income and subtract operating expenses. Operating expenses include property manager fees, legal fees, general maintenance, property taxes, and any utilities that you pay.

Don’t include your mortgage payments—they are not operating expenses.

Capitalization Rate (Cap Rate). Think of it as similar to the stock market’s return on investment. It’s the ratio of the amount of income produced by a property to the original capital invested (or its current value). It tells you the percentage of the investment’s value that’s profit.

Cap Rate divides your net operating income (NOI) by the asset value. This should be equal to the property’s sale price. Know this: the higher the cap rate (higher returns), the higher the risk.

Internal Rate of Return (IRR). This estimates the interest you’ll earn on each dollar invested in a rental property over its holding period, or the rate of growth that a property has the potential to generate.

The calculation estimates long-term yield. When calculating IRR, set the net present value (NPV) of the property to zero and use projected cash flows for each year you plan on holding the building. Net present value is the value of money now, versus in the future once the money has accrued compound interest. It’s a complicated formula, so most investors use the IRR function in Excel to calculate the ratio.

Be aware that IRR assumes a stable rental environment and no unexpected repairs. A typical IRR metric ranges from 10-20% but can vary widely. It’s a way to measure whether or not a property is performing well for you.

Cash Flow. This tells you whether your property is making money for you—or not. It’s what you have left over after you’ve collected your rents and paid your expenses. It should be positive—or you are losing money—which is not why you got into the rental business!

Gross Rent Multiplier (GRM) helps you determine your investment’s worth. It’s calculated by dividing the property’s price by its gross rental income. The lower the GRM the better, but an average GRM is between 4-8.

LTV Ratio, or the Loan to Value Ratio measures the amount you’ll need vs. the property’s current fair market value. The difference between the percent a lender will finance and the property’s total value is the amount of cash that you will have to put into the deal. As I said earlier, most lenders will require at least a 20% down payment on an investment property loan. That would make your LTV 80% (100%-20%).

Debt Service Coverage Ratio compares the operating income you have available to service debt to your overall debt levels. Divide your net operating income by debt payments, on either a monthly, quarterly, or annual basis, to get your DSCR.

Lenders give great consideration to the DSCR. They want to make sure you can repay the loan. A high ratio indicates that you might have too much debt, and you may not qualify for a loan. A typical lender wants to see a DSCR in the 1.25–1.5 range. This means that your rental property produces 25% more of additional income after debt service. The higher the better.

Operating Expense Ratio (OER) shows how good you are at controlling expenses. To calculate it, add all operating expenses, less depreciation, and divide them by operating income. The lower the better.

Occupancy Rates consider two rates: 1) Physical Vacancy Rate—the number of vacant units, multiplied by 100, and divided by the total number of units. This gives you the percent of your units vacant when compared to the total units available. And 2) Economic Vacancy Rate, or the income you’re missing out on when a unit is vacant. Add up rents lost during the vacancy period and divided by the total rent that would have been collected in a year to get what the vacancy cost you.

Capital Gains Tax. There are two types:

Long-Term Capital Gains Tax is applicable if you sell a property you’ve owned for more than a year. You will pay tax on the profits you make.

Short-Term Capital Gains Tax is applicable when you’ve owned the property for less than a year (ex., house flip). Your profits are taxed according to short-term capital gains rates.

1031 Exchange is a great way to postpone capital gains taxes. With a 1031 Exchange, the IRS says that you can sell a property and reinvest the profit into what the IRS calls a “like-kind” investment. However, there is a time limit. You have to identify a replacement property for the assets sold within 45 days and then conclude the exchange within 180 days.

At last, we are getting to the bottom line! To determine if a rental property will be profitable for you, you must calculate its ROI. Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

For a cash purchase, to calculate the ROI, take the net profit or net gain on the investment and divide it by the original cost.

If you have a mortgage, you’ll need to factor in your down payment and mortgage payment, as well as other costs such as repair and maintenance costs, and regular expenses.

Here’s the formula:

Total gain on investment – original cost of the investment. Take that net gain and divide it by the original cost and you get the ROI.

Example:

Cash Transaction

You paid $300,000 in cash for the rental property.

The closing costs were $1,000 and remodeling costs totaled $9,000, bringing your total investment to $310,000 for the property.

You collected $2,000 in rent every month.

A year later:

You earned $24,000 in rental income for those 12 months.

Expenses including the water bill, property taxes, and insurance, totaled $2,400 for the year. or $200 per month.

Your annual return was $21,600 ($24,000 – $2,400).

To calculate the property’s ROI:

Divide the annual return ($21,600) by the amount of the total investment, or $310,000.

ROI = $21,600 ÷ $310,000 = 0.0697 or 6.97%.

Financed Transactions

For example, assume you bought the same $300,000 rental property as above, but instead of paying cash, you took out a mortgage.

The down payment needed for the mortgage was 20% of the purchase price, or $60,000 ($300,000 sales price x 20%).

Closing costs were higher, which is typical for a mortgage, totaling $2,500 upfront.

You paid $9,000 for remodeling.

Your total out-of-pocket expenses were $71,500 ($60,000 + $2,500 + $9,000).

There are also ongoing costs with a mortgage:

Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $240,000, the monthly principal and interest payment would be $1,146.00.

We’ll add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $1,346.00.

Rental income of $2,000 per month totals $24,000 for the year.

Monthly cash flow is $654 ($2,000 rent - $1,346.00 mortgage payment).

One year later:

You earned $24,000 in total rental income for the year at $2,000 per month.

Your annual return was $7,848 ($654 x 12 months).

To calculate the property’s ROI:

Divide the annual return by your original out-of-pocket expenses (the down payment of $60,000, closing costs of $2,500, and remodeling for $9,000) to determine ROI.

ROI = $7.848 ÷ $71,500 = 0.1098.

Your ROI is 10.98%.

Now, the longer you hold your property, hopefully, the more value it will accumulate. So, when you finally elect to sell it, you can throw your home equity into the equation, and you’ll end up with a higher ROI.

Bottom line, ROI can vary greatly; so, it’s essential that you compare the expected ROI of each property you are considering purchasing.

5 More Tips to Becoming a Profitable Real Estate Investor

Finally, (I bet you thought we’d never get here!), I’ll leave you with a few other tips to help you maximize your profitability and minimize your costs in your real estate investing career:

Beware of High Interest Rates. Money is cheap right now, but it won’t always be. Keep that in mind, as you may be subject to variable interest rates at some point.

Calculate Your Margins. If you are buying distressed properties, investors should set a return goal of 10%. It’s a good rule of thumb to estimate maintenance costs at 1% of the property value annually. But don’t forget other expenses like homeowners’ insurance, possible homeowners’ association fees, property taxes, monthly expenses such as pest control, and landscaping, along with regular maintenance expenses for repairs.

Invest in Landlord Insurance. This covers property damage, lost rental income, and liability protection.

Expect Unexpected Costs. Think about emergency repairs (e.g., storms, fires, and burst pipes!) You’ll need to stow away 20%-30% of your rental income for such expense.

Invest in Less Expensive Homes. Your ongoing costs will be less.

Know Your Legal Obligations. This includes state and local landlord-tenant laws.

I hope this information is helpful in giving you some tips on real estate investing. Know that I am not an accountant or tax attorney, so make sure you seek qualified help before you begin your investing journey. I wish you good luck and healthy profits!

What’s Causing the Dollar Short Squeeze?

The month of June saw a fairly significant decline in the price of precious and industrial metals, which is broadly being attributed to a “short squeeze” in the USD. Gold and silver declined around 7% during the dollar’s rally, while copper suffered a 13% pullback and platinum led the way down with an 18% drop.

Although an immediate pullback in USD following the rally may have signaled exhaustion in short covering, the dollar has continued to strengthen since. Metals, broadly, experienced a relief rally but the ongoing strength has left metals’ price performance muted.

What Caused the Dollar Short Squeeze?

Serving as a catalyst to the dollar short squeeze event was the recent policy statement from Federal Reserve Chairman Jerome Powell, who indicated that the central bank could begin tightening interest rates by 2023, if not in 2022. While this is still a long way off, investors were spooked by the inference that prevailing easy money conditions will eventually come to a halt.

It was admittedly an emotional reaction to a distant event on the market’s part, but traders may also have been discounting an earlier-than-expected Fed tightening if inflation continues to increase in the coming months.

Last month, currency analysts quoted by Reuters noted that “If the risk-off response to expected Fed tightening persists, Treasury yields and tightening views might soften temporarily, too, allowing a dollar pullback.” But what appears to be happening is that, far from going “risk-off,” market participants seem to be moving closer to embracing a “risk-on” approach once again, as evidenced by recent gains in growth-sensitive areas of the stock market.

What’s more, the 10-year Treasury Yield Index (TNX) started showing strength again shortly after that weakness as investors seemed to be betting on a stronger economic outlook. More recent conditions have reversed that rise and driven the 10-year yield to lows not seen since the beginning of the year, however. Ongoing low treasury yields could potentially make non-yielding bullion more attractive as a safe haven in the near term.

Meanwhile, the leading industrial metals—particularly copper—are still in a position of short-term weakness. This can be seen in the graph of the Invesco DB Base Metals Fund (DBB), which has lately established a series of lower highs and lows and remains below its key 25-day and 50-day trend lines.

What to Do Now

While it’s always possible that the market is setting up for a classic “whipsaw” rally to confuse the metal bears, the fact remains that as long as the dollar index remains in a position of near-term strength, the safest course of action – if you invest in precious metals, like me – is to remain in a heavy cash position and avoid buying new long positions in the metals and mining stocks for now. Before you think about initiating new positions, you’ll need to see the dollar index show significant weakness by backing off levels and falling closer to its May low. Right now, the dollar’s residual strength is simply creating too many headwinds for the major metals.

Concerning gold mining stocks specifically, we also need to see substantial internal improvement before we start buying them again. As of this writing, my favorite technical indicator for the mining stocks—the 4-week momentum of the new highs and lows for the 50 most actively traded gold stocks—still hasn’t reversed its decline to let us know that the internal weakness in the gold miners has ended.

Do you have any precious metals plays in your portfolio? Tell us about them in the comments below!

Why Biden’s Proposed Tax Hikes Won’t Affect Stocks

News last month that President Biden was planning on hiking the capital gains tax rates on some investors cast a shadow over the market which was broadly blamed for rising selling pressure in equities. The fear, of course, is that higher taxes are bad for stocks and investors.

“Wealth inequality” in America was a central plank of Candidate Biden’s campaign platform last year and the proposal seems specifically designed to use higher taxes on wealthy Americans to fund The American Families Plan which includes enhanced tax credits for families. The initial plan, which is likely to be subjected to significant changes to get through Congress, proposes a top marginal income tax rate of 39.6% for households making more than $1 million annually.

There is also a new “Old-Age, Survivors, and Disability Insurance” (Social Security) payroll tax imposed on income earned above $400,000, evenly split between employers and employees.

Corporate income tax rates would increase to 28%, up from 21% now, which were just lowered four years ago by the Tax Cuts and Jobs Act in 2017 under former President Trump. Big businesses with profits of $100 million or more would also face a new alternative minimum tax to close corporate loopholes. The below chart, courtesy of the Cato Institute, shows the higher tax rates being proposed (red bars).

But what really got the stock market’s attention, and not in a good way, was the part of President Biden’s plan to nearly double the capital gains tax on folks making $1 million or more.

And when you add in the 3.8% surtax on investment income that helps pay for the Affordable Care Act it would raise the total capital gains tax on seven-figure income-earners to 43.6%!

According to estimates from the American Enterprise Institute on the plan’s likely impact, the top 1% of income earners (the target group for income inequality) would see their after-tax income decline by nearly 18%.

Do Higher Tax Rates Really Affect Stock Prices?

Overall, the first draft of Biden’s tax plan aims to raise tax revenue by $3.3 trillion over the next decade. But are higher taxes really the nightmare scenario for the stock market that some believe they are?

Historically speaking, the answer is no.

In fact, a timely Tweet last week from Schwab chief investment strategist Liz Ann Sonders (see chart above) shows that there is virtually no relationship between changes in the capital gains tax rate and S&P 500 Index performance. This is based on many tax law changes dating back to the 1960s and up through the present.

The lack of correlation between higher taxes and lower stock prices holds true in both the year the tax change takes effect and the year before it happens, in anticipation of possible tax hikes (the stock market tends to be forward-looking, after all). In fact, Sonders goes on to note, “The last time cap gains went up (in 2013), the S&P had a stellar year (up 30%).”

There are, of course, still plenty of unknowns about what the final tax plan will look like. But investors should be able to take some comfort in the fact that, according to the historical record at least, higher tax rates are not automatically bad for stock prices.

Has this concern about capital gains tax rates caused you to alter your tax planning?

3 Positive Outcomes from the GameStop Fiasco

The GameStop (GME) fiasco was briefly the most newsworthy story on the planet, with a group of individual investors leveraging the commission-free trading app Robinhood and the social media site Reddit to coordinate a “short squeeze” by driving up the price of the heavily shorted stock and forcing professional investors to buy up shares and cover their short bets.

A few retail investors made money. Even more lost it, when they were left holding the bag as the stock came back to earth.

And in the background, there’s the broker-dealer network that required Robinhood to put up more cash to cover potential losses, an unexpected demand that led Robinhood to temporarily shut down trading in GameStop stock. Yes, the broker-dealer was just practicing good risk management, but it doesn’t seem right that the little guy was the one who was inconvenienced—or worse.

Still, I see numerous good outcomes from the affair.

First, in the wake of the testimony of the involved parties in Washington, I expect some kind of regulation that will tip the scales a bit more to the side of the individual investor. Already, Robinhood has modified its options trading screens in an effort to better educate its users.

Second, I expect the movement to democratize investing (one of Robinhood’s stated goals) to grow. Already, the firm’s zero-commission model has led other brokers to cut their fees to zero as well. The difference is that the older firms are making money from the big deposits their customers hold in cash. Robinhood, lacking those big cash deposits, gets paid when its customers trade, and that’s a bad incentive. In a frictionless world, customers who recognize this might transfer their assets out of Robinhood to another broker. Trouble is, Robinhood assesses a fee of $75 for that.

Third, and most important of all, I expect that the wave of traders who pushed up GameStop stock (as well as those who rode it back down) will work, over time, to improve their education about how the stock market really works. Call me an optimist, but I have great confidence in the ability of education to bring about positive change.

What Robinhood Investors Should Do Next

A strategy that works much better for the vast majority of investors is long-term investing. Trouble is, long-term investing doesn’t deliver the adrenaline rush that comes from watching your stock gap up in response to social media posts. And it doesn’t bring the camaraderie among fellow investors/traders (admittedly anonymous) that the Reddit/Robinhood crowd enjoy.

But if you truly care about your financial future, you’ll realize that investing is not a game. It isn’t meant to replace poker games or sports betting or visits to the casino—all of which have been in short supply thanks to the pandemic.

Investing is serious business—and it should be treated as such.

In fact, the original investment bible Security Analysis, published by Graham and Dodd way back in 1934, explained, “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

They go on to explain that an investor may be defensive, in which preservation of capital is of utmost importance, or he may be “enterprising” or “aggressive,” in which case he strives a bit harder to increase his principal—but in both cases he does his research thoroughly and thus is well-informed about the prospects of his investments.

The Best Way to Learn About Investing

I was lucky; my father was a passionate investor who focused on growth stocks and he was happy to share his passion with others—which is how the Cabot business got started over 50 years ago.

But there are plenty of other ways to learn.

You can read books.

You can learn more about the value of charts.

And of course, you can become a regular reader of the advice published by any of the thoughtful analysts featured in this edition.

So Where is GameStop Stock Going Next?

When GME was trading at 100 (down from 483) I did a poll of 11 of those aforementioned analysts, asking them to predict (individually, not as a crowd) where GME would be at the end of June, and at the end of December.

Their average guess for the end of June was 72 (with a median of 50), while their average guess for the end of December was 34 (with a median of 31)—though one analyst predicted that GameStop would be acquired by year end, at 52.5.

Additionally, one analyst (our growth stock expert Mike Cintolo) predicted a Phoenix formation, in which the stock would experience a temporary rebirth that would take it to 185 before it collapsed again.

Well, the stock popped up to those levels (kudos to Mike!), and the odds are extremely high that it is going to 70—and then even lower.

What are your predictions for GME at the end of June and the end of December?

3 Free Websites that Will Help You Become a Better Investor

Professionals in equity research departments nationwide have access to a suite of tools that most individual investors either won’t need or simply can’t afford. The cost of something like a Bloomberg Terminal would be so exorbitant that it would easily wipe out any investment gains it might help you make.

So how does an individual stock trader level the playing field when the firm on the other side of the trade has the best research that money can buy?

The answer, perhaps unsurprisingly, is to take advantage of the amazing free resources that you can find online. There are a lot out there, and it can be easy to get overwhelmed, so here are three of my favorites.

Best Free Investing Resource: Twitter

If you are not on Twitter, you need to sign up. And when you do, make sure to follow me! It is far and away my favorite free investing resource (I would gladly pay if required).

I will give just one example, but I could write a book on the benefits of Twitter.

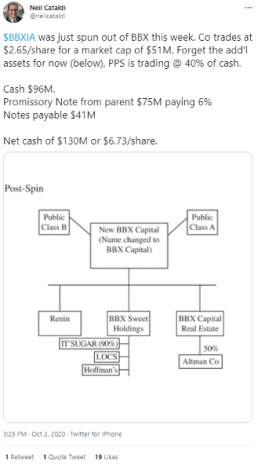

I closely follow spin-offs, but BBX Capital (BBXIA) slipped under the radar. It was tiny and there were some corporate governance concerns and so I didn’t spend much time on it until I saw Neil Cataldi tweet this.

To summarize, you had a recent spin-off trading at 39% of the cash that it had on its balance sheet (with no debt). Better yet, the company has operating businesses and real estate that were/are worth even more.

I quickly recommended the name to my subscribers and then bought it myself. We are up about 99% in five months! Book value per share is 16 (the stock price is 6.30) so there is still some good upside remaining.

Thanks, Neil!

Best Free Investing Resource: Google Alerts

Google Alerts are great and totally free. You just need to have a Google email to use them.

To set them up, go to www.google.com/alerts.

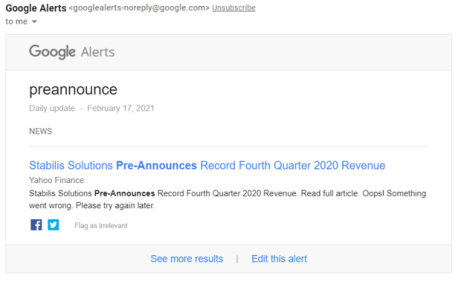

In a nutshell, you can get a daily email that alerts you to certain keywords.

Some keywords that I monitor:

- Special dividend

- Stock spin-off

- Revenue pre-announcement

“Revenue pre-announcement” is a good one to use because – to state the obvious – it signals that things are going better than expected or worse than expected.

Usually, the market is slow to catch on. If a company reports a positive pre-announcement, its stock will trade up, but usually not by as much as it should.

Here’s an example.

On February 17, before the market opened, I got a Google Alert that a company called Stabilis Solutions (SLNG) had pre-announced positive revenue.

After reading the press release, I learned that Stabilis Solutions expected to generate Q4 revenue that is 170% higher than Q2 2020 revenue (the low point for the year). On a year-over-year basis, Q4 revenue is expected to be up at least 8%. It’s pretty impressive that an energy company is already back to peak revenue generation.

Meanwhile, the company’s valuation (1.4x revenue) seemed reasonable and there had been insider buying right around the current share price.

On the day of the pre-announcement, the stock jumped 3%; however, this was clearly an under-reaction. Fast forward to today and the stock has doubled!

Best Free Investing Resource: Koyfin

Koyfin is an amazing, FactSet-like resource that is completely free!

The company is venture backed so at some point I would expect it to start charging for certain features, but for now the company is focused on building a great resource.

Take advantage while it lasts!

My favorite feature with Koyfin is “Estimates Overview,” which enables you to see consensus estimates from sell-side analysts.

You can find consensus estimates using Yahoo Finance (another good free tool) but only on a limited basis.

Koyfin shows consensus expectations for Revenue, EBITDA, EBIT, and EPS. Further, its user interface is beautiful and intuitive.

I recommend checking it out.

What’s your favorite online research tool?

The Women’s Guide to Maximizing Wealth

In 1990, a friend asked me if I wanted to attend a National Association of Investors Corp. (NAIC, now called Better Investing) conference to learn about starting an investment club. I said, “sure,” and we went on to form a women-only club. There was a good reason for that. Most of our members were women aged late 30’s – 70 years old; many had no investment knowledge but were eager to learn; and none of us wanted men “taking over” and telling us what to do!

We did very well. As president, I made sure we had training every month, and I spent a lot of time helping these women learn the fundamentals of investing. But they put in the work. Eventually, we had 20 or so members—all who wanted to learn about investing. We did so well that every year, someone’s husband or boyfriend wanted to join, and we always voted a resounding no!

As you might imagine, that created some havoc in our personal lives. The solution was that I started an additional, co-ed club, and, not surprisingly, the majority of the members were men. (My women friends still did not want to comingle!) That club also was very successful—but our returns were never as good as the “women-only” club.

That disparity of returns did not belong just to our clubs; several national surveys confirm that women, on average, outperform men’s investment gains.

Between 1991 and 1996, The University of California reviewed 35,000 brokerage accounts and found that women outperformed the men by 0.94% every year.

Later, in 2018, financial services firm Fidelity reviewed more than 8 million investment accounts. They discovered that women not only save 0.4% more than men, but their investments also earn 0.4% more per year than those of men. That may not sound like much of a difference, but Fidelity’s math shows that over a lifetime, “using a 22-year-old starting out with a salary of $50,000 a year, a woman investor will outpace her male counterpart by more than $250,000.” That may mean the difference between eating beans and hot dogs regularly in your golden years, versus having a nice juicy steak once a week!

Finally, in 2020, a Goldman Sachs survey found that 43% of women-managed mutual funds outperformed their benchmark in 2020, compared to just 41% of those managed by men.

And in down markets—such as in 2015—on average, women lost 2.5% of their stock portfolio value, while men lost 3.8%.

Why the Difference?

There are several reason why women’s investment gains typically outpace those of men, including:

Women don’t trade as much. Fidelity reports that “men are 35% more likely to make trades,” which means they are paying more fees which, in turn, reduces their gains. A Wells Fargo study showed that single women trade 27% less frequently than single men. And Robo-advisor Betterment reports that women change their asset allocation 20% less frequently than men. In a survey of their investment accounts, Vanguard said women trade 40% less frequently than men.

The University of California study determined that this excess of trading reduced men’s investment gains by 2.65% a year. Interestingly, the hit to the returns of women who were considered traders, was just 1.72%.

Women save more money than men, as I mentioned above. Further, Fidelity found that while women save 0.4% more than men on an annual basis, when it comes to our retirement accounts—such as 401(k)s and IRAs—we save nearly 1% more.

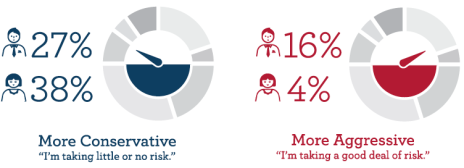

Women don’t like risk as much as men. We tend to be more conservative investors, don’t put all our funds into equities alone, tend to diversify our portfolios more by using age-related, target-date funds, and make more automatic deposits, ensuring a constant influx of investing funds.

A study by WIM Analytics found that women take 94% of the risk that men take. And only 5% of women take much risk at all.

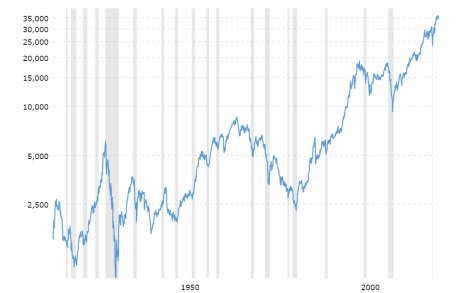

That, unfortunately, is not really enough for most of us, as playing it completely safe will drastically limit your returns. There’s a balance between risk and reward—for all investors, depending on your personal risk profile and investment strategy. If you invest in equities, history tells us that the S&P 500 has—on an annual basis—returned on average 9%. If you limit yourself to just extremely conservative fixed income investments, like bonds, over a 30-year period, you’re gains will probably add up to just half of that. Which is why most investment professionals recommend a mix of equities and other assets.

Women are less impulsive. Women don’t react to market or stock fluctuations as much as men. As many of us are long-term planners, we tend to view our investments that way. I can’t tell you how much more often a man in our co-ed investment club would recommend acting on a stock with very little information—often just a “hot” tip. Conversely, the women in that club and our women-only club always insisted on additional research before making an investment decision.

As I always say, those “hot” tips are good for one thing only—an idea that needs to be further researched to determine if it fits into your personal investing strategy.

Women Can do Even Better – What’s Holding us Back?

Women could see even better investment returns but there are a few societal mores that often prevent us from maximizing our gains.

Women have less confidence in our investing and financial abilities and skills. This dates back to puberty. A Time magazine study of 1,300+ girls from ages 8 to 18 and their parents discovered that “between the ages of 8-14, girls’ confidence levels drop by 30%.” Boys also see decreased confidence at these ages, but by age 14, “girls are hitting their low, and boys’ confidence is still 27% higher.”

That lack of confidence persists into adulthood for women, although often, confidence tends to rise with our age. However, the statistics are dim. According to Fidelity, just 9% of women think they are better investors than men (despite the proof to the contrary!). And Merrill Lynch says that just 52% of women have confidence that they can manage their own investments, compared to 68% of men. FINRA’s survey was even worse. That survey concluded that while 49% of men feel confident in making investment decisions, that number goes down to 34% with women.

But as I said, sometimes age helps. A report from U.S. Trust found that millennials (born between 1981-2000) are 46% confident in their investing skills; Gen X (born between 1965-1980), 52%; baby boomers (born between 1946-1964), 54%; and the silent generation of women (born between 1927-1945), 60%. So, there’s some hope for us!

Part of the lack of confidence is due to limited exposure to financial and investing education. I had a mother who ran the finances in our household, so I was lucky. In my years running banks I personally experienced dozens of instances of widows trying to locate their assets following the deaths of their husbands with no idea where to start. And once they found the assets, they lacked the tools or knowledge to manage them. Now, that’s a shame!

Another interesting point—I also started an investment club for gifted middle-school children, most of whom were boys. They were all from fairly wealthy families, and their parents had started their investment education at a very young age. But again, the demographics were mostly boys—not too many girls were afforded the same opportunities.

Women experience more fear around finances. Because women have less exposure to managing finances they are often too frightened to wade into the investing waters. I’ve heard from many of my professional friends—doctors, lawyers, and CEOs—who have spouted plenty of excuses as to why they don’t handle their own investments, including:

- I’m not good at math

- My husband (father, brother-in-law, etc.) handles all that

- I don’t have enough money to invest

- I don’t have time to learn about investing

- I’m not interested

And while you would think that younger women are more financially savvy, that, apparently, is not the case. According to SoFi and Levo League, 56% of millennial women admit that fear holds them back from investing. That’s really too bad, as millennials, aged 21 - 40, have a long runway to retirement during which they could be saving and investing.

This fear of investing significantly limits the accumulation of wealth. While about 25% of women are involved in the stock market, they also keepa whole lot of cash around. BlackRock reports that the portfolio of the average woman is 68% in cash. To that I say, “what?”

I know from experience you can learn how to be a good investor. In my first investment club, those women had never bought a stock; they didn’t balance their checkbooks; and they didn’t know how to calculate a percentage gain. If they can learn that (in a short period of time) and ultimately, become very successful investors with an investment club portfolio that today runs into the hundreds of thousands of dollars, so can you!

Women make less money than men, on average, so we have to make our money work harder! Last year, Payscale.com updated its gender inequality study, reporting that women earned about 82% of the wages of men. That’s $0.82 vs. $1.00. Sure, that is an improvement—in 1963, that number was 59%. But it’s inequitable and it puts us behind from the start. That extra 18 cents compounds over a lifetime of working. And it’s just less money to invest, which limits our gains.

As we grow older, men’s salaries tend to move up—peaking at an average of $101,200 at age 55. However, women tend to reach their peak earnings at age 44, topping out at an average of $66,700. Now, that difference can drastically change how much money we end up with at retirement. And, in fact, it is estimated that the cumulative lifetime earnings gap between men and women is $1,055,000.

Women traditionally bear the cost of getting married. The Knot informs us that the average cost of a wedding today is $30,000. And that’s if you pay cash. But if you’re like most young brides, you’ll charge a good portion of those costs, which means you are going to rack up substantial interest cost. You know, you can buy a decent economy car for that, or make a meaningful down payment on your first house! If you happen to come from a family that can afford it, it’s traditionally the bride’s parents that foot the bill. That may be a wonderful gift, but it’s at the expense of assets that could continue to grow over time to be passed down in the future.

Women have children. Spendmenot.com reports that in 2020, the cost of raising a child until age 17 was $233,610 on average.

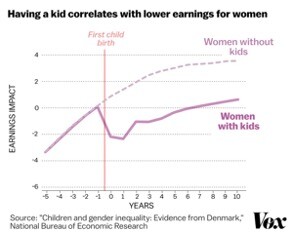

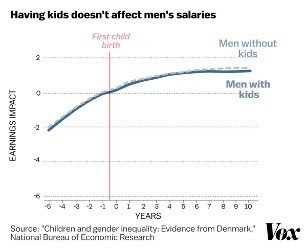

Women take time out to care for children. That tends to reduce our income by a whopping 39%. And maybe more. Here’s just one example from Rate.com, depicting wages lost due to taking time off to care for children:

“Let’s consider life without COVID (please!) in which a 28-year-old woman is doing some advance thinking, and figures she might take off two years starting at age 35 to have a kid. She started working at 22, and right now earns $60,000, and is contributing 10% to her 401(k) and her employer kicks in a 3% match. Those two years off (at 35 and 36) translate to a loss of around $330,000.

Here’s where it gets big: If she stays out for five years, which many parents of young children do, the total financial loss over her lifetime is $900,000.”

That’s frightening, isn’t it? Here’s a link to their calculator, so you can compute how opting to temporarily leave the work force may impact your future savings.

Women are often financially responsible for the care of our elderly parents. The average price of an assisted care facility in the U.S. is $4,000 per month (the range is $2,844 to $9,266, according to Payingforseniorcare.com). And a skilled nursing facility will set you back from $153 to $963 per day. They offer a cost of care calculator for you to find costs in your area of the country.

Women bear the cost of getting divorced. According to one report from the U.S. Government Accountability Office, women’s household income fell by 41% following a divorce or separation after age 50, while men’s household income dropped by only 23%.

Women live an average of five years longer than men—80.5 years vs. 75.1. And during those extra years, we will probably see our healthcare costs climb. Consequently, our money has to last longer, according to the CDC.

Women’s ultimate financial goals fall short of the goals set by men. It turns out that our goals are not all that different than men’s: vacations, education for our children, eldercare for our parents, and a secure retirement. Yet, a Mylo Financial Technologies study showed that men’s financial goals, on average, are double those that women set. It’s true that goals should be realistic, but in this case, it’s important to aim for—and to plan for—a much more substantial financial goal than we do now.

How to Overcome the Hurdles to Build a Bigger Nest Egg

Those statistics sound a bit depressing, don’t they? However, it’s not too late to kick your finances into high gear. There are some very practical steps that you can take.

Learn as much as you can about money. Before you dive in, you need to determine what you know and what you don’t know. So, first step, figure out your financial IQ. There are many websites with such quizzes. I would recommend you find a few, take them, and then decide where the holes are in your financial education. AARP and CNBC both offer quizzes that can help you get started.

Next, it’s time to learn!

In today’s world, there’s lots of investment education available. Here at Financial Freedom Federation and our sister site Cabot Wealth, we offer scads of educational articles.

If you are looking for some hands-on learning and would feel more comfortable joining a group of like-minded investors, consider starting or joining an investment club. These clubs focus on beginning investor education. To find one in your area, go to betterinvesting.org. Better Investing (formerly NAIC) was founded in 1951 and has helped thousands of investment clubs get started. I have had a lot of experience with them; all of my clubs have been chapters of Better Investing. They do a fine job of educating investors.

There are numerous investing books that are helpful. Anything by Peter Lynch, the genius who kick-started the Fidelity Magellan Fund in 1977. At that time, the fund had a mere $18 million in assets. By the time he left 13 years later, it had grown to more than $14 billion in assets, and sported a 29% annual return. I’ve been a long-time fan of Lynch and his books Beating the Street and One up on Wall Street remain two of my favorites.

I would also recommend The Intelligent Investor by Benjamin Graham, Warren Buffett’s mentor. Graham is also the co-author, with David Dodd, of what I consider the securities industry bible, Security Analysis. That book is my all-time favorite, but it is a huge volume, and you may want to defer reading it until you have a bit of investing experience.

The other three books are suited for investors of any experience level.

By the way, I’m working on a comprehensive list of my favorite investment and financial books for our Financial Freedom website. As soon as I have it completed, I’ll shoot you an email.

Negotiate a higher salary. If you don’t ask, you don’t receive, in most cases. An AAUW survey found that just 53% of women felt confident in negotiating a salary, compared to 61% of men. But a Harvard study reported that if women are armed with objective information about the salaries of colleagues and peers in the same industry, they are actually better at negotiating than men. That’s no surprise, since as I mentioned earlier, we like to do our research!

So, if you’re ready to see if your pay is comparable to your cohorts (so that you have a base from which to negotiate), here are a few sites to consult:

- Salary.com

- Glassdoor.com (includes company reviews and employee feedback)

- Payscale.com (for new grads)

- Indeed.com

- SalaryList.com (data from the U.S. Department of Labor)

- SalaryExpert.com (includes cost of living analysis and career salary potential)

- BLS.com (Bureau of Labor Statistics)

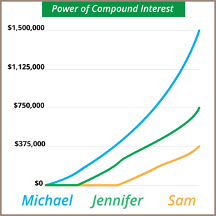

Start saving and investing early. That way, you can take advantage of compounding. This graph from Moneyunder30.com paints a great picture:

Here’s the back story:

“Michael saved $1,000 per month from the time he turned 25 until he turned 35. Then he stopped saving but left his money in his investment account where it continued to accrue at a 7% rate until he retired at age 65.

Jennifer held off and didn’t start saving until age 35. She put away $1,000 per month from her 35th birthday until she turned 45. Like Michael, she left the balance in her investment account, where it continued to accrue at a rate of 7% until age 65.

Sam didn’t get around to investing until age 45. Still, he invested $1,000 per month for 10 years, halting his savings at age 55. Then he also left his money to accrue at a 7% rate until his 65th birthday.”

They each saved exactly the same amount—$120,000, during a 10-year period.

But their ending nest eggs were dramatically different:

- Michael, $1,444,969

- Jennifer, $734,549

- Sam, $373,407

The difference was due to starting early and enjoying the magic of compounding, which is simply your money making more money.

If you didn’t start early, there’s no time like the present to begin. And if you have younger relatives, encourage them to begin saving and investing right now!

Take a little more risk to boost your investment returns. Of course, be cautious; continue to do your research; but if you allocate most of your portfolio to conservative investments just so you sleep a little easier, your overall returns may just be so-so. Consequently, to boost your gains, consider carving out a small portion of your portfolio for more growth stocks that may offer some spectacular returns.

And the younger you are, the more risk you can afford, so if that’s the case, I recommend that you make your portfolio equity-heavy so that you can maximize your returns over time.

Set a tangible financial goal. Then, step-by-step, plan out how you are going to achieve it. Start with what you are saving/investing for, come up with a specific, reasonable (but stretch) goal, and make a plan as to how you are going to accomplish it. Create both short- and long-term goals. And celebrate when you reach those milestones! Each time you get a raise (or a windfall), instead of spending it, invest it (or at least part of it). And keep in mind that your goals will most likely change as you age, so be flexible.

Part of your goal-setting process will include creating a budget. After all, if you don’t know where your money is coming from and where it is going, you will not be successful in setting or achieving your ultimate goals. Along with your budget, it’s imperative to keep debt to a minimum.

Build an emergency fund. Traditional thinking was to set aside 3-6 months of living expenses in a liquid (not investment) fund. In today’s COVID-19 world, you might want to double that time frame. If you have an emergency fund, you’ll be ready for any temporary interruptions to your income or unexpected expenses, and you won’t have to take that money out of your regular savings/investment funds to meet that need.

Women are way behind men with this essential step. Last year, a MetLife survey found that 55% of women and 44% of men are living without this safety net.

Invest for retirement. There are many, many investment retirement options today, including IRAs, 401k’s, SEP’s, etc. And most of them offer some form of payroll deduction, making it very easy to “save it before you see it.”

If you think you’re going to be okay depending only on Social Security in your golden age, think again. This year, the average monthly benefit is $1,543, which would barely cover insurance, medication, utilities, and food—much less a mortgage or rent payment. And sadly, according to the National Women’s Law Center, in 2019, 10.3% of women, aged 65 and older lived in poverty. The rate for men in the same age group was 7.2%.

Reconsider paying for your children’s education. According to U.S. News.com, “the average cost of tuition and fees for the 2020–2021 school year was $41,411 at private colleges, $11,171 for state residents at public colleges and $26,809 for out-of-state students at state schools.”

College-bound seniors do have other options (besides mom and dad) in paying for their educations:

- Student loans come in many varieties and will require a dedicated effort to discover and dissect which ones may be of value to you and your children. This site lists the Top 10 student loans.

- Scholarships are plentiful, but may require a lot of research. But if you are diligent, you can find scholarships for almost anything—red-haired children, relatives of Realtors, specific courses of study, and yes, even women (especially in the STEM fields)! A couple of good sites to get started are org and https://opportunity.collegeboard.org/.

- I worked my way through college, and so did millions of other folks. I was fortunate to work for a company that paid 50% of my college tuition, and yes, there are still businesses that do that.

If you opt for a professional financial advisor, do your research carefully. Start with your friends, family, and colleagues; ask them if they have a trusted advisor. If not, U.S. News has a list you can consult. So does the National Association of Financial Advisors,. You can also check on investor.gov for any violations by specific advisors. That will direct you to the SEC site for state registered investment advisers or the individuals who work for them. Be very careful, and if you do find someone you wish to work with, start slow—don’t give them all your money until they build trust.

Women and Money—a Bright Future

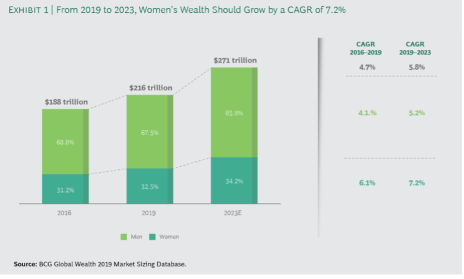

Despite the challenges we face, the prognosis for women and our money is excellent. According to BCG.com, from 2016 to 2019, women accumulated wealth at a compound annual growth rate (CAGR) of 6.1%. And as you can see in the graph below, that rate goes up to 7.2% by 2023.

In fact, every year we are adding some $5 trillion to the wealth pool globally—at an accelerating rate. And one-third of the world’s wealth is now under our control.

Part of that wealth accumulation is due to the gradual changing in women’s attitudes about money.

A recent Visa study found that:

- 57% of millennial women and 52% of Gen X women associate money with independence

- 76% of millennial women and 78% of Gen X women associate money with security

- 62% of women said they wouldn’t quit their job, no matter how much money their partner earned

- 1 in 2 women believe they aren’t fairly compensated at work

I love this “awakening”! We’re starting to take responsibility for our financial futures and Financial Freedom, so let’s take the necessary steps to “go all in,” plan, save, and invest, so that we can maximize our wealth—for us, our children, and grandchildren.

P.S. For more information on many of these topics, please consult our Financial Freedom Federation website. I have written extensively on budgeting, goal-setting, retirement, etc.

3 Stocks that Won’t Benefit from the Post-Covid Recovery

Just one month into the new year, there are already signs of progress of reopening in the states. A growing number of U.S. states are gradually taking steps toward a return to normal. The stock market has already discounted much of the anticipated economic recovery, with perhaps some additional upside to come in the next few months as lockdowns end and strictures are eased.

But the substantial gains seen last year in several segments of the consumer discretionary sector—including automobiles, food services and entertainment—will likely lose some of their tailwinds as the reopening proceeds (and which is already baked into stock prices to some extent).

While some stock market sectors look to remain strong even as the reopening gains traction (e.g. communication services and financials), other areas will lag. Foremost among the potential laggards are companies in industries that aren’t poised to see an immediate benefit from the early stages of the economic reopening. Let’s take a look at some of them.

3 Reopening Stocks to Avoid

One such area that looks set to continue struggling in the coming months is the airline industry. According to the International Civil Aviation Organization (ICAO), airline industry seating capacity last year fell nearly 50% worldwide. Just 1.8 billion passengers booked flights through 2020, compared with around 4.5 billion in 2019, according to the ICAO.

Furthermore, according to a United Nations News report the ICAO “does not expect any improvement until the second quarter of 2021, although this will still be subject to the effectiveness of pandemic management and vaccination roll-out across the world.”

American Airlines (AAL)

One of the most useful proxies for how forward-looking institutional investors are betting on an airline industry recovery is to watch the stocks of the leading U.S. airlines. American Airlines (AAL) is a case in point. Passenger traffic for the nation’s largest carrier by fleet size remains muted, although the company did recently report a slight sequential increase in passenger demand.

Some industry analysts believe that a full recovery for the airlines could be anywhere from three to five years away.

But for now, American’s chart tells the story of sluggish demand which will likely continue into the foreseeable future. What would change this outlook? A decisive new breakout above the upper boundary of its 10-month trading range at the 20 level would suggest the market sees the proverbial “light at the end of the tunnel” and is beginning to discount a return to normalcy for the company. Until then, however, conservative investors should probably avoid the stock.

American Airlines Group (AAL) is one of several reopening stocks to avoid.

Carnival Corp. (CCL)

Another industry particularly hard hit by the pandemic is cruise lines. Carnival Corp. (CCL) is the industry leader but continues to face stiff headwinds from pandemic-related restrictions. As analyst Josh Arnold has pointed out, “Cruise lines are the most vulnerable because the business model is to pack thousands of people into a floating box and keep them there for days at a time.”

Carnival is still struggling with the effects of shutdowns and social distancing. However, cumulative advance bookings for the second half of 2021 are within the historical range, according to Carnival. And the company’s advance bookings for first-half 2022 are actually ahead of a “very strong” 2019 (which was at the high end of the historical range). Further, management said the company has enough cash ($9.5 billion) and liquidity to sustain itself through 2021 even in a zero-revenue environment. Still, virus-related problems are likely to remain a factor for the cruise line going forward.

Hyatt Hotels (H)

One industry that’s seeing a fair share of reopening optimism in the new year is lodging. Hotels were among last year’s biggest losers, but with the overall economic picture brightening, many observers feel confident that hotels will make a huge comeback in 2021. And while higher occupancy rates are widely expected by analysts this year compared to 2020, obstacles remain on the path to a full recovery.

Hyatt Hotels (H) experienced huge revenue losses last year due to pandemic-related shutdowns and travel restrictions. Subsequently, the company was forced to suspend dividend payments in order to conserve cash.

What’s more, last year’s disastrous events led to Hyatt taking on massive levels of debt (currently around $3 billion), which will require a substantial boost in the top line to service. Fortunately for Hyatt, the consensus expects revenues to increase in each of the next three quarters (though at a tepid pace).

But for a long-term recovery case to be made for Hyatt, a return of big-spending business customers is likely needed. The question that many are asking, though, is: “With the work-from-home paradigm likely here to stay, will business travel ever reach pre-pandemic levels again?” It doesn’t take much imagination to see that, even after a return to normal, traditional business travel isn’t likely to recover to pre-2020 levels anytime soon.

Hyatt is making efforts to counteract this likely decline in business guests by introducing its Work from Hyatt program, which permits customers the use of a private guest room from 7 a.m. to 7 p.m. with Wi-Fi, dining and parking discounts, plus other hotel perks. Management hopes this new offering will pick up some of the slack from lost overnight stay revenue. That remains to be seen, but given the listless action of Hyatt’s stock price in recent months, the market is obviously still skeptical. Avoid for now.

If you already have these stocks in your portfolio, are you selling or holding for the long-term?

What Will it Take for Gold to Shine Again?

Gold has been a source of frustration for investors who bought it as a hedge against pandemic-related economic and political uncertainty. Its price has continually eroded in the last several months, prompting growing concern that perhaps the metal has lost its value as a safety hedge.

I’ll make the case here that gold’s value as a protection against both uncertainty and inflation should remain intact. I’ll also explain what is holding gold prices back and what likely needs to happen before the yellow metal can finally resumes its long-term rise.

Gold investors are asking two big questions:

● Why are gold prices falling?

● How can you tell when gold is rebounding?

Why Are Gold Prices Falling?

I’ll start with why gold prices are falling. It’s the result of the puzzlement over gold’s currency factor. Since gold is priced in dollars, a decline in the dollar normally results in a corresponding advance in gold prices. But instead of rallying in the face of recent dollar weakness, gold fell.

It’s not often that gold and the dollar move in the same direction. But when it happens it’s normally the result of a significant countervailing force. In this case, the force in question is the current trajectory of U.S. Treasury bond yields.

Gold, in fact, competes with Treasury bonds; and since gold doesn’t offer a yield, yield-seeking investors tend to favor bonds over gold whenever bond rates are rising. Indeed, the rising 10-year yield has convinced many investors to allocate more of their money to Treasuries at gold’s expense as they remain focused on chasing higher yields.

How You’ll Know Gold is on the Rebound

All told, a significant T-bond yield decline is probably what it will take to kickstart the next extended rally for gold. Falling yields will cause investors to reevaluate their choice in safe-haven assets, and lower yields will naturally make owning Treasuries less attractive than owning gold. Moreover, assuming the dollar remains weak, it should serve as an added enticement for participants to own the yellow metal as a hedge against future inflation.