Get this Investor Briefing now, How to Pick the Best Stocks from Around the World, and you’ll learn how global investing can be a profitable strategy for you. From understanding global investing to the six key rules to follow about global investing … from how to invest for the future to robotics stocks you should consider … and from everything you should know about fintech investing to the best Canadian stocks to buy now. How to Pick the Best Stocks from Around the World is your best guide to a making a global investing strategy work for you.

The Surprising Sector Benefitting from a Growing Global Middle Class

When you imagine consumers splurging on $100,000 handbags and luxury goods, odds are you’re thinking of only the wealthiest citizens of the globe. The jet-setting 1% or 0.1% that live a life that most people can only dream of.

The truth, however, is that some of the biggest growth in luxury retailers is being driven by not a growing elite class, but a growing middle class that’s interested in spending a little extra for the same status symbols the domestic middle class might occasionally indulge in.

You might think that Jeff Bezos or Elon Musk or Bill Gates is the richest person in the world.

But the trophy passed to Bernard Arnault, the French tycoon who got his start in luxury by acquiring Christian Dior in 1985 and then went on to capture Louis Vuitton and other premium names under his luxury group Louis Vuitton Moet Hennessy, better known as LVMH (LVMUY). It’s one of three luxury stocks I’ll examine today.

This January, LVMH purchased Tiffany & Co. Tiffany operates 326 stores globally in countries such as the United States, Japan, and Canada, as well as certain regions of Europe, Latin America and Pacific Asia.

For many Americans, it’s a sad development since it ends Tiffany’s 182-year reign as the leading stand-alone luxury brand in America. Tiffany’s had been struggling a bit as revenue was coming in at a slower rate as the company was in the midst of a turnaround.

Meanwhile, LVMH and other luxury titans were weathering Covid-19, the slowdown in Japan, turmoil in Hong Kong and the trade war without breaking a sweat.

This brings me to some interesting trends going on in luxury consumer markets that are making them deeper and broader than you might expect.

It’s not just the super wealthy, the so-called top 1%, who are driving luxury sales; it’s also the emerging global middle class that will splurge for a few luxury items as a sign of status.

The Economist predicts that by 2030, 93% of the world’s middle class will reside in emerging nations, controlling $6 trillion in buying power, and a nice chunk of this will go to luxury products. This trend seems to be happening around the world – including in America. So with Tiffany’s stock off the luxury investment menu, you should look to LVMH as an (admittedly relatively expensive) luxury stock alternative, and consider two of what I call “pink sheet blue-chip” stocks, Hermes and Burberry.

One reason I like these stocks is that their lower-end products start around $100 -$200, within the reach of the emerging middle class, while the companies have demonstrated strong pricing power with their higher-end products.

Another plus is their brand strength with a key market – Asian tourists with money to burn.

“It’s the global traveling luxury consumer that is dominating,” says Burberry Chief Financial Officer Stacey Cartwright.

Let’s do a deeper dive on these two emerging luxury stocks.

Hermes International (HESAY), a French luxury goods maker going back to 1837, is partially owned by LVMH. While Hermes crafts a wide assortment of belts, shoes, fragrances, handbags and gloves, it is best known for its iconic premium silk scarves and ties.

An elegantly crafted Hermes scarf is highly prized and priced and this translates to impressive profit margins. The company made a big splash by introducing a sari for India. The sari is a silk cloth draped around a woman’s body and is a must for many Indian women for special events and formal evenings.

Hermès bags are handcrafted and are priced at an eye-popping $150,000. The company sells its products through a network of 310 stores, including 219 directly operated stores worldwide. Revenue in the first quarter of 2021 was up 38%, with Asian revenues ex-Japan surging 94%.

Burberry (BURBY), meanwhile, was founded in 1856 and this iconic British brand and its products share many of the characteristics of Hermes.

I remember well that Japanese shoppers during the 1980s could not get enough of Burberry’s bags, ties and coats and the same is now happening throughout the Pacific Rim. A survey of high-end department stores by Credit Suisse suggests that Burberry’s brand is equal to that of Chanel, Louis Vuitton and Hermes.

Burberry’s stock is on a price-to-earnings basis the least expense of these three luxury stocks even as same-store sales were up 32% in the last quarter on a year-over-year basis. Its strategic plan includes opening dozens of new stores in emerging markets.

All three of these luxury stocks are in strong uptrends and tap into sizable growth markets with healthy profit margins. Consider adding some luxury to your portfolio for 2021.

Would you rather have these luxury companies in your closet or your portfolio?

How to Invest in the World

One very common investing misperception that I have heard frequently is the idea that it doesn’t matter where in the world you invest because markets always move together.

This couldn’t be further from the truth. Regions and country stock markets often move to the beat of their own drummer based on any number of factors, from economic growth to political events and perceptions of risk. Taking a more global perspective is a strategy that can truly pay off over time.

One easy strategy to capture global opportunities is through a country ETF rotation portfolio. Almost every major and emerging market country you can think of has an exchange-traded fund (ETF). Here are just a few.

How to Invest in the World

New Zealand (ENZL)

Switzerland (EWL)

Italy (EWI)

United Kingdom (EWU)

Philippines (EPHE)

Turkey (TUR)

Brazil (EWZ)

India (INP)

Argentina (ARGT)

China (FXI)

Why would some of these markets be doing better than China? It’s simple: they are competitors to China.

Because of higher costs in China, production is going to other markets in the region. Trade and investment within Southeast Asian countries is also rapidly increasing. During the last decade foreign direct investment between these countries has more than tripled. I could go on with other examples, but you get the point. What country’s markets and, in turn, what stocks you invest in makes a tremendous difference in performance.

2 Country-Specific ETFs with Value and Momentum

I have learned over time that the best strategy for picking country ETFs is to look at the extremes of value and momentum.

On the momentum side I would look at Taiwan (EWT), a market that is up 21% in 2021 and up 68% in the last year. This ETF’s largest holding, at 20% of assets, is Taiwan Semiconductor (TSM), which is the dominant producer of high performance microchips in the world. With a global semiconductor shortage making headlines, this stock should outperform. Many of the Taiwan ETF’s other holdings are in high tech and finance.

On the value side, despite all the corruption and political meddling in the Russian economy, its stock market, and the Russia ETF (RSX), is dirt cheap. Second, Russia, as a Pacific Rim nation, is stepping up its trade and investment outreach to countries such as China, South Korea and Japan. In fact, over the past five years, Russia’s bilateral trade with Japan has already doubled and trade with South Korea has tripled. These trends will accelerate as the Pacific century unfolds.

In addition to ample supply of energy resources, Russia has geography on its side. It takes only 2-4 days to get raw materials from Russia’s Asian frontier to China compared to weeks for many of its competitors. Finally, despite the bad headlines, the Russian economy is chugging along pretty well with about a 4% growth rate.

So don’t be lulled to sleep by the myth that all markets move in tandem. Be alert for the country opportunities showing great value or momentum.

Have you ever invested in country-specific ETFs?

As the U.K. Reopens for Business Consider these 7 Stocks

Covid lockdowns have hammered much of the global economy, and with plans in place to allow non-essential businesses to begin reopening in England, Scotland, Northern Ireland and Wales, the London Stock Exchange is rallying.

The lifting of lockdown restrictions ends one of the most stringent economic shutdowns in the world. While the British Prime Minister Boris Johnson isn’t turning the tap fully on, instead opting for a phased reopening like most U.S. states, the plan is to lift all lockdown restrictions in England by June 21, with the rest of Britain operating on a similar timetable.

The easing of restrictions is a much-needed life raft for the U.K. economy, which is in a deep recession after four straight quarters of declines, including by 7.3% in the fourth quarter of 2020. By comparison, the U.S. economy declined only 2.4% year over year in the fourth quarter.

Not surprisingly, the London Stock Exchange has not rallied as sharply as the S&P 500 or many other global stock markets in the last year. Since the March 2020 bottom, British stocks are up 33% – not bad, but tepid compared to the 80% advance in the S&P during that time.

British stocks as a whole, as measured by the benchmark FTSE 100, currently trade at a price-to-earnings ratio of 22.9, well below the historically high 44 P/E ratio in the S&P 500. And after falling in January on the heels of the country’s third lockdown in a year, the index has risen more than 8% and is trading near all-time highs.

You don’t have to look far to see which British stocks are leading the way. Some of the more recognizable U.K. companies, with the largest market caps, are up big since the beginning of the year.

With that in mind, here are year-to-date returns for seven of the largest British blue-chip stocks by market cap (listed from largest to smallest), most of whose names you’ll recognize.

7 British Stocks on the Rise

Linde (LIN)

Market Cap: $147.5 billion

YTD Return: 9.5%

Rio Tinto (RIO)

Market Cap: $139.5 billion

YTD Return: 12.7%

HSBC Holdings (HSBC)

Market Cap: $128.1 billion

YTD Return: 19.4%

BP plc (BP)

Market Cap: $85.8 billion

YTD Return: 24.5%

Prudential (PUK)

Market Cap: $54.3 billion

YTD Return: 12.9%

Vodafone (VOD)

Market Cap: $53.2 billion

YTD Return: 14%

Barclays (BCS)

Market Cap: $41.7 billion

YTD Return: 25.5%

All but one of those stocks has outperformed the S&P so far this year, and all have outpaced the Nasdaq. More importantly, each of them likely has more room to run than U.S. large caps, trading at an average share price of less than 14 times forward earnings estimates. With the British economy on the brink of a major bounce-back – U.K GDP is expected to grow 4% in 2021 and another 7.3% in 2022 – all seven of these hiding-in-plain-sight British stocks look like bargains.

So if you’re worried that the U.S. stock market looks a bit too frothy these days, and would prefer to invest in an economy that’s at an earlier stage of its recovery, British stocks look like a good place to be right now.

What’s the next economy you expect to bounce back?

4 Global Central Banks You Can Actually Buy Shares In

Imagine running a bank that helped set industry regulation, exercised control over the interest rates that influence borrower behavior, or even controlled the supply of money in circulation with the flick of a switch. You’d imagine that to be a fairly profitable institution, right? Well you’d be correct.

The thought exercise above describes central banks, like the U.S. Federal Reserve system which generated nearly $89 billion in profits last year. If the Fed was a privately run company it would have been the most profitable company on the planet according to Fortune’s Global 500 List for 2020.

While you can’t invest directly in the Fed, you can invest in a handful of central banks that exert similar influence over the fiscal policies of their national governments.

Central Bank Shares that You Can Actually Buy

Unlike commercial banks, which are owned by public shareholders, nearly all central banks are branches of their national governments. As such, investors have no ability to sit side-by-side with these profit powerhouses. However, there are a few central banks that do have publicly-traded shares, including the Swiss National Bank (Schweizerische Nationalbank), the Bank of Japan (日本銀行), the Bank of Greece (Τράπεζα της Ελλάδος) and the National Bank of Belgium (Banque nationale de Belgique).

These publicly-traded central banks can produce immense profits just like their government-owned peers. The Swiss National Bank (SWS: SNBN) produced $23 billion in profits last year, while the Bank of Japan (TSE: 8301) generated net income of $15 billion in its most recently completed fiscal year. Smaller central banks like the National Bank of Belgium (ENXTBR: BNB), with $983 million in profits, and the Bank of Greece (ASTE: TELL), with net income of $789 million, were no slouches either. And central banks are highly unlikely to go bankrupt.

Stock price performance can be both dull and exciting. The Bank of Japan’s price nearly tripled in 2013, then steadily slid by 70% until doubling earlier this year. Shares of the Swiss National Bank were flat from 2011 to mid-2016, then surged 6x over the next two years, but have been relatively tame ever since.

Like becoming king, buying shares of a central bank is not always easy and comes with caveats. Trading volumes can be low and the shares typically trade only on their in-country stock exchanges. Dividends may be scarce. The Swiss National Bank’s shares have a dividend yield of about 0.3%, although the National Bank of Belgium’s shares currently yield 4.5%. Also, shareholders may hold very limited or no voting rights.

For investors willing to put up with the inconveniences, owning shares of a central bank can provide financial rewards and the feeling of being, on paper at least, among the most powerful investors in the world.

When you’re investing in banks and financials, how important is dividend yield to you?

3 Industrial Metals Stocks Helped by America’s Recovery

As the U.S. rapidly approaches the light at the end of the proverbial pandemic tunnel, the economy seems primed to come roaring back in a big way. The market is already pricing in a full recovery, and Main Street is experiencing a rally of its own in a red-hot housing market that, in this low interest rate environment, is putting equity in the hands of homeowners and helping drive a new housing boom.

That construction boom, plus anticipated infrastructure projects, a strong domestic auto market and supply shortages have pushed industrial metal producers (particularly aluminum and steel) to a leadership position among cyclical industries that tend to outperform during economic acceleration.

One of the key drivers of the bull market in aluminum involves supply-related problems, with the shortfalls due to collection and transport system breakdowns during global lockdowns.

For instance, even before last year’s pandemic, China had some major import-related troubles in securing needed copper and aluminum supplies in 2018 and 2019 (both metals were moved to China’s restricted import list in 2018). This was a major impetus in propelling the prices of both metals higher starting last year.

In fact, China is still busily trying to fill the so-called “scrap gap” from the last couple years of shortfalls. Meanwhile, news reports inform us that Chinese traders are hoarding scrap for both metals as the supply imbalance continues.

There is also an ongoing aluminum can shortage in the North American food and beverage industry related to the pandemic. Ball Corp. (which makes metal and plastic packaging for the food and beverage industries) anticipates “demand continuing to outstrip supply well into 2023,” which should keep aluminum prices (currently at 30-month highs) buoyant for some time.

Even more critical to domestic industry is steel, which has also been in short supply ever since the pandemic broke out (due to mill outages, etc.). Automakers and aerospace parts manufacturers have had to scramble to secure steel supplies, with inventories at their lowest levels since 2004 and hot-rolled steel prices recently hitting highs not seen in decades.

Given the bullish global economic backdrop for these industrial metals, let’s take a look at some of the companies involved in their production and sale. Below are what I consider to be among the strongest U.S.-listed aluminum and steel stocks (from both a technical and a fundamental perspective) and which stand to benefit from this year’s anticipated economic resurgence.

Aluminum Stock: Alcoa (AA)

Rising use and tightening supplies are boosting the white metal’s outlook, and Alcoa (AA), one of the world’s largest aluminum producers, should benefit. Its operations include bauxite mining (aluminum ore), alumina refining (for smelting) and the primary aluminum manufacturing. With top user China on the mend, and with a boom underway in the global electric vehicle (EV) market (where it’s now the fastest growing automotive material), aluminum is expected to be in heavy demand this year.

As an indication of this demand, Alcoa reports that net imports of the metal have risen steadily in recent quarters in China in what the company calls an “unusual reversal” of normal trade flows. Moreover, the firm expects vigorous sales in 2021, including from higher anticipated demand in U.S. residential construction.

Looking ahead, the consensus expects the company’s bottom line to turn around in the coming quarters and accelerate higher in the next few years as China’s economy continues to grow, while the U.S. and Europe are predicted to consume more aluminum. The company also plans to pay a dividend as cash flow increases from its refinery and smelting operations.

Steel Stock #1: Steel Dynamics (STLD)

Steel Dynamics (STLD) is one of America’s largest producers of carbon steel (used in buildings, bridges, rails and pipelines, which makes this company an infrastructure play). It reported record levels of nearly 11 million tons of steel shipments for 2020, while revenue of almost $10 billion was the fourth highest in its history.

The company also reported record fabrication volume, strong earnings and steel shipments that were only 1% shy of a record, which management described as a “phenomenal performance” in view of prevailing economic conditions last year (and despite below-capacity steel mill operations).

Liquidity is also plentiful, with cash and equivalents north of $2.5 billion as of the end of Q4, so there’s plenty of reserves in case the industry faces an unforeseen headwind in the coming months. It’s worth noting, however, that Steel Dynamics uses highly scalable electric-arc furnaces to produce its steel, which should give it lots of flexibility in dealing with the volatility of the steel market.

Looking ahead, analysts expect a 35% increase in the firm’s top line for 2021, along with a sterling 82% bottom-line bump.

Steel Stock #2: Insteel Industries (IIIN)

Insteel Industries (IIIN) is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications (making it a play on the domestic construction boom).

In Insteel’s fiscal Q1, revenue was an eye-popping 23% higher while per-share earnings rose to 42 cents (from 3 cents a year ago), reflecting a very favorable demand backdrop for the company’s products across several key industries.

In particular, public construction was a key demand driver, with spending well above expectations in 2020. Highway and street construction, one of the largest end-use applications for Insteel’s products, were even with 2019 levels (despite dire predictions of an infrastructure-related spending collapse).

Going forward, management expects a strong financial performance over the next few months driven by current robust demand trends for its products and “rapid significant escalations” in steel costs, which the company is passing through the supply chain.

Insteel also expects the new administration and Congress to come to terms on a long-term infrastructure investment program, which should inspire confidence in the domestic steel market and drive increased consumption of the metal. It’s a solid growth story, and a good-looking steel stock.

How do you plan to invest as America recovers?

Why It’s Time to Buy Overseas Stocks

Stocks are on an incredible upside tear, but if you think this is as good as it can get, better think again. Take a look at how well markets outside the U.S. are performing right now.

Every major global stock market is up. In fact, many overseas markets are outperforming America’s by wide margins. For instance, just since the end of October …

- Emerging Markets are up 26.2%

- Brazilian stocks are up 33.8%

- European stocks have gained 36.8%

- South Korean shares have jumped 47.1%

Unfortunately, there is a phobia of sorts among U.S. investors called home-country bias. Many Americans quite simply have blinders on to what’s happening in other markets around the world.

And you can’t really blame them.

We are all bombarded constantly by the mainstream media, and especially business TV, about how well the Dow Jones Industrial Average is doing, or what’s happening to Nasdaq tech stocks or the S&P 500 blue chips.

But don’t let yourself be distracted by the home-field advantage of domestic stocks. There is a whole wide world of investment opportunities out there in other markets to choose from.

Plus, many overseas stock markets are not only at cheaper valuation than U.S. stocks today, but are expected to post stronger growth too. Take emerging markets (EM), for example.

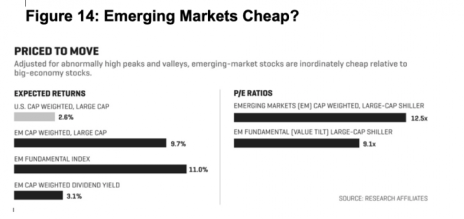

EM Stocks on Sale: 39% Cheaper than U.S. stocks

According to Fidelity’s Jurrien Timmer, emerging market stocks trade at valuations that are only 61% of the price-to-earnings ratio of U.S. stocks, which means EM stocks are 39% less expensive than U.S. stocks. That’s the lowest valuation for emerging markets in almost 20 years.

The U.S. dollar plays an important role in emerging markets’ economic and stock market performance. When the dollar is weak, as it has been recently, EMs have historically outperformed. And there are signs the dollar may stay low in 2021.

Another big factor in favor of EMs is where we are right now in the economic cycle.

After most countries suffered from a pandemic-induced recession in 2020, a global recovery is now taking hold in 2021. The combination of faster growth rates in emerging market economies and lower stock valuations could make 2021 a banner year for EM stock performance as worldwide economic growth accelerates.

The global pandemic is accelerating the adoption of digital technology everywhere, but this revolution is unfolding even faster in emerging countries. And it is delivering a larger boost to economic growth for EMs, according to research from JPMorgan.

Their analysts point out that, “Of the world’s 30 most digitized economies (by digital revenue as a share of GDP), 16 are found among emerging markets, led by China, South Korea, Indonesia and Colombia.”

The truth is, digital revenue is barely growing in developed countries, but is expanding much faster in emerging markets. In fact, digital revenue is growing by 11% per year in emerging markets.

JPMorgan also says that while “digital technologies are lowering the cost of launching and operating business everywhere, this process is fastest where the adoption of digital services is most rapid: emerging markets.”

History Says It’s Time to Buy International Stocks

History may also be on the side of international stocks in 2021 and beyond.

Over the past decade or so, U.S. stocks have easily outperformed international stock markets. But that could be due for a change.

Besides, international stocks, represented by the MSCI All Country World ex-U.S. Index (ACWX), have actually outperformed the S&P 500 for long periods, and by a fairly wide margin.

And we are now overdue for international stocks to regain their performance advantage.

How to Invest in International Markets

There are many ways to add international and emerging market exposure to your stock portfolio. For instance, there are hundreds of ADRs (American Depositary Receipts) that trade in the U.S. but represent ownership of international companies.

Perhaps the easiest way into international stocks is through regional, or even single-country, exchange traded funds. For example, there’s the iShares MSCI Emerging Markets Index ETF (EEM), or the iShares MSCI EAFE Index ETF (EFA), which represents mainly European, Japanese, Australian and developed Asian markets. Both have been trending upward in recent months.

Bottom line: The valuation gap between U.S. and emerging stock markets has never been this wide. And with the growth prospects of emerging economies rising relative to America’s, this imbalance is enough to make it worth owning international stocks, and especially emerging markets, in 2021 and beyond.

Do you invest internationally? Which markets do you tap into?

What the GameStop Short Squeeze Says about the Current Market

Just half a year ago GME was a sleepy, money losing $5 stock, that was the target of many hedge funds who were shorting it. Then the day traders on a Reddit message board named #WallStreetBets (WSB) “ganged up” and succeeded in driving the stock to ridiculous levels in just a matter of weeks.

No doubt everyone who has even a passing interest in the stock market has heard this tale of the short squeeze in GameStop (GME) stock.

But what does the GME short squeeze mean for stocks, and is it the kind of Black Swan event that could sink the market, and the many hedge funds that are betting against GME?

The coordinated GME short squeeze involved people buying the stock plus cheap out-of-the-money call options. This forced options market makers to go long the stock to hedge against their growing short call option position. If this happens enough a stock’s price can quickly spin out of control, resulting in a short squeeze. That’s when the hedge funds that were short millions of shares of the stock scrambled to buy back GME stock, desperate to cover their short positions.

The result: GME shares soared 10,500% higher – that is NOT a typo – in less than five months as of last Thursday. In fact, at one point last week GME’s market capitalization had swelled so much that it was among the 500 largest publicly traded companies!

The pain for those who were short GME, and other short squeeze plays, was brutal. Here are some of the losses from leading hedge funds through January:

- SUNDHEIM’S $20 billion D1 Capital lost about 20% in January

- POINT72 lost 10-15% in January

- Maplelane lost 33% in January

- Melvin Capital needed a $3 billion infusion

Never in their wildest dreams could these hedge funds have foreseen GME, which was assumed to be a dying company/stock, rally as high as 483 a share! This was undoubtedly a Black Swan event in the investing/risk management world.

So, What Now?

What do these losses mean for the stock market as a whole?

What day traders do with their spare time and spare pocket change isn’t my concern.

But this kind of activity elevates overall market volatility and risk, as large hedge funds, many of which were short GME, Bed Bath & Beyond (BBBY) and other stocks, have been reporting massive losses. When these hedge funds are facing these types of losses, they are often forced to liquidate liquid leaders such as Apple (AAPL) and Uber (UBER) in order to pay for the losses, which could trigger a deeper market correction.

And, according to Goldman Sachs: We recently saw the largest active hedge fund deleveraging event since February 2009, with long positions sold and shorts covered in every sector.

These losses, and the selling the hedge funds were almost certainly doing in the liquid leaders, clearly weighed on the market, as the S&P 500 and Nasdaq each lost more than 3.3% last week.

Now, we have seen these dislocations in the trading world before, and often, with a bit of time, the market digests these situations, then resumes normal trading.

If you want to know how to get long/short exposure to GME via options, my takeaway is this: big picture, the spreads in GME options between the bid and ask makes any buys or sales very difficult. Essentially, you have to give up a ton of edge to get in and out of trades.

Also, the prices of options in GME are so ridiculous, that it is very difficult to make big money. For those reasons, you should stay away from GME.

I’d love to know what your experience was, if any, during this historical event, leave a comment below.

Why Electric Vehicles Could Be the Next Huge Catalyst for Apple Stock

In short, electric vehicles are just one more reason to buy Apple stock.

We know that Henry Ford didn’t invent the automobile. Rather, he took a machine that was merely the interest of curious hobbyists and made it available to everyday Americans.

And we also know that Steve Jobs, the co-founder of Apple Inc. (AAPL), didn’t invent the personal computer. He simply took a machine that appealed to a specific niche and made it mainstream.

And ever since, Apple has proven again and again to be more curator than inventor. It takes an idea, refines and improves it, and creates a premium product that’s accessible to the average consumer.

Apple is Getting into the EV Market With Five Major Advantages

Could electric vehicles (EVs) be Apple’s next big target? It’s rumored to start production in 2024 with “next level” battery technology.

If Apple succeeds, it will dominate the auto industry of the future as Henry Ford dominated the early 20th century. Here are five reasons it has a chance.

- Innovation. The company has a longstanding culture of innovation. And with its recently acquired employees, it’s ready to capitalize on the rapidly advancing battery industry and manufacture the ultimate EV battery that will offer both relative affordability and unprecedented range. The Apple car will likely boast a wide array of technological advances, perhaps even the rumored autonomous driving capability.

- Design. Former Apple design folk hero Jony Ive is a well-known car enthusiast and has been rumored to frown upon the “tasteless” auto designs of Detroit. The Apple team may be able to apply his signature design principles to create a truly distinctive and premium product.

- Integration. Apple is one of the most powerful brands in the world. Between its advertising power and horde of groupies, the company instantly garners immense media attention. Plus, an electric vehicle will likely operate seamlessly within the Apple ecosystem, adding to its appeal. And as the king of affordable luxury, Apple’s products are priced highly enough to make them premium, but not so high as to make them inaccessible to most Americans.

- Capital. Perhaps most importantly, Apple could win the EV battle because of its enormous cash reserves. The tech giant could leverage its war chest to scale up in even the capital-intensive auto industry. And if it applied that cash hoard toward the EV industry, who’s to say it can be stopped?

- Market Interest. The final reason why Apple may make the plunge is the overlap between the market for Apple products and electric cars, giving users one more opportunity to express their Apple brand loyalty.

Even better, since the car is likely to be self-driving, that opens up a whole new slate of opportunity for Apple to offer its products directly to drivers. Music, videos, movies, even games—drivers will be looking for new distractions while their cars take them wherever they want or need to go.

If you have not yet invested in Apple, is the EV market enough to convince you to buy at an already high price tag?

This Long-Term Chart Says You Should Still Be Buying Stocks

Can the market survive a pandemic? It did once before, why not again? Today let’s look at a 106-year stock market chart, dating back to 1915. This is a chart of the Dow Jones Industrial Average in real (after inflation) terms, courtesy of the website macrotrends.net.

This chart below includes the 1918 Spanish Flu global pandemic and accompanying market crash. The market bottomed in late 1920 and proceeded to embark on a nine-year bull market that saw stocks rise nearly 600% – the Roaring ‘20s indeed.

Of course, then came Black Tuesday on October 29, 1929, when the party came to a screeching halt and the Great Depression ensued. Stocks lost more than 85% of their value in less than three years, and only managed to recover about half those losses once they finally bounced back in the mid-1930s.

A Pattern Emerges

The next true bull market didn’t start until 1949. That one lasted even longer than the Roaring ‘20s, with stocks mostly rising for 16 years before topping out in December 1965. Again, a bear market emerged, and didn’t stop until the middle of 1982. The next rally – you’ll notice a pattern here – lasted longer than the one before it, going from August 1982 until the height of the Dot-com boom in November 1999, more than 17 years long.

You know what happened next. The bubble burst, stocks came crashing back to Earth for nearly three years, recovered all the losses by late 2007…then fell off a cliff again during the 2008-09 subprime mortgage crisis-fueled recession. The bottom came in March 2009. Stocks have mostly been moving up since then over the past 12 years.

How Long We Have Left in this Rally

As the 100-year stock market chart shows, there have been three major bull runs prior to this one. The first lasted nine years. The second one lasted 16 years. The third one lasted 17 years. Thus, it’s not unreasonable to think we could have another six years left in this rally—which would indeed put us in the mid-to-late innings of this bull market. That’s a tip I heard first from Mike Cintolo, Chief Analyst of Cabot Growth Investor, probably the best at timing the stock market of any investment expert I know. He told listeners in his annual January webinar that we are in the middle innings of the current secular (very long-term) bull market.

That doesn’t mean there won’t be some speed bumps along the way – perhaps (likely?) even this year. There already have been two big ones in the last two-plus years alone: the fourth-quarter 2018 correction (remember that?), when stocks fell nearly 20% in three months; and, of course, the Covid-19 crash last February and March.

Despite those two major pullbacks, which combined shaved about 50% off of share prices in a matter of four or five months, they look more like small blips on the 100-year stock market chart. Market history is dotted with those blips. What matters more is the long-term trend. And right now, that trend is firmly on an upward trajectory.

Do you agree that we are only in the middle of the current bull market? What’s your evidence?

5 Ways to Invest in the Cybersecurity Boom

Cybersecurity is one of the fastest-growing segments of IT spending. Chief information officers consistently rank cybersecurity as their top spending priority. Damages from cybercrime could cost the world $6 trillion this year, prompting individuals, companies, and governments to spend a bundle with cybersecurity firms to provide sophisticated software and services to protect proprietary data.

Cybersecurity is a powerful theme that will be further fueled by the growth of new technologies that offer connectivity to data, such as machine learning, cloud computing, and the internet of things (IoT). You should definitely consider adding some cyber stocks to your portfolio. Here are five ideas that you can take action on right now.

5 Cyber Stocks and ETFs to Consider

You could begin with the Global X Cybersecurity ETF (BUG), a basket of cybersecurity stocks of companies developing and managing security protocols to prevent intrusion and attacks on systems, networks, applications, computers and mobile devices. This ETF has 29 holdings and the top 10 stocks represent roughly 60% of the total market value of the basket. Seventy-four percent of the companies are incorporated in America, followed by 13% in Israel and 8% in Japan.

The best value cyber stock may be Check Point Software Technologies (CHKP), which develops and builds both software and hardware products for information technology (IT) security. The company offers network and gateway security services, data and endpoint security services, and management solutions.

Two fast-growing companies and momentum stocks are Zscaler Inc. (ZS) and CrowdStrike Holdings Inc (CRWD). Both have had a very good run since March 2020 so I would be more aggressive on pullbacks.

Zscaler provides security software and a cloud-based web and mobile security platform that also addresses threat protection, cloud application visibility, and networking challenges.

CrowdStrike Holdings, founded in 2011, offers a cybersecurity platform that provides a range of products including antivirus, endpoint detection and response, device control, risk management, and threat intelligence. The company primarily sells its platform and cloud modules through its direct sales team.

Finally, I like a fairly new cybersecurity stock with lots of upside: Dynatrace (DT). This is a cloud software firm that was restructured and then re-launched through a 2019 IPO. Dynatrace’s software intelligence platform for enterprise cloud applications provides much-needed automation. The company’s revenue has been increasing at a 30% clip with positive cash flow and profitability. Its future looks bright, as it is still a small player in an absolutely huge cloud industry, spending more than $200 billion each year.

My advice for 2021 is to put some cyber in your portfolio, as the digital economy will grow exponentially from here.

4 Ways to Play the Infrastructure Boom under a Unified Congress

For years, political gridlock on Capitol Hill led to inaction on the U.S. infrastructure spending front. But with a politically unified Congress just sworn in, many economists expect to see a significant uptick in infrastructure spending in the coming years. Here we’ll examine a few of the companies and ETFs that stand to benefit from new construction and maintenance projects for America’s critical transportation, power and water facilities.

For years, economists and political pundits have lamented that spending on U.S. infrastructure wasn’t sufficient to keep roads, bridges and public transport in repair. In 2017, for example, it was estimated that spending on the local, state and federal levels for infrastructure was a mere 2.3% of GDP—the lowest percentage ever recorded.

Disagreements among a gridlocked Congress on how public funding was to be allocated kept several approved infrastructure projects in the last two presidential administrations from getting off the ground. But with a one-party Congress newly sworn in, many observers are hopeful that nationwide infrastructure projects will finally become a reality.

A recent edition of The Economist asked the question: “Is an infrastructure boom in the works?” The article answers its own question:

“Covid-19 may temporarily divert funds: governments may need to bail out struggling urban-transport systems, for instance, meaning there is less to spend on other projects. But the pandemic also explains governments’ enthusiasm for infrastructure: it can boost growth, both in the near term and further out.”

Moreover, the International Monetary Fund (IMF) maintains that “increasing public investment by 1% of GDP across advanced and emerging economies would create 20-to-30 million jobs and lift GDP by 0.25-0.5% in the first year, and up to four times that after the second.”

With gridlock no longer an obstacle, infrastructure spending projects will likely meet with limited resistance, especially with interest rates coming off multi-decade lows. This will make it easier for Congress to finance the spending. Further, as experts have noted, insurance companies and pensions funds in desperate need of yield will likely welcome—even encourage—the attractive cashflows that typically result from infrastructure-related assets.

A final consideration is that public works spending will almost certainly be a top priority of the new Congress, especially given the economic recession underway. Such projects are widely regarded as a panacea to quickly boost employment and stimulate economic activity.

With these considerations in mind, let’s examine a few select stocks (including an ETF) that are poised to appreciate in the coming months and years from increased infrastructure spending.

The Best Infrastructure ETF

One of the best ways for having comprehensive exposure to companies that provide infrastructure-related equipment and services is through the Global X U.S. Infrastructure Development ETF (PAVE). This fund invests in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering and construction.

The Best Infrastructure Stocks

Jacobs Engineering (J)

Jacobs Engineering Group (J) provides technical, professional and construction services and support for a several major industries and government agencies.

Indicative of the strong outlook for Jacobs is its impressive string of project backlogs, including a $24 billion backlog for the firm’s consulting services at the end of 2020 (up 6%). The backlog for Critical Mission Solutions (which serves the aerospace and defense industries) at the end of 2020 was up 3%.

Of even greater significance, however, is the firm’s qualified new business pipeline of $30 billion, which reflects increased investment from various government programs (including the U.S. Defense Department), as well as various nuclear, cybersecurity and 5G-related projects.

The strongly diversified Jacobs also recently announced an intent to acquire a majority stake in PA Consulting as a way to increase its reach in the fields of 5G, robotics, autonomous technology and machine learning automation. Analysts expect PA to post sales of around $715 million for 2020, which makes the acquisition potentially attractive for Jacobs’ bottom line.

Trimble Inc. (TRMB)

Trimble Inc. (TRMB) is a leading provider of advanced location-based solutions (GPS, laser, optical and wireless communications) that maximize productivity and enhance profitability. The company serves a variety of industries including agriculture, engineering and construction, transportation and wireless communications infrastructure.

Two of its largest business segments, Buildings & Infrastructure and Transportation, were negatively impacted by COVID-related headwinds in early 2020. But things are turning around for the company, with earnings expected to see 7% growth for 2020, followed by 7% and 13% growth in 2021 and 2022, respectively.

Trimble also recently completed the acquisition of a business that further expands its positioning services network to cover over a million square miles in North America. Management is further committed to making investments in the areas of cloud enablement, data management and artificial intelligence that will enable scaling to meet the huge opportunity it sees ahead.

Eaton Corp. (ETN)

Eaton Corp. (ETN) is a multi-industry power management company that provides sustainable solutions to help customers manage electrical, hydraulic and mechanical power. Eaton’s business provides it with exposure to the red-hot residential construction and data center markets, as well as utility infrastructure and the electric vehicle market.

While the top and bottom lines for Eaton are expected to be down for 2020, a sign that things are turning around for Eaton can be seen in its total backlog for the third quarter, which was up 11% from last year thanks to strength in data center orders (up 40%) and utility markets (which are benefiting from increased investment in smart grids).

Analysts foresee a strong rebound for Eaton starting in 2021 and continuing for several years on the back of an anticipated U.S. infrastructure spending bump.

China’s Rapid Recovery is Boosting these 3 Chemical Stocks

Chemicals are of paramount importance to the modern world, as many of the everyday materials we take for granted are results of modern chemistry. From rubber to plastics to paint, chemical companies convert raw materials into countless thousands of consumer products which lower costs and improve living standards for everyone.

The chemical industry constitutes 15% of the total U.S. manufacturing sector. And while the industry was seriously impacted by COVID-related shutdowns, chemical producers have been gradually resuming shuttered operations in the U.S. and around the world. What’s more, the supply-chain disruptions that were problematic for the overall industry in the last few months are finally being alleviated as production returns to normal.

No discussion of the chemical industry would be complete without mentioning China, the world’s largest user of commodity chemicals. With China’s economy impressively bouncing back from the coronavirus (its economy grew over 3% in the second quarter, compared to a 7% contraction in Q1), there’s even more reason to hope for booming business ahead for chemical companies with international exposure.

With that in mind, let’s take a look at some of the most attractive U.S.-listed chemical companies with exposure to China.

Eastman Chemical (EMN)

First up on the list is Eastman Chemical (EMN), which makes a broad range of plastics, chemicals and fibers for everyday purposes. The company has done well to focus on its higher-margin products (such as textile operations) in the wake of pandemic-related disruptions, and it has increased its footprint in key markets, including China (the firm has nine factories in the country with long-range plans of expanding into its lower-tier markets).

Management remains focused on free cash flow, and the company reported resilient revenue in the second quarter and first half of 2020. Eastman also reported that Q3 was off to a strong start and was seeing volume recovery due to the inventory management actions it took in the second quarter. Consequently, the firm expects to post a “substantial” sequential increase in earnings. Analysts also anticipate steady improvement to Eastman’s top line in the next few quarters.

Eastman Chemical is also a reliable dividend payer and has steadily increased its dividend over the last several years.

Eastman Chemical (EMN) is one of several strong chemical stocks right now.

Albemarle (ALB)

Albemarle (ALB) manufactures additives to or intermediates for plastics, polymers, agricultural chemicals and pharmaceuticals. Earnings in Q2 for Albemarle were negatively impacted by COVID, but the firm topped revenue estimates by 7% and beat EPS estimates by 14 cents. Moreover, analysts foresee a steadily rising growth path for both the top and bottom lines, beginning in 2021 and in the coming years.

Additionally, Albemarle’s lithium and lithium derivatives segment – with a sizable toehold in China – should be helped by increasing battery demand from China (ranked #1 in the world among countries most heavily involved in the lithium-ion battery supply chain in 2020).

The consensus on Wall Street concerning Albemarle seems to be “wait ‘til next year,” but the impressive strides that ALB and other chemical stocks have made this summer are encouraging and suggest investors may not have to wait that long to see worthwhile returns. If you’re long ALB, I suggest using the 50-day line on a weekly closing basis as a rolling stop-loss guide (as with all stocks covered here).

Albemarle (ALB) is one of several chemical stocks on the rise.

Dow Inc. (DOW)

Dow Inc. (DOW) is the result of a 2019 spinoff from DowDuPont. The firm designs and manufactures specialty chemicals, polymers and related products. Dow has a broad portfolio of commodity chemicals and this diversification should serve it well in facing any adverse economic headwinds that may lie ahead.

During the pandemic, Dow shifted its strategic focus to take advantage of increasing consumer demand for cleaning and disinfectant products. The company has also seen more business from its food packaging, health and hygiene and pharma application segments. And orders for chemicals used in the automobile and construction industries have had a noticeable uptick.

The economic improvement in China should further benefit Dow. (Indeed, management indicated as early as March that demand for its products in China were already on the rebound.) Dow also features a healthy dividend yield of 6.1%. From a technical perspective, the stock is a bit stretched from its 50-day line and could use a pullback. But the intermediate-to-longer-term trend for this stock looks healthy.

In summary, the chemical industry is rapidly rebounding from this year’s virus-related shutdowns and appears to be on a solid growth path going forward. Although some degree of uncertainty surrounds the economy in the months ahead, the companies mentioned here are poised to benefit from a continued economic recovery both in the U.S. and (especially) in China.

2 Under-the-Radar Japanese Stocks to Buy

John Templeton, dean of global investing, began his famed global stock-picking career scooping up ignored Japanese stocks in the 1960s. In the 1980s, when many thought Japan was an unstoppable economic juggernaut, its stock market delivered an average annual return of 36%.

Then the bubble burst and Japan’s stock market was at best a sideshow, showing some strength and then fading back into the background. Japan’s benchmark index, the TOPIX (short-hand for “Tokyo Stock Price Index”), still sits about 40% below its 1989 peak. The TOPIX is up just 12% in the past five years, against a 76% increase for the S&P 500.

Recently, however, Warren Buffett made a splash by announcing a sizable investment in five blue-chip Japanese stocks:

- Mitsubishi Corp. (MSBHF)

- Mitsui & Co. (MITSY)

- Sumitomo Corp. (SSUMY)

- Itochu Corp. (ITOCY)

- Marubeni Corp. (MARUY)

Buffett is dipping his toe in Japan for a number of reasons, the first being that Japanese stocks are trading at bargain prices.

The TOPIX trades for less than 15 times earnings, compared with a price/earnings ratio of about 21 times for the S&P 500, and the TOPIX trades for 1.2 times book, versus 3.9 times for the S&P.

Therefore, Japan is likely to offer investors lower downside risk than the high-flying tech darlings in America. Buffett being the world’s foremost value investor, this surely played into his calculations. Finally, with the U.S. dollar weakening over the last couple of months, Buffett is betting that this trend will continue.

I suggest that you follow Buffett’s lead, and perhaps have the opportunity to do even better than the “Oracle of Omaha,” by considering two Japanese stock ideas that are off the radar screen of most investors.

Rakuten (RKUNY) – The Amazon of Japan

With markets a bit on edge these days, it makes sense to move to a high quality, conservative play that is in an uptrend (see chart below), with plenty more upside potential.

Rakuten (RKUNY) is a strong under-the-radar Japanese stock in an uptrend. Rakuten is a well-diversified conglomerate with tentacles throughout Japan, and has plenty of room for international expansion.

Many of you may not have heard of Rakuten but I assure you that very few Japanese are not part of its ecosystem in multiple ways.

- Diversity. Its loyalty membership program is more than 100 million strong and it is Japan’s #1 internet bank, #1 credit card and one of the country’s leading travel platforms.

- Large and Growing. Rakuten’s core business is as an internet sales platform akin to Amazon. The company’s market share in Japan is about 25% – roughly equal to Amazon’s market share in the U.S. Next comes Yahoo Japan, at around 15%.

- Expansion Opportunities. Rakuten already has a large number of e-commerce cloud sites built with high-speed fiber connections in Japan. This offers the company natural expansion capabilities into virtual mobile networks and 5G. If successful, this investment will put Rakuten in a strong position with Japanese telecoms. Building a 5G network would typically involve huge investments. Luckily, Rakuten can bypass this because of its already existing infrastructure in Japan.

In short, Rakuten is a growth conglomerate with multiple drivers and a sterling balance sheet, with cash and short-term investments worth roughly $12.5 billion.

Fanuc (FANUY) – Robots Making Robots

While you have probably seen a multitude of stories about the rise of robots in manufacturing as well as everyday life, you may not be aware of Fanuc (FANUY), a Japanese blue-chip with zero debt, a sterling reputation, and a storied past.

Headquartered in the shadow of Mount Fuji, Fanuc is the world’s leading manufacturer of computerized numerical control (CNC) devices that are used in machine tools and also serve as the “brains” of industrial robots.

- Industry Leader. Fanuc claims to be the only company that uses robots to make robots. Fanuc, whose name is an acronym for Fuji Automatic Numerical Control, has been a world leader in robotics since the early 1970s. It was founded as a wholly owned subsidiary of Fujitsu in 1955 after that electronics giant decided to enter the factory automation business. Today Fanuc is as global as it gets, with over 240 joint ventures and offices in 46 countries, with a commanding 65% share of the world market.

- Building the Future. Fanuc should benefit from robust demand from developed markets as well as China as manufacturing wages continue to increase and manufacturers look to robots to increase productivity. You can find Fanuc robots at Amazon warehouses as well as on the shop floor of General Motors. Use of industrial robots has allowed companies like Panasonic to run factories that produce 2 million plasma television sets a month with just 25 people

- Profitable. Fanuc offers investors a pristine balance sheet, with zero debt and a whopping $7 billion in cash. And the stock is in an uptrend.

If you are looking to diversify your portfolio into international markets, I suggest you take a serious look at Japan. Both Rakuten and Fanuc offer investors high quality value plays on what seem to be unstoppable trends.

Semiconductor Stocks are in the Crosshairs of the U.S. - China Tech War

In the on-again-off-again clash with China, it’s impossible to ignore the dependence both countries have on one another through global supply chains and trade. The finer workings of this relationship are enough to dizzy the most educated of economists. And you can’t take any single part of this into consideration without looking at the broader picture.

That’s why Intel Corp.’s recent announcement that it may outsource all of its chip fabrication to Asian partners has to be seen against the backdrop of the United States and China’s increasingly intense techno-rivalry. Both countries want to protect and promote their national technology champions while still selling to each other while securing and strategically decoupling from their complex multinational supply chains.

This is all about which country is going to lead the commanding heights of global technology with implications for economic strength, financial security, cybersecurity, national security, as well as ideology.

One of the areas where China is still relatively behind is in advanced chip technology, which runs across chip design, computer software and equipment.

America’s Semiconductor Dilemma

Semiconductors are crucial, and the most strategically important technology because they are the materials and circuitry needed to produce microchips that are at the heart of everything from smartphones to advanced satellites. You might think of these microchips as the brains inside all advanced technology.

Understanding the microchips’ intricate and fragile supply chains is important for both policymakers and investors. Alex Capri, of the Hinrich Foundation, outlines a typical manufacturing and assembly scenario for a semiconductor chip: from research and development in America, base silicon ingots are cut into wafers in Taiwan or Korea, and finally the microchips are embedded into end products in China.

The challenge for America is that it wants to protect its lead in semiconductor technology while U.S. companies want to continue selling advanced chips to China. Day by day, this makes China a more formidable tech rival across the board.

Many American chip designers, such as Nvidia (NVDA), Micron Technology (MU), Qualcomm (QCOM), Texas Instruments (TXN) and Advanced Micro Devices (AMD), outsource the fabrication of these chips to Taiwan Semiconductor (TSM). With the exception of Intel (INTC), most U.S. chip companies shut or sold their domestic plants years ago.

American semiconductor and related equipment exports to China climbed 22% to a record $9.8 billion in 2019 while chip exports through Hong Kong added an additional $4.7 billion.

Total U.S. technology exports to China are estimated to have been close to $100 billion and companies such as the ones mentioned above receive 35% or more of their annual revenue from China, in one form or another.

Meanwhile, China’s total revenue from technology sales incorporating American technology exceeded $1 trillion in 2019. This includes telecom exports to America and around the world. The controversy around Huawei we have all been following is the perfect microcosm of the U.S.-China high-tech war.

All this is why Intel Corp. is struggling to keep up with the latest production process and technology. To make matters worse, Intel, which makes a majority of its chips in America, is considering outsourcing all of its fabricating overseas. This news reverberated well beyond Silicon Valley, to Washington, D.C.

U.S. semiconductor firms and their lobbyists in Washington emphasize that they allocate around 20% of revenues to research and development in order to maintain their technological lead over competitors in China, Japan, Taiwan, Korea and Europe. So if sales of U.S. advanced chips to China are curtailed or off limits, then revenue for R&D will be cut back and they will lose ground to competitors. This is America’s semiconductor dilemma.

Can the U.S. Revive Domestic Semiconductor Production?

One way to reduce America’s chip-making vulnerability would be to get Samsung or Taiwan Semiconductor to put a cutting edge fabrication plant in the United States. And that’s precisely what Taiwan Semiconductor is considering, as the world’s largest fabricator is exploring building a new $12 billion facility in Arizona.

The plan is to begin construction of this fabrication facility soon and complete it by 2024 though details, final financial arrangements and Taiwan Semiconductor board approval are currently pending.

Taiwan Semiconductor makes semiconductors for major names like Apple (AAPL) and Huawei Technologies mainly from its home base of Taiwan; it also operates plants in Nanjing and Shanghai.

As Asia’s dominating chip fabricator, Taiwan Semiconductor must execute a diplomatic balancing act between its sizable list of American, Chinese, Japanese and European clients.

But don’t count out Intel since it might be able to focus its efforts and gain political support and cash to help it get back into this high stakes, strategically important game. As strategic decoupling accelerates in America, China and around the world, you can expect a bumpy ride in semiconductor stocks before things settle.

Investing for the Future: Think Global

In the next few years, expect a big change in stock market trends.

In my constant search for great global stocks, international travel is a big part of my life. And no matter how interesting it is for me to travel overseas exploring new investment opportunities for you, there is a special feeling when I return to America.

For one thing, the air is a lot cleaner. It’s also nice to put my head down on my own pillow and get back to my normal routine and all the familiar surroundings.

In much the same way, investors also feel more comfortable putting money to work in companies close to home. The technical term for this is “home bias,” and researchers find that one persistent trend in investing is the inclination by investors to favor their home stock market.

One team of researchers (Coval & Moskowitz, 1999) even found investor preference for companies located in their home city or state.

Why Home Bias Shouldn’t Apply to Investing

I think it’s great that investors back local companies where they shop or where their friends work. But when you really think about it, this home bias is puzzling. Why should the world’s best companies with the best growth prospects just happen to be in America or wherever your home country happens to be?

In investing, where a company is based means less and less; what it does and how it performs are what matter now.

This is especially true for emerging markets, as the value of their stock markets play catch-up to their contribution to global economic growth and share of the global economy.

The Time to Invest is Now

While no one can predict how markets will move going forward, it seems smart to start taking some of your profits and adding more overseas exposure to your portfolio.

Though it won’t be anything resembling a straight line, over time the market value gap between U.S. stocks and other global stocks will narrow.

The time to buy overseas stocks is now, but the strategy you use to take advantage of this mismatch is critical.

Move incrementally and buy emerging markets when they are down and out. Stick with high-quality companies showing good growth and strong balance sheets. Diversify across many countries and favor those that respect private capital, rule of law, and open markets.

Also keep in mind that the best way to capture the growth and upside potential of overseas and emerging market stocks is through old-fashioned, bottoms-up stock picking— the art of analyzing individual stocks based on their own merits, not those of sector, cycle, or market performance.

Robots (and This Stock) Are the Future

One of my favorite television series growing up was “The Jetsons.” The storyline was to imagine what life would be like a century later, in 2062.

Here we are a bit more than half a century later, and many of the gadgets in the show still seem fanciful—consider the Jetson space car folding neatly into a briefcase, or the pill you could take for dinner.

On the other hand, the Jetsons’ robot maid “Rosie” highlights an area where we seem to be well ahead of the game.

Take Boston-based iRobot’s “Ava,” a 5-foot-plus robot with an iPad tablet for a brain and Xbox motion sensors to help it navigate around a kitchen or living room.

iRobot (IRBT) is a volatile stock but the company has already sold millions of disc-shaped Roomba vacuum cleaners, and has robots that will clean your pool or cut your lawn.

The military is a key player in the growth of robotics and its bomb disposal robots have protected soldiers in Iraq.

The robot market for the health sector also looks promising. iRobot recently expanded a partnership with InTouch Health, a small company that enables doctors at computer screens to remotely treat stroke victims and other patients.

And if you’ve seen an Amazon distribution warehouse of late, you’ve seen thousands of robots moving around like ants filling orders and managing inventory.

Another player in this market is ABB Ltd (ABB), which is a familiar European multinational that manufactures electrification, industrial automation, and robotics and motion products worldwide.

But one you may not be aware of is Fanuc (FANUY), a Japanese blue-chip stock with zero debt, a sterling reputation, and a storied past.

Who is Fanuc, and Why MIght They Be the Next Big Robot Stock?

Headquartered in the shadow of Mount Fuji, Fanuc is the world’s leading manufacturer of computerized numerical control (CNC) devices that are used in machine tools and also serve as the “brains” of industrial robots.

Fanuc, whose name is an acronym for Fuji Automatic Numerical Control, has been a world leader in robotics since the early 1970s. It was founded as a wholly owned subsidiary of Fujitsu in 1955 after that electronics giant decided to enter the factory automation business. Here’s why we like them:

- Fanuc offers investors a pristine balance sheet with zero debt and a whopping $7 billion in cash. Profit margins are impressive.

- Fanuc should benefit from robust demand from developed markets as well as China as its manufacturing wages continue to increase and manufacturers look to robots to increase productivity.

- Fanuc does most of its manufacturing in Japan. Fanuc is building a new factory near Tokyo to double its domestic output capacity of machine tools to produce parts of smartphones.

- Much of the company’s sales are channeled through GE Fanuc, a 50-50 automated machinery joint venture with General Electric Company (GE).

- Industrial robot manufacturer Shanghai-Fanuc Robotics Co. Ltd. has a plant in Shanghai’s Baoshan district. Fanuc claims to be the only company that uses robots to make robots.

As for Fanuc’s stock, its conservative management and penchant for maintaining high margin and quality products makes it a fine core holding. In short, Fanuc is a high quality play on what seems to be an unstoppable trend.

Investing in Monopoly isn’t Just for Kids

Growing up, our Monopoly games were rough and tumble.

Tensions ran high because our attitude was a bit like the Kennedys – the difference between second place and last place was nothing at all.

Monopoly is a great game for many reasons. One is that it reflects personality traits so well.

Most of my siblings cautiously managed their cash and picked up random properties. This allowed them to stay in the game for a long time but it also made ultimate victory unlikely.

As for me, I always went for the kill with a strategy of feast or famine. Either crush opponents with hotels on a great monopoly like Boardwalk and Park Place or crash and burn and happily head out to play a game of basketball.

Perhaps a strategy in the middle is best but this raises an interesting question: Just why is it that so many people are bad at Monopoly? Maybe monopolies aren’t all that bad, and investing in monopolies makes sense.

But that’s not always easy for U.S. investors. Lasting monopolies are tough to find in America but there are plenty of them in emerging markets.

Why?

Well, most emerging and frontier markets are a fascinating blend of “wild west capitalism” and “state capitalism.” These are countries that have less developed, less liquid stock markets and normally smaller economies. Additionally, many frontier market companies remain hidden to investors, and bargains abound. Frontier markets account for 25% of the world’s population and 12% of the global economy but less than 3% of the market value of all companies trading on world stock markets.

Early movers can gain enormous economies of scale, making competition difficult. Governments tend to keep big western multinationals at bay with import and investment restrictions.

Then there are many of these monopoly-like, state-owned and controlled giants whose stocks are publicly listed. I guess the best way to convince government regulators to protect your markets is to be owned by the government itself.

But there are also plenty of private companies that don’t have a complete monopoly but profit from some edge that gives them a partial monopoly. Business professors refer to these as “moats.”

They can be based on relative size, government ownership, cost advantage or some intangible benefit like a dominant brand name.

Or perhaps they are just very well-run companies head and shoulders above their competitors? I call this a market monopoly.

Whatever the edge, these companies are attractive to investors for only one reason – their ability to deliver consistent and strong revenue and profit growth.

And in case you think it’s not patriotic to invest in international companies, you should know that international companies make a significant contribution to America’s economic growth and jobs.

Toyota has the largest manufacturing facility in the world based in Kentucky.

BMW relies on hundreds of American auto-part suppliers.

In fact, international investment accounts for nearly 7 million high-paying jobs in America.

So my advice is this – don’t be shy about investing in monopolies.

Everything You Need to Know About Investing in Fintech Right Now

Believe it or not, many young people in the world today have never stepped foot inside a bank and may never do so.

Thanks to the ubiquity of smartphones, the internet and financial technology (fintech), these people have a whole new set of options for how to manage their finances and grow their investment portfolios.

The key is emerging financial technology, which is driving the evolution of traditional financial services as companies and countries attempt to adapt to evolving consumer expectations regarding choice, costs, convenience and security.

Below is a summary of the trends in fintech, where I’ll introduce seven fintech stocks, cover key fintech applications, and then present you with our best specific stock recommendation that plays into these trends.

Trends in Fintech

Digital Transformation

Physical financial infrastructure requires significant investment in people, buildings, aging technology systems and even older paper-based processes. This dated foundation places incumbents at a disadvantage in terms of both cost structure and user convenience.

In contrast, new companies have the advantage of a clean slate and can begin with a state-of-the-art technology platform from the get-go.

This dynamic is playing out in virtually every arena of financial services, including banking, capital markets, real estate, insurance, payments, asset management and wealth management.

Artificial Intelligence (AI)

Artificial intelligence is simply the ability of machines to think like an intelligent human but perhaps 1,000 times faster and at a higher level.

The ability to gain actionable insights from data using AI is driving fintech and creating frictionless and personalized consumer experiences that are predictive, personal and efficient.

Taking a page from the playbooks of Amazon and Netflix, incumbent financial firms are seeking to move from a “search-and-browse” to “curate-and-deliver” model, where they anticipate client needs utilizing data and machine learning.

Emerging fintech companies are helping consumers gain access to small business loans and home mortgages, “intelligent” automated savings and investment plans based on a customer’s data profile.

Blockchain

You might think of blockchain as a secure, flexible ledger in the cloud, which offers tamper-proof, transparent tracking of transactions. This allows any process to be streamlined and settlement times can be greatly shortened. Not only does this greatly reduce costs for financial services firms, but it also saves capital, which is increasingly important given the decline in fees and returns, plus the increase in regulatory costs.

The Countries Leading in Fintech

Because of their size and technology base, America and China lead in fintech though China perhaps has the edge because of its ability to scale up over a population more than four times that in America.

Increasingly, banks and other financial services companies will need to acquire new customers and interact with ongoing customers through digital ecosystems, requiring new approaches to branding and relationship management as well as changes in business models and technology.

As the U.S. and China trend toward financial technology (fintech), fintech stocks are trending well. In recent years, however, Asia has tilted the scale, delivering game-changing growth and innovations in banking services.

This reflects not only the increasingly central role of diverse Asian economies in global trade and economic growth, but also Asia’s renewed leadership in scaling innovative technologies and new business models.

For example, in China’s larger cities (113 cities have a population over one million), cash is largely a thing of the past, as are credit cards. People in those cities make their purchases by scanning QR (quick response) codes with a smartphone, using them everywhere from traditional stores to street vendors.

As you can see from the above chart, China has two dominant payment systems: Alipay and WeChat, both of which the Chinese government can access.

You can see that fintech is centered on collecting and analyzing data.

Google, Apple, Amazon, Samsung and Facebook all have bespoke e-payment initiatives and data that can indicate who our friends are, what our exact location is, and what we search for on the internet. They are especially after payments data, because it lets them know how we spend our money.

With that in mind, here are seven companies taking advantage of the trend.

Seven Leading Fintech Stocks

Goldman Sachs: (GS)

Goldman Sachs, founded in 1869, is one of America’s largest and oldest banks. The financial institution has been able to replace many of its human traders with complex computer algorithms, some backed by machine learning and computer engineers. The investment bank generally can replace four traders with one computer engineer. More than one-third of Goldman’s personnel, or approximately 9,000 employees, are computer engineers and most trades are now automated, even in opaque currency markets, where human trading was once thought to be essential.

SS&C Technologies Holdings: (SSNC)

SS&C Technologies provides software platforms to financial institutions, asset managers, and trusts that enable the manager to integrate their daily tasks, such as trading and portfolio management, with back-office functions, such as accounting and regulatory compliance. Most of these software platforms are subscription-based, requiring contract terms of one to five years.

BlackLine: (BL)

BlackLine is a cloud-based software platform that allows businesses to automate burdensome and tedious accounting tasks, such as reconciling financial data, in real time. These tasks traditionally take lots of man-hours and are only done at the end of each month or even quarter. BlackLine’s platform allows businesses with several product lines in different geographical markets to accumulate this data instantaneously, giving companies the confidence needed to make quicker strategic decisions all while sharply reducing accounting and back-office costs.

PayPal: (PYPL)

PayPal was essentially the world’s first digital wallet. The service gained significant traction as eBay’s early buyers and sellers sought a safe and fast way to make transactions. PayPal has more than 260 million active user accounts, meaning those customers now use their accounts more than three times per month.

Guidewire: (GWRE)

Guidewire provides property and casualty (P&C) insurers with software platforms that allow them to run their businesses effectively. Guidewire’s platforms enable insurance companies to accomplish seemingly all of their core services, from data analytics and digital engagement to underwriting and claims management. Guidewire serves more than 350 companies in 32 different countries, including Farmers Insurance and Nationwide.

Q2 Holdings: (QTWO)

Q2 Holdings is a technology company that helps smaller banks and credit unions offer cloud-based platforms to their account holders can enjoy good experiences across all digital channels. These smaller banks often do not have the IT expertise or the necessary in-house resources to compete with the virtual offerings of bigger rivals.

Square: (SQ)

Many might know Square as the credit card reader used by their local farmer’s market or favorite food truck. Indeed, that’s how the company started, offering payment processing services to smaller businesses that could not traditionally afford card acceptance services. But today, Square is a place where small businesses can go to meet nearly all their administrative needs.

All seven of these fintech stocks would make solid long-term investments.

6 Rules for Investing in the Best Global Stocks

Our philosophy, in a nutshell, is that there’s always a growth trend and bull market somewhere in the world.

We begin by researching and identifying the best growth trends which, like the wind behind a runner or the current behind a swimmer, makes success all the more probable.

And no question, one of the most prominent growth trends in the world right now is the rise of emerging markets.

Representing 85% of the world’s population in countries brimming with confident, better-educated young consumers, they have more money in their pockets and are riding economies with growth rates that are 2-3 times greater than in well-developed markets.

But we also look beyond emerging markets to markets such as Canada, Europe, Australia, Japan, which are full of world-class companies capturing growth and profits from around the globe.