I’m often asked how I go about setting up my trades. More specifically, how do I know which strike prices to use?

The answer is simple.

Once I’ve looked at the various factors such as implied volatility, IV rank, and several others screens I use on a daily basis, I then turn to one of my favorite trading tools trader known as the Expected Move, or the Expected Range.

The expected move is the amount a stock or ETF is predicted to advance or decline from its current share price, based on the security’s current level of implied volatility and days to expiration. The expected move fluctuates, in real time, based on changes in a security’s price and its implied volatility.

Let’s take a look at a quick example.

[text_ad use_post='262604']

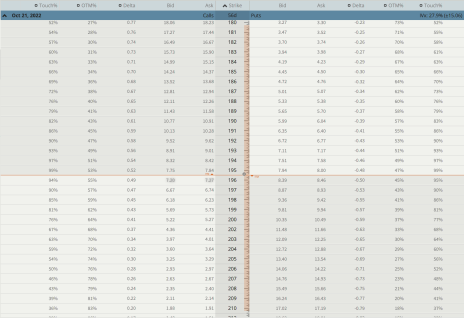

Below is an image of the Russell 2000 ETF (IWM). I want to look at the options chain for the October 21, 2022, expiration cycle that has 56 days left until expiration.

The vertical, tan-colored bar represents the expected move for the expiration cycle. The current range is between roughly 180 to just over 210. The market is essentially telling us that it expects IWM to close somewhere between 180 and 210 at the end of the October 21 expiration cycle. Having this information prior to placing a trade is incredibly valuable.

How Do I Use the Expected Move?

Okay, so knowing the expected move is between 180 and 210, I can place a trade outside of the range.

Options Selling Strategy: Bullish Approach

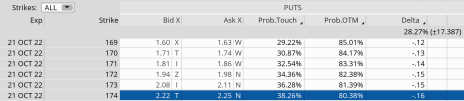

If I’m bullish and using a risk-defined trade, I can use a bull put spread, otherwise known as a short put vertical spread. My preference, in most cases, is to place the spread outside of the range, in this case below the expected move, or the 180 put strike.

Oftentimes, I like to go well outside the expected range, thereby increasing my probability of success, or probability of profit. As you can see from the image above, by choosing the short put strike of 174, my probability of success on the trade is 80.38%. Of course, I could increase my potential probability by significantly more by choosing a strike further away from the current price of IWM.

I also like to look at the probability of touching my chosen strike. In this case, the probability of IWM touching 174 at some point within the October 21 expiration cycle is only 38.26%. I look at probability of touch as kind of a stress indicator. In most cases, I look for a probability of touch below 50%, as I want to keep the stress low when using a high-probability trading approach.

Options Selling Strategy: Bearish Approach

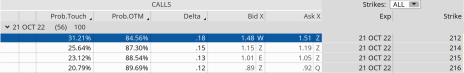

If I’m bearish and using a risk-defined trade, I can use a bear call spread, otherwise known as a short call vertical spread. My preference, in most cases, is to place the spread outside of expected move or range, in this case above the 210 call strike.

Again, my preference is to go outside the expected move, thereby increasing my probability of success. As you can see from the image above, by choosing the short call strike of 212 my probability of success on the trade is 84.56%. The probability of IWM touching the 212 strike in the next 56 days is 31.21%

Of course, I always have the choice of increasing my probability of success by choosing a strike further away from the current price of IWM.

For instance, if I chose the 215 strike as my short call strike, my probability of success increases to 88.54%. The probability of touch falls to 23.12%. The only tradeoff as I increase the probability of success on the trade is that my premium, or potential profit, declines.

Quick Summary

The expected move is just one of many important tools I use as a professional options trader. I reference the expected move for every trade I place, and I suggest you get in the habit of doing so as well. Always, always, always understand what your probabilities are throughout the life cycle of each trade you place. Whether you are initiating a trade or managing the risk of your open position, knowing the expected move is an essential tool to your long-term trading success.

[author_ad]