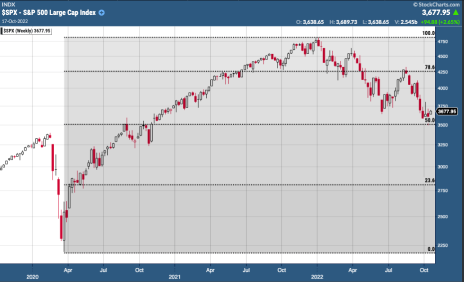

The stock market made an important move last week: It surrendered half the gains from the bull move from the pandemic panic’s bottom of March 2020 to the peak of November 2021. That’s bad, you say. But it’s potentially very good.

This 50% retracement is important because it’s a classic market move that often augurs a revival of the bull market . Here is a weekly chart of the recent retracement from March 2020 to now, with the peak and 50% retracement lines for the S&P 500 index.

We know markets move in cycles that are bullish and bearish depending on your time frame. Early in the development of modern technical analysis about a hundred years ago, a trader and analyst named William Gann noticed that a healthy bull market typically will have down periods where half of the gains of any leg will be surrendered before moving higher again. This is a Gann retracement. This move is also usually included in the more attractively mysterious (or mumbo-jumbo-like, depending on your view) Elliot Wave Cycle and Fibonacci approaches to the markets. Whatever you call it, it’s an important move and one that suggests we could be at an inflection point. One sign of that is that upon hitting it, we saw a big bounce last Thursday and good follow through. The bears have yet to unwind the gains made so far since. Every day that happens is further confirmation that this is a potentially significant bottom.

If you follow the financial press, this mark and the subsequent bounce have been dismissed. I’m not one to usually dump on the press – it’s part of a healthy democracy and key to efficient markets too. But the overconfidence on how bad everything is by the punditry side of the business press is one of the signs I look for as a signal a bear market could be ending. My favorites for this are Barron’s, which has called the recent buying noise and even silly, and The Economist, a perpetual contrarian indicator of the health of the American markets. Don’t dismiss the significance of overconfident, bearish financial editors. There’s also probably some political bias in the bad news too – the financial press by and large are owned by billionaires with a distinct preference of political parties and often what they call bad under one ruling party is spun positively in another. This is one of those periods and once Election Day passes the spin will subside, mostly.

Another, harder to quantify sign we may have bottomed: It’s mid-October and bear markets often bottom in mid-October as people throw their hands up in despair with the market and sell. There are many fascinating reasons why this could be so – a psychological coming down from the lazy, happy days of summer, the shortening of the daylight that makes people feel more negative or even a surprisingly credible theory that autumn sell-offs and panics are linked to the gravitational pull of the moon.

But back to more tangible indicators.

There are five classic signs to the end of a bear market, known as Schabacker’s Rules, after a technical analyst who was an early developer of Dow Theory on the markets. What are they telling us?

1 – Stock prices are declining and bad news is everywhere. We know the former and I see the latter, as explained above.

2 – Commodity prices have declined. You may not believe this, especially as winter heating bills start coming, but key commodity prices – grains, softs, metals and yes, heating oil and natural gas – are all down-trending from June peaks.

3 – Trading volume is low. Here our thesis starts to show cracks. Trading volume is a little lower in recent months than what it has been. It’s trending in a confirming direction, but isn’t convincing. However, growth stocks that report good news haven’t generally sparked buying, an indifference which I take as a confirming sign.

4– Corporate earnings are low. Based on FactSet data through the first half of the year, earnings have been lower – half the S&P 500 missed earnings targets in the second quarter – but overall they’re still growing, albeit more slowly. This is evidence the market may continue to go lower from here.

5– Interest rates have declined. They’ve been doing the opposite. Chalk another indicator in favor of the bears. It would be interesting to see how U.S. rates are trending relative to other major economies, however.

Greentech Timer

The Greentech Timer is bearish, with the index we use as a proxy for the health of the sector, the Wilderhill Green Energy Index (PBW) below its 20-day and 40-day moving averages, with those averages down-trending. Our timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending.

A look at our subsectors with their moving averages. Like the Timer, they are bearish when below their averages.

Solar

Invesco Solar ETF (TAN)

Water

Invesco Water Resources ETF (PHO)

Nuclear

VanEck Uranium and Nuclear ETF (NLR)

Wind

FT Global Wind Energy ETF (FAN)

Featured Stock: Trex Company, Inc. (TREX)

Overview

Higher interest rates means home sales and new home starts are slowing. But that has an upside: More people staying put in their existing home means more remodeling. The Leading Indicator of Remodeling Activity, a Harvard University index meant to track the U.S. market, expects expenditures on homes to rise more than 10% in 2023. That’s an activity not immune from higher rates – that rate of advance would be a slowing from this year’s 17% gain. But a 10% 2023 advance in remodeling spending is still better than the gains seen every quarter of 2020 and 2021, according to the Harvard data.

Business Model

Trex (TREX) makes composite wood decking that primarily gets sold to remodeling jobs. New home builders typically use wood for decks and cladding because it’s cheaper upfront. Homeowners like composite decking, of which Trex is the market leader. That’s because while Trex is more expensive upfront, the cost of maintenance is lower – Trex never needs to be painted and repainted and it doesn’t rot or warp with the frequency of wood. A 16-by-20 foot deck in wood will cost about $576 in materials; a composite deck will start at double that and goes as high as $4,068, depending on color choices and quality levels. Maintenance-wise, however, that wood deck will cost another $4,688 in maintenance over 25 years – the composite decking won’t add more. That’s the kind of calculus homeowners do. My past two homes I’ve used Trex decking instead of wood and have never had to give it another thought. I’m happy to pay upfront that, for what my testimonial is worth.

Composite decking is generally made with a high recycled plastic content – bottles and, increasingly, thin film plastic bags which many grocery stores collect in special bins, which are considered a lower cost recyclable source. Recycled wood and sawdust are also mixed in, providing for an overall carbon impact abut 40% less than wood. Composite boards are uniformly formed (no knots or warped boards) and easy to work with from a carpenter’s point of view.

Wood still dominates the market with about 75% share, and composite decking, including Trex competitors, commanding 25% share. Every percentage point gain in share adds $80 million to Trex sales, according to the company. Trex has about half the composite market.

2022 is a bit of a year of transition for Trex, in that distributors and home improvement centers Lowe’s (LOW) and Home Depot (HD) that sell its product have been focused on dramatically reducing inventory levels. That means total 2022 sales should dip 8% for the full year, to about $1.1 billion. Net income is seen at $1.87 a share, also down from $2.10 in 2021.

Business Outlook

The inventory correction resets Trex for 2023, however, and we see the decline in 2022 is largely baked into the share price right now – management told investors the inventory correction is costing about $300 million in sales this year, a sizeable drop that has contributed to the 67% decline in the share price in 2022. This year’s weakness in shares also reflects a deflation of the skyrocketing price of lumber, which spiked during the pandemic and led to Wall Street buying up Trex shares in hopes of continued tightness in lumber, which wasn’t sustained.

Management believes the inventory correction and the sales impact it brings will bottom out in the fourth quarter this year, making that quarter the base from which sales will rise off of starting next year. In 2023, Trex sales should rise 13% to hit $1.23 billion with net income per share of $2.26. The expectation is that sellers of Trex products will keep lower inventories and want faster deliveries to ramp up as demand gains. That is why Trex is building a third manufacturing plant, in Arkansas, which will increase capital expenditures through 2025 by about $400 million.

The stock will also get a boost from about 4.3 million shares left in a corporate buyback plan, equal to almost 4% of the float.

Product-wise, Trex continues to roll out premium lines that offer a larger variety of colors for homeowners willing to pay up to for a unique look. The company has also moved into cladding – the trim used on homes – which has been a key market for competitor Azek (AZEK).

Issues to Consider:

- Trex management could be incorrect about when the destocking trend will bottom.

- A deeper economic hit to consumers could affect 2023 demand.

- Wood prices are expected to stay at current levels. However, it is possible wood prices could fall enough to retake share from composite. That happened in 2006 and 2007, although Trex’ quality then wasn’t close to the level it is today.

- Trex has no long-term debt.

Technical AnalysisTrex is bearish right now, with shares struggling to push back over resistance formed by the convergence of its 20-day and 40-day moving averages, right around 47. Shares are just off an 18-month low and down 67% from their all-time high of 141, touched in December. But there are signs TREX is bottoming. The zone of 44-47 has held up as since September. This is potentially a base from which to work higher. Purely from a technical standpoint, we want to see shares push into the low 50s and hold the gains and start to work higher over its 20- and 40-day averages. 62-66 sits as a zone of potentially notable resistance.

What to Do Now

Technically, shares aren’t a buy. But fundamentally, Trex is starting to enter a zone where it may be a bargain. We have two options: One if to watch for improving technicals, as noted above, and buy from there with an eye toward perhaps exiting the position at resistance in the 60s, depending on market conditions. The other is for shares to slip enough that on a forward earnings per share basis, TREX is worth buying ahead of the 2023 rebound foreseen. Right now, shares are at about 20 times 2023 net income. WATCH

Trex Company, Inc. (TREX)

Revenue (trailing 12 months): $1.365 billion

Earnings per share (trailing 12 months)): $2.26

All-time high (intraday): 1140.98

Market cap: $5.1 billion

Recommendation: WATCH

Intended Portfolio: Real Money

The ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds. This issue, we feature three most bullish stocks among the holdings of ESG funds, regardless of sector.

ConocoPhillips (COP)

What is it?

An oil company

Why is it ESG?

ESG ratings are relative to peers, meaning Conoco’s better than other oil and gas companies at ESG metrics. ESG ratings firm MSCI says Conoco is better at environmental and social metrics than other oil companies. ESG funds own $313 million of shares.

Why now?

OPEC-plus is cutting oil production and natural gas prices are high from the E.U.’s supply crunch from Russia.

Marathon Petroleum Corp. (MPC)

What is it?

A refiner and marketer of petroleum products

Why is it ESG?

Greenhouse and acid rain emissions below peers. ESG funds owns $114 million of shares.

Why now?

Marathon primarily refines and sells gasoline in the U.S. Gas prices are moving higher thanks to OPEC, creating more room for better profit margins.

Cheniere Energy Inc. (LNG)

What is it?

A liquid natural gas provider

Why is it ESG?

Its carbon intensity ratio to how much revenue it generates is lower than oil and gas peers. ESG funds own $185 million of its shares.

Why now?

Cheniere liquefacts and exports LNG from the Gulf Coast. It’s a play on the global natural gas market, which enters the northern hemisphere winter with high demand and tight supply.

Current Portfolio

SX Greentech Advisor Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 10/19/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.99 | 9.9 | -0.90% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.01 | 0.15 | 1400.00% | Hold | |

| Clean Earth Rights | CLINR | 3/4/22 | 0.01 | 0.16 | 1500.00% | Hold | |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 30.18 | -9.67% | Hold | Around 28 |

| Energy Recovery | ERII | 9/9/22 | 25.57 | 22.21 | -13.14% | Hold | Near 20 |

| Enovix | ENVX | 8/18/22 | 20.49 | 17.13 | -16.40% | Hold | Below 15.90 |

| Enphase Energy | ENPH | 8/11/22 | 298.56 | 250.22 | 16.19% | Hold | Around 230 |

| First Solar | FSLR | 120.89 | Watch | ||||

| Growth for Good Shares | GFGD | 2/3/22 | 9.97 | 9.85 | -1.20% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.01 | 0.04 | 300.00% | Hold | |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.01 | 0.03 | 200.00% | Hold | |

| Li Auto | LI | 7/21/22 | 36.01 | 19.09 | -46.99% | Hold | Around 19 |

| Onsemi | ON | 8/11/22 | 67.32 | 60.54 | -10.07% | Hold | Around 59 |

| Shoals Technologies | SHLS | 21.1 | Watch | ||||

| Sunrun | RUN | 22 | Dropped |

*Clean Earth units cost 10.01 each; Growth for Good units 9.99. Buy prices above reflect an allotment for each component after splitting the units.

*Returns don’t include dividends totaling $0.714 per share for CWEN/A

SX Greentech Advisor Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 10/19/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.56 | -66% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 86.28 | 34% | Hold | Sell-stop ‘around 77’ |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.59 | 11% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.10 | -40% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.01 | -58% | Hold | 1/6th-sized position |

| Ree Automotive | REE | 6/16/21 | 5.50 | 0.66 | -88% | Hold | 1/6th-sized position |

| ReNew Power Warrant | RNWWW | 6/16/21 | 1.81 | 0.90 | -50% | Hold | 1/6th-sized position |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.38 | -83% | Hold | 1/6th-sized position |

* Returns don’t include dividends totaling $0.282 per share for CEG

Real Money Portfolio

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

The SPAC announced it is merging with Alternus Energy, an Irish renewable energy owner/operator. It produces an annual 177 gigawatt hours of solar in eight E.U. countries. This means we can now advance our initial strategy on this trade. When Clean Earth asks shareholders to vote on the merger (not set yet) we will vote on two separate things: to approve the merger and whether or not we want the return of share capital held in the trust. This will allow us to both vote for the merger while opting to get our trust capital returned to us – 10.10 a share (recall, we bought units at 10.01 on March 4). Warrants and rights haven’t appreciated since the announcement which isn’t a surprise in the current environment. These days, it takes a completed merger to rally the derivatives. We’ll firm our strategy on those as the merger nears, to sell for profit or hold for the longer term. HOLD

Clearway Energy (CWEN/A)

Clearway held over our sell-stop of ‘around 28’ last week. The next hurdle is to break resistance at 31-33. No news. We’ve collected $0.714 in dividends so far. HOLD

Energy Recovery (ERII)

ERII also held over our ‘near 20’ sell-stop despite a test last week. Earnings should be announced in early November. Support is at 20-21, resistance at 23. HOLD

Enovix (ENVX)

Last week’s trading eliminated the price gap formed in early August that provided technical support. Shares are edging downward with resistance just overhead at 18-20.50. Earnings will be released after the close of trading on November 1. Our sell-stop is ‘beneath 15.90.’ HOLD

Enphase Energy (ENPH)

The microinverter maker is weaker but still has support in the 220-228 band, which is below our sell-stop of ‘around 230.’ Resistance is at 284. Little news besides choosing a distributor in Germany, a strong solar power market. BUY

First Solar (FSLR)

The American solar panel maker fell below support at 130 last week but seems to be finding buyers. Shares are still well over their 200-day moving average, currently around 88, so we continue to watch, given current market conditions. WATCH

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

The ESG-focused SPAC is searching for a merger, and so the lack of news is normal. Little change to our shares and warrants; rights are unusually weak – down 6 cents to 2 cents apiece – but it’s on light volume. HOLD

Li Auto (LI)

Li is right on top of our sell-stop, which is ‘around 19.’ A firm close below 19 should trigger our sell-stop in the interest of preserving capital and in light of general market uncertainty around China’s draconian policies. HOLD

Onsemi (ON)

ON has been testing our sell-stop of ‘around 59,’ and indeed if you sold this week the move was rational. We’re continuing to hold with shares working to move back over 60, but another close firmly below 59 should trigger the sell-stop. HOLD

Ormat Technologies (ORA)

ORA broke our sell-stop and we recommended selling with last week’s update. The portfolio booked the sale Thursday at 82.94, the midpoint of the high and low, a loss of 4%. SOLD

Shoals Technologies (SHLS)

SHLS continues to sit between resistance and support, with an eventual break above or below likely to dictate whether we buy or drop from our Watch list. No news. WATCH

Sunrun (RUN)

We dropped RUN from our Watch list with last week’s update. DROPPED

Excelsior Portfolio

Excelsior is our special opportunities portfolio, managed without consideration to the Real Money Portfolio.

In June 2021 we purchased six SPAC warrant positions as a basket trade (1/6th a position per warrant): Navitas, Li-Cycle, Origin, ReNew, Ree and Volta. Of these, Li-Cycle was closed at a 4% profit in December 2021. Navitas was closed this February at a 127% profit.

ADS-Tec Energy (ADSEW)

The warrants keep getting cheaper on market indifference. They are at an attractive price now, if you are willing to wait potentially many months or even a year or two for investors to realize they want EV-related growth stocks again. ADS-Tec is well run with a novel technological approach. HOLD

Constellation Energy (CEG)

Our sell-stop is ‘around 77’. Shares at a recent 85 have us up 33% and they continue to look very good, holding initial support levels. HOLD

ESS Technology (GWH.WS)

Warrants are around 60 cents, still a profitable trade for us. We want shares to improve in price and pull the warrant values up with them. Right now the shares are bearish but seem to be consolidating in the 3-4 area. HOLD

FuelCell Energy (FCEL)

FuelCell needs positive news and/or earnings results to get buyers back in. Right now, it’s suffering from a mixed launch of a fuel cell system for the U.S. Navy submarine base in Connecticut. This is a half-sized position HOLD

Origin Materials (ORGNW)

Origin will start producing carbon negative plastics late this year and we expect the market will start to embrace alternative materials companies as they get product rolling off the production lines. Origin’s warrants are holding around 1, and need shares (now in the 5 area) to strengthen to also see price improvement. HOLD

Ree Automotive (REE)

This EV chassis maker needs a catalyst, which may come next month with earnings. There are hopes 2023 will bring production of EVs based on the chassis. HOLD

ReNew Energy Global (RNWWW)

Board director Robert Mancini stepped down and was replaced by Philip Kassin. Neither move is terribly significant, both are executives with the sponsor that created the SPAC that took ReNew public and are simply stewarding their investment. Warrants are weak on market indifference, but do show signs of opportunistic buying when they dip. HOLD

Volta Inc (VLTA.WS)

Like Ree, Volta needs a positive catalyst, which likely doesn’t come until 2023 given the company’s recent restructuring. HOLD

Our next SX Greentech Advisor issue will be published Wednesday, November 2. Weekly updates are published every non-issue Wednesday, and any timely notices get distributed as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabot.net. Thank you for subscribing.

Cabot Wealth NetworkPublishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.