We still face headwinds in the market, but action to start the week in Greentech is encouraging. This issue we look at what stocks the “typical” ESG mutual fund and ETF own and examine an undiscovered stock that is showing great strength appealing to health-conscious consumers.

As always, we also suggest three ESG stocks to consider and review our current portfolios.

Greentech Outlook

Overview

A slight change in format starting with this issue. From now on, research and commentary on market conditions will lead off SX Greentech Advisor issues, along with our Greentech Timer. Thoughts and suggestions are welcome.

What makes an environmental stock isn’t a difficult question to answer. Ultimately, carbon increases global warming, so not emitting carbon, or reducing it, is my clear bar. That is what constitutes the roughly 290 U.S.-listed Greentech stocks I follow in our coverage universe. That covers the “E” of ESG. But the “social” and “governance” part are harder.

There is no set definition of what makes a business a benefit to society or an exemplar of good governance. They’re both desirable qualities that lead to good shareholder and societal outcomes, but they’re often in the eye of the beholder. Is Meta Platforms (FB) a social good because it connects people around the world to others? Or is it not an ESG stock because of its role in spreading misinformation during elections? That is far less clear cut.

For our purposes, we care what an ESG stock is to guide our selections for the ESG Three, the highlighted, top-performing ESG stocks we feature each issue. With environmental stocks, where we focus most of our attention, we built our coverage universe from the ground up – that is, we look at each stock and decide if it’s Greentech enough to follow.

For the S and G, we take a different approach, letting the managers of the funds tell us what they consider ESG. Annually we examine the holdings of a sizeable sample of ESG mutual funds and ETFs to answer that question. We then take the top 300 most-held (by asset value) U.S. equities and make that our universe for the ESG Three.

For this year’s update we reviewed the full holdings of a group of ETFs and mutual funds holding $55 billion in assets, equal to about 12% of all ESG-themed fund assets under management, according to the most recent data from the Investment Company Institute. We then sampled another group of ESG funds holdings a further $60 billion in assets as a check that our first 12% group is representative of weightings (and it is, with only slight variations on weightings.)

Here are the top 50 most-held ESG stocks, accounting for almost three-fourths of all the assets of ESG-focused funds, according to our research. The percentage column is approximate, based on our above sampling approach.

| Stocks Most-Held by ESG Funds | ||

| Name | Ticker | Percent of ESG Fund Assets |

| Microsoft | MSFT | 6.20% |

| Alphabet | GOOG & GOOGL | 5.14% |

| Apple | AAPL | 4.74% |

| Mastercard | MA | 2.44% |

| Deere & Co. | DE | 2.42% |

| Fiserv | FISV | 2.37% |

| CME Group | CME | 2.27% |

| Danaher | DHR | 2.16% |

| S&P Global | SPGI | 2.14% |

| Becton Dickson | BDX | 1.97% |

| Proctor & Gamble | PG | 1.80% |

| NVIDIA | NVDA | 1.79% |

| Comcast | CMCSA | 1.73% |

| Canadian Pacific Railway | CP | 1.66% |

| Linde | LIN | 1.65% |

| Amazon | AMZN | 1.61% |

| Costco Wholesale | COST | 1.60% |

| Charles Schwab | SCHW | 1.53% |

| Texas Instruments | TXN | 1.46% |

| Applied Materials | AMAT | 1.45% |

| Ball Corp. | BLL | 1.32% |

| American Tower | AMT | 1.31% |

| Home Depot | HD | 1.26% |

| Adobe | ADBE | 1.24% |

| Booking Holdings | BKNG | 1.17% |

| Verisk Analytics | VRSK | 1.16% |

| Waste Management | WM | 1.13% |

| Verizon | VZ | 1.11% |

| T-Mobile US | TMUS | 1.09% |

| Boston Scientific | BSX | 1.06% |

| Thermo Fisher Scientific | TMO | 1.05% |

| Tesla | TSLA | 1.00% |

| Mondelez | MDLZ | 0.99% |

| Nike | NKE | 0.98% |

| Gilead Sciences | GILD | 0.95% |

| IntercontinentalExchange | ICE | 0.88% |

| Sherwin Williams | SHW | 0.88% |

| Micron Technology | MU | 0.88% |

| Alexandria Real Estate | ARE | 0.81% |

| Union Pacific | UNP | 0.69% |

| CoStar Group | CSGP | 0.57% |

| J.P. Morgan Chase | JPM | 0.51% |

| Meta Platforms | FB | 0.49% |

| Johnson & Johnson | JNJ | 0.43% |

| UnitedHealth Group | UNH | 0.43% |

| Visa | V | 0.42% |

| Pepsico | PEP | 0.40% |

| Coca-Cola | KO | 0.39% |

| ExxonMobil | XOM | 0.35% |

| Bank of America | BAC | 0.33% |

* Percentages are approximate through analysis of top quarter largest ESG mutual funds and ETFs

The first thing to note about the list is it’s very similar to the S&P 500 – only two stocks, Canadian Pacific Railway (CP) and CoStar Group (CSGP), aren’t in that index. In fact, if you take just four stocks – Microsoft (MSFT), Apple (AAPL), both classes of Alphabet shares (GOOGL, GOOG) and Amazon (AMZN)—you have 20% of the S&P 500 weighting as well as about 20% of the holdings of all ESG equity funds. That’s neither good nor bad, depending on your point of view. Statistically, the more stocks you have in a portfolio the greater the likelihood it performs closer to the broad market. Holding an ESG fund is therefore essentially getting the S&P’s performance. Usually that’s not bad.

The problem becomes how funds determine ESG. In nearly every case, they take a relativistic approach: that is, Exxon Mobil (XOM) is a top 50 ESG fund holding because it’s considered better at E, S or G against other oil and gas producer stocks. To my eye, it’s clearly a negative for the carbon its efforts unleash and would never be considered by for the ESG Three.

Other businesses offer up less clear, potentially troubling decisions. Is Coca-Cola (KO) ESG, even as global studies show it is the worst polluter for plastic waste in the world from all those soda bottles? Even plastic itself is a potentially troubling item: it generates massive pollution but because it actually takes so long to break down could be seen as sequestering carbon. Back to Coke, should it get credit for reducing the overall sugar content of its products because it simply expanded the amount of coffee and water it sells? Moving beyond the top 50 listed above, should gambling stocks be included, knowing it’s a certain percentage of the populace suffers from gambling addiction? How about businesses whose major shareholders or employees espouse the lie that the 2020 elections were stolen? I don’t have the answers (I do have opinions). The point is, ESG funds get murky fast and may not reflect your goals.

Greentech Timer

April was one of the poorest markets for equities in some time, and with the whole market off to its worst four months to open a year since World War II, we certainly need to be cautious. While we expect Greentech will eventually rebound and return to its long-term bull trend, that’s going to take more work. There are at least three levels where resistance should be expected to be firm above the market here. While we have had three notable periods of bull movement since growth stocks topped out in February 2021, they ended up stalling after four to six weeks and then moved lower. There’s a good chance that pattern will present itself again, so we’re going to be taking a more assertive approach in taking profits in positions in the future, using technical signals that use pricing actions to signal a change in sentiment – moving average convergence-divergence (MACD) and stochastics are the best known of these. Hopefully, that will avoid situations like Lithium Americas (LAC) and MP Materials (MP) when we were shaken out around our buy prices from what had been profitable positions.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but it’s not essential). We’re below all the averages this week and they are all now trending downward. The one bright spot is a floor is holding around 49-50, which has now been touched three times in recent weeks (it’s also significant from price action in autumn 2020). Even that holds a warning, however – the more support is tested, the more likely it is to fail.

Wind, solar and water subsectors are also bearish, Nuclear has weakened and is nominally bullish. EVs are wildly mixed, with more individual stocks bearish.

Natural Grocers by Vitamin Cottage

Overview

There aren’t a lot of attractive charts in Greentech these days, after a terrible April for stocks all around and a market that continues to not want to support growth stocks. Our Greentech universe does include a selection of stocks that can be considered defensive in the current environment, such as grocery stores. People need to buy groceries in good times and bad. That dovetails too with increasing consumer desire for organic food – organics are growing 9% to 13% a year, depending on the study, far outpacing overall U.S. grocery store market growth of about 3%.

Business Model

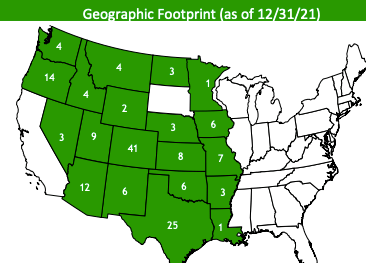

Natural Grocers by Vitamin Cottage (NGVC) isn’t a name that rolls off the tongue, but it’s a well-managed small format seller of organic food and supplements, with 162 stores in every state west of the Mississippi but California and South Dakota.

NGVC likmits its products to organic and “nartural.” Natural for them is defined as no artificial colors, flavors, preservatives or sweeteners, or partially hydrogenated or hydrogenated oils. Produce is exclusively organic, while meat is raised organic or pasture-fed, free-range and confinement free.

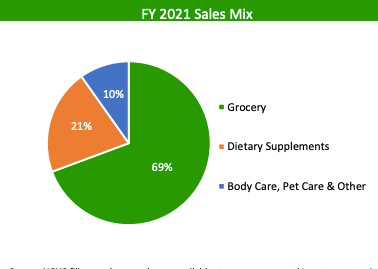

The store format is typically 11,000 square feet, about a quarter of the size of a Whole Foods Market, with sections for produce, prepared foods meat and dairy, frozen foods, health and beauty care and a sizeable footprint for vitamins – a fast-growing subsection that is especially strong-growing with organic and health-conscious consumers. The vitamins/supplements section carries nearly 7,000 items – about a third of the SKUs a location carries overall – and features an education area, and is a key part to differentiating the chain from other natural grocers. The education center is staffed by nutritional health coaches who are required to undergo 164 hours of continuing education themselves each year to stay apprised of the latest science and trends. The coaches conduct cooking demonstrations, seminars and one-on-one consultation for customers.

The average store generates about $6.5 million in sales a year, over the past two years, up from the mid-$5 million range about five years ago. The company’s loyalty program, {N}power, offers members discounts on some items and provides points for every dollar spent, with a conversion rate of points back to dollars off merchandise of about a penny. The loyalty program is part of the reason the sales per store are growing, with loyalty club members shopping more frequently and spending more per visit than other customers. Last quarter, 73% of sales were from {N}power members, with club membership up 20% from 2020 to well over 1 million people.

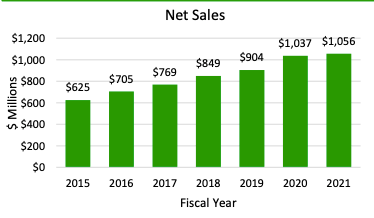

Overall NGVC had $1.06 billion in sales in 2021, $20.6 million in net income (or 91 cents a diluted share) and same-store sales growth of 0.7%, which came against a very strong pandemic-driven 2020 when comps grew 12%. Comparing 2021 to pre-pandemic 2019, comp-store sales were up more than 10%

The first quarter of fiscal 2022, which ended December 31, saw sales up 4.7% to $277.3 million, same-store sales up 3.8% and net income sharply higher to 39 cents per share from 16 cents the prior year period.

Business Outlook

Natural Grocer probably should (or could) be growing faster than it is. Management is fairly deliberate about opening new locations, adding a handful of stores annually. In a bearish market not rewarding growth efforts, that’s probably a rewarding approach. This year, they are looking to add four to six new stores. Opening costs are about $2.2 million a location, with a five-year payback period. The small footprint makes the store a good fit for urban environments as well as small towns that may have trouble supporting a full-sized specialty grocer.

In addition to the loyalty programs and physical expansion, the company is also increasing the percentage of private label goods sold in stores. They totaled 7.5% of sales in the first quarter of 2022 – by comparison, private label was about 15% of Whole Foods’ sales mix, according to industry reports. Private label allows for cheaper pricing with the same (or better) margins as brand name.

The balance sheet is good, with debt (including lease obligations) of about $64 million and cash of $23 million.

Shares pay a dividend. It was 10 cents a share the past two quarters, having been raised from 7 cents.

Issues to Consider:

- Shares have been supported by a $10 million share buyback that ends this month.

- As a micro-cap stock, with a market cap of $490 million, fund support is lighter than better-known stocks. Fund ownership has improved mildly year over year.

- The Isley family, children of the couple who founded the chain in Colorado in the 1950s, control the majority, 59%, of shares.

- The trailing price-to-earnings for NGVC of 18 is greater than other organic grocery peers United Natural Foods (UNFI), Village Super Markets (VLGEA) and Sprouts Farmers Markets (SFM) – they average 13. NGVC’s P/E is equal to the whole group of consumer defensive stocks in our Greentech coverage universe

Technical Analysis

Just about 16% of the Greentech universe is over its 200-day moving average, which is our base indicator for if a stock is bullish or not. NGVC is among them, and is one of the best-looking charts, showing excellent Relative Strength (price performance compared to the broader market). Shares hit a seven-year high of 23 in late April and have backed off to support at the near-term moving averages. The company went public in 2012 at the price of 12 and peaked at 36 in 2014 on general Whole Foods-related enthusiasm.

Oddly, NGVC shares plunged with the rest of the market during the 2020 pandemic sell-off. I say oddly because at that time peers UNFI and other grocery stocks were exceptional performers from consumers stocking up. Natural Grocer stores saw the same uptick, but shares didn’t benefit. Whatever the reason for that divergence, it’s a warning that the stock may not trade in lockstep with other defensive shares.

Support is at 19.50 down to 16.50, with the 200-day average in the low 14s. That suggests shares may have gotten too extended away from the long-term trend, but NGVC is cutting a rather orderly chart, suggesting a reversion to that line may not occur. There is long-term resistance up to 25. Generally, we don’t see a technical effect from historic prices older than seven years.

What to Do Now

NGVC reports second-quarter 2022 earnings tomorrow morning before the open, so we’re watching shares right now. The stock is lightly covered by Wall Street. We expect EPS nearing 20 cents a share and hope to hear management announce a future share buyback plan. WATCH

Natural Grocers by Vitamin Cottage (NGVC)

Revenue (trailing 12 months): $1.068 billion

Earnings per share (TTM): $1.14

All-time high (intraday): 36.83

Market cap: $490 billion

Recommendation: WATCH

Intended Portfolio: Real Money

The ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 300 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. This week, oil and gas stocks dominate the top of the ESG universe and, as a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

HP Inc. (HPQ)

What is it?

A consumer-focused computer and related technology company (Hewlett Packard Enterprise (HPE) is a separate company handling corporate business).

Why is it ESG?

The company is considered overall superior to peers in ESG metrics and is seen as having opportunities in cleantech. ESG funds own $111 million of shares.

Why now?

The company is expanding into adjacent tech areas with the purchase of Poly, a workplace collaboration tech company. If hybrid work is here to stay, HP should grow with it.

Molson Coors Beverage Co. (TAP)

What is it?

One of the largest brewers in the world.

Why is it ESG?

Management is actively addressing its water risk, including securing water-efficient barley supply and committing to reduce its water usage, rare among brewers, according to MSCI. ESG funds own $42 million of shares (its “sin” stock nature and multiclass share structure get it screened out by many ESG funds)

Why now?

Sales and earnings reported Tuesday bested expectations. Moves to cull underperforming brands should fund better growth elsewhere.

Hormel Foods Corp (HRL)

What is it?

A U.S. producer of pork and meat products

Why is it ESG?

The EPA says it’s number 57 on the Fortune 500 list of green power users thanks to meeting 7% of power needs from clean energy. It expects to match all of its domestic U.S. power use to renewable sources by year’s end. ESG funds own $55 million of shares.

Why now?

Shares hit an all-time high of 51.81 two weeks ago and are holding 50-day moving average support now, suggesting a good entry point.

Current Portfolio Update

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 5/4/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 105.94 | -18.91% | Hold | Under 100 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 21.68 | 18.66% | Hold | Under 20 |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.84 | 1.55% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.20 | -13.04% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.20 | 0.00% | Hold | None |

| Cleanway Energy | CWEN | 3/17/22 | 33.41 | 31.38 | -6.08% | Hold | Around 28 |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 76.25 | -10.23% | Hold | Below 62 |

| Daseke | DSKE | 2/3/22 | 11.23 | 8.70 | -22.53% | Hold | Under 7.19 |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 14.01 | -25.76% | Hold | Half-sized position |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.74 | 3.18% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.20 | 11.11% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.19 | 11.76% | Hold | None |

* WMS gain excludes 11 cent per share dividend collected in March

* *Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 5/4/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.80 | -52% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 59.70 | -7% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 4.35 | -16% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.46 | -40% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.27 | -75% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.67 | -8% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.61 | -72% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 33.31 | -19.50% | 4/27/22 | need sell price |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Advanced Drainage Systems (WMS)

Is buying Cultec, a private Connecticut maker of plastic stormwater chambers and septic piping. The price is undisclosed. The business fits in nicely with Advanced Drainage, which makes about half its plastic water control products from recycled polymer. Shares are at the bottom of a range and appear to be ready to turn higher again. Our sell-stop is “under 100.” HOLD

Archaea Energy (LFG)

Archaea is paying $215 million cash to buy NextGen Power Holdings, which has 14 landfill gas-to-power facilities in the U.S. and gives Archaea methane reserves at the sites as well. The news has given support to shares, which continue to look bullish. Our sell-stop is “below 20,” which should allow us to book some profit if market weakness extends to LFG. HOLD

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

The clean energy-seeking SPAC is profitable for us; the trust money the shares can claim is 10.10, even as shares trade under 10 in the weak market. Warrants and rights represent additional profit and exposure to the future deal the SPAC finds. HOLD

Clearway Energy (CWEN/A)

Clearway reports earnings tomorrow, May 5, before the open of trading. The weaker action into earnings suggests disappointment ahead, but it’s not conclusive. The consensus is a for a per-share loss of 15 cents, with a wide range of a loss of 5 to 33 cents seen by Wall Street. The renewable energy provider sold its thermal business for $1.9 billion to KKR, of which net $1.35 billion goes to Clearway’s books. The division provides steam heat to large institutions like hospitals and colleges. Clearway will have $750 million of that to do with as they will, with another $650 million already committed to specific uses by management. Our sell-stop is “around 28,” with the mid-27 area a level that would be a bearish break out of a price channel. HOLD

Darling Ingredients (DAR)

Darling reports earnings Tuesday, May 10, after the close of trading. Expectations are for $1.12 earnings per share on sales of $1.3 billion. The company closed its $1.1 billion purchase of rendering company Valley Proteins, which has 18 facilities in the U.S., to start the week. Shares are in a zone of support. We’re instituting a sell-stop of “below 62,” which would be a break of some long-term chart support. HOLD

Daseke (DSKE)

Daseke beat earnings consensus with $421 million in Q1 revenue, 18 cents a share earnings. Management also sounded a confident note in the earnings call this week, reaffirming guidance for the year and hinting quite strongly they expect to beat guidance, noting April was exceptionally strong for specialty trucking. Yet shares were mixed in reaction, likely because Daseke keeps getting lumped in with “dry van” (a very consumer-influenced trucking sector), where rates are weak. Management says a decade worth of market data shows there’s no correlation between dry van and their business. The question is how long we would hold to wait for the market to discover Daseke’s strong performance this year? Our sell-stop is “under 7.19,” which held an early April test. HOLD

Energy Vault (NRGV)

The kinetic energy storage business shares are holding up well enough, while continuing to be volatile. This is a half-sized position with no firm sell-stop in place. HOLD

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news, as the SPAC is on the hunt for a target. We’re profitable on the position, with the trust value at 10, even as shares trade below that price, and the warrants and rights our profit and exposure to potential long-term gains from any merger deal. HOLD

KraneShares China Green Energy (KGRN)

We recommended selling with last week’s regular update after consecutive closes below our stop-loss level of “under 32.” The portfolio booked the sale Thursday at 31.74, the mid-point of the high and low of trading. The downtrend in shares is accelerating and suggests the China-focused Greentech fund will see steeper losses from here. EV sales have been hurt in China due to pandemic lockdowns with the government there appearing committed to a draconian response. SOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed out in February for a 127% return.

ADS-Tec Energy (ADSEW)

The super-fast EV charging company reported 2021 results: a loss of $92 million on sales of about $35 million. Refreshingly, guidance for 2022 exceeds the guidance given to SPAC investors when ADS-Tec first proposed coming public. For 2022, the company sees sales of $85 million to $105 million – they had told investors last August $85 million for 2022. Management said most revenue will be in the back of the year from confirmed sales orders. HOLD

Constellation Energy (CEG)

The company will pay a dividend of $0.141 a share to owners as of May 13, payable on June 10. Shares are holding up fine over support and appear like they may begin working higher from the recent dip. HOLD

FuelCell Energy (FCEL)

FCEL is still in a downtrend, but shares look inclined to move higher without testing recent, prior lows. There’s space to get back to our buy price without a lot of chart resistance. HOLD

Origin Materials (ORGNW)

In potentially significant news, Origin and Mitsubishi Chemical formed a development partnership for the Japanese conglomerate to use Origin’s technology. Financial terms aren’t disclosed. It has helped Origin’s shares turn bullish, with a Golden Cross occurring this week. Our warrants are largely unchanged at 1.45 over the past week. HOLD

Ree Automotive (REEAW)

Ree will release earnings May 17 before the open of trading. Warrants are slightly weaker this week. HOLD

ReNew Energy Global (RNWWW)

Little news but the shares of ReNew are stabilizing and our warrants are holding steady about a dime under water. HOLD

Volta Inc (VLTA.WS)

The EV charger maker is partnering with Michigan and a utility DTE Energy to use its EV data and analytics platform to help identify EV needs, particularly targeting adoption in lower-income neighborhoods. Financial terms, if any, weren’t disclosed. Warrants are a little weaker this week. HOLD.

Thank you for being a subscriber. Our next SX Greentech Advisor issue is published Wednesday, May 18. Our next regular weekly portfolio update will hit your inbox May 11. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabotwealth.com.

The next Sector Xpress Greentech Advisor issue will be published on May 18, 2022.