Fossil fuel energy market turmoil sparked by Russia has spurred buyers into Greentech, giving our sector its best stance in three months. This issue, we feature two stocks. One is a play on re-shoring, scarcity and even national defense in addition to the boom in renewable energy. The other is a nearly guaranteed way to preserve capital with private-equity-like upside.

Also in this issue, we detail our current portfolio recommendations, the state of Greentech and offer up a fresh ESG Three stocks to consider.

MP Materials (MP)

Overview

American rare earth metals offer us a few plays: a scarcity play as the increasing exile of Russia from the world market develops and as Ukraine’s potential supply remains impossible to utilize; a necessity play, because they are essential to renewable energy and EVs; and a reshoring play as the United States recognizes the strategic need to embrace domestic rare earth resources. What are rare earth metals? A basket of 17 elements that are abundant in the earth’s crust but not often in enough concentration for effective mining. There are 115.8 million tons of rare earth metals in global reserves, according to U.S. Geologic Service data, of which 44 million are in China and 12 million in Russia. The U.S. has 1.5 million, with another 6.4 million tons with unequivocally friendly nations – Canada, Australia and Denmark (in Greenland). Brazil and Vietnam have massive reserves, but are among the world’s smallest actual producers of rare earths. In addition to wind turbines, which are made lighter and more efficient by rare earths, and EVs, which are large users of rare earth magnets, rare earth metals are required by the defense industry: the F-35 fighter jet uses 920 pounds of it, the Arleigh Burke-class destroyer requires 5,200 pounds and the Virginia-class submarine needs 9,200 pounds. So then add a fourth play here, in light of world turmoil: a U.S. defense play.

Business Model

MP Materials (MP) is the largest American miner of rare earth metals. It owns the Mountain Pass mine in California, near the southwest Nevada border. Long-time Greentech observers may recognize MP as the heir to Mountain Pass from Molycorp, the business that began the mine in the 1950s and which went public in the mid-2000s’ Greentech stock boom. Molycorp overexpanded and found itself in a market flooded by Chinese supply and filed for bankruptcy. The mine ended up mothballed in 2015, only to be revived in 2017 as a standalone entity from the other businesses Molycorp had acquired. In 2020, MP went public by SPAC.

Mountain Pass makes MP Materials one of the largest rare earth metal producers on the planet, accounting for about 15% of production of concentrate globally and all of the production in the Western Hemisphere. The mine is an open pit that has operated for more than 70 years, so there’s no permitting issues. It holds 804,000 metric tons of recoverable rare earths. The business generated $73 million in revenue in 2019, which leapt to $134 million in 2020. Last year, sales jumped a further 134% to $328.6 million, with $135 million of that net income (89 cents a share) as demand for rare earths began to heat up, especially for production of NDPR, which is shorthand for neodymium magnet metals.

To date MP has sold to a Chinese entity, Shenghe Resource, which buys raw concentrate MP mines. Senghe resells inside China to refiners, and it’s ultimately used to supply China’s domestic renewable energy projects as well as build up strategic reserves.

Business Outlook

MP’s business plan is to move beyond shipping raw material to China. Right now, it is in stage two of its three-stage development. Stage two is to partly roast and extract the mined rock into some component NDPR metals, lanthanum (used in cathodes, glass and as a catalyst) and cerium (used primarily in LED lights) as well as the usual rare earth concentrate it sells in stage one. Stage two is near completion and should produce 6,075 metric tons of NDPR, according to management. Beyond just refining the metals, stage two represents MP’s plan to become the only integrated miner and refiner outside of China. Stage two will allow MP to boost revenue to $438 million this year and $653 million next year, with earnings per share of $1.30 and $1.86, respectively.

Stage three will be to become a producer itself of NDPR magnets. The business recently broke ground on a Fort Worth, Texas, plant to produce the magnets. The facility will use about 10% of annual NDPR metals production at maximum capacity to build 1,000 metric tons of magnets. As part of the construction, MP inked a deal with General Motors (GM) to supply alloy and magnets for a dozen EVs on the Ultium Platform, GM’s proprietary battery system for its future EVs. Production of Fort Worth alloy will ramp up slowly toward the end of 2023, with magnets to follow in 2025. The deal with GM is non-exclusive for MP, and is almost certainly largely non-binding for GM, as is typical with auto supply agreements throughout the supply chain.

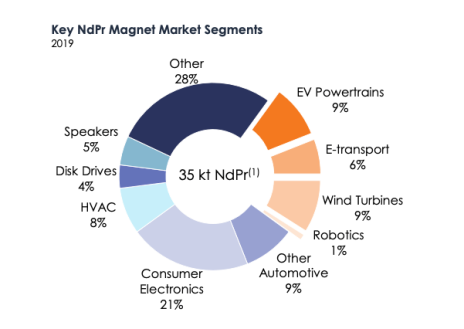

This graphic, taken from MP’s going-public presentation in 2020, shows the end markets for NDPR, which accounted for 85% of world rare earths production according to a third-party report from 2019.

The graphic, of course, doesn’t show future demand for wind turbines and EVs. Based purely on projected EV production in the years ahead and current production levels, EVs alone would consume all global production by mid-next decade.

MP hasn’t formally sworn-off China as a customer, but management states its goal is to get the U.S. to a full rare earth supply chain in future years. The federal government considers rare earths a strategic priority, awarding MP a $35 million grant last week to expand its Mountain Pass refining capability for heavy rare earth metals, which are even harder to come by and have defense applications in addition to consumer product ones.

Issues to Consider:

- China’s reserves and production capability could flood the market in the future, depressing prices.

- Q4 2021 average market prices for NDPR exceeded prior forecasts by 20%. Excessive commodity prices create long-term demand destruction as alternatives are utilized. Rare earth metal won’t be immune from the classic dynamic.

- A SPAC-derived listing, MP has redeemed its warrants and appears well past the volatile investor shift typical of pre-merger and post-merger SPACs.

- Price-to-earnings is 53, 2.5 times the S&P. Current year forward P/E is 25. Materials stocks have a group P/E of 18, and a forward P/E of 14.

- MP has $880 million in debt and liabilities; $1.2 billion in cash. Management hasn’t indicated plans for what it may do with future strong cash flows.

- Q4 earnings reported last week beat consensus estimates handily for sales and income.

Technical Analysis

Metals and ores are a very strong sector, meaning the broader tide will help MP too. Within the group, MP is one of the better performing stocks (portfolio holding Lithium Americas is the best Greentech minerals stock, with a technical profile slightly better than MP right now). MP itself is testing resistance at the stocks’ all-time high band of 46 to 50. Buyers came in with earnings and put shares back over all their moving averages. Support is at 43, down to the 200-day moving average at 37. Normal volatility could push shares down to 36 without cracking the technical bullishness. Institutional ownership has risen nicely, more than quadruple a year ago with plenty of room to grow. By nearly every measure, MP looks technically very strong.

What to Do Now

A big down day yesterday makes it prudent to wait on the sideline for the moment, with shares caught in a short-term downtrend and long-term uptrend. WATCH

MP Materials Corp. (MP)

Revenue (trailing twelve months): $332 million

Earnings per share (trailing twelve months): $0.72

All-time high (intraday): 53.03

Market cap: $8.1 billion

Recommendation: Watch

Our Intended Portfolio: Real Money

Clean Earth Acquisitions Corp. (CLINU)

Overview

Two issues ago we entered our first special purpose acquisition company, Growth for Good (GFGD). As we discussed then, in current market conditions, SPACs offer us a unique opportunity: an almost guaranteed return of capital with exposure to exciting growth businesses the SPAC may end up merging with. With this issue’s recommendation we want to do the same as we did with Growth for Good: Buy the units at or below their trust value, split the units into their components when able (on or about April 18). The shares will retain their claim to the capital held in trust –– our guaranteed return of capital (but for some black swan sort of systemic crisis/Act of God) – while the warrants and rights that were part of the units will provide our profit exposure. SPACs got a bad reputation in some senses during the mania of 2020 and early 2021, mainly because shares held past the merger tend to perform very poorly. Our strategy avoids that situation and embraces the SPAC upside: an investment that offers at worst a better-than-a-bank return on capital with the chance to get in cheap to a potentially great public company.

Business Model

Clean Earth Acquisitions (CLINU) is a cleantech-focused SPAC that held its IPO on February 23. Its stated focus is “to identify and pursue businesses that participate in the global energy transition ecosystem that are facilitating the way that energy is produced, stored, transmitted, distributed and consumed, all while reducing or mitigating greenhouse gas emissions.” The company is pursuing businesses that fit that bill around carbon, hydrogen, agriculture and renewable energy. Energy storage, distributed energy, zero-emission transport, low- or no-carbon industrial applications and sustainable manufacturing are also specified in the prospectus.

The SPAC is led by Aaron Ratner, who is president of Cross River Infrastructure Partners, a business that for the past couple of years has sought to implement sustainable projects. It has deals with Canada next-generation nuclear reactor maker ARC Clean Energy to develop projects. It also is seeking carbon capture projects in North America with carbon capture start-up Svante, Enbridge (ENB) and others. Ratner previously was at a venture capital firm, Vectr, which invested in start-ups including for ESG reporting for asset managers, to facilitate bee pollination and a series of sustainable food businesses, among other, non-cleantech enterprises.

The executive chairman is Nicholas Carter, who leads Toronto-based Parker Venture Management, which makes cleantech investments. He previously was chairman of publicly traded UGE International, a solar project developer. He’s been involved in Greentech since 2002, much of the time spent at San Francisco-based Cleantech Group, which helped start-ups raise money in the sector. The COO and CFO is Martha Ross, who has a background leading the City of Austin housing authority, as well as various jobs in wholesale power and at Dell. Three independent board members have experience in SPACs, finance and European-focused green projects. We feel the SPAC team is suitable for finding an appropriate and potentially exciting project in our sector, an important consideration since, ideally, we want deals sooner than later to offer chances for taking back all or part of our initial investment.

We also like the underwriter, Citigroup. Research into SPACs suggest quality of underwriter is somewhat indicative of long-term success of the venture, with Citigroup considered a top-tier underwriter.

The SPAC has 15 months to find a business combination, which it can extend automatically to 18 months with the deposit of another 10 cents per share into the trust fund.

Business Outlook

The Clean Earth units consist of one share, one half of a warrant to buy a share at 11.50 post merger, and one right, with each right equaling one-tenth of a share. Units will split 52 days after the IPO. We need to request the units split with the broker – they will not split automatically – and each component will trade independently on the stock market. Here’s the important details on each component of the unit.

Shares: each share will have right to the money kept in trust by the SPAC. That is 10.10 per share. At the latest, we can recover our 10.10 per share at the end of 15 months, or 10.20 per share at the end of 18 months if the SPAC fails to find a deal. We also can elect to get the per-share capital back at any vote on a merger or the extension of the SPAC beyond 18 months. The trust money is held domestically, in U.S. government-backed securities (Treasuries and agencies) with a maturity under 6 months.

Warrants: We need two units to gather one warrant, since each unit comes with half a warrant. The warrants are exercisable at 11.50 to buy a share after a merger. They face a redemption call by the company if shares trade at 18 for 20 or more out of any 30 days. The redemption will come with about a month to exercise the warrants or sell them on the market. They will expire essentially worthless, at 10 cents each, otherwise. Warrants expire worthless if the SPAC doesn’t execute a merger.

Rights: 10 rights equal one share in the merged business. Rights garner shares regardless of whether one still owns the unit’s original share or not. Rights expire worthless if the SPAC doesn’t close a deal.

Issues to Consider:

- SPACs by rule cannot have a specific target company in mind when they go public (otherwise, the SEC will say they should have held a traditional IPO). With that, a SPAC can decide to try and merge with any business in any sector it thinks it can convince shareholders to approve.

- The trading market is down on SPACs right now. That is a plus in that we should be able to enter Clean Earth at or around its IPO price of 10 a unit, meaning we automatically lock in a small profit with the trust amount being 10.10. However, SPAC warrants and rights are trading at lower levels than in the past. The average warrant for a searching SPAC now trades at 47 cents, according to our research, while rights often trade under 20 cents.

- SPAC shares tend to trade under trust value in the current market, around a 3% to 5% discount. That means if we want to sell Clean Earth shares, we may be leaving money on the table.

Technical Analysis

CLINU is trading around its IPO price. There is little trading chart information of use with SPACs so early in their life cycle. Our strategy is to buy the unit in the open market at the current price, around 10. Based on the 18-month trust value and average trading prices of SPAC warrants and rights today, the probable low-end return for our investment is about 8.7%.

We estimate the probable high-end return at 44%. That assumes we collect 18-month trust value on the shares, assume warrants can be sold at their theoretical maximum value of $6.50 (the difference between the 18 redemption trigger and the 11.50 exercise price), and assuming rights are sold at 10 apiece (10 being the likely price point in a merger).

Our Strategy

- Sell shares above trust value on any spike coming with merger news or collect the trust value at the merger vote. This returns our capital and hopefully brings a modest profit.

- Hold warrants and rights as our profit. Ideally, we hold them post-merger and sell warrants at 6.50 apiece, assuming a strong deal. Similarly, the shares we collect from the rights, we hold and sell at or above 10, depending on our long-term desire to be in the resulting business.

- If no deal is apparent ahead of a looming SPAC deadline, we sell warrants and rights for a smaller profit, and collect the trust value from the shares, as our return of capital.

What to Do Now

Liquidity remains good in CLINU right now, so we recommend buying a full position. SPAC unit liquidity typically dries up fairly quickly, so trades should be executed in the next few days. BUY

Clean Earth Acquisitions Co. (CLINU)

IPO Amount: $200 million

IPO Trust Capital per share: $10.10

All-time high (intraday): 10.025

Market cap: $200 million

Recommendation: BUY

Intended Portfolio: Real Money

The ESG Three

The ESG Three are three technically strong stocks selected from the 200 most-held stocks in environmental, social and governance focused mutual funds and ETFs. ESG fund holdings tend to be weighted toward blue-chip companies drawn from every industry which are rated highly in social and governance aspects. We screen top performers further to eliminate widely held companies we believe have clear environmental, social and/or governance problems. These aren’t formal stock picks but suggestions for those looking to explore additional stocks beyond the Greentech portfolio.

American Express (AXP)

What is it?

A credit card and financial services company.

Why is it ESG?

Excellent security around customer privacy and about 15% of loan volume to small businesses. ESG funds own $655 million of shares.

Why now?

Travel and consumer spending rebounding bodes well for credit card usage and related fees.

Keurig Dr. Pepper (KDP)

What is it?

A hot and cold beverage maker.

Why is it ESG?

Strong programs to reduce water stress in its sourcing (such as with corn products) and practices to promote fair trade in coffee sourcing. ESG funds own $75 million of shares.

Why now?

Long-expected merger efficiencies are starting to be seen. Shares are just a dollar off all-time highs.

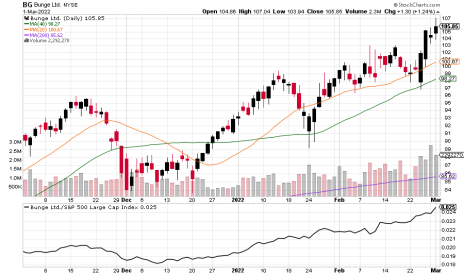

Bunge Corp. (BG)

What is it?

A food commodity brokerage.

Why is it ESG?

The business is working to improve traceability of products and to counter deforestation. Employee safety practices are widely lauded.

Why now?

Shares recently broke to all-time highs and pricing outlook is strong.

Greentech Timer & Current Portfolio

After slipping to a 17-month intraday low last Thursday, Greentech has rallied some 20%, pushing over the 20-day and 40-day moving averages yesterday. Technically, there is still some work to do before it would hit our Timer definition of bullish, but we’re seeing much better action in recent sessions, with strong buying volume and unconvincing selling volume. The catalyst is obviously fears around global fossil fuel supplies and rising oil and gas prices. Traders see renewables as likely to enjoy sympathy as the alternative.

It logically seems to be true there must be some broad connection between affordability of renewables and their adoption – utility-scale solar was the most expensive electricity source 13 years ago, now it’s the cheapest and it’s seen massive growth in that time. But statistically, oil and Greentech only have a low correlation – that is, the price moves in oil don’t really historically do much for Greentech, as represented by the 70-component Wilderhill Green Energy index. In fact, on a monthly, 10-year time frame, they are lightly negatively correlated. Oil and gas prices react to marginal demand right now – the recent price of $103 for West Texas Intermediate crude represents the price someone is willing to pay for one additional barrel of oil by month’s end (the price is then applied to all barrels). Greentech stocks, meanwhile, are longer-term plays, since installation of a wind turbine won’t be affected by one day’s price in energy, but many days’ prices, along with environmental concerns, tax policy and infrastructure availability.

Still, while we remain skeptical of a strong link between the two, if higher oil prices bring higher renewable stock prices, we welcome it. With it, we have seen solar and wind subsectors turn not-bearish for the first time in four months, with both rocketing over their 20- and 40-day moving averages. Nuclear is mixed, and water is bearish.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving averages and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). Right, now our Timer is mixed-to-bearish. There’s a lot of technical damage to many Greentech stocks that we are starting to see repaired, but caution should continue when evaluating potential investments.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 3/1/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 118.81 | -9.06% | Hold | Under 100 |

| Aecom | ACM | 2/17/22 | 73 | 69.66 | -4.58% | Buy | Under 58 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 18.95 | 3.72% | Buy | Under 12.85 |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 5.30 | 1.53% | Hold | Around 4.10 |

| Daseke | DSKE | 2/3/22 | 11.23 | 12.26 | 9.17% | Buy | Under 7.19 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.67 | 2.44% | Hold | None |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.31 | 72.22% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.16 | -5.88% | Hold | None |

| Heritage Crystal-Clean Inc. | HCCI | — | — | 27.86 | Watch | ||

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 40.52 | -2.08% | Hold | Under 32 |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 27.04 | -2.03% | Buy | Near 22 |

| Stantec | STN | — | — | 48.88 | Watch |

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 3/1/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy | ADSEW | 10/20/21 | 1.66 | 1.15 | -31% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 6.10 | 17.3% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.22 | -50% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.50 | -55% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.59 | -12% | Hold | |

| Volta Inc. | VLTA.WS | 6/16/21 | 2.21 | 1.79 | -19% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | -17% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

Advanced Drainage Systems (WMS)

Shares went ex-dividend yesterday, meaning we’ll collect an 11-cent dividend. We’re down 9% on price, but the maker of drainage infrastructure from recycled plastics pushed over the moving averages yesterday. Expect bulls and bears to continue to tussle around current prices. We’re initiating a sell-stop “under 100” as a hedge against extreme market events. HOLD

Aecom (ACM)

The engineering firm is volatile with the rest of the market around Russia. Support is around 67; we’re initiating a sell-stop “under 58” as a hedge against extreme events. BUY

Archaea Energy (LFG)

We’ve pushed back into the black with the landfill gas business, with February’s action looking to have halted a downtrend. Management release earnings March 17 before the open. Estimates are for Q4 EPS of 3 cents on sales of $57.4 million. We’re instituting a stop-loss of under “12.85.” HOLD

Charah Solutions (CHRA)

We’re around break-even for the remediator of coal ash ponds. The 6.25 area is key resistance, while support is down toward 4.80. A stop-loss of “under 4” is prudent in anticipation of extreme volatility. We’re shifting our recommendation from Buy to Hold. HOLD

Daseke (DSKE)

While rising fossil fuel prices have clipped other shares, they have hardly slowed our specialty trucker. In part, that’s because fuel surcharges are commonplace in transport now, meaning higher prices shouldn’t affect the bottom line too much. Shares have pushed to a four-year high on good volume. The technical picture looks excellent. All-time highs around 14 are resistance; long-term support sits at 9. A stop-loss at “under 7.19” would respond to a definitive break of the multiple levels of support. BUY

Good for Growth SPAC Units (GFGDU)

The ESG-focused SPAC is on the hunt for an acquisition target, we’ll hear little news until a deal is on the horizon. The units are effectively illiquid now and unavailable to buy. At market prices, we’re underwater in our buy price among the three components (shares, warrants and rights). However, we’re guaranteed to collect 10 a share if we hold, which means our trade is profitable with warrants and rights prices. HOLD

Heritage-Crystal Clean (HCCI)

Earnings are announced after the market close today. Consensus is for earnings of 58 cents a share. A strong upside reaction could make us buyers, but as things stand right now, we’re dropping HCCI otherwise. WATCH

KraneShares China Green Energy (KGRN)

The China-listed stock fund didn’t get to test support at 36 last week and looks a bit better this week, in the low 40s. We’re putting on a sell-stop for the outside chance of extreme events, at “under 32.” HOLD

Lithium Americas (LAC)

The company is exploring separating its Thacker Pass mine from its South American holdings. The purpose would be to create an American company (LAC is Canadian), thereby enabling it to receive various federal financial incentives and support. The market seems mixed to the idea. Shares remain bullish here and our sell-stop is “near 22,” which is below major support levels. BUY

Stantec (STN)

Earnings didn’t lift shares last week. The company hit expectations on EPS of 42 cents and missed slightly on adjusted revenues of $726.9 million. They’ve fallen below long-term support. They could rebound, but odds are some technical damage is done. We’ll likely drop without improvement. WATCH

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas has been closed out last month at a total of a 127% return.

ADS-Tec Energy (ADSEW)

No news for our German super-fast EV charger maker this week. Business, including U.S. expansion, is performing well. HOLD

FuelCell Energy (FCEL)

The fuel cell maker is turning bullish, now well above the near-term moving averages, though resistance at the 200-day, 7.10, remains. We’re now about 16% profitable on the trade, a half-sized position. Earnings are tentatively scheduled to be out March 16. HOLD.

Origin Materials (ORGNW)

The company reports Q4 and full-year results Thursday. It didn’t generate business revenue in the quarter, with its first plant not due to come online until later this year. It did have earnings of 4 cents a share in the period, from government grants and financing activities. For this year, ebitda loss will be $36 million. The company’s operational model also projects losses until the second plant, Origin 2, opens in Louisiana in 2025. HOLD

Ree Automotive (REEAW)

Earnings are released tomorrow morning, before trading begins. Three analysts expect a loss of 12 cents a share on slight revenue. HOLD

ReNew Energy Global (RNWWW)

ReNew reported a loss of 10 cents a share for the third quarter on revenue of $181 million. ReNew’s CFO resigns the end of the month, news the market brushed off (there is no controversy involved). HOLD

Volta Inc. (VLTA.WS)

Little news this week. The next earnings announcement will be on April 4. HOLD

Thank you for being a subscriber. I welcome your comments and questions any time. Reach me at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on March 9, 2022.