Global fossil fuel uncertainty is shining the spotlight back on renewables as the best way for most economies to be energy independent. This issue we feature one of America’s largest renewable generation portfolios, which offers an exceptional 4%-plus dividend yield. We also look at a young renewables-focused business finding its legs in wind, solar and infrastructure.

As always, we also highlight three technically strong ESG stocks to consider and give updates on our Greentech Timer and Real Money and Excelsior portfolios. Read on!

Infrastructure and Energy Alternatives (IEA)

Overview

We’ve mentioned before the expectation that the 2021 infrastructure bill will bolster a number of domestic companies, given the large renewable energy and efficiency allocations in the bill. When, exactly, we’ll see business hitting companies’ top lines is unknown, but expectations are that it should start this year and flow through following years.

Regardless, on the renewable energy side, the Energy Information Agency, a federal department, says its annual survey shows there will be 21.5 gigawatts (GW) of solar and 9.6 GW of wind installed in the country this year. Projections from other parties is there will be 210 gigawatts (GW) of wind and solar installed in the U.S. from now till 2030, about evenly split between the two. We suspect that number is likely low, given the size of this year’s additions and the need to increase the scale of renewable installations to meet targets. Simple economics, too, mean the logical choice for utilities is to add more renewables. On a levelized cost basis, wind and solar are 40% to 60% cheaper than new construction of any other form of electricity, before any single incentive or tax break is taken into account.

Business Model

As its name suggests, Infrastructure & Energy Alternatives (IEA) splits its business into two categories: renewable energy, accounting for 70% of sales, and civil engineering, contributing the balance of 2021’s $2.1 billion in revenue. Organic revenue grew 19% last year. It’s a selection for our Real Money Portfolio.

The Indianapolis-based business acts as a project manager, installing utility-scale solar and wind developments on behalf of project-owning customers. IEA identifies and designs sites, and constructs, installs and redevelops energy projects. For much of its history, it focused solely on wind, but added solar capability in 2019, around the same time it expanded heavily into civil engineering – paving, rail construction, environmental remediation and industrial maintenance arms. The additions came from a series of acquisitions that diversified the business as it entered a going-public transaction with a SPAC. The company is ranked by Engineering News as the second-largest wind contractor in the U.S., fourth in power, eighth in solar and in the top 50 of rail, mining, highways and transportation. Overall, the business has installed 24 GW of renewables in the U.S. (its primary market).

On the renewable side, IEA is somewhat insulated from the variable costs of solar panels and turbines since their customers buy them. But they do have some inflation and supply chain exposure since clients can delay projects based on their appetite for cost hikes and supply chain delays. Still, its profile suggests it should be a less volatile way into solar and wind. IEA’s typical renewable job lasts 12 to 18 months, with the average contract around $55 million, with no exceedingly large contracts that would be a customer risk. The company also constructs the power delivery infrastructure around renewables.

Its specialty civil division often dovetails with the renewables operations, allowing IEA, for instance, to bid to also build access roads to wind farms. The business primarily constructs highways – overpasses, etc. – rehabs bridges, and other large infrastructure through its William Charles, Saiia and American Civil Contractors subsidiaries, which cover most of the continental U.S. among them, with a particular concentration in the Midwest and Mountain West.

Both sides of IEA’s business have a 10% gross margin now, with renewables seen as having better odds of rising to 12%, and civil seen as having an 8% to 10% long-term gross margin.

Business Outlook

Wind and solar are on pace to become the largest source of electricity generation in the U.S. by the end of the decade, surpassing natural gas (it is likely solar by itself will surpass natural gas in that timeframe). Given IEA’s relatively recent amalgamation of many businesses under its umbrella, we expect management will continue finding more efficiencies from integration. Indeed, executives believe they are ironing out a mixed bag of performance in solar. Even being a relatively recent entrant into constructing solar farms, the fact IEA is eighth-largest speaks to its effectiveness already. Solar is now 20% of the renewable business and includes Kentucky’s utility-scale first solar farm, Turkey Creek Ranch, which begins construction this year. Margins aren’t as strong as wind, but management says the learning curve is flattening out and should reach wind’s levels in the next year or so. The company signed $2 billion in renewable project deals in 2021, but revenue from them will vary – the company doesn’t start to buy materials or receive any payments until clients give the order to proceed, which can have substantial delays. Total backlog is $2.9 billion entering this year.

On the civil side, IEA has teamed with a sea cargo handler, Logistec, to offer services to the off-shore wind industry, with the expectation of handling some of the multiple east coast wind projects being developed. IEA would pre-assemble and stage turbine components at the dock, which Logistec would then bring out to sea. More typical civil deal examples include constructing six new miles of Interstate 69 in Indiana, a modernization of Los Angeles’ intermodal bus/rail facility and a quick-turn revamp of a Marathon Oil facility in Detroit. The infrastructure bill should lead to more civil work as well, given it produced the largest annual funding increase for American highways since 1958, according to IEA.

Management is particularly enthused about the potential for its niche business in coal ash remediation. As we know from Charah Solutions (CHRA), a current Real Money Portfolio holding featured in our January 19, 2022 issue, the Biden administration EPA is finally starting to enforce a law passed by Congress late in the Obama administration requiring coal ash ponds to be remediated. Coal ash ponds are large deposits of spent coal from power plants. Usually open air and dry ponds (sometime covered and/or wet) they can pose a health hazard if leeched into the drinking water and also if ash gets windborne. There are about 1,000 coal ash ponds which are now required to be lined, relined or removed altogether. IEA’s major coal ash pond remediation is part of the Chesterfield plant in Virginia owned by Dominion Energy. Charah has the contract for another large segment of coal ash at this facility.

Only about 10% of the large coal ash ponds in the U.S. that need remediation by law have done so (since there was no EPA enforcement under the prior administration, remediation was either state mandated or purely voluntary). According to IEA’s estimates, that is a potential $150 billion, based on back-of-the-envelope math of 2 million tons of ash per site, generating revenue of up to $75 a ton to remove. Remediating coal ash is an environmental positive in and of itself. Coal ash is also a simple substitute into concrete, making the end product both stronger and less energy intensive by displacing cement creation.

For this year, IEA tells analysts to expect sales of $2.1 billion to $2.2 billion with adjusted EBITDA of $150 million and its first net income, at 86 cents per share.

Issues to Consider:

- There are warrants remaining from IEA’s SPAC merger. They are exercisable until March 23 of next year, with two warrants needed to purchase one share at 11.50. Warrants trade around 2.20 now, so the warrants imply a price for shares of 15.90. The warrants can only be called by the company if shares trade at the price of 24 or over for 20 out of 30 days. You’d have to be very confident shares will exceed 16 within the next year to make the trade worthwhile. That’s risky, but would be a less capital-intensive entry if you prefer not to buy equity on margin. Management has been buying warrants on the open market to retire them, as part of a program to simplify the balance sheet (they retired a class of shares this way), which would support the price. They have postponed doing so of late to preserve cash on the balance sheet.

- The wind industry generally is expected to have a weak 2022, with IEA’s wind-generated business possibly dropping double digits. New solar is expected to make up the difference.

- Total debt is about $386 million; net debt is $262 million.

- Market cap wise, at $670 million, IEA is about half the size of many comparable peers. The business also lacks much analyst coverage on Wall Street.

- 2022 projections are management’s “middle of the road” estimate, meaning there is a downside surprise risk as well as upside surprise potential.

Technical Analysis

The going-public SPAC merger closed in March 2018. IEA appeared to go through many of the transition pains typical of SPACs, with a lack of institutional support after the merger weighing shares down to an all-time low of 1.68 in spring 2020, a reflection also of the pandemic uncertainty. Shares participated in the broad Greentech rally in the back half of 2020, sending shares to an all-time high in January 2021 of 23.42. They slumped over the next year in sympathy with Greentech, too, touching a low of 7.84 last year in action that suggested a lack of conviction rather than outright bearishness. Last week IEA pushed over its 50- and 200-day moving averages for the first time in 14 months on earnings and outlook. Resistance probably sits at the 13.60 area based on price and volume history. It shouldn’t offer a lot of pushback, with 17 and 18 appearing likely to be stiffer levels; 11 shows a confluence of support factors. Shares are overbought here and may need to pause or let off a little steam.

What to Do Now

Having pushed over the moving averages for the first time since early 2021, IEA is set up for a bullish Golden Cross soon. The overbought factor suggests we can wait for a step back to around 12.50, on an intraday basis, to buy. BUY around 12.50

Infrastructure & Energy Alternatives (IEA)

Revenue (trailing 12 months): $2.08 billion

Earnings per share (TTM): (2.79)

All-time high (intraday): 24.13

Market cap: $621 million

Recommendation: BUY around 12.50

Intended Portfolio: Real Money

Clearway Energy (CWEN/A)

Overview

Utilities are traditionally a safer haven in times of turmoil. Proponents of Dow Theory – the basis of most technical analysis today – look for the relationship between the Dow Jones Industrials, Transports and Utilities averages for the broad strokes of how the economy and markets are doing. Typically, transports and industrials trending higher is bullish for equities. They’re both trending lower. As confirmation, the accompanying chart here looks at the relative performance of transports versus utilities. If the economy is improving, transports should be outperforming utilities. But, as we can see, transports are weaker relative to utilities, as indicated by the orange downtrend line.

Business Model

Clearway Energy (CWEN/A) is one of America’s top owners and operators of renewable energy assets. With a current portfolio of 5 GW of renewable energy, it is somewhere around fifth or sixth largest, behind NextEra (NEE), Duke (DUK), Berkshire Hathaway (BRK.A) and others.

The company has 3.3 GW of wind farms, mainly in Texas north through Oklahoma, Iowa and Minnesota and westward, particularly in California. Clearway has 1.6 GW of utility scale solar, mainly in California, Arizona and Utah, as well as distributed solar assets of 332 MW. The business also owns 2.5 GW of conventional energy plants, nearly all natural gas plants in California focused on providing peak period power.

In October, Clearway signed an agreement to sell its thermal arm which provides hot and cold water, steam and sometimes electricity to large buildings like hospitals and schools – to private equity firm KKR (KKR) for $1.9 billion total consideration, which will give Clearway about $1.3 million cash free and clear when all is wrapped up this year.

In 2021, the business made $1.3 billion in revenue, net income of $51 million after removing losses attributable to noncontrolled interests – mainly power development partnerships – and paid $1.33 in dividends to all common shares.

Business Outlook

The sale of the Thermal business arm provides Clearway with a lot of cash. Of the $1.3 billion net it will receive from the sale, $600 million is committed to new projects – 2.1 GW of wind and solar in Texas, California and elsewhere – leaving $750 million to be allocated to future projects. Management sees a key part of its strategy as bolstering the dividend, by investing in more revenue generating renewable assets. It just raised the quarterly dividend to $0.3468 and sees the infusion of cash enabling it to raise the dividend 5% to 8% annually through 2026, with the expectation cash available for dividends will be firmly over $2 in the long run.

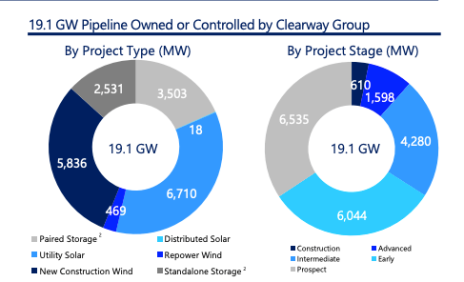

Business-wise, Clearway has a development pipeline of 19 GW, primarily new construction wind in the western U.S. with utility scale solar planned in Massachusetts, Illinois, Mississippi, Colorado, Texas and California.

In the longer-term, utilities’ appetite for renewable energy is said to be as strong as it has ever been, which should provide plenty of opportunities for Clearway. There are some 240 GW of utility roadmap for renewables in the U.S. (called IRPs, integrated resource plans, filed with most state regulators), and some 80 GW of coal plants will be shutting their doors for good in coming years.

Issues to Consider:

- Voting control of Clearway is through Class B and Class D stock owned by Global Infrastructure Partners. GIP is a Connecticut based investment fund holding $77 billion in assets, including airports, ports, oil and gas gathering pipelines and renewables companies. Such single entity control can mean Clearway isn’t suitable to be held by certain indexes, funds and ESG frameworks.

- There are two classes of common shares, Class A and Class C. They are equal in every manner but the Class C is more liquid and uses the ticker CWEN. However, those shares have only 1/100th of a vote on matters put to shareholders. They also trade about $2 higher than their Class A equivalents, which get one vote per share and trade under the ticker CWEN/A. The premium is larger than it has been in the past, which we believe stems from the simpler ticker and reinforced by the higher average volume.

- The forward yield of shares therefore is a healthy 4.3% for the Class A shares and a still-robust 3.89% for the Class C. Payment of the latest dividend is today, so theoretically shares have already dipped to reflect the dividend, or will tomorrow.

- Debt-to-equity is high at 3.8. We like that 99% of the debt is at fixed interest rates, which shields it from raising rates.

Technical Analysis

Public since 2015, CWEN/A peaked at 35.33 in late November, before sliding with Greentech as a whole, back to its 200-day moving average in February. Shares bounced nicely off that support line as earnings came in fine. A rally last week to a two-month high has seen shares pause to take a breath and consolidate. Support is at these levels around the mid-32 range. The next target of resistance will be the all-time high.

What to Do Now

Shares are easing after a 10% rally last week. Weakness toward 31 is an opportunity to buy. We suggest buying the less expensive Class A shares (CWEN/A), which bring with them the better dividend yield and superior voting right. They are less traded than the Class C (CWEN), but remain quite liquid for our purposes. BUY

Clearway Energy (CWEN/A)

Revenue (trailing 12 months): $1.52 billion

Earnings per share (TTM): $0.44

All-time high (intraday): 35.79

Market cap: $3.77 billion

Recommendation: Buy

Intended Portfolio: Real Money

The ESG Three

The ESG Three are three technically strong stocks selected from the 200 most-held stocks in environmental, social and governance (ESG) focused mutual funds and ETFs. ESG fund holdings tend to be weighted toward blue-chip companies drawn from every industry which are rated highly in social and governance aspects. We screen top performers further to eliminate widely held companies we believe have clear environmental, social and/or governance problems. These aren’t formal stock picks but suggestions for those looking to explore additional stocks beyond the Greentech portfolio.

Mosaic Co. (MOS)

What is it?

A manufacturer of fertilizers

Why is it ESG?

The company has pledged to cut water use 20% from 2015 levels by 2025, and is seen as having general cleantech opportunities, though environmental issues around conventional fertilizers remain. ESG funds own $60.2 million worth of shares.

Why now?

The U.S. imports 96% of its potassium fertilizer from Russia. Sanctions will either increase their cost (with tariffs) or eliminate them, boosting the pricing power of domestic producers.

Kroger Co. (KR)

What is it?

A grocery store chain

Why is it ESG?

It’s a majority union workforce and even part timers have access to health insurance. ESG funds own $95 million of shares.

Why now?

People continue to order groceries in even as the pandemic fades, producing a double-digit earnings beat in Kroger’s latest quarter. Management is firmly committed to producing shareholder returns of about 11% annually.

Newmont Mining Corp. (NEM)

What is it?

A precious metals mining company

Why is it ESG?

The company has a strong biodiversity program and is noted for monitoring how its mining affects surrounding nature. It has excellent safety protocols, including linking executive pay to it. ESG funds own $80 million of shares.

Why now?

It costs Newmont $1,050 to produce an ounce of gold. The yellow metal is recently at $1,930 and expected to stay strong due to European turmoil.

Greentech Timer & Current Portfolio

Conflicting forces have our Timer signaling caution, although we see some shoots of bullishness.

On one hand, the war in Ukraine suggests further strength should be ahead for rare earth metal producers in the Western Hemisphere, as well as for energy independence plays including wind and solar. And both solar and wind subsectors are holding up a bit better than Greentech overall this week.

However, there is a concurrent concern over the potential for delisting of Chinese companies from American exchanges, which has EV maker Nio (NIO) down 25% in the past week, with similar moves seen in other Chinese Greentech listings stateside. Also giving fuel to renewable bears is the potential for further supply chain disruptions and inflation in raw and base materials which may cause large projects to be delayed or destroy demand altogether. We also see general bearishness in water-related stocks and nuclear stocks right now.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). Right now our Timer is mixed-to-bearish. There’s a lot of technical damage to many Greentech stocks that we are starting to see repaired, but caution should continue when evaluation potential investments.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 3/15/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 117.32 | -10.20% | Hold | Under 100 |

| Aecom | ACM | 2/17/22 | 73 | 74.65 | 2.26% | Buy | Under 58 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 18.64 | 2.03% | Hold | Under 12.85 |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.96 | -4.98% | Hold | Around 4.10 |

| Clean Earth SPAC Units | CLINU | 3/4/22 | 10.01 | 9.95 | -0.60% | Buy | None |

| Daseke | DSKE | 2/3/22 | 11.23 | 11.13 | -0.89% | Hold | Under 7.19 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.67 | 2.44% | Hold | None |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.16 | -11.11% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.19 | 11.76% | Hold | None |

| Heritage Crystal-Clean Inc. | HCCI | — | — | 27.86 | Dropped | ||

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 32.13 | -22.35% | Hold | Under 32 |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 25.24 | -8.55% | Hold | Near 22 |

| MP Materials | MP | 3/9/22 | 45.01 | 41.54 | -7.71% | Buy | |

| Stantec | STN | — | — | 48.88 | Dropped |

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 3/15/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy | ADSEW | 10/20/21 | 1.66 | 1.10 | -34% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 5.87 | 12.9% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.31 | -46% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.28 | -75% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.90 | 5% | Hold | |

| Volta Inc. | VLTA.WS | 6/16/21 | 2.21 | 1.55 | -30% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | -17% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Advanced Drainage Systems (WMS)

No news worth using ink on this week. Shares are in a zone of congestion, reflecting indecision between bulls and bears. 122 is resistance, with support down to 115 and additional support likely down through 100. We collected an 11-cent-per-share dividend yesterday, so add one-tenth of one percent to performance in the table. Our sell-stop is “under 100.” HOLD

Aecom (ACM)

Aecom was named one of the world’s most ethical companies by Ethisphere, an established for-profit outfit that judges companies. It’s the sixth year it has been so named. Aecom has rallied after a decision to cut ties with Russia. Shareholders as of April 6 will collect a 15-cent dividend. Our sell-stop is “under 58;” 75 then 78 are resistance. Shares are over support and look generally positive. BUY

Archaea Energy (LFG)

Management releases earnings tomorrow, before the open. Estimates are for Q4 EPS of 5 cents (up from 3 cents last week) on sales of $57.4 million. Earnings estimates have a wide range, from a loss of 8 cents to earnings of 16 cents a share. Our stop-loss is “under 12.85.” Shares are positive and should have very good support down to 17. HOLD

Charah Solutions (CHRA)

Charah reports earnings next week, with a whisper number of $87 million of revenues circulating, above the high end of published Wall Street estimates. Shares are treading water in a zone of competing support and resistance levels. Our stop-loss is “under 4,” with a probable sell recommendation from us before shares would reach that level. HOLD

Clean Earth Acquisitions Corp. (CLINU)

The Greentech-focused SPAC is a way to preserve capital while having exposure to the upside of the business Clean Earth merges with. The portfolio added a position at 10.01 March 4. That means we’re already profitable, with the per-share trust value we can demand back being 10.10. We’ll hear little news until a deal announcement. The next action here will be to split the units when possible. That will be on or about April 15. Units largely are now illiquid, but can be bought at a discount to trust value, still. BUY under 10.10

Daseke (DSKE)

The specialty trucker (turbine arms and the like) is finding support at the 50-day moving average, but it is some 13% off the recent high and we’re concerned the break upward that had been teed up has been stifled by energy prices. Our stop-loss is “under 7.19,” which would represent a definitive break of the multiple levels of support. HOLD

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

We’re profitable on the shares alone given the $10 trust value, with the warrants and rights therefore all profit even at their depressed prices. No news, as the SPAC is on the hunt for a merger target. HOLD

Heritage-Crystal Clean (HCCI)

We dropped the small business waste remediator from our Watch list with last week’s update for mediocre stock performance. DROPPED

KraneShares China Green Energy (KGRN)

Weakness as concerns over U.S.-listed Chinese shares being delisted by regulators. 27% of the portfolio is in ADRs of Chinese companies, the rest in companies traded on Chinese exchanges. Our sell-stop is “under 32,” on a closing basis, which is where we’re trading now. HOLD

Lithium Americas (LAC)

The lithium miner failed to hold support at 27 last week and now is testing support under 24. Our sell-stop is “near 22.” Like KGRN, since we’re near our stops at what we consider long-term plays, the decision is to cut losses in expectation of steeper losses and re-enter down the line at lower prices with better technicals. We’re shifting our recommendation to Hold from Buy based on volatility. HOLD

MP Materials (MP)

We recommended buying shares with last week’s update in the only Western Hemisphere miner of rare earth metals. The portfolio added shares at 45.01, the mid point of the high and low that day. Support is at 38, resistance is at 47. We continue to believe MP has a great advantage to become the primary supplier to North America as it pivots away from sending raw mining to China. BUY

Stantec (STN)

We dropped the engineering services firm from our Watch List with last week’s update for mediocre stock performance. DROPPED

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed out last month at a total of a 127% return.

ADS-Tec Energy (ADSEW)

No news this week from the German turbo EV charger maker. Warrants have seen volume dry up, while the underlying shares have slumped to 7.70, an all-time low. Overall, we expect our Excelsior warrant holdings to remain depressed until the broader sector turn bullish again. HOLD

FuelCell Energy (FCEL)

The fuel cell maker reported a first-quarter 11-cents-per-share loss on Thursday, narrower on the year but worse than consensus expectations. Analysts didn’t seem too troubled by the miss with some price targets raised subsequently. Of interest to investors is the ability to sell into Korea after a settlement with a partner there, as well as a carbon capture product with Exxon. Management was generally positive during the earnings call, without telegraphing much on new deals. HOLD

Origin Materials (ORGNW)

As a business that won’t open its first plant till late this year, we likely need a bull market to generate much interest in Origin right now. Warrants are basically unchanged over the week. HOLD

Ree Automotive (REEAW)

Ree management expects some orders for its P7 EV delivery truck chassis to come in this year and they are also focusing on trying to convert some other of 20 automaker discussions into orders by year end too. The company expects to have capacity to construct 10,000 sets annually entering 2023. Firm order news will be bullish. Shares and our warrants are quite weak and could use a catalyst. HOLD

ReNew Energy Global (RNWWW)

Management is presenting at a Wall Street investor conference this week to raise awareness of its business. ReNew shares have been forming a nice uptrend since bottoming in January, which should be supportive of our warrants. We sit on a decent profit at the moment. HOLD

Volta Inc (VLTA.WS)

Volta releases earnings after the close next Monday. Expectations are for sales of $12.3 million and a loss of 18 cents a share. Outlook from the EV charger maker’s management will be closely watched. HOLD

Thank you for being a subscriber. Our regular updates come weeks between issues, with the next being Wednesday March 23. I welcome your comments and questions any time. Reach me at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on April 6, 2022.