A new year brings a fresh perspective. Flows into U.S. ESG funds rose 20% in 2021 and doubled worldwide. Some $3.9 trillion is now dedicated to environmental, social and governance issues globally, primarily in equities. All that money sees the long-term trend of Greentech continuing upward, driven by the desire to combat climate change and the universe of innovation it has inspired.

This issue we feature two selections. For the Real Money Portfolio, we focus on an upcycler benefitting from strong construction activity. For the Excelsior portfolio, we offer a high-risk, high-reward player in hydrogen.

Advanced Drainage Systems (WMS)

Overview

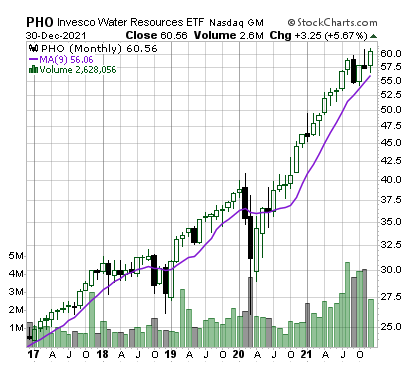

The infrastructure bill passed in November includes $55 billion for drinking water, storm water and wastewater projects. The whole bill will continue the tailwinds for the construction and engineering industry, which is also being helped by home prices and what will still be low long-term interest rates. The Dodge Momentum Index, a measure of nonresidential construction, is near a 14-year high, despite volatile swings in month-to-month activity. That suggests 2022 will remain very strong for warehouses, datacenters and other large projects that have been in favor of late. Billing by architects, the AIA Index, are a leading indicator ahead almost a year, which suggests the first half of 2022 should exceed 2019 levels in new construction. These point to continued strength for the water subsector of Greentech, which has been the most consistent the past year. As the monthly chart of one water index, the Invesco Water Resources ETF (PHO), shows, water stocks have participated in Greentech’s upside without suffering much from the retracement of the past 10 months.

Business Model

Advanced Drainage Systems (WMS) is a manufacturer of stormwater and wastewater infrastructure products – water capture, movement, storage and treatment, like pipes and septic tanks. Advanced Drainage uses so much recycled plastic for its products it is the second largest recycler of plastics in the U.S., turning trash into its products. The company buys or directly recycles 500 million pounds of plastics annually, which makes up half of its feedstock and makes its products less energy intensive and less carbon intensive than it otherwise would be (45% is new plastic, the remaining 5% is other recycled inputs). The business says avoided greenhouse gases are equal to what 64,000 cars spew each year. Plastic products are structurally competitive to the concrete and metal alternatives that developers and municipalities could choose. Because plastic is lighter, it is cheaper and less-labor intensive to transport and install, and durability is said to be better too. Market share for plastic pipes in Advance Drainage’s sectors generally is roughly 45%.

The company generated $1.983 billion in sales in fiscal 2021, ended March last year, of which 45% was in non-residential (commercial) projects, 39% in residential, 9% agricultural and 7% general infrastructure. The American market drives the business, with just 8% of revenue coming from outside the U.S. Net income was $226.1 million. In the two first quarters reported for 2022, sales rose 32% and 29%, with net income rising more slowly, around 9% each quarter.

Business Outlook

Reliance on recycled plastic has long had another benefit for Advanced Drainage – recycled plastic has been cheaper and less volatile price-wise than virgin polymer. That’s changing as other companies embrace recycled plastic as feedstock for both the cost savings and the ESG benefits. The business took a big step toward controlling more of its supply chain by purchasing Jet Polymer Recycling in December for an undisclosed price. Jet is the largest supply of recycled plastic feedstock to Advanced’s Infiltrator Water Technologies division, which is a large maker of septic and leachfield products. Jet has three recycling facilities in Georgia and Alabama, where the latter could help Advanced make inroads into state approval of its products. A key part of the company’s strategy is proactively working with state officials to approve its offerings and become a competitor to traditional vendors for stormwater infrastructure products. Alabama is one of three states where Advanced has few approvals (Texas and South Dakota are the others). The three Jet facilities boosts the number of direct recycling businesses Advanced owns to eight, nationally.

What’s particularly appealing about Advanced is its growth, which continues to be forecast to come in at around a 30% annual clip, providing growth not often seen in the more utility-driven area of water. For the current fiscal year, management projects sales rising to between $2.55 billion and $2.65 billion, a 29% to 34% rise. Wall Street expects the third quarter, to be reported in early February, to see $643 million in sales and earnings per share of 94 cents.

Issues to Consider:

- No estimates have been given by management on how Jet may affect costs or revenue.

- Southeast U.S. is a focus for expansion, with additional manufacturing capacity expected to open in Florida this year and Georgia in 2023.

- WMS is an index component of the Russell 2000, Russell 3000 and, at about 4% weighting, the two dominant water ETFs, PHO and FIW.

- Shares pay a small dividend, recently 11 cents a quarter. The company has paid a quarterly dividend regularly since its IPO in 2014. It also paid a special dividend of $1 in 2019.

- Price ratios (to earnings, to book, to free cash flow) are at all-time highs.

Technical Analysis

WMS spent much of the autumn period testing its 200-day moving average support, rallying higher on the infrastructure bill passage in November and successfully navigating Q2, which management had said would be its most difficult quarter ever. The company went public in 2014 and spent five years in a trading range between 15 and 29. It finally broke out in 2019, only showing weakness along with everybody else at the start of the pandemic. Shares have been consolidating between 123 and 135 since November. On a chart formation basis, WMS appears set to break higher from here. Momentum and Relative Strength indicators also suggest strength ahead. Resistance is at 135, support at 130, 122 and 116.

What to Do Now

Despite Greentech’s overall bearishness, water remains a bright spot, helped along by its more defensive, utility-like characteristics. Advanced Drainage also provides a legitimate growth story in an area likely to benefit from continued strong economic activity and an emphasis on adjusting to the more intense water events brought about by global warming. We’re going to buy here and give a broad space for shares to ease in their longer-term uptrend. BUY

Advanced Water Systems (WMS)

Revenue (trailing twelve months): $2.31 billion

Earnings per share (trailing twelve months): $2.59

All-time high (intraday): 138.02

Market cap: $9.6 billion

Recommendation: BUY

Intended Portfolio: Real Money

FuelCell Energy (FCEL)

Overview

FuelCell Energy is a more speculative pick, and is intended for our Excelsior Portfolio as a riskier trade. It, along with Advanced Drainage Systems, are two stocks we offered up as stock picks for 2022 – one risky, one safer – when asked for the usual new year prognostications. We want to provide subscribers access to those picks before they are published elsewhere.

Projections by equity researchers and industry analysts are that hydrogen-related projects will begin to be seen in force in the back half of this decade, as announced projects begin to come online and governments push for lower emissions hydrogen promises. Hydrogen is especially promising for the long-distance trucking industry, where it is seen as the new diesel. It’s lighter than batteries and refuels at a speed like diesel. Already hydrogen created by use of natural gas to split off the molecule is cost competitive with diesel. Longer term, hydrogen is seen as a way to store excess renewable energy as well as transition other dirty energy users to cleaner emissions – the cruise industry, for instance, has a long-term goal of reducing emissions by 40%, which would require hydrogen or some yet-developed technology to be feasible (hydrogen is likeliest). European Union regulations are driving that change. Hydrogen fuel cells are also increasingly seen as a storage system for backup utility power and microgrids. The technology has been around for a century but has largely been limited to capturing hydrogen naturally created from certain chemical plants.

In reading about hydrogen, there are often references to colors. Here for our reference is the generally accepted definitions of the color spectrum for hydrogen, adapted from various explainers.

- Green hydrogen: use of renewable energy to electrolyze hydrogen, the splitting of the hydrogen molecule from water.

- Blue hydrogen: use of natural gas and steam in a process called steam reforming. The output is hydrogen and carbon, which is captured during the process.

- Pink hydrogen: electrolyzed hydrogen from nuclear energy. Sometimes this same process is called purple or red hydrogen; sometimes those colors refer to slightly different methods of creating hydrogen from nuclear power.

- Grey hydrogen: the steam reforming method in which the carbon byproduct is not captured.

- Turquoise hydrogen: creation of hydrogen from methane pyrolysis, in which carbon isn’t gasified.

- Yellow hydrogen: no standard meaning, sometimes referring to solar power generated hydrogen, sometimes to mixed renewable and fossil fuel hydrogen creation.

- White hydrogen: generally speaking, hydrogen doesn’t exist on its own on Earth. However, it is believed geologic processes have split hydrogen and that some is trapped beneath the surface. Theoretically, that could be tapped.

- Brown & Black hydrogen: creation of hydrogen using oil or coal. It has no environmental benefit overall, but can have a local air quality benefit if hydrogen is used away from its production source.

Business Model

FuelCell Energy is a fuel cell manufacturer based in Connecticut. The company has been around for 50 years and has made money from a mix of commercial fuel cell deployments and grants for advanced technologies research from the government. Fuel cell technology comes in five different approaches. FuelCell’s is carbonate technology, which generates hydrogen directly from a fuel source, such as natural gas or biogas. For technical reasons its cells are better suited for utility storage and sizeable applications, rather than for use in a vehicle.

In 2021 the company generated $69.6 million in revenue, about 72% from its commercial fuel cell business – servicing, licensing and generation – with the balance from advanced technologies work, some funded by the U.S. government and some by ExxonMobil (XOM), which we will discuss below. The business just opened a utility-scale, 7.4-megawatt (MW) project in Yaphank, New York, commissioned by the Long Island Power Authority, the island’s primary utility. This quarter, a similarly sized project will come online at the Groton, Connecticut, submarine base, as part of the U.S. Navy’s long-term plan to make its bases more resilient to climate-change induced power outages. In Long Beach, California, Toyota has commissioned a project to help it meet local port air quality regulations. In total, FuelCell Energy has 41.4 MW of operational fuel cells installed since 2012, and 33.9MW in development, including Groton and Toyota. 24.1 MW of projects in development are through three Connecticut projects with Eversource Energy (ES).

The business doesn’t make money, but it is seen narrowing its loss to the lowest level in many years to 21 cents a share in 2022, from 27 cents last year.

Business Outlook

This year, FuelCell is selling 20 cells for $60 million to Posco, a Korean conglomerate, a big chunk of the consensus $143 million this business is seen producing in 2022. Last year the company didn’t sell any cells. The Posco sale is the resolution of a dispute between the two companies stemming from a 2016 deal for Posco to market fuel cells in Korea and which included an investment in FuelCell equity. The dispute, resolved last month, frees FuelCell to market its cells in Korea – which we surmise was likely management’s goal in initiating the legal dispute in 2019. The settlement limits Posco to servicing existing customers who bought Posco-labelled product. The 20 cells go to service such customers. Korea is seen as a very promising market, with the government targeting 15 gigawatts (GW) of hydrogen fuel cell generation capacity and 2.1GW capacity for homes and buildings. The Koreans also aim for more than 6 million fuel cell vehicles to be serviced by 1,200 filling stations.

Japan is another growth market, where the government has long term goals of hydrogen fuel cell cost and quantity. In the U.S., the infrastructure bill contains $9.5 billion for clean hydrogen development.

Overall, FuelCell has a $1.3 billion business backlog, consisting of generation contracted in future years. Contracted backlog is, by and large, the source of sales for 2021 and 2020, with no cell sales occurring in the period.

FuelCell Energy’s Advanced Technologies division offers an intriguing differentiator among fuel cell companies. FuelCell believes it can deploy a next generation cell to efficiently capture carbon from power plants in a way that generates additional power while doing so. This is done by directing the flue gas from a power plant into a more concentrated airstream where the Co2 can be captured by the fuel cell membrane, where it is chilled and can be transferred for sequestering. It’s an experimental technology where FuelCell and its research partner ExxonMobil claim it can capture 70% of emissions without reducing power plant output, with an increase in the cost of electricity by about 33%. That’s in contrast to current carbon capture processes at power plants which reduce energy output some 20% with a cost of electricity increase on the order of 80%. Chemical and Engineering News recently reported the carbon capture system appears cost effective, at below $34 a metric ton captured compared to the Department of Energy target of $40 a ton. If economically feasible, the system does enable continued use of fossil fuels, which the world must move away from in the long term. We consider it a worthy transitional technology, if successful. FuelCell earned $7.4 million from the research deal last quarter and ExxonMobil will make a decision in the first half of this year whether or not to move forward with a pilot project in Rotterdam.

Issues to Consider:

- FCEL, like all fuel cell stocks, has been very volatile. Expect it to outperform as Greentech turns bullish and to be a laggard as Greentech works through current bearishness.

- ExxonMobil has long been a funder of climate change denial media efforts. Since the 1980s it has seen the fact of global warming as a potentially crippling development for its business. Given Exxon’s history, we consider the company’s involvement a risk, meaning Exxon’s interest in FuelCell’s carbon capture technology could simply be greenwashing much the way “clean coal” and carbon sequestering have been used the past 20 years. No commercial revenue may ever come from the efforts.

- We come to FuelCell stock this issue as a result of choosing a potential big gainer for 2022 – in the calculus of annual picks for financial media roundups, we prefer to swing big. That means we have almost totally set aside our technical screens, which focus on near- and medium-term signals. Consider this stock far riskier than other Excelsior efforts.

- Valuation-wise, FCEL is about average for pure-play fuel cell companies (30 times price-to-trailing 12-month sales, versus the 28 average for it and three peers). Cummins (CMI) bought a fifth publicly traded fuel cell maker, Canada’s Hydrogenics, for $290 million in 2019, at about nine times sales and 2.2 times contracted backlog.

Technical Analysis

Usually, we let technicals drive our recommendations. Right now, the technical picture for FCEL isn’t good. Sitting over 5, it is, however, on the better side of a price that for much of FCEL’s past 20 years has been notable support/resistance (on a long-term chart adjusted to unwind for reverse stock splits). On a split-adjusted basis, it hit a three-year high of 28 last February, peaking with Greentech. Shares then fell to a 13-month low of 5.11 the last week of December on earnings. Shares just filled the bearish gap from the reaction, a plus. But there remains resistance, especially at 8, which the 40- and 200-day moving averages sit near. Holding the low 5 area is beneficial, a floor for much of 2021.

What to Do Now

Buying FCEL largely relies on bullish hopes for Greentech. We read Greentech as consolidating at a classic 50% retracement from the bull leg of March 2020-Fenruary 2021 and believe the sector will begin a new bull leg soon. The timeframe for that is sometime in 2022 – if we are comfortable with a potentially large percentage drawdown while waiting for that to occur, we can add it to the Excelsior portfolio. BUY A HALF

FuelCell Energy (FCEL)

Revenue (trailing twelve months): $69.58 million

Earnings per share (trailing twelve months): ($0.32)

All-time high (intraday and adjusted for reverse splits): 7,830.00

Market cap: $2.1 billion

Recommendation: Buy a half-sized position

Intended Portfolio: Excelsior

The ESG Three

The ESG Three are three technically strong stocks selected from the 200 most-held stocks in environmental, social and governance focused mutual funds and ETFs. ESG fund holdings tend to be weighted toward blue-chip companies drawn from every industry which are rated highly in social and governance aspects. We screen top performers further to eliminate widely held companies we believe have clear environmental, social and/or governance problems. These aren’t formal stock picks but suggestions for those looking to explore additional stocks beyond the Greentech portfolio.

Thermo Fisher Scientific (TMO)

What is it?

A supplier of life science instruments and services.

Why is it ESG?

Fewer recalls and product quality problems than peers. ESG funds own $1.6 billion of shares.

Why now?

Heavy investment in expansion and new products along with generally strong business has Wall Street bullish for 2022.

Cadence Design Systems (CDNS)

What is it?

A provider of electronic design automation software and services.

Why is it ESG?

A gender and ethnically diverse board of directors and strong ethics training for employees and corporate oversight of ethics practices. ESG funds own $392 million of shares.

Why now?

Strong demand for its products plus increasing royalties from intellectual properties licensed out in previous years have Cadence expected to grow revenue to $4.1 billion by the end of 2023, from $3 billion in 2020.

Quest Diagnostics (DGX)

What is it?

A clinical lab and testing operator.

Why is it ESG?

High scores for environmental practices, though there is exposure to lawsuits over testing failures and irregularities in Ireland and South Carolina. ESG funds own $101 million of shares.

Why now?

Stronger than previously anticipated Covid-19 testing is coming, as guided by management. With a dividend, shares are a bargain, priced 11 times sales, half the S&P’s rate.

Greentech Timer & Current Portfolio

Greentech looks to have held the bottom of the trading range it has been in since May. The signals of how strong this bounce of support may be are mixed: on one hand, the past two weeks and the start of this one show prices being moved more by buyers than sellers – that is, we’re seeing candlestick patterns where prices close near the top of the weekly range. On the other hand, the daily chart is showing less of a quick bounce higher than we saw in three tests of support since May. There isn’t significant chart resistance until about a 10% rise from current levels, so we’re looking to see relatively easy action higher until then.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential).

Right, now our Timer is bearish. Maintain sell-stops and enter trades cautiously.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 1/4/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | New | — | 136.41 | — | Buy | |

| Aptiv | APTV | 11/18/21 | 177.01 | 172.21 | -1.95% | Hold | Around 152.50 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.37 | 8.37% | Hold | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 11.31 | -24.98% | Hold | Near 11 |

| FuelCell Energy | FCEL | New | — | 5.88 | — | Buy a Half | |

| Heritage Crystal-Clean Inc. | HCCI | — | — | 32.63 | — | Watch | |

| KraneShares China Green Energy | KGRN | — | — | 45.24 | — | Watch | |

| Onsemi | ON | 8/4/21 | 44.63 | 70.95 | 56.06% | Hold | Half at Near 60; Half Under 54 |

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 1/4/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy | ADSEW | 10/20/21 | 1.66 | 1.06 | -36% | Hold | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 5.38 | 110% | SELL at 6.50 or higher | |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.41 | -42% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 1.35 | 23% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.51 | -17% | Hold | |

| Volta warrant | VLTA.WS | 6/16/21 | 2.21 | 1.83 | -17% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 48% | 12/6/21 |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | -17% | 12/22/21 |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Aptiv (APTV)

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When the sector is bearish like now, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

APTV bounced nicely after a test of the 200-day moving average last month, but saw pushback at the 40-day moving average yesterday, unable to close above it. Generally, the price technicals look positive and we should see bulls make another attempt at breaking over 166-167 soon. Management presents at a JP Morgan auto/tech forum tomorrow, with fourth-quarter earnings slated to be announced in a month. We’re raising our stop loss to “around 152.50” from “near 151.” HOLD

Archaea Energy (LFG)

The landfill natural gas company is caught between support at the 200-day average, 16.94, and resistance at the 40-day, at 19. Sentiment appears good, with two firm up days to start the week. The company ended 2021 with the official opening of Project Assai, the largest renewable natural gas operation in the world. Management says it should contribute $40 million annually to ebitda. Arachaea is derived from a SPAC, but is trading more predictably than SPACs usually do after closing their merger because Arachaea called and retired all the warrants last month, leaving shares the primary way to play its potential. Our sell stop is “under 16.” HOLD

ESS Tech (GWH)

With the company and its largest shareholder, SB Energy, each selling 5 million shares, GWH is weighed down, sitting on its 200-day moving average right now. ESS will use the money for expansion plans, while SB Energy says the sale will lower its ownership below 20% of the business and better reflect the 19.9% cap on voting power it already is subject to. Our sell-stop is “near 11.” If we break the sell-stop and are forced to exit, we may reenter GWH with its warrants, assuming they weaken as well, from their current price of 2.70. HOLD

Heritage-Crystal Clean (HCCI)

HCCI is another stock above its 200-day and below its 40-day. Both are trending toward the other, leading to an eventual decision point for bulls and bears. Price internals look positive and a break to 33 may be a signal to buy. WATCH

KraneShares China Green Energy (KGRN)

China has largely spared Greentech companies from its crackdowns the past year (with the exception of EV-related businesses, which it has suggested need to be culled). The question is when to enter KGRN, which is primarily China-listed stocks. Right now, shares are in a six-month trading range between 42 and 50 and saw a notable drop in trading this morning. Between support at 45 and resistance at 47 right now, we’re inclined to wait for a breakout to enter. WATCH

Onsemi (ON)

ON continues to have excellent Relative Strength compared to the S&P as the semiconductor maker benefits from a focus on higher-margin EV applications and in-demand 300-mm chips. When we entered ON in August, shares traded at a bargain 17 times forward one-year earnings, compared to 44 for peers. Both are around 23 now. So, valuation-wise, we’re still in fair territory with ON. At 71, shares have moved a good bit above the 200-day moving average, at 46. That suggests we could be in for a pause or step back at some point. For that reason, being up nearly 60% now, we recommend putting half the position in a high sell-stop to lock in profits if shares reverse. We’re raising the first half of our sell-stop to “near 60” from “near 57,” and are raising the second half to “under 54” from “below 48.” HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June we purchased six SPAC warrant positions as a basket trade – NVTSW, ORGNW, REEAW, RNWWW, VLTA.WS. One holding from that basket, Li-Cycle, was closed at a 4% profit in December.

ADS-Tec Energy (ADSEW)

The German maker of decentralized, ultra-fast EV chargers inked a deal for distribution in the Netherlands last month. Our warrants have weakened a fair bit over the past month to the point we’re underwater in them. Having only recently closed its SPAC merger, it will take time for ADS-Tec to get its story out stateside. HOLD

Navitas Semiconductor (NVTSW)

We’ve held one-quarter of our Navitas warrants since selling three-quarters in mid-November at 6.68, booking 160% profit on that portion. Warrants have a maximum value of 6.50, since they are redeemable at 18 and exercisable at 11.50. We recommended selling when warrants hit 6.50 with last week’s update. They haven’t yet. Warrants are at 5.71 today, up 124% from our buy price. SELL at 6.50 or higher.

Origin Materials (ORGNW)

Management presents at a Credit Suisse conference on carbon negative businesses January 11. Origin, which has designs to produce plastics from biomass, has shares trading in the 6 area. Our warrants are at 1.57 today. HOLD

Ree Automotive (REEAW)

EV chassis maker Ree continues to show life of late the past few weeks, as it appears its efforts to work with Toyota and Samsung are gaining some notice. Warrants hit 1.25 today, their highest price since August. HOLD

ReNew Energy Global (RNWWW)

Little news from the India renewable energy operator besides a restatement of financials as of September 30, to account for the cost of raising capital during the SPAC transaction, which has little bearing on looking ahead. Warrants and shares are largely unchanged from a week ago. HOLD

Volta Inc (VLTA.WS)

Warrants have firmed up about 30 cents this week to 1.90 recently. Volta is an EV charger company that has a strong focus on selling display ads on its chargers as part of its business plan, with a belief it can generate incremental sales for area retailers. Volta has the option to redeem warrants when shares trade at 10 or higher for 20 out of 30 days. That’s not executable right now, but we no longer recommend buying the warrants given the possibility that clause can become effective with a couple of strong weeks. HOLD.

Thank you for being a subscriber. Our next SX Greentech Advisor issue is published Wednesday, January 4. Our regular weekly update comes next Wednesday, December 21. We will send a special bulletin with any interim recommendations. Contact me anytime with questions or comments at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on January 19, 2022.