Omicron, inflation and the Fed all seem to be conspiring to make traders restless. While Greentech is down, we appear to be at the bottom end of a long-term trading range. The sector has managed to find the strength to rebound at current levels before over the past half year, we expect it to find reason to do so again.

We set aside the high-growth, high-volatility stock this issue to focus on a quotidian task: collecting waste oil and waste water for purifying and recycling. Our featured stock this issue is a leader in the U.S. and Canada. It makes money, has a good price chart and trades at a discount to its main competitor.

Heritage-Crystal Clean Inc. (HCCI)

Overview

Environmental services and pollution control is a more workmanlike sector of Greentech – there are few high-growth, world-changing ideas like we see in solar or EVs – but evolving environmental regulations continue to make it a strong sector. In the U.S., disposal of waste oil and other engine fluids is around a $8.1 billion market. In particular, waste oil, such as the oil collected by mechanics when they change a car’s oil, is re-refined in a process by which dirty oil impurities are removed and refined again to produce a useful base oil for new products, including fresh engine oil. Re-refining is a different business than recycling oil – which simply means using it one more time, usually burning for energy generation. Re-refining is less energy intensive than initial refining of crude oil and engine oil can be re-refined many times. There are about 325 recyclers/re-refiners of waste oil, and related fluids, in the U.S.

Business Model

Heritage-Crystal Clean (HCCI) is a large environmental services provider and a collector and re-refiner of waste oil and related waste oil. The company owns and operates one re-refinery, in Indiana, which it operates continuously to produce about 55 million gallons of new oil products, from 75 million waste gallons collected. Crystal Clean (as the company refers to itself) focuses its environmental services business on the cleaning and collection of residue from auto parts, collection of antifreeze, the collection of waste water marred by oil, paints and food production and general field services, such as oil and antifreeze delivery and small-spill remediation. It has 89 service centers in the U.S. where it deploys its trucks to service most of the continental U.S. and Southern Ontario, mainly the area below where New York meets the St. Lawrence River and extending west to Lake Huron. Scale is a positive in the business, given the truck routes become more efficient the more clients it has. Crystal Clean focuses primarily on small and medium-sized businesses, primarily the 810,000 outfits that maintain or manufacture vehicles.

Environmental services is the largest business segment, accounting for more than half of sales. Think of collection of everything a car repair shop or small manufacturer can’t pour down the drain. That and other service offerings, like collection of wastewater with its vacuum tanker trucks to recycling of oil barrels, track with general industrial activity. The company also does strong business in parts cleaning, either cleaning items themselves for customers or providing a dedicated sink that drains into a waste barrel which Crystal Clean collects. The solvent used is collected and recycled or used as a component of other manufacturing. The segment generated $72.8 million of Crystal Clean’s $123.2 million sales in the latest quarter (Q3 ended September 30). Every segment of environmental services rose compared to 2020 and pre-pandemic 2019.

Oil collection and its re-refining is the balance of the business. It boomed last quarter, with sales up 106% over 2020 thanks to a rise in the price they can charge for base oil (that is, the re-refined oil). When oil prices are high, re-refiners have to pay for waste oil from their sources. When oil prices are low, as in 2020, the company charges its sources for collection (as is standard in the industry), which mitigates the swings in revenue. Of late, Crystal Clean has been paying for waste oil, but about 10 cents less than management feels they ordinarily would, with build-up of waste oil uncollected from the pandemic.

Crystal Clean’s primary competitor is the Safety Kleen division of Clean Harbors (CLH), which owns seven re-refineries in the U.S. and generates about 10% more revenue overall from operations than Crystal Clean. Safety Kleen is the largest re-refiner; Crystal Clean second largest.

Business Outlook

This year Crystal Clean will produce about 49 million gallons of base oil from re-refining, due to scheduled refinery shut downs in the current quarter. It will collect and reconstitute 3.7 million gallons of antifreeze and treat about 53 million gallons of wastewater at its plants. For the current quarter, the business should generate 68 cents in net income per share on sales of $160 million. That will put the full year at $506 million revenue and $2.49 EPS.

Consensus Street expectations for 2022 are $527 million sales and $1.92 EPS. Overall, HCCI has been a steady grower, expanding mid-single digits annually in recent years, excepting the pandemic-impacted 2020. Over the past two decades, the business has a 17% compounded annual growth rate.

The market Crystal Clean serves is highly fragmented, it and Safety Kleen command just 13% as the two largest players. That means there is room to add growth through acquisitions, of which the company has done three since October. California is identified by management as a growth area, with Crystal Clean expecting to add a license to collect antifreeze in the state soon. The region also is seen as conducive to boosting route density.

Issues to Consider:

- As the second-largest player in the market, we believe Heritage-Crystal Clean can be both a consolidator and an attractive acquisition candidate.

- Long-term debt to equity is low. Price to expected 2021 earnings is 16. Competitor Clean Harbor is at a 27 PE. Pollution control as a group has a PE of 43.

- HCCI’s business has been driven by regulatory requirements – that is, that auto shops and small businesses have to do something with waste liquids. We believe that business will increasingly see momentum from the carbon-reduction benefit of its re-refined oils. Management already sees emergence of customers who are motivated at least in part by the carbon intensity reduction of reused products.

- HCCI a microcap stock and trading volumes can be lower.

Technical Analysis

HCCI only recently regained pre-pandemic price levels but appears to have suffered a failed breakout over the resistance line at 32. Support at 30 (the 200-day moving average and a zone of prior price support) may be its destination. Selling volume from the recent peak over 34 is declining, suggesting lack of commitment from the bears. Weekly charts suggest a failed breakout of a cup pattern, though creation of a bullish cup-and-handle pattern may still be happening.

What to Do Now

HCCI isn’t a flashy business or one that is expected to spark leaps in growth. But it’s well run and as a stock is exhibiting a series of good characteristics – it has good Relative Strength, positive EPS, sales and price trends and has decent fund support coming in. The pollution control sector as a whole is showing good performance and the current federal administration is likely only supportive of further opportunities. We’re going to watch shares for now and see how they test the long-term support at 30. WATCH

Heritage Crystal-Clean Inc. (HCCI)

Revenue (trailing twelve months): $477.87 million

Earnings per share (trailing twelve months): $2.05

All-time high (intraday): 36.29

Market cap: $782 million

Recommendation: Watch

Intended Portfolio: Real Money

The ESG Three

The ESG Three are three technically strong stocks selected from the 200 most-held stocks in environmental, social and governance focused mutual funds and ETFs. ESG fund holdings tend to be weighted toward blue-chip companies drawn from every industry which are rated highly in social and governance aspects. We screen top performers further to eliminate widely held companies we believe have clear environmental, social and/or governance problems. These aren’t formal stock picks but suggestions for those looking to explore additional stocks beyond the Greentech portfolio.

Thermo Scientific (TMO)

What is it?

A supplier of scientific instruments.

Why is it ESG?

Fewer product quality issues than competitors and corporate employee development programs considered in line with best practices. ESG funds own $1.5 billion of shares.

Why now?

An earnings beat in October and an agreement to partner with Merck on bringing to market a potential oral COVID-19 treatment.

Nvidia Inc. (NVDA)

What is it?

A computer processor maker.

Why is it ESG?

Excellent employee benefits and intensive research funding that are opening the business to Greentech possibilities, expanding beyond gaming and AI. ESG funds own $1.9 billion of shares.

Why now?

The company easily beat Q3 earnings expectations and strength from its core gaming and data center customers remains strong.

Marvell Technology (MRVL)

What is it?

A data infrastructure business.

Why is it ESG?

Industry-leading responsible minerals program and better-than-peers corporate governance practices. ESG funds hold $81 million of shares.

Why now?

A big gap higher at the start of December on excellent Q3 results, with shares holding most of the gains despite recent market worries around growth stocks.

Greentech Timer & Current Portfolio

Our Greentech Timer is bearish. Our Greentech Timer tells us to be buyers when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). Now, we’re below all three averages. Sub-sector-wise, wind and solar are bearish, while water and nuclear are short-term bearish, but over their 200-day lines, signifying their long-term uptrend is intact.

Four weeks ago, in mid-November, we heralded a release of the “animal spirits,” as Greentech had rallied quite strongly, finally breaking the downtrend lines drawn from the February peak. The omicron variant and inflation fears unexpectedly sucked the wind from the sails. Then two weeks ago, with our last issue, the sector was down, but still sitting on some support, a situation we called mixed-to-bearish. Our sector has gotten decidedly worse since, with a test of crucial support just 2% below prices today. That’s the mid-71 area on our Timer chart, a support level that has been set three times since May, when the sector arrested the February retracement from our recent highs.

Over the course of the seven months shown in the chart, Greentech clearly has found itself in a trading range, with the ceiling around 95 on the chart, an area also touched three times, starting in late April, just off the chart.

Yet, indexes can sometime be deceiving – they are only a slice of the sector and are often market cap weighted, as is our benchmark here, the Wilderhill Clean Energy Index. That means a handful of large-cap stocks performing poorly could be skewing true sentiment. Could looking at Greentech as a whole tell us something different?

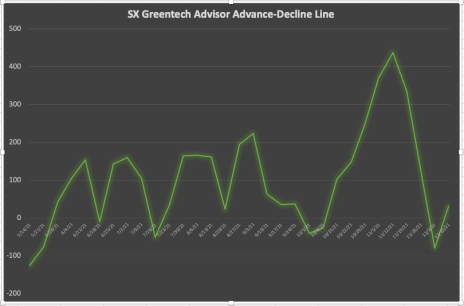

We calculated the weekly Advance-Decline line for Greentech from the bottom of the winter retracement – mid-May – through last week. Rather than using an index that’s a sampling of 30 to 40 stocks of the sector, we used the whole Greentech stock universe we follow of about 270 U.S.-listed Greentech stocks to compile the A-D line (the number of stocks in our Greentech universe changes a little over the weeks as new stocks have IPOs and the occasional stock gets dropped from coverage). The A-D line is a simple net summation of how many stocks per week advance and how many decline. In a bull market, A-D lines grow steadily stronger as more stocks post gains than losses. As the image here shows, the breadth of the October-November move suggested strongly that the rally was real and we should break out higher. The severity of the drop from that peak to now also shows just how ugly the market reaction since has been. In short, our A-D line is confirming what our Timer tells us: it’s a bear move in a rangebound market. Since May, what it’s been giving, it has been taking away.

Rangebound markets require a tough decision as a technical-based trader. Momentum stocks, which generate the big wins, need a trending market (up is preferable, but down can generate big profits too). Rangebound requires a different approach, betting on the trend shifting as it reaches its limit, trading in the reversal direction with a plan to sell as it reaches the other extreme of the range, ultimately booking modest profits. The biggest risk: that the stock finally breaks out of the range and we either surrender big upside for some profits or, worse, that we buy at the bottom of the range expecting its normal turn upward and instead it breaks to the downside and quickly adds losses with long-held support broken. Should Greentech hold the support it’s about to test here, we’ll be quicker to take profits on the upswing. We’ll also focus on less volatile stocks that are relative values, such as this issue’s featured stock.

For now, make sure you have a sell-stop on every holding to cut losses before they get too large.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price* on 12/14/21 | Gain/Loss | Rating | Sell-Stop |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.64 | 14.76 | 0.82% | Sold 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 158.95 | -10.20% | Hold | Near 151 |

| Archaea Energy (LFG) | LFG | 12/2/21 | 18.27 | 17.69 | -3.17% | Hold | |

| Array Technologies | ARRY | 11/18/21 | 25.3 | 17.70 | -30.04% | Sold 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 51.61 | 12.22% | Buy | Under 48 |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 59.19 | 76.90% | Sold 11/17/21 Sold 12/4/21 | |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 198.56 | -13.19% | Hold | Around 182 |

| ESS Tech | GWH | 11/18/21 | 14.97 | 13.80 | -7.82% | Buy | Near 11 |

| Heritage Crystal-Clean Inc. | HCCI | — | — | 31.35 | — | Watch | |

| KraneShares China Green Energy | KGRN | — | — | 45.69 | — | Watch | |

| Onsemi | ON | 8/4/21 | 44.63 | 62.34 | 39.68% | Hold | Half at Near 57; Half Under 48 |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 108.83 | -16.28% | Hold | Under 107 |

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price* on 12/14/21 | Gain/Loss | Rating | Note |

| European Sustainable Growth SPAC / ADS-Tec Energy | EUSGW | 10/20/21 | 1.66 | 1.50 | -10% | Buy | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.98 | 23% | Hold | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 5.40 | 111% | Hold | |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.41 | -42% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.74 | -33% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.46 | -19% | Hold | |

| Volta warrant | VLTA.WS | 6/16/21 | 2.21 | 2.39 | 8% | Hold |

*Price on date reflects the price sold at for closed positions regardless of date.

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When the sector is bearish like now, we keep our cash in U.S. Treasury bills. The approach of this portfolio relies heavily on sell-stops, based on portfolio and gambling risk-of-ruin theory. This approach absorbs small losses, preserving capital for big winners we let run, and defending as much as possible against the statistical risk of a string of losses washing us out of the market. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows.

Aemetis (AMTX)

A frustrating shift in Aemetis ended up triggering our sell-stop with Monday’s close. If you haven’t sold Tuesday, sell on any potential bounce higher soon. Shares are now below the 200-day moving average in the low 15 area, presenting real resistance in a bearish market. The Real Money Portfolio booked the sale Tuesday at 14.76, the average of the high-low for the session, leaving us a slight, 12-cents per share, profit. SOLD

Aptiv (APTV)

APTV remains over its 200-day of 155. There’s little news this week. Our sell-stop is “near 151.” Do we loosen to hold shares for the long haul and avoid getting stopped out? For now, we’re staying with the plan. HOLD

Archaea Energy (LFG)

We’re still slightly profitable on the landfill gas company and it’s holding the uptrend line drawn from its August low. No news, other than the warrants leftover from the SPAC going-public transaction were officially retired. Our sell-stop is “under 16.” Given market conditions we’re shifting our rating to Hold from Buy. HOLD

Array Technologies (ARRY)

We sold Array with a special bulletin two weeks ago, after it broke our sell-stop on the close of December 1. The portfolio booked a 30% loss, selling at 17.70. Shares are mired in the mid-17 area now. SOLD

Aspen Aerogels (ASPN)

ASPN is holding on well, with some cracks from market volatility. Still, shares are only about 4% below the 40-day moving average, and longer-term charts suggest they could hold here, rather than drop. Our sell-stop is “under 48.” We’re keeping our rating based on the stock’s recent strong relative performance. BUY

Centrus Energy (LEU)

As noted in last week’s update, the half position we still held in the uranium refiner was sold after triggering our sell-stop on December 3. The portfolio sold at 49.68 on December 4. We previously sold half our position in mid-November at 68.70, a 105% profit on that portion. Overall, we gained 77% on the total position in just over two months. The selloff isn’t Centrus’ issue – it’s profit taking that probably was telegraphed by shares far outpacing the longer-term moving averages in recent months. At their November peak of 85, they were nearly three times the value of the 200-day moving average, making the current move arguably a return to the normal upward pace. Centrus’ 200-day moving average sits at 33, which is a probable target. SOLD

Enphase Energy (ENPH)

The microinverter maker announced a move to establish an installer network in Mexico, as part of the company’s international expansion plans. Our sell-stop is “around 182,” initially a very loose stop to keep us in the trade long term. Shares gapped down Tuesday which is a concern we could be headed to a test of the support sitting above the stop level. HOLD

ESS Tech (GWH)

The medium-duration energy storage maker is a recently closed SPAC deal, so we have expected it to be volatile. Surprisingly, it’s not as volatile as other stocks in the sector, at least this week. Management finished restating the SPAC-era financials to account for SEC guidance on expensing warrants, a move that shouldn’t affect much current sentiment. Our sell-stop is “near 11” as an acknowledgement of SPAC-related volatility. We’re keeping our rating with the caveat this is a higher-risk trade. BUY

KraneShares China Green Energy (KGRN)

We continue to wait for the mostly China-listed Greentech stock fund to retreat down to support before buying. We’re watching for a move to or below the 200-day moving average in an orderly enough fashion that suggests shares are rangebound and will move higher again. WATCH

Onsemi (ON)

We remain up strongly with ON; we’re up about 45% on the position. Given market conditions we’re going to set a sell-stop for half the position “near 57” which is below the 40-day support line at 57.69 now. Our buy price, 44.63, is right about where long-term support sits. We’re going to adjust the sell-stop on the other half of ON to “below 48,” which would be a bearish erasure of a prior bullish gap higher. Our prior sell-stop for the whole position was “under 50.” There’s little news for the semiconductor maker this week. We’re shifting our rating to Hold from Buy based on market conditions. HOLD

Wolfspeed (WOLF)

WOLF is starting to eat into a gap zone of 96-105 that provides support for shares. Opening at 104 Tuesday, we did see support come in as the gap suggests, which is a positive. Selling volume also lightened last week. Our sell-stop is “under 107.” The next level of support at 101 is technically more important, as it’s both the 200-day average and the area that would keep shares bullish on the monthly charts by holding onto half of November’s strong gains. We’re shifting our rating from Buy to Hold. HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. Right now, five of our six holdings made up a basket of SPAC warrant purchases in June, intended to be held as a group long term. European Sustainable Growth wasn’t part of that group. We may or may not recommend sell-stops in Excelsior.

European Sustainable Growth SPAC / ADS-Tec Energy (EUSGW)

The merger between the SPAC and ADS-Tec Energy will go into effect December 21, taking some risk off the table here. The new tickers will be ADSE for shares, ADSEW for our warrants. Warrants are around 1.50, below our Buy price, but ADS-Tec is a conviction buy for us to play the rapid EV charger expansion. An alternative fuels filling station company in France, V-Gas, is installing three charging stations with an additional undisclosed number planned, according to a press release Tuesday. There is no sell-stop. BUY

Li-Cycle (LICY.WS)

Li-Cycle is expanding its Rochester, NY plant to be a hub, as planned, and is bumping up the amount of capacity it plans in the near term overall to 35,000 tons, from a previously planned 25,000. The expansion will be funded all by cash on hand. Li-Cycle also struck a non-binding deal with Korean conglomerate LG to collaborate on a closed-loop li-ion battery system. The deal includes a $50 million purchase of Li-Cycle shares by March 13. Warrants are down a buck from last week, though. Li-Cycle has the option to initiate a cashless redemption if shares trade at $10 or greater for 20 of 30 days, which shares have. For that reason, we don’t recommend buying the warrants any longer. HOLD

Navitas Semiconductor (NVTSW)

Navitas opened a new China design center for gallium nitride chips, to encourage its inclusion in more electronics. Warrants are down about two dollars from last week, but still more than double our purchase price. We sold three-quarters of the position in mid-November at 6.68, booking 160% profit on that portion. Warrants have been pushing over 7 regularly, so planning to sell the rest over that mark is a fine strategy. We’re holding the balance for a possible more dramatic spike higher. There are redemption clauses executable now by the company, so we no longer recommend buying the Navitas warrants. HOLD.

Origin Materials (ORGNW)

No news for the carbon-negative plastics maker this week. Origin doesn’t have a warrant redemption clause for when shares are trading above 10 for a period of time, unlike our other holdings. Warrants are weaker this week, but not concerning. HOLD

Ree Automotive (REEAW)

Toyota’s Hino division will be showing off its Ree chassis-based concept vehicle at the Consumer Electronics Show in Las Vegas next month. Warrants have been basically steady in the 70-cents area. The underlying shares have stabilized above 4. HOLD

ReNew Energy Global (RNWWW)

A Goldman Sachs SEC filing discloses that it owns 34 million shares of ReNew and intends to sell at least 20.5 million when the lockup period expires. Last week the brokerage side of their business issued a “Buy” rating on the stock. We remain underwater on the warrants of ReNew, India’s largest renewable energy owner and operator. HOLD

Volta Inc (VLTA.WS)

We’re modestly profitable on the warrants, which have weakened this week. Little news from the U.S. EV charger company. Volta now has the option to redeem warrants when shares trade at 10 or higher for 20 out of 30 days. For that reason, we’re no longer recommend buying the warrants. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue is published Wednesday, January 4. Our regular weekly update comes next Wednesday, December 21. We will send a special bulletin with any interim recommendations. Contact me anytime with questions or comments at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on January 5, 2021.