The recent market sell-off has made for a bearish-looking market – yet it also has opened up some bargain basement opportunities in Greentech companies. This issue, we recommend kicking the tires on discounted warrants in two companies with compelling business models and strong outlooks.

As always, we also suggest three ESG stocks to consider and review our current portfolios.

Cabot SX Greentech Issue: May 18, 2022

Greentech Outlook

The primary focus of SX Greentech Advisor is to produce profits. By making money investing in Greentech, we help strengthen the capital markets for companies that are reducing carbon and creating revolutionary ideas that are de-carbonizing the future. That’s done by improving trading volume, getting more investors into the market and allowing these companies to access more capital at better rates. That helps fuel their businesses and further innovation.

But I hope you’re like me, too, and have a genuine interest in helping the environment. That’s why I’m pleased to announce that I’ve made SX Greentech Advisor carbon neutral for all of us, through the purchase of a sliver of carbon sequestration production capacity. I calculated the carbon generated by the equipment I use to produce the newsletter – my MacBook Air, the monitor and keyboard I use at my desk with it, plus the lamps, speakers and ancillary items I use in my workday, like the iPad I use for paging through stock charts away from my desk, plus the heat and electricity used by my office (the biggest carbon contributor, by far). It also tallies my estimate of the computer and email power used in the editing and emailing of this letter (the average person contributes about 136 grams of Co2 a year to the atmosphere through email). While it’s a small action by any measure (this isn’t a very carbon intensive operation) I hope you consider this a gift of thanks from me to you for being a subscriber.

Ideally, I could recommend a carbon sequestration stock along with this announcement, but with so many Greentech technologies today, most of them are pre-public businesses. Many of the publicly traded companies doing carbon sequestration now – Equinor (EQNR) appears to be the most advanced – are also oil and gas producers, and none of them are yet doing sequestration at scale to offset their fossil fuel negatives.

Our offsetting carbon is purchased through Climeworks, which is a direct-air capture plant that opened in Iceland in September. Iceland is a good spot for carbon projects, as its abundant geothermal energy allows the carbon-free powering of Climeworks’ direct air capture containers.

The system works by pulling in air which is them chemically bound to the air filter, emitting Co2-free air back to the atmosphere. Once the filter is saturated with carbon, the Co2 is mixed with water and pumped deep underground where over coming years it turns to stone. One day, very many more powerful versions of a system like this will be needed to de-carbonize the atmosphere to return Earth’s Co2 levels to normal.

Greentech Timer

Greentech remains bearish. The sector hit a 22-month low last week, as measured by the performance of the Wilderhill Clean Energy Index. It’s a level, around 43 in the associated ETF (PBW), that was the peak of the pre-pandemic cleantech bull market. It also was back in 2009-2011 the ceiling for the sector. Trading this week so far is mildly encouraging and we could be back into an upswing that will test resistance overhead at 51 and then 57. But the overall signal is telling us to continue to be patient and diligent on having sell-stops and exit plans on your holdings. The major subsectors – solar, wind and water – are all bearish as well. Utilities are mixed.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). We are below all the averages this week and they are all now trending downward.

Two Opportunities in Warrants: Altus Power and ESS Tech

Overview

We’ve invested a bit in warrants derived from Special Purpose Acquisition Companies (SPACs). Last June we bought a basket of five Greentech SPACs with the objective of believing that while we may pull a rock on one, it’d be more than offset by a big winner or two, with the remainder being modest performers. So far we booked a 94% on Navitas Semiconductor warrants from that basket, and a 4% gain on Li-Cycle. We also have ADS-Tec warrants as a separate buy of a company we quite like, plus the warrants from two SPAC units we purchased for the Real Money Portfolio.

This issue we’re examining two additional companies’ warrants, both of which are past the SPAC stage, having been merged and in operation. We’re intending them for the Excelsior portfolio, where we have no portfolio or position size guidance, to allow you to buy in at a level you’re comfortable with and also to reflect the reality that we may need to hold the positions for a long period to see a profit.

As with all SPAC warrants, the ultimate risk here is losing everything if we let the warrants expire, or a very prolonged market slump means we can never exercise the warrants or sell them at a profit. Yet market demand for SPACs has dried up to such an extent that there are some that appear to offer a compelling upside, through a combination of cheap prices, beneficial conversion terms and good underlying businesses. The SPAC market historically has gone through troughs, and we expect that it will rebound again.

Altus Power Inc. Warrants (AMPS/WS)

Business Overview

Altus is a U.S.-focused provider of solar energy to commercial businesses. Unlike utility and residential solar, commercial solar has been a more difficult sell – homeowners are driven by word-of-mouth and seeing neighbors’ installations, while utilities are in the business of producing energy as cheap as they can, making solar an obvious pursuit. Altus markets, develops and manages solar projects for commercial and industrial properties. It closed its going-public by SPAC deal in mid-December, and has suffered in the stock market from the broad distaste for SPACs. Yet its business is doing quite well.

The current portfolio is 362 megawatts (MW) and serves a variety of customers, mainly in states that have had strong government support for solar. Its sales mix right now is 62% northeast, 42% west and most of the rest the south. It includes about 55,000 residential customers through community programs, primarily apartment buildings municipally or corporate owned. To find customers, Altus teams with CBRE Group (CBRE) and Blackstone (BX), two huge commercial property owners in the U.S. (and shareholders of Altus – it went public by a CBRE-sponsored SPAC with financing from Blackstone).

In the first quarter of 2022, reported Monday, operating revenue rose 54% to $19.2 million with net income of $60.1 million – the obvious oddity of that caused by a $64.8 million non-cash gain from fair value of warrants and “alignment shares,” another instrument that was part of the SPAC unit and is now retired. Basically, shares and warrant prices fell and benefitted the company. As they rise, they will negatively affect the bottom line going forward. Stripping that out to an adjusted EBITDA reported by the company, the business generated $8.75 million, up from adjusted EBITDA of $6.33 million a year ago. Adjusted EBITDA for the year should come in around $60 million, give or take 5%, according to management.

Altus has $330 million in cash and $225 million in long-term debt, most fixed around a 3% interest rate.

Business Outlook

Rising energy prices should benefit Altus this year, since 60% of its production is under rate-adjustable contracts, with 40% under fixed rate contracts. The cost of producing solar, of course, isn’t affected by oil and gas prices, so upward adjustments will be highly profitable.

Altus has a project pipeline that will more than triple the business. In its Q1 call, management said they have 1 gigawatt (GW) of solar in their sights, half of which is operating solar they are close to acquiring and the other projects they are developing. The latter includes a recently inked 300 MW deal with Trammell Crow, the largest commercial real estate developer in the country, which will see Altus put solar and energy storage on top of some of 35 million square feet of properties. It does have supply chain risk, which is ongoing in solar from pandemic shutdowns and delays in Asia. The company is mitigating that some with an American supplier Heliene, which agreed to a 250 MW supply deal in February.

Only about 5% of the commercial and industrial solar market is tapped in the U.S., giving Altus a large market to compete for. Of existing contracts, the remaining life on what are typically 20-year deals is more than 18 years. Altus also has space to expand into EV charging, primarily as a selling point to employers, and using energy storage to participate in wholesale energy markets.

For this year, sales should come in around $120 million, based on management’s indication of an adjusted EBITDA margin of 50% for the year. That would be lower than $137 million indicated to investors last July when the merger was announced.

Issues to Consider:

- AMPS’ market cap is about $785 million, based on company-disclosed 153.59 million diluted sales and its recent price of 5 per share.

- CBRE and Blackstone’s shareholding in Altus doesn’t mean they will generate sales for Altus. SPAC sponsors typically make profits from the act of getting a company public.

- Tax policy and solar incentives are undoubtedly an influence on the business, but not one quantified in detail by management.

Warrant Analysis

Altus closed its merger on December 10, 2021, with the warrants expiring five years from then, in 2026. The warrants had gotten a bump in July when the merger was announced. They had been trading at 1, long the default “normal” price for a SPAC warrant, quickly rallying to 2. They peaked at 3.14 in November and have since slid with market-wide bearishness on growth securities. As recently as mid-March, before Altus released its first earnings results as a public company, the warrants traded at 2.03. They really sold off in the recent volatile market, with high selling volume at the start of May. The recent price of 0.79 is the weakest the warrants have been, but still better than the average SPAC-derived warrant, which was trading at 47 cents a couple of months ago when we last surveyed the whole market, which, though weak, was still stronger then than now. The warrants are convertible to one-to-one for shares by paying $11 a piece (which is different from the typical $11.50 exercise cost of other SPACs).

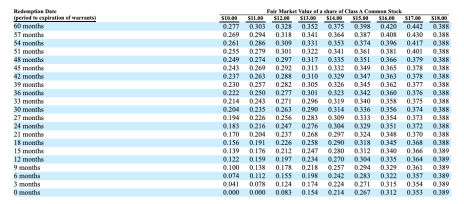

The AMPS warrants have two company-forced redemption prices. One is if shares trade at or above 18 for 20 of any 30-day period. The other is if shares trade at or above 10 for 20 of 30 days. If they trade above 18 for 20 of 30 days, we’re assuredly well profitable on the warrants with them having an intrinsic value of 7 a piece at that price (the difference between 18 and the exercise price). Normally, SPACs with the redemption at 10 clause we avoid from a cost-reward analysis, but with Altus warrants trading so cheaply they present a good profile for potential profit. That’s because the $10 redemption is a cashless one, in which a portion of each warrant is surrendered to pay for the share, and the rest of the warrant converts into a share (though only on a whole warrant to share basis, no fractionals). This is Altus’ $10 redemption table, from the final prospectus. Note it is different from the typical conversion table SPACs use.

What does this tell us? We’re five months out from the merger, so there are 55 months remaining. Let’s assume next month, so the line 54 months to redemption in the table, AMPS rallies to trade at an average of 10, enough to trigger the redemption. We’d surrender four warrants to pay for the cashless redemption. At recent prices for the warrants, about 0.80, we’d have spent $3.20 to receive a share that should still be trading at 10 – tripling our money. You can see that the same scenario nine months before expiration, we’d have to pay 10 warrants, or an $8 investment, for a $10 share – still economical.

If AMPS’ price rallies even stronger, we pay fewer warrants. For instance, 36 months until redemption, if the average price is 14, we’d surrender four warrants – the table’s ratio off 0.323 forcing us to surrender nearly all of one warrant to round to a full share. Still, our theoretical investment of $3.20 would net us $11.80 profit.

As you can see, the strategy becomes uneconomical at current prices with 12 months left until expiration. The table isn’t comprehensive – that is, if the average price or time remaining isn’t indicated on the table, it’ll be calculated by Altus in line with what’s published.

The risks of this strategy:

- Altus shares never rise and therefore never convert and they expire worthless in December 2026.

- AMPS warrant prices in the market today may be abnormally strong now, and their price never rebounds.

- Altus hits the hurdle to convert warrants, but in the time period between hitting the redemption price and when conversion can occur (a lag of three days) or when we convert (we have 33 days after notice), shares fall again and we can only book a loss.

- Warrant liquidity may be such that we can never exit our position, or can only exit at a loss.

- Unforeseen regulatory or corporate actions negate this strategy.

What to Do Now

Altus shares are trading at an Enterprise Value to forward company-adjusted EBITDA of 17.7, which is below the stock market’s trailing EV/EBITDA of 18.2 and higher than renewable energy’s 16.9, according to data from NYU, which ignores firms with negative EBITDA. It’s not apples to apples comparing forward to trailing ratios, and forward data for the market and sector would likely show Altus in a better light. The valuation and compelling warrant price with a 4.5-year runway to turn a profit, seems a compelling enough equation to add a position here. BUY

Altus Power Warrants (AMPS/WS)

Revenue (trailing 12 months): $78.4 million

Earnings per share most recent quarter: 0.39

All-time high (intraday): 3.14

Market cap: $785 million

Recommendation: BUY

Intended Portfolio: Excelsior

ESS Technology Warrants (GWH/WS)

Business Overview

In a sign that companies and their stocks are often two different things, we previously featured ESS Tech (GWH) shares in the November 17 issue of SX Greentech Advisor. That turned out to be the peak of a mini bull move by Greentech, and we were quickly stopped out. Our view on the company remains positive, however. ESS is an Oregon-based maker of longer duration energy storage that is an iron-based system called an iron flow battery. A flow battery is one where two chemical solutions are separated by a membrane and the exchange of ions across the membrane charges and discharges the battery. ESS’ battery uses iron, salt and water. It’s a hundred-year-old idea, but one bedeviled by the fact the membrane would get clogged. ESS solved that by introducing a proton pump, which maintains balance between the sides by passively mixing hydrogen, created in the battery and which causes the cell failure, back into the solution to maintain the pH and states of charge needed by the battery.

ESS’ product being sold now is called Energy Warehouse, a shipping container-sized box that offers medium-term energy storage and discharge of four to 12 hours = of 50 to 90 kilowatt hours (KwH). It’s cheaper and safer than lithium-ion batteries and has a start-up discharge time of less than a second.

Business Outlook

Right now, ESS is underperforming. It has shipped Energy Warehouses to clients but because of “whack-a-mole” supply chain issues and contract benchmarks management won’t divulge, they have yet to recognize any revenue from the shipments. Last year, management said they would see perhaps $2 million at the end of 2021 and some in the first quarter. In Q1, reported last week, the company had shipped two energy warehouses to San Diego Gas & Electric and will ship four more this week, after also shipping a handful to other business in Q4. Management said it still expects to ship 40 to 50 Energy warehouses in 2022 and, if it can recognize revenue on all of them under the contracted schedules, would generate about $10 million revenue. That too is well below projections offered up last year of $37 million (although management had been upfront that just around $7 million of that figure was actually booked business). Management says future deals will allow it to book sales more quickly.

Yet, we believe the supply chain and revenue issues are growing pains, not symptomatic of larger issues. In particular, the iron, water and salt combination means there is no exposure to rising lithium costs and expected lithium tightness, projections for which are part of what’s holding back many EV and energy storage stocks. The Ukraine war and the urgency it has created for Europe to wean itself from Russian natural gas appear to have sparked much more interest from the continent for ESS’ product. A larger version of the Energy Warehouse, called Energy Center, will begin production next year and offer 3 megawatt (MYW) storage.

Issues to Consider:

- Fully diluted share count is 151.86 million, giving ESS a market cap of $810 million, according to company disclosed data.

- Management says it has received requests-for-proposals or other serious indications of interest for $8 billion of storage projects. They aren’t offering any estimate on how much or when any business may come from those.

- ESS will have $120 million in cash at year-end, according to management, after booking $100 million of expenses. The company books expenses for shipped products immediately, even as revenue recognition is delayed, as well as parts for future orders. This implies we should see better quarters ahead.

Warrant Analysis

ESS Tech shares had a post-SPAC Merger peak in the mid-16 area in late November. Since then shares have fallen to as low as 3.77 last week and are trading a bit over 5 now, after a good reaction to earnings. The culprit, as in many SPACs, is the rotation out of SPAC-era investors and the lack of new investors coming in to take their place: simply finding institutional support will take time. No surprise, its warrants have similarly weakened, from 5 in late November to a low of 0.55 in February; they have firmed a bit since, to a dollar.

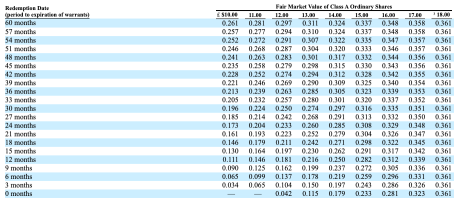

ESS warrants are valid for five years since the merger closed, on October 11, 2021. One warrant is the right to buy a share at $11.50. The shares have two mandatory redemption clauses the company can exercise. One is if shares trade at or above 18 for 20 days of any 30-day period. The other is if shares trade at or above 10 for 20 of 30 days. Normally, SPACs with the 10 clause we avoid from a cost-reward analysis, but with ESS warrants trading so cheaply they present a good profile for potential profit. That’s because the $10 redemption is a cashless basis one, in which a portion of each warrant is surrendered to pay for the share, and the rest of the warrant converts into a share (though only on a whole warrant to share basis, no fractionals). This is ESS’ $10 redemption table, from the final prospectus.

What does this tell us? We’re seven months out from the merger, so there are 53 months remaining. Let’s assume in two months, so 51 months to expiration, GWH rallies and trades right around 10 for the month and the company does its mandatory redemption (it almost certainly would). We’d surrender about three quarters of each warrant to pay for the shares and receive 0.246 share per warrant. That means we’d need to have 5 warrants to pay for one. That would cost us $5 (five warrants) at recent prices to receive a share that should still be trading at 10 – doubling our money.

As another example: shares spike higher to an average price of 16 a share and are called with 30 months left. We’d spend three warrants to get one share probably trading at 16, a 333% gain. With either rally, warrants should strengthen in the trading market too, perhaps allowing us to exit at a profit without waiting for conversion.

As you can see, the strategy becomes uneconomical at current prices with 12 months left until expiration.

The risks we see:

- ESS shares never rise and therefore never convert and they expire in October 2026.

- ESS warrant prices may be abnormally strong now, and their prices fall (the average SPAC-derived warrant trades well under a dollar now).

- ESS shares hit the hurdle to convert warrants, but in the time period between hitting the redemption price and when conversion can occur (a lag of three days) shares fall again and we can only book a loss.

- Warrant liquidity may be such we can never exit our position, or can only exit at a loss.

- Unforeseen regulatory or corporate actions negate this strategy.

What to Do Now

ESS warrants have tended to be stronger than other SPAC peers. However, we believe the next market dip should provide an entry price better than a dollar and given management needs to prove it is booking revenue to Wall Street, we should have time. As long as Greentech is bearish, we expect warrants will ease below a dollar for a better entry. WATCH

ESS Technology Warrants (GWH/WS)

Revenue (trailing 12 months): none

Earnings per share most recent quarter: (0.04)

All-time high (intraday): 6.65

Market cap: $810 million

Recommendation: WATCH

Intended Portfolio: Excelsior

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

Eli Lilly & Co. (LLY)

What is it?

A pharmaceutical company

Why is it ESG?

Robust employee engagement makes it stand out, with other ESG metric considered average to peers, by MSCI. ESG funds own $577 million of shares.

Why now?

A big slate of recent drug approvals and label expansions over the past year forecast strong growth ahead although management trimmed 2022 guidance on upfront expenses. Shares are about 5% off their all-time high.

AbbVie Inc (ABBV)

What is it?

A pharmaceutical company

Why is it ESG?

Lower than average employee turnover (8% annually vs. 12%-plus for peers) suggests excellent employee engagement. The company also leads peers in environmental metrics. ESG funds own $255 million of shares.

Why now?

Two immunology drugs appear on track to more than replace blockbuster Humira, which sees its exclusivity end in 2023. Shares are lower after lower 2022 guidance in late April, presenting a possible value for longer-term buyers.

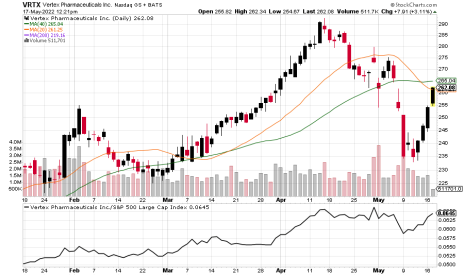

Vertex Pharmaceuticals (VRTX)

What is it?

A pharmaceutical company

Why is it ESG?

On par with peers on most ESG metrics, its employee training programs and its efforts at monitoring executive ethics compliance are highlighted as strengths by MSCI. ESG funds own $225 million of shares.

Why now?

Q1 sales were up 22%, driven by a cystic fibrosis treatment, plus a number of potential blockbusters in its drug development pipeline. Shares are rebounding and are 15% off their all-time high, a potentially good entry point.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 5/17/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.80 | 1.14% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.15 | -34.78% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.20 | 0.00% | Hold | None |

| Cleanway Energy | CWEN | 3/17/22 | 33.41 | 32.64 | -2.30% | Hold | Around 28 |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 79.16 | -6.80% | Hold | Below 62 |

| Daseke | DSKE | 2/3/22 | 11.23 | 8.04 | -28.41% | Hold | Under 7.19 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.68 | 2.54% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.15 | -16.67% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.19 | 11.76% | Hold | None |

* Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 5/18/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.56 | -66% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 58.75 | -9% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.76 | -28% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.26 | -48% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.22 | -80% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.27 | -30% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.61 | -72% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Advanced Drainage Systems (WMS)

We sold May 9 on a stop-loss violation, as detailed in last week’s update. Shares have rebounded to around 100 since but remain bearish. SOLD

Archaea Energy (LFG)

We sold, taking a 9% profit, on May 10, as detailed in last week’s update. Shares have weakened another 6% since. SOLD

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

The SPAC’s quarterly financials released this week confirm the trust value for our shares is 10.10. Between the trust and the prices for our warrants and rights, we’re modestly profitable. HOLD

Clearway Energy (CWEN/A)

No news this past week on our renewable energy producer. Shares are stronger after nearing our stop-loss level at the end of April. They’re still beneath the longer-term moving averages, but over their 20-day average, which is encouraging. Ahead: a per-share dividend of $0.3536, payable to shareholders as of June 15. Our sell-stop is ‘around 28,’ with the mid-27 area a level that would be a bearish breakout of a price channel. HOLD

Darling Ingredients (DAR)

Shares held a test of the 200-day moving average and are back above the other moving averages we watch this week. Action suggests a test of the 2022 ceiling of 85 ahead, with a close over that level setting the stage for a strong advance. HOLD

Daseke (DSKE)

Daseke, which specializes in transporting large, unwieldy items like wind turbine arms, is struggling against resistance, with weak follow-through after its quite positive earnings results two weeks ago. Basically, the company still seems dragged down by association with weak trucking rates in an area it doesn’t operate in. Our sell-stop is ‘under 7.19.’ HOLD

Energy Vault (NRGV)

There just got to be too many red flags on the company, with management suggesting too many things can go wrong (delays, expenses) in the months ahead, so in a bear market with shares gapping sharply lower, we elected to sell our half-sized position in the energy storage business with last week’s update. The portfolio booked the sale at 10.14 on Thursday, the mid-point between the high and low for the day, a 46% loss. The sole bright spot: The trade’s loss equates to about 1.9% of our Real Money Portfolio capital under our strategy, within the acceptable range of losses for a long-term viable portfolio under risk-of-ruin scenarios. SOLD

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

The SPAC’s quarterly report confirms our trust value per share is $10, making us modestly profitable on the position if we see it through, even with the warrants and rights weak in a generally poor market for SPACs right now. HOLD

Natural Grocers by Vitamin Cottage (NGVC)

Market volatility sent shares falling instead of rising after a better-than-expected earnings report, so we’re watching to see how the organic grocery store chain moves from here. Shares are improved, but face some resistance up to 20. WATCH

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas has been closed out last month at a total of a 127% return.

ADS-Tec Energy (ADSEW)

A much stronger open for the fast EV charger maker Tuesday was quickly sold into. There’s no news, but we continue to believe ADS-Tec is technologically well positioned in the EV charger sector. Warrants are weak on general market conditions. HOLD

Constellation Energy (CEG)

The nuclear energy producer reported a fine Q1 last Thursday though it came in below consensus earnings, at 32 cents a share, and sales, at $5.59 billion. Business was hurt by its legacy natural gas plants facing higher fuel costs. Management reaffirmed full-year adjusted EBITDA guidance with a midpoint of $2.55 billion. Hopes are for tax breaks for nuclear energy to be passed ahead of the upcoming midterm elections. We will collect a dividend of $0.141 a share, payable on June 10. Shares are in a resistance zone right now, holding up fine. HOLD

FuelCell Energy (FCEL)

The volatile fuel cell stock is bearish and we generally don’t anticipate a turnaround until the broader Greentech sector improves. Earnings results coming in early June could be a catalyst. HOLD

Origin Materials (ORGNW)

Warrants are basically unchanged over the week. HOLD

Ree Automotive (REEAW)

Tuesday Ree reported a 10 cents per-share loss compared to expectations of a loss of 11 cents. Costs and equity grants, two of our past concerns, appear under control, and should get the company into production as expected next year. The company, with Rockwell Automation, will build an EV plant in the U.K. Costs of that aren’t disclosed yet. Ree also said it will begin customer evaluation of an EV bus with EAVX, a division of U.S. truck maker JB Poindexter, this summer. HOLD

ReNew Energy Global (RNWWW)

No news and light trading in the India renewable energy producer. HOLD

Volta Inc (VLTA.WS)

In its latest 10-Q management said it has “substantial doubt” about its ability to continue as a going concern for the next 12 months given its roughly $400 million in accumulated deficit and $200 million cash – in short, they need to raise more money. The pronouncement hasn’t affected share or warrant prices. Shares and warrants are weak, but as part of our 2021 SPAC warrant basket trade strategy, we’re holding for now. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue is published Wednesday, June 1. A weekly update will come as usual next Wednesday, May 25, with any interim bulletins sent as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on June 1, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.