A difficult June closed out the most challenging first half to a trading year in a very long time. Caution remains our primary watchword, but we continue to hold a selection of the strongest stocks in Greentech and see some opportunities to make more incremental gains even in these difficult conditions. This issue, we add to our Watch list a renewable energy producer whose chart suggests a breakout is soon to come.

Also this issue, three fresh stocks to consider in our ESG Three, and we touch base on our portfolios and see what our exclusive Greentech advance-decline line is telling us.

Cabot SX Greentech Issue: July 6, 2022

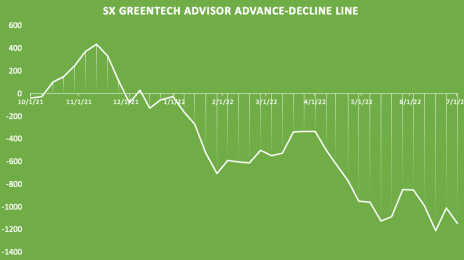

A Look at the Advance-Decline Line

We last discussed the Greentech Advance-Decline line in our December 15 issue. The Advance-Decline line is a simple summation of the weekly moves of the stocks in the Greentech universe – the number of stocks that gain minus the ones that lose money (ones that are unchanged are ignored). The use of an A-D chart is to spot divergences between the price chart. For example, if prices make a fresh low but the advance-decline line doesn’t make new low, that a bullish divergence – it hints sentiment is improving.

As the updated A-D line here shows, we had a good advance in November before entering this year largely neutral. Unfortunately for us right now, the Greentech A-D line doesn’t tell us of any bullishness below the surface – it’s confirming the price chart for the sector, with a clear downtrend line and making new lows as the price chart makes new lows. Things remain bearish.

Greentech Timer

Last week Greentech failed to hold a modest push over the near-term moving averages and by our definition, that leaves the Greentech Timer also telling us the sector is bearish. Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving averages and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential).

Subsector-wise, wind, water, nuclear are all similarly bearish. Solar, encouraged by easing tariffs, is offering some hope it could turn into a leader after having been the lagging sector for most of the past two years.

Wind

Water

Nuclear

Solar

So, while things are bleak at the moment, Greentech largely reflects the overall stock market, especially technology and growth stocks. There were some signs last week the bears are losing a bit of fervor for pushing equities lower from here, but it may just be a pause in a longer move lower. On a fundamental basis, we watch the S&P 500 price-to-earnings ratio as a sign of when bear runs may be turning. The index’ P/E sits at 19 entering this week. While that’s down from 24.5 in November’s mini-peak – and well off the P/E of 39 in December 2020 – we probably need to see it ease back into the 15 area –roughly its long-term median – before value propositions draw buyers back in.

Overall, we expect there need to be signs inflation is getting under control so big traders start projecting out what values they want to pay for growth going forward. Inflation lowers projections for future net returns over other investments, such as fixed income, and also generates immediate worries about consumer spending and operating margins. While oil and metal commodities are easing of late, potentially a positive, there are worries that any retreat by them is a sign of weakening economies. The good news for us is we don’t need to be fully invested. Cash and some opportunistic trades keep us from bearing the brunt of the selloff.

Featured Stock: Ormat Technologies (ORA)

Ormat is an established developer and operator of geothermal power plants that’s been expanding to related renewable operations in recent years. The company has been in operation for more than 50 years and is a pioneer in the sector. It’s also the second-largest operator of geothermal assets in the country, after Calpine, a utility.

At its most basic, geothermal takes steam produced beneath the earth’s surface from hot water heated by magma to generate electricity. The World Bank estimates there are 70 to 80 gigawatts (GW) of geothermal power potential to be tapped by existing technologies. The world market remains a sliver of that, at 15.9 GW at the end of 2021, up from 246 megawatts (MW), or 0.25 GW, from the year before, according to data from ThinkGeo Energy, an industry publication.

Business Model

Ormat owns and operates 910 MW of geothermal in 23 developments in the U.S. and abroad, mainly around the “ring of fire” of the Pacific Ocean, where volcanic activity puts geothermal resources relatively close to the surface. About 30% of capacity is international, in Guatemala, Kenya, Honduras, France’s Guadeloupe island and Indonesia.

Another 53 MW of capacity is waste energy recovery, what the company calls REG, much of it in Nevada for the benefit of the Los Angeles water and power department. Ormat’s REG mainly grabs heat from hot-springs-related facilities and also applies it to general industrial processes at scattered locations worldwide.

A small part of the business is solar, about 13 MW after an expansion this year by 6 MW, all at Tungsten Mountain, Nevada, as part of hybrid plant using solar power to operate a geothermal plant the company has on site.

In 2017, Ormat entered the energy storage market when it acquired a Philadelphia company, Viridity Energy, for $35 million. It now has 83 MW of renewable energy storage, about half in New Jersey and the rest mainly in California and Texas.

Management says the business will produce revenue of $710 million to $735 million this year with adjusted EBITDA around $440 million. Wall Street expects about $73 million net income, or $1.30 per share earnings in 2022, a fraction of a penny better than last year. The stock pays a dividend of 12 cents a share, quarterly. The most recent distribution was in May.

Business Outlook

Never a fast growth organization, Ormat management is starting to focus on quickening its pace, embracing energy storage for improving growth, looking to triple its size to about 290 MW by the end of next year through eight projects, all in existing U.S. markets, to take advantage of established markets where energy demand during peak times can yield strong prices for stored electricity.

Ormat is also aiming to boost total electricity generation capacity to 1.2 GW by year-end 2023 (up from 910 MW entering this year). This will come from nine geothermal projects under development and six solar projects underway (all in the U.S.). Ormat is vertically integrated, meaning it manufacturers essentially everything it needs for geothermal, resulting in little supply chain exposure, according to management. Solar would be subject to the more typical supply chain and tariff issues the market has experienced.

Longer term, Ormat is targeting total capacity – generation and storage – of 2.2 GW by 2026 year’s end. That should produce revenue of $1.15 billion in 2026, double 2021. Beyond that, management sees Indonesia, an OPEC member but one with massive potential geothermal capabilities, as a key to growth, as well as increased land permitting and legislative support in the U.S. On top of those two keys, acquiring new resources is also seen as part of strategy, with little detail provided beyond that potentiality.

Debt and financing capabilities all fine, total net debt is $1.4 billion.

In short, Ormat is a solid, well-run business that is dependent on capacity expansion for long-term growth and benefits from incremental increases in electricity rates it gets paid.

Issues to Consider:

- Geothermal isn’t as quick-growing a business as other forms of renewables. Over the past 10 years, Ormat has doubled its geothermal capacity, a little better than 7% annual growth rate. The next few years have Ormat aiming for double that rate. Can management execute?

- ORA tends to trade at a high price-to-earnings ratio, – at a 60 P/E now, shares are closer to the top of their past 10-year range of 20 to 90.

- Near-term benefits from geothermal incentives seen in the U.S. infrastructure bill have yet to appear to have an effect on business generation.

Technical Analysis

Ormat’s selection this issue is primarily a technically driven one. Shares are showing excellent relative strength to the S&P 500 and show various price and trading action that suggest it may be close to exiting a consolidation period and breaking out to the upside. Right now, shares are in a range between 70 and 85, with moving average support at 75. Shares had a spike to all-time highs at 127 at the peak of the pandemic bull market in early 2021, but otherwise have conformed to a slow, steady, long-term uptrend that suggest a firm bottom of 65 to the downside for shares.

What to Do Now

We’re aiming in the current market environment to hit singles, as they say, rather than home runs, here. Technically, ORA would break out of a consolidating double-bottom type formation if shares can hit 86.60 on strong volume. That would be our point to buy, and then set up to take profits fairly quickly. WATCH

Ormat Technologies (ORA)

Revenue (trailing 12 months): $680.44 million

Earnings per share (TTM): $1.16

All-time high (intraday): 127.38

Market cap: $4.3 billion

Recommendation: WATCH

Intended Portfolio: Real Money

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

Vertex Pharmaceuticals (VRTX)

What is it?

A pharmaceutical company

Why is it ESG?

The largest maker of cystic fibrosis therapies has a robust employee engagement program and has corporate governance on par with global peers. ESG funds own $180 million of shares.

Why now?

The 2019 rollout of Trikafta, a new combination cystic fibrosis therapy, is greatly expanding Vertex’ market. In Q1, Trikafta was a remarkable 84% of sales.

McKesson Corp. (MCK)

What is it?

A pharmaceutical and medical supplies distribution business.

Why is it ESG?

Its corporate and board structure are seen as the most shareholder-friendly in the industry. The company still has exposure under its role in the U.S. opioid epidemic, however. ESG funds own $70 million of shares.

Why now?

McKesson is one of the “big three” pharma distributors in the U.S., so it benefits from the ever-increasing American marketplace for specialty drugs. Opioid exposure has declined through legal settlements.

General Mills Inc. (GIS)

What is it?

A food producer

Why is it ESG?

Mainly U.S.-focused means it has low exposure to corruption concerns and the business is making effort to source lower environmentally stressed crops. ESG funds own $133 million of shares.

Why now?

Strong quarterly performance vaulted shares to an all-time high last week on excellent volume.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 7/5/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.82 | 1.34% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.13 | -43.48% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.19 | -5.00% | Hold | None |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 32.17 | -3.71% | Hold | Around 28 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.75 | 3.28% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.10 | -44.44% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.12 | -29.41% | Hold | None |

| Montauk Resources | MNTK | 9.58 | Watch | ||||

| Natural Grocers by Vitamin Cottage | NGVC | 15.85 | Watch | ||||

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 10.26 | -26.08% | Buy | None |

* Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

* Returns don’t include dividends of $0.3536 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 7/5/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.65 | -61% | Hold | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 1.18 | 11% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 54.94 | -14% | Hold | |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.36 | -32% | Buy | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.84 | -26% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.07 | -56% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.14 | -87% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.27 | -30% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.39 | -82% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

Our cleantech SPAC remains on the hunt. The trade is profitable as long as we see through the SPAC merger process. HOLD

Clearway Energy (CWEN/A)

The CFO is stepping down after the filing of the June quarterly results. No reason was given and market reaction doesn’t signal any worries. Shares are among the best looking in Greentech by a variety of technicals. They’re in a trading range between 28 and 35, holding over support in the middle of that area now. HOLD

Growth for Good Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news from the ESG SPAC. We’re profitable on this trade as long as we wait through the SPAC merger hunt. Warrants and rights remain weak along with shares given market conditions. HOLD

Montauk Resources (MNTK)

Short interest ballooned 47% in the latest reporting period, with shares now needing about 2.6 days to cover shorts. That’s not high enough to bet on a short squeeze, leaving us on the sidelines with the renewable fuel maker. Shares knifed through multiple levels of support since we featured it in our mid-June issue. Shares around 9 are at the bottom of their recent trading range and is a level to watch for a potential bounce. WATCH

Natural Grocers by Vitamin Cottage (NGVC)

NGVC continues to sit between resistance from the declining 40-day moving average near 17 and support from the 200-day at 15.50. It’s likely we’ll see a break above or below at some point soon, directing us to a potential buy or drop. WATCH

Vertex Energy (VTNR)

The renewable fuels maker has stepped back but generally appears fine, with support below – it’s still in a bull trend. Despite still-high energy prices, energy was the worst of the market’s sectors in June. BUY

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June of last year we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed in February at a total of a 127% return.

ADS-Tec Energy (ADSEW)

The superfast EV charger maker is a relative outperformer among the decidedly bearish EV-related stocks. We remain bullish on the business. Earnings likely get reported toward month’s end, potentially providing a catalyst. Warrants are up to 70 cents this week, from 50 last week. Shares are showing some good buying interest. HOLD

Altus Power (AMPS/WS)

Altus warrants keep easing from their recent high of 1.92, touching 1.34 this week. Shares joined the Russell 2000 index last week. HOLD

Constellation Energy (CEG)

The nuclear plant owner is mixed, with shares in the mid-50s and little news. As sentiment turns back toward nuclear as a carbon-free energy source, Constellation should be a long-run beneficiary. HOLD

ESS Technology (GWH.WS)

The iron-flow battery maker is weak from being a little behind on revenue recognition for the start of this year. Revenue should start being booked at a better clip the back half of this year and should improve sentiment. Warrants remain risky, but at 33 cents of late, would pay off handsomely if ESS shares can push back over 10 in the next four years. BUY

FuelCell Energy (FCEL)

FCEL is on top of a long-term support line around 3, where shares busted out of a bear formation in November 2020. Little news. HOLD

Origin Materials (ORGNW)

Origin was added to the Russell 2000 and 3000 indexes last week. Little news otherwise. The company is on track to open its first carbon-negative plastics plant by year’s end. Warrants are weaker of late, at 90 cents recently. Origin management has the right to redeem the warrants when share trade at or over 18 for 20 of 30 days, giving warrants a maximum theoretical value of $6.50. HOLD

Ree Automotive (REEAW)

On July 28, Ree will host an investor event in Michigan for a walk-in van it will build with Morgan Olson, an established delivery truck maker. The event should spark some interest and lift warrants, recently a quite-weak 15 cents each. Ree needs any sign of street-deliveries in the pipeline. HOLD

ReNew Energy Global (RNWWW)

Renew is India’s largest renewable energy operator/owner. Warrants are holding up fine at 1.16 recently. HOLD

Volta Inc (VLTA.WS)

Volta has stabilized after executive suite shuffling. The EV charger maker is aiming to hit upward of $80 million revenue this year. Warrants are at 40 cents after touching an all-time low of 26 last week. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue will be published Wednesday, July 20. Weekly updates will come each Wednesday, as well as any timely notices needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabotwealth.com.

The next Sector Xpress Greentech Advisor issue will be published on July 20, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.