Greentech remains near-term bullish, an encouraging sign as most subsectors are holding on to gains. Our featured stock is an innovative energy storage venture that has exceptionally encouraging performance since going public in February. It’s not all clear skies however – we tweak some of our holdings this issue to acknowledge specifics with companies.

Energy Vault Holdings

Overview

Energy storage is projected to increase 20-fold by 2030 compared to the 2020 baseline, according to New Energy Finance. That amount to be added – 999 gigawatt hours of annual capacity – equates to more than all of Japan’s power generation in a year. What form that energy storage takes is going to vary, subject to market pressures and constraints, like the fact lithium faces scarcity, while other formats, like iron-salt, are still waiting to find market support. The primary form of energy storage today, pumped hydro, suffers from a lack of reservoir sites in the U.S. and Europe, so alternatives are needed. Sufficient, effective energy storage is seen as the missing piece to the renewable energy puzzle and the way to counter the argument that the sun doesn’t always shine and the wind doesn’t always blow.

Business Model

There’s a cliché that originated in 1980s TV where someone suggests some outlandish plan as a half-joke and it lights a bulb in a companion’s head and they respond, “It’s so crazy it just might work.”

That’s a reflection of our feeling about Energy Vault Holdings (NRGV). In the height of special purpose acquisition company deals last year, we lumped the business with other seemingly outlandish ideas that only were coming to market due to extremely strong demand for new growth stocks. Not that the ideas themselves have been bad – just that many plans seem only partially baked with companies not projecting revenue until, in some cases, five years down the line.

With notable exceptions (primarily some SPAC warrants we purchased as a basket play in June last year) we avoid businesses that don’t generate any revenue today. There are just too many variables and not enough fundamentals to base decisions on. Greentech especially is filled with companies we want to love but are too far away from making their first sales. We assumed Energy Vault was one of those, but instead the company has surprised by actually producing signed deals for $368 million revenue, which starts to be booked this year.

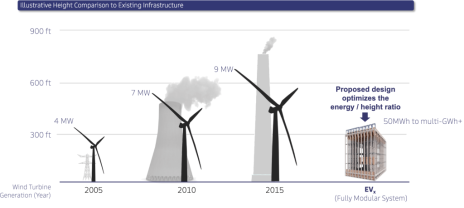

But back to Energy Vault’s crazy idea: Energy Vault offers kinetic energy storage – using the same theory as pumped hydro – where excess energy is used to physically move something that can be used to physically generate electricity later, when needed. Energy Vault’s product consists of very large, 35-ton bricks that are on a pully system. When solar and wind demand are strongest, typically at periods of the day when energy demand isn’t at its peak levels, the excess energy is used to lift the bricks up about 30 or so stories – the company says 350-foot-high facilities hit the optimal efficiency. When energy is needed midday or other high demand times, the bricks are lowered, generating electricity as they do so.

One of the reason the idea strikes us as crazy was a prototype, deployed in Switzerland, was a massive crane with many arms raising and lowering bricks. Quite simply: it was ugly. Given how people have raged against the idea of seeing wind turbines on the horizon from the beach, who would want a contraption visible from nearly everywhere in town? The company has designed a more appealing design – at least as proposed, as the image below shows. It’s essentially a building frame designed to meet typical building codes worldwide – where you can build a 35-floor building you can put an energy vault. The target customer are utilities looking for 50MWh or more of storage.

According to the company, the vault compares favorably to an equivalent lithium storage system in terms of efficiency, with 83% to 85% of the energy put into raising the bricks returned as power when discharging, compared to 87% to 89% for lithium-ion. The Energy Vault is a much larger form factor (about four times in square footage overall), but noise levels are the same and the vault has a cheaper cost of ownership ($344 per kilowatt hour vs. $504), cheaper initial capex and the regulatory benefit of no risk of fire, like li-ion presents. The Energy Vault system is pitched as a good option for large energy farms in remote areas, or as more environmentally friendly redevelopment option for coal-fired power plants. On a levelized cost of energy, the Energy Vault comes in about 51% the price of a lithium battery system, according to the company. The system is a medium-term storage system discharging its energy from two to 12 hours. Energy Vault offers essentially one product, but they use different names depending on size. The base system is called the EVx, while a larger, gigawatt-sized system consists of many EVx built together and is called the Energy Vault Resiliency Center.

Management says its production bricks will consist of coal ash and end-of-service wind turbine blades. That smacks of a bit of greenwashing – it easy to say the base product will include trashed turbine blades, which right now have no recyclability. However, we do know coal ash is a plentiful waste product that can be blended with concrete and result in a less energy-intensive, stronger brick.

Business Outlook

Projections of future business are easy. Making sales is harder. Energy Vault has made sales for this year. Management says it expects to begin construction on the first installation of a vault for DG Fuels. DG Fuels is a developer of renewable jet fuels. The first stage is a 500 MW storage system in Louisiana, which could provide close to $100 million in revenue this year. Future projects for DG Fuels will be in Ohio and British Columbia, totaling 1.6 GW overall. They could generate $520 million total. However, all deals are covered by eight letters of intent, and to date no firm contract has been disclosed. Energy Vault also bought $1 million in subordinated debt in DG Fuels as part of the deal.

Energy Vault also inked a license and royalty agreement for renewable energy storage with Atlas Renewable LLC and its majority investor China Tianying, a mainland China environmental remediation company. The deal pays Energy Vault $50 million this year in intellectual property fees and more if the technology is propagated throughout China.

There are also two promising potential clients. One is BHP, the massive Australian commodity producer, which has a commitment to get its production carbon neutral. BHP seems like a good candidate for large, mechanical energy storage, given its operations tend to be in remote, lightly populated regions of the country. Korean nickel producer Sun Metals also has a non-binding deal with Energy Vault for storage as part of its goal of getting production carbon neutral. Overall, there are proposals with 21 other customers. Clearly, the company is betting some of those will come to fruition, given its projections for years ahead are aggressive, with management saying 2023 will bring $535 million in sales and positive EBITDA, rising to $2.76 billion sales in 2025.

The business has $105 million in cash and about $30 million in various liabilities, two-thirds of which are warrants from its SPAC origins and the rest various leases and deferred revenue pensions.

Issues to Consider:

- While the China deal will pay $50 million this year, China has a history of coopting U.S. company technology in Greentech and deploying their own version without paying licensing fees. In effect, it’s likely the company is trading immediate sales now for IP it will lose to China. That may not end up being the case, but the risk is enough, from experience, that China revenue beyond the $50 million shouldn’t be a relied-upon metric.

- DG Fuels is an energy start-up. It needs significant capital to build its facilities and if it doesn’t receive them, Energy Vault’s letters of intent won’t get executed. DG Fuels submitted a $2.15 billion application under Department of Energy Title XVII Loan Guarantee Program late last year. The program still has roughly $40 billion in grant money allocated under President Obama to be dispensed (the program was dormant under the prior administration). Timikng of the DOE grant decisions isn’t immediately apparent.

- Energy Vault’s roster of significant investors lends it credibility. They include Idealab’s Bill Gross (12% of equity), Helena, a well-regarded Greentech focused VC fund (8%), Prime Movers Lab (6%) and Softbank (14%), among others.

- Share float is about 148 million shares, diluted including warrants.

Technical Analysis

A problem with businesses going public by SPAC is that, from a technical analysis standpoint, the information conveyed by trading action is quite unreliable until the merger. The trend with SPACs of late is that the vast majority of shareholders elect to get IPO capital held in trust back during the merger vote (indeed, that is our strategy with our SPACs), which means redemptions no longer signify if a deal is good or bad. In Energy Vault’s case, about 85% of shareholders elected to turn in their SPAC shares for return of capital. Still the business had enough financing to close the deal and Energy Vault began trading on the New York Stock Exchange on February 14. The originating SPAC was Novus Capital II. The first Novus SPAC brougth AppHarvest (APPH) public, a small indoor vegetable grower.

After the merger NRGV has been one of the best-performing SPACs in many months. Only in its first two days of trading did shares change hands under 10. Since then, they spiked to 18, only to be sold off heavily the same trading day but held at 11 and have since pushed over 20. Warrants, which can be called immediately given they have a provision to be called when shares trade at 10, are trading at 3.30, also exceedingly strong for a SPAC in the current market (indeed, we’d consider the fair value of those warrants as $0, given the redemption at 10 provision).

It’s the strength of trading since the merger that is signaling Energy Vault’s business is potentially legitimate today. That’s because the mechanics of how investors transition in and out of SPACs, depending on their investment strategies, usually means we see exceptional weakness. Based on Relative Strength, one of the most powerful technical signals, NRGV is the second-strongest Greentech stock in our universe (Lithium Americas (LAC), which we already own, is first).

What to Do Now

Shares promise to be volatile and we could get shaken out quickly. We’re going to recommend adding a half-sized position to our special opportunities portfolio, Excelsior, buying on a dip below 20 as part of a normal step back on a bullish move higher. Do not buy the warrants. Be quick to take profits and cut losses. BUY HALF under 20

Energy Vault Holdings (NRGV)

Revenue (trailing 12 months): None

Earnings per share (TTM): ($0.23)

All-time high (intraday): 20.10

Market cap: $2.9 billion

Recommendation: BUY half under 20

Intended Portfolio: Excelsior

The ESG Three

The ESG Three are three technically strong stocks selected from the 200 most-held stocks in environmental, social and governance focused mutual funds and ETFs. ESG fund holdings tend to be weighted toward blue-chip companies drawn from every industry which are rated highly in social and governance aspects. We screen top performers further to eliminate widely held companies we believe have clear environmental, social and/or governance problems. These aren’t formal stock picks but suggestions for those looking to explore additional stocks beyond the Greentech portfolio. Last issue’s selections, Mosaic (MOS), Newmont Mining (NEM) and Kroger (KR) remain the three strongest ESG stocks. Here are the next three.

Vertex Pharmaceuticals (VRTX)

What is it?

A pharmaceutical company.

Why is it ESG?

Excellent employee engagement marks, while oversight and corporate governance are good – on par with global peers. ESG funds own $206 million of shares.

Why now?

Its cystic fibrosis treatment, Trikafta, has the potential to to treat 90% of all patients, with additional therapies being pursued to address the other 10%. Shares are now just 10% below their all-time high.

Nvidia (NVDA)

What is it?

A maker of computer processors.

Why is it ESG?

High R&D appears to be setting the stage for Nvidia to play a bigger role in Greentech. Employee benefits are excellent, given its need to attract highly skilled talent. The board is majority independent. ESG funds own $2.1 billion of shares.

Why now?

Shares are 20% off their all-time high, touched in November. The pullback has shares near multiple, converging levels of support, suggesting the weakness is a good time to enter a position.

Costco (COST)

What is it?

A big box retailer.

Why is it ESG?

Unlike other discount competitors, Costco has largely been free of corruption and anticompetitive practices. The business has executive-level ethics oversight. ESG funds own $283 million of shares.

Why now?

Store traffic in the U.S. and globally was up more than expected to start the year, as was the average sale. Shares are at all-time highs around 582.

Greentech Timer & Current Portfolio

The Greentech Timer remains bullish, with our benchmark Wilderhill Clean Energy Index (the ETF is PBW) sitting over its 20-day and 40-day moving averages, which are trending higher – our definition of a bull market. That’s tempered by the fact long-term resistance indicated on chart levels are right around 68, where PBW is trading right now. Further resistance awaits at the 200-day moving average beyond that, about 13% higher from current levels. Buying action has been good, with lighter down days compared to volume on up days.

A different Greentech index, the Nasdaq Clean Edge (QCLN), is over its 200-day average this week, and stands more bullish. The QCLN is an index that is more heavily weighted in Tesla (TSLA) and has fewer overall components.

However, there are hints of weakness when looking at our full Greentech universe, the 293 stocks we track. Only 38% of stocks are up on the past five days, compared to 78% that are higher over the past four weeks. So, the overall signal is to be optimistic, but prepare for a possible change in sentiment.

Subsector-wise, solar and wind are bullish but pressing right against resistance and, so far, not breaking through. Water is similar to broad Greentech now, bullish but with long-term pushback waiting overhead. Nuclear is soundly bullish. EVs continue to trade all over the place, with no consistent “theme” among the companies.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential).

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 4/5/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 115.13 | -11.88% | Hold | Under 100 |

| Aecom | ACM | 2/17/22 | 73 | 75.34 | 3.21% | Buy | Under 58 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 22.41 | 22.66% | Hold | Under 12.85 |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.40 | -15.71% | Hold | Sell Half |

| Clean Earth SPAC Units | CLINU | 3/4/22 | 10.01 | 10.04 | 0.30% | Buy | None |

| Cleanway Energy | CWEN/A | 3/17/22 | 33.41 | 33.89 | 1.44% | Buy | None |

| Daseke | DSKE | 2/3/22 | 11.23 | 8.34 | -25.73% | Hold | Under 7.19 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.72 | 2.97% | Hold | None |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.20 | 11.11% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.19 | 11.76% | Hold | None |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 11.90 | -10.19% | Buy | None |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 37.50 | -9.38% | Hold | Under 32 |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 34.63 | 25.47% | Hold | Near 22 |

| MP Materials | MP | 3/9/22 | 45.01 | 59.00 | 31.08% | Buy | None |

* WMS gain excludes 11 cent per share dividend collected in March

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 4/5/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy | ADSEW | 10/20/21 | 1.66 | 1.47 | -11% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 5.98 | 15% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.53 | -37% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.32 | -71% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.83 | 1% | Hold | |

| Volta Inc. | VLTA.WS | 6/16/21 | 2.21 | 1.00 | -55% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | -17% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Advanced Drainage Systems (WMS)

WMS is right on top of a zone of support around 118. Resistance is at 126 and 136. News has been quiet. Our sell-stop is “under 100.” HOLD

Aecom (ACM)

Shares have eased slightly on light volume in what appears to be normal consolidation on no news of consequence. Shareholders as of April 6 will collect a 15-cent dividend. Our sell-stop is “under 58.” BUY

Archaea Energy (LFG)

Archaea set a new high Monday and continues to look strong. Shares are starting to show some signs of being a touch hot, but trading patterns show bullishness that could easily keep the uptrend going. Our stop-loss is “under 12.85.” HOLD

Charah Solutions (CHRA)

Charah missed estimates of 7 cents a share profit in its earnings, instead reporting a 2 cents per share loss. The business is also seeing some delays in project decisions after an EPA decision that coal ash pond owners must also consider potential effects on groundwater. In the long run that should broaden the work, but in the short term it’s held up deals. Shares sold off on modest volume below support levels, so we’re going to cut some losses here and dig in for good news management says is coming. SELL HALF

Clean Earth Acquisitions Corp. (CLINU)

The Greentech-focused SPAC is profitable for us given the per-share trust value we can demand back is 10.10, though the unit price trades at a typical discount (for the current market), around 10. Units will be eligible to be split on or about April 15. Units largely are now illiquid but remain a buy if you can find them. BUY under 10.10

Clearway Energy (CWEN/A)

CWEN/A has been catching its breath in the 33-34 area, holding onto support nicely. The company got the last portion of a 340 MW Mesquite Sky wind farm in Texas online. The farm has long-term offtake deals with Whirlpool and John Deere. Support is at 32.50, 31.50 and 30, with resistance at 35. BUY

Daseke (DSKE)

Shares lost a good bit of ground in the past week, breaking support at the 200-day moving average. The concern is both a predicted weak year for wind installations – one of the specialty products Daseke transports – and demand destruction of fossil fuel prices. If the business holds, share are back to value levels at 8 times forward earnings. Of course, that’s the variable that has people worried. Management will address that, at the latest, in a month when earnings are due out. For now, our stop-loss is “under 7.19,” which would represent a definitive break of the multiple levels of support. HOLD

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

We’re profitable on the shares alone given the $10 trust value even as the shares, warrants and rights all trade at depressed levels typical of the current SPAC market. No news, as the SPAC is on the hunt for a merger target. HOLD

Infrastructure & Energy Alternatives (IEA)

IEA fells steeply back to support at the 50-day moving average this week. Typically, that level is where institutions come back in to support shares, and the charts suggest there are multiple levels where support should come in. We’ll shift our recommendation from Buy to Hold, based on the potential for a breakdown here. HOLD

KraneShares China Green Energy (KGRN)

Shares have rallied over near- and medium-term resistance, and if they can firm up here, would be in a good position to start tallying more gains. Asian funds bet heavily on China-listed Greentech stocks entering this year, so we’d expect institutions to work hard to keep shares from retreating much more. Our sell-stop is “under 32.” HOLD

Lithium Americas (LAC)

The invocation of the Defense Production Act for essential Greentech metals has boosted the whole sector, with LAC gaining on its best volume in nearly two years this past week. The all-time high of 41 is resistance; bears have only had a weak response to the move so far. Our sell-stop is our buy price of 27.60. HOLD

MP Materials (MP)

MP keeps pushing to fresh all-time highs, as the lone western hemisphere producer of rare earth metals. Technically, shares look a little overbought, but those signals are secondary to a strong uptrend backed by fundamentals. That means a pause or only slight dip is likely here. BUY

Excelsior Portfolio

Excelsior is our special opportunities portfolio and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Two of these have been closed: Navitas at a 127% profit and Li-Cycle at a 4% gain.

ADS-Tec Energy (ADSEW)

Management says 2022 revenue should hit $85 million, even while saying its order backlog of about $68 million and other business forecasts suggest they could come in much higher than that. They are sticking with the $85 million figure, however as an acknowledgement existing supply chain issues could affect business – in fact, they expect the first half of this year will be weaker than the first half of 2021 due to the supply chain. For full-year 2021, results of which have yet to be fully disclosed, revenue will come in at $39 million, about $5 million less than prior forecasts due to supply chain delays which pushed some sales into this year. The U.S. business appears promising, however, with initial rollouts of chargers at a handful of locations (10 to 50) of a very large bank (2,000-plus locations), retail REIT owner (1,000 locations) and hotel REIT owner (1,000 sites). Warrants are 15 cents stronger this week. HOLD

FuelCell Energy (FCEL)

FCEL continues to sit between support at 5.80 and resistance at 6.70, looking for a catalyst. We’re up 17% on the position. HOLD

Origin Materials (ORGNW)

Warrants are basically unchanged the past week, with little news as the carbon-negative plastics maker gears up for a late-2022 open of its first plant. HOLD

Ree Automotive (REEAW)

Ree hired a Tesla executive, Josh Tech, as its chief operations officer. Tech was head of the new product/manufacturing group at Tesla (TSLA). That helped our warrants strengthen a bit to a still-weak 35 cents. However, it’s likely Tech received a strong options package. Generous packages for hires have been a dramatic cost issue with Ree before. HOLD

ReNew Energy Global (RNWWW)

ReNew is teaming with Indian Oil, a large fossil fuel refiner, and Larsen & Toubro, an Indian construction firm, in a joint venture to develop green hydrogen – hydrogen produced using renewable energy. Indian has ambitious hydrogen goals. Warrants are basically unchanged this week. HOLD

Volta Inc (VLTA.WS)

Volta has delayed 2021 earnings due to prior SPAC-related accounting issues. It announced preliminary results for Q4 2021 of $12 million sales, bringing 2021 to $32 million, with a year-end total of 2,330 EV charging stalls. Full-year 2022 sales should come in between $70 million and $80 million, according to the firm, stronger in the back half, with the overall addition of 1,700 to 2,000 new stalls. Warrants are a little weaker on the week. HOLD

Thank you for being a subscriber. Our regular updates come weeks between issues, with the next being Wednesday March 23. I welcome your comments and questions any time. Reach me at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on April 20, 2022.