This issue we examine two unique companies. The first is the only one of its kind making high-value products, including food and fuel, from what others consider waste products. The second is a large clean energy producer that offers a combination of utility-like stability and growth from ESG macro trends in the U.S.

We also tweak our Real Money Portfolio in light of performance and conditions, review the Excelsior portfolio, the Greentech Timer and suggest three additional ESG stocks to consider.

Darling Ingredients

Overview

A great debate is whether batteries or fuel cells will win out in the electrification of trucking fleets. It’s not insignificant – about 7.3% of U.S. emissions come from medium and heavy duty trucks, according to EPA data. But electrification expectations overlook the very real condition that diesel still runs American trucking fleets (with compressed natural gas handling some of the market). That means there will exist for some time a robust market for renewable diesel. There is a federal-level tax credit for green diesel that expires the end of this year (the languishing Build Back Better Act would extend it through 2026). But BBB isn’t necessary for the market – the main driver of renewable diesel demand is California’s low-carbon fuel standard (LCFS). It provides a tax credit on a scale depending on the carbon intensity of the production, usually ending up somewhere in the 80-cents a gallon range.

Business Model

Darling Ingredients (DAR) is probably the only company that primarily creates feedstock and fuel from waste animal and oils. It’s not exactly an appealing business to think about (there’s a reason Darling’s website is populated with stock photos rather than of slaughterhouse and rendering plant operations), but it’s a unique and fascinating enterprise to take what would simply be trashed and turn it into a variety of profitable products. Green diesel is one of those.

Darling and refining giant Valero (VLO) jointly own Diamond Green Diesel, a JV they formed in 2013. The business makes renewable diesel in a Louisiana refinery adjacent to a Valero refinery. When a third expansion of the plant (currently in process) is up and running next year, the facility will produce 1.3 billion gallons of renewable diesel annually. While most renewable diesel is being sourced from food crops, mainly soybean, Diamond Green sources its feedstock from slaughterhouse waste and waste cooking oil Darling collects. That should insulate the company from much of the competition (and ethical ambiguity) between using crops as feedstock for fuels versus food for people. The bottom line for Darling is once the expanded plant is up and running, the company sees it contributing another $1 billion in free cash flow, which it will use to reduce debt, buy back shares and boost the dividend.

Darling has a long history, starting in the 19th century as a business creating products out of animal waste. It owns 135 plants, including processing and rendering facilities and it also has a network that collects used cooking oil. Ownership of the rendering plants puts it in a position to control more of its raw materials, creating a barrier to entry for others who may now see value in waste-to-fuels.

The biggest part of Darling’s business today is creating feed ingredients. Feed accounts for two-thirds of 2021’s $4.74 billion net sales. The feed is primarily pet food, livestock feed and aquaculture ingredients.

The company also makes food products. That involves using different parts of slaughter animals for things such as sausage casings, food-grade lard for cooking and collagens used in the food and the pharmaceutical industries. It’s a bit trendy now to take collagen peptides to improve skin and joints – Darling pioneered the business last decade and is the source of the supplements being sold today. At $1.27 billion in revenue, food products are about 27% of the business.

Today, fuel is the smallest of the three operating segments, contributing $430 million in sales. In addition to green diesel, it makes biogas in Europe from various organic wastes as well as a natural fertilizer.

The company has significant operations in the U.S., Brazil, China and Australia, and can ship fats and oils between markets to maximize profitability.

Business Outlook

Darling got some notice recently for signing a deal with the privately held fast food chain Chick-fil-A to collect used cooking oil from its locations in North America, some 2,700 restaurants. Yet the company already had a large cooking oil offtake business, with 120,000 locations it collects from. It’s a bit of a manual labor business now – a driver has to go collect canisters of old oil from kitchens – but Darling is creating automatic collection systems to make it quicker and easier for restaurants to discard the oil and drivers to collect.

Securing supply, such as with Chick-fil-A, means Darling is set up well to enjoy the tailwinds facing its businesses. Those include rising fossil fuel prices which in turn make renewable fuels more profitable, and the rising prices of food commodities that both raise what Darling can charge and are more likely to raise costs for competitors (such as other green diesel refiners who will need to buy crops as feedstock).

Revenue is seen rising 16% to $5.5 billion this year. Earnings per share are expected to grow to $5.11, from $3.90. Price-to-trailing earnings of 21 matches that of the S&P 500. Price to forward earnings is 16.

Issues to Consider:

- The Ukraine war is seen reinforcing strength in animals fats and proteins by creating a supply crunch on top of fundamental demand growth.

- China – the world’s largest pork consumer – has lost about half its hog herd to African Swine Fever and it buys feed heavily from Darling to repopulate its herd (African Swine Fever had been spread widely by Chinese farmers’ habit of feeding culled swine back to their herds).

- The federal low-carbon diesel program may not get extended beyond 2022 without the Build Back Better Act. However, California believes it is successfully lowering carbon intensity without raising costs on consumers much, meaning its program likely is here to stay.

- Darling uses 12% of the world’s slaughtered animal by-product; it uses 40% of U.S. animal waste. Most of the supply it uses are sourced from its own processing plants that have collection agreements with slaughterhouses.

- We previously have invested in Darling – during the “Peak Oil” price scare of the mid-to-late 2000s, and consider the management team professional, capable and transparent.

Technical Analysis

DAR reached an all-time high of 85.34 on a closing basis in November as part of a brief bullish run for Greentech last year. Shares retreated to the low 60 area, a level of some longer-term support, into February this year. Bulls regained the 200-day moving average in March and shares withstood a bearish push at the 40-day line. Now around 81, they are showing very good relative strength. Resistance sits at the all-time high which, if broken, suggests a run to around 100 is possible. In addition to the 40-day average, at 75.70, the 200-day should be excellent support, at 71.70 – it’s also right where normal volatility suggests support should come as well. We consider normal volatility to be three times the Average True Range, a measure of recent price action. That’s $9 from the current price.

What to Do Now

This is a Real Money Portfolio recommendation. However, we’re constrained by our maximum portfolio of 12-equally sized positions in the Real Money Portfolio. As noted in the Current Portfolio section, we’re eliminating one holding today – Charah Solutions (CHRA) – freeing up a half-sized position. We recommend adding half to Darling here, given shares are running away from our preferred entry point closer to the 50-day moving average. We’ll look to build up the position later on an advantageous entry point.

Darling Ingredients (DAR)

Revenue (trailing 12 months): $4.34 billion

Earnings per share (TTM): $3.89

All-time high (intraday): 85.98

Market cap: $13.2 billion

Recommendation: BUY A HALF

Intended Portfolio: Real Money

Constellation Energy

Overview

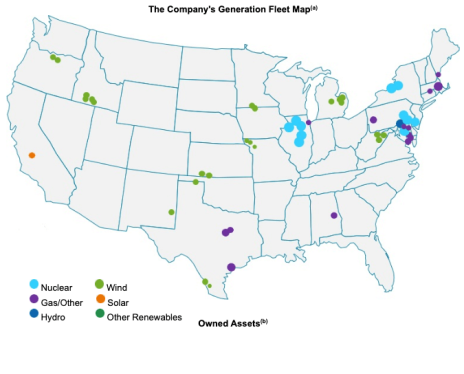

Constellation Energy (CEG) is the largest producer of carbon-free energy in the U.S. and the lowest overall greenhouse gas emitter among utilities. It’s a spin-off of Exelon (EXC) which went into effect in January. The split divided Exelon into two clearer cut businesses to appeal to investors. The remaining Exelon is a regulated utility in Illinois and the mid-Atlantic while Constellation provides energy in competitive markets. Constellation provides 10% of total U.S. electricity output, operating in 47 states and Canada. It has 32,400 owned megawatts (MW) of generating assets. About 65% – or 20,899 MW – is nuclear, 8,819 MW is natural gas and oil and the balance, 2,682 MW are solar, hydroelectric and wind.

The business produced $19.7 billon in revenue in 2021 with a net loss of $83 million. The year was likely an anomaly based on losses from the Texas deep freeze last winter, in which its natural gas power plants had to shut down in the cold. The results also include costs incurred from a round-trip decision to shut down an Illinois nuclear plant and then to keep it open last year in preparation for Constellation’s independence. In 2020, the business saw net income of $579 million on $17.6 billion sales.

Business Model

Constellation is a pure play clean energy producer. Given its size and importance to U.S. power output, it provides some of the safety of a utility – its energy is essential. Yet it’s also a way to benefit from increasing consumer demand for clean energy. Since it’s not a utility in the sense it doesn’t provide total grid coverage to a geographic area (that’s former-parent Exelon’s business), it can seek out ways to grow the value of its energy generation portfolio.

It does this by focusing primarily on selling power to commercial and industrial clients. These are businesses that are increasingly interested in reducing or eliminating their net carbon footprint by purchasing clean energy. For instance, Constellation recently partnered with Microsoft (MSFT) in a deal in which Microsoft will buy energy from Constellation over the next five years and, more importantly, jointly develop an energy sourcing matching system to better inform corporate customers where their energy is produced and to help model their carbon footprint. Most zero-carbon energy is bought today using certificates or annual credits as offsets, without consideration to when and how the energy used was generated. The Constellation-Microsoft system will provide detailed real-time carbon mapping, which should provide superior carbon reduction by providing companies with more accurate one-to-one matching of power usage and generation.

On a day-to-day basis of managing the business, Constellation aims to hedge its exposure to commodity – mainly uranium – price swings. Typically, the current year will be 90% hedged, the next year 60% hedged and the third year out 30% hedged. The aim is to prevent cost swings and make the business more predictable for customers and investors. It also buys uranium over many years – they start securing supply six years out and require suppliers to guarantee supply two years out from a refuel. That means Constellation doesn’t buy in the uranium spot market, which has seen sharper volatility in recent years.

About two-thirds of Constellation’s nuclear fleet also get tax benefits from states that need nuclear power to meet their stated clean energy goals. It has also made the company highly confident its current nuclear fleet licenses will eventually be extended out 80 (!) years.

Business Outlook

In some ways, Constellation is a growth business in a utility’s clothing. That’s overstating it a bit (we wouldn’t expect triple-digit price gains in the short or medium term) but management has an eye toward long-term growth through innovation. In its core business of nuclear power generation, Constellation sees itself as the consolidator of the American nuclear industry. It wants to buy up nuclear assets that may be sold and believes it is the best company in the world at operating nuclear plants. In practice, they say they believe they can improve the efficiency of operations of any nuclear plant they may acquire – management notes their plants are online 4% more than the average across the industry, a relatively modest figure but one that feeds directly to the bottom line.

The company sees its nuclear fleet as a way to grow into more valuable services. One is green hydrogen production. In conjunction with the Department of Energy, the company is installing a 1 MW electrolyzer powered by its Nine Mile Point plant in Oswego N.Y. The plant should be making hydrogen by December. Excess hydrogen could be used to prove the utility of the gas as a long-term energy storage solution – an application with New York State to use the excess hydrogen for that purpose is under consideration now. Constellation, in a January presentation to analysts, said there is potential hydrogen demand of 14 million tons within 100 miles of its plants today, including steel producers that could theoretically swap to hydrogen energy fairly easily.

Constellation also sees itself moving into the area of energy storage and, in regions where it isn’t permitted to sell energy into, selling data and analytics services focused on energy efficiency to corporate customers. Management also foresees a time when corporate customers will want clean energy apart from the grid to power things like data centers and blockchain/crypto farms, and will pay a premium for such energy.

Constellation enters its first year of independence with what will be about $2 billion in free cash, after costs, including reducing debt by $2 billion and paying $180 million total dividends this year (that’s 55 cents a share, although one quarter has been paid already). Management hasn’t said what it will do with the extra $2 billion, but said it prioritizes the use of the money as investing in/acquiring businesses that will add to the bottom line, or share buybacks/higher dividends. In short, we don’t know what they will do with the money, but they’ve telegraphed they will do something. It may not be, however, immediately accretive to 2022 results.

What may an investment be? In recent years, Constellation has invested in companies like Net Power LLC, which has a design for a natural gas plant with zero emissions (it is highly efficient and recycles all the CO2 as a fluid in operations.). It also has invested in small, modular nuclear reactors in the UK in a venture with Rolls Royce.

At a forward price-to-earnings of 19.7, Constellation is at a discount to utility peers – the sector is at a 21.6 forward P/E, according to Yardeni Research. Given we believe Constellation has a better growth profile than a regulated consumer utility, it makes it appear an even better value.

Best case scenario this year: the Build Back Better bill is signed into law. It would extend the nuclear production tax credit out six more years, which would offer $15 per kilowatt-hour generating credit, and a $3 per kilogram for green hydrogen that would last a decade. The bill has passed the House of Representatives but has been stalled in the Senate where it may very well die, given the body’s near-even split and the coal sympathies of a swing vote.

Issues to Consider:

- The business should generate $3.30 net income per share this year on $19.1 billion revenue, rising to $3.73 in 2023 on smaller revenue that assumes lower commodity costs.

- Constellation is repowering up to 500MW of wind turbine assets this year, in part because they will get a reset 10-year production tax credit.

- Management says maintaining investment-grade debt ratings is a priority.

- There are six growth avenues identified by management, in order of preference and time:

- Carbon-free acquisitions

- Adding value to the current fleet (such as repowering assets)

- Adding energy efficiency and storage products for business customers

- Green hydrogen production

- Innovation through partnerships with start-ups and researchers

- Next generation nuclear technologies

Technical Analysis

Spin-offs generally fall after their separation from the parent company because investors tend to not want to own the spun-off business, either because they preferred the main business that stayed behind to begin with or they are a fund with some investment criteria constraint. CEG began trading independent on January 19 at 37.88 and appears to have gone through its investor repositioning by the end of February. Shares broke through resistance at 54 at the end of March and rallied nicely. A period of consolidation around 61-64 last week has built a base for a further move higher.

What to Do Now

As a spin-off, which has far less technical history and data than we normally judge, it’s a fit for our special opportunities portfolio, Excelsior. We anticipate holding it for a long period, but would move to take profits should shares advance dramatically above “fair” value as seen through traditional ratios such as price-to-earnings. BUY

Constellation Energy (CEG)

Revenue (fiscal 2021 ending December): $19.65 billion

Earnings per share (2021): ($0.26) excluding non-controlling and membership interests

All-time high (intraday): 66.29

Market cap: $21.5 billion

Recommendation: Buy

Intended Portfolio: Excelsior

The ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook.

Exelon Corp. (EXC)

What is it?

A transmission and distribution utility in the mid-Atlantic and the Chicago area.

Why is it ESG?

The company emphasizes microgrids and energy efficiency improvements, such as the introduction of superconducting wire, for its energy distribution networks. ESG funds own $74 million of shares.

Why now?

The business spun off its electrical generation business, Constellation, in February, simplifying its structure, appealing to institutional investors. Shares hit their all-time high of 50.13 two weeks ago.

Consolidated Edison (ED)

What is it?

A utility with operations in New York City and the Hudson Valley.

Why is it ESG?

Multi-billion-dollar clean energy and energy efficiency programs underway. Direct greenhouse gas emissions are down 54% from 2005. ESG funds own $111 million of shares.

Why now?

ConEd’s expanding clean energy business (it is now the second-largest solar owner in the U.S.) is diversifying its operations beyond New York, where, quixotically, it is forbidden to own more than 200MW of solar. Shares recently hit all-time highs.

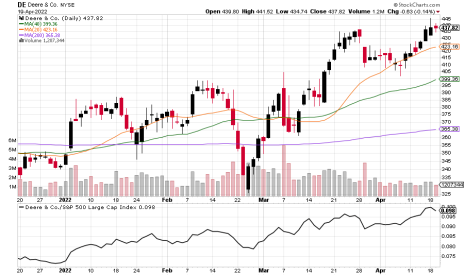

Deere & Co (DE)

What is it?

A manufacturer of farm equipment.

Why is it ESG?

Scope 1 and 2 emissions were lowered 4% last year. The company has long-term renewable energy off-take agreements. Less than 5% of sales come from clean energy related efforts, but a high R&D budget suggests that can grow. ESG funds own $388 million of shares.

Why now?

Inflation (by most definitions) is a rise in commodity prices and higher prices mean more demand from farmers for new equipment. Shares hit an all-time high last week.

Greentech Timer & Current Portfolio

The negative pressure on Greentech has alleviated a bit the past week, with two-thirds of stocks in the universe we follow higher on the past week, compared to just 33% higher over the past month and about 45% higher over the past 3 months. Still, there’s no overlooking we’re bearish in Greentech again, but we have the sense that, to turn a common phrase on its head a bit, the seeds of the next bull market are being sown in the bear market.

The Timer shows our benchmark index, the Wilderhill Clean Energy, below its moving averages, with the 200-day and the 20-day averages both downtrending, implying short-term and long-term negativity. But from volume and price action we get a sense more of indifference this week than bearish pressure, which is another glimmer of hope. The charts suggest the Wilderhill is holding support implied by the long-term price chart, which is a plus too. Very long term, we could also see some formations that suggest the market is setting up for a strong bull move higher. The fundamentals that global demand for clean energy is rising and the shift to clean energy is vitally necessary means the bull market will return.

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). This week, our timer is saying to be cautious, maintaining sell strategies to preserve capital.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 4/20/22 | Gain/Loss | Rating | Sell-Stop |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 111.44 | -14.70% | Hold | Under 100 |

| Aecom | ACM | 2/17/22 | 73 | 78.34 | 7.32% | Buy | 73 |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 22.04 | 20.63% | Hold | 18.27 |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 3.48 | -33.33% | Sell | None |

| Clean Earth SPAC Units | CLINU | 3/4/22 | 10.01 | 10.15 | 1.40% | Hold | None. Trust is 10.10 |

| Cleanway Energy | CWEN/A | 3/17/22 | 33.41 | 33.89 | 1.44% | Hold | Around 28 |

| Daseke | DSKE | 2/3/22 | 11.23 | 8.13 | -27.60% | Hold | Under 7.19 |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 13.00 | -31.11% | Hold | Half-sized position |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.77 | 3.50% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.19 | 5.56% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.19 | 11.76% | Hold | None |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 11.95 | -9.81% | Hold | Under 10.80 |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 35.12 | -15.13% | Hold | Under 32 |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 32.03 | 16.05% | Hold | 27.6 |

| MP Materials | MP | 3/9/22 | 45.01 | 59.00 | 31.08% | Buy | 45.01 |

* WMS gain excludes 11 cent per share dividend collected in March

* ACM gain excludes 6 cent per share dividend collected on April 6.

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 4/20/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy | ADSEW | 10/20/21 | 1.66 | 1.04 | -37% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 5.28 | 2% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.44 | -41% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.04 | -97% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.86 | 3% | Hold | |

| Volta Inc. | VLTA.WS | 6/16/21 | 2.21 | 0.83 | -62% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/21 | Half sold this date |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

We have one fresh sell this week – the remainder of Charah Solutions (CHRA), below.

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

Advanced Drainage Systems (WMS)

The maker of recycled plastic drainage pipes and water flow systems is toward the bottom of the range it has trawled this year. Resistance looks firm at 116-119 and a break under support at 100-102 would likely be significant and a reason to exit the trade. Our sell-stop is “under 100.” HOLD

Aecom (ACM)

Shares are holding onto the uptrend though volume has been soft this week. Little news. Our sell-stop is “under 73.” BUY

Archaea Energy (LFG)

Shares of the renewable landfill gas business look like they may have temporarily topped and may drift back to some near-term support toward 19-20. Our stop-loss is our buy price. HOLD

Charah Solutions (CHRA)

Charah got oversold and we’ve seen a bounce higher. We recommending selling the remaining half of the position as a long-term bearish chart outlook settles in here. SELL

Clean Earth Acquisitions Corp. (CLINU)

As of Monday, the SPAC’s units can now be split into their component: each unit equals one share (CLIN), half a warrant (CLINW) and one-tenth of a right (CLINR). You need to call your broker and ask to split the units into their components – it will not happen automatically. Normally the split takes a couple of days, but may take longer. Having flexibility to sell components is part of our strategy for profiting from SPACs. Our shares have claim to $10.10 in trust funds and the components add about another 10-cents a share value right now, putting us up almost 2% with no risk of a loss. The SPAC is seeking a Greentech business. HOLD

Clearway Energy (CWEN/A)

CWEN/A has been testing support, with the 200-day at 30.36 as the usual firewall below here. The high-31 region is now resistance, followed by 34. Little news and light volume this week. Our sell-stop is “around 28.” We’re changing our rating from Buy to Hold based on recent softness. HOLD

Daseke (DSKE)

Shares have held onto support down to 7.19. which is where our stop-loss is set – “under 7.19” – which would represent a definitive break of the multiple levels of support. Shares have notched six-straight up sessions with encouraging volume after nine straight down days. HOLD

Energy Vault (NRGV)

True to our prediction of volatility, the kinetic energy storage company shares have swung between 21 and 12 the past two weeks. Right now, they’re around support levels and have managed to hold an uptrend line formed since its SPAC merger closed in February. This is a half-sized position. HOLD

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

Our ESG SPAC remains on the hunt for a target. We’re profitable on the position no matter what, having bought the units under their trust value of $10. HOLD

Infrastructure & Energy Alternatives (IEA)

The engineering firm remains weak, but holding onto support in the 11 area. No news. Our sell-stop is “under 10.80.” HOLD

KraneShares China Green Energy (KGRN)

The China stock fund is clearly in a downtrend formed from November. We’re looking for gap support down to 33.75 to prop up shares here. China’s severe COVID lockdowns are hurting economic activity and sentiment. Our sell-stop is “under 32.” HOLD

Lithium Americas (LAC)

The company submitted a loan application to the Department of Energy for its Thacker Pass mine under the advanced technology vehicles manufacturing program, which has $17 billion to loan out. The size of the request hasn’t yet been disclosed. Shares are finding support at the 50-day line here, and price technicals suggest they are turning higher again soon. Support is at 26-24 below us, resistance at 39. There remains some uncertainty over Thacker Pass from lawsuits from Native American tribes, but there is little expectation it will stop what would be America’s largest lithium mine. Our sell-stop is our buy price of 27.60. HOLD

MP Materials (MP)

MP slipped to support at the 50-day moving average this week on mild volume, so the action is unconcerning. Earnings tentatively are slated to be released next week on the 28th. Consensus is for the rare earths producer to report 40 cents earnings per share on sales of $131 million. BUY

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas has been closed out in February at a total of a 127% return.

ADS-Tec Energy (ADSEW)

No news for the super-fast EV charger maker. Warrants have been lightly traded this past week and remain basically unchanged. HOLD

FuelCell Energy (FCEL)

Shares have eased down past support to a six-week low this week. Fuel cell stocks are volatile and we’re weathering the drawdowns with FCEL in anticipation of good strength down the line. HOLD

Origin Materials (ORGNW)

Warrants are softer this week but with signs of opportunistic buying on the dips. Origin will produce carbon-negative plastics from a plant to open in Canada later this year. HOLD

Ree Automotive (REEAW)

Ree remains weak as the EV chassis maker needs to generate some excitement over its business. There are enough indications of interest from Asian automakers to suggest news could come one day. ‘Til then, we hold. HOLD

ReNew Energy Global (RNWWW)

The India renewable energy operator shares are holding up fine and so are the warrants as a result. No news this week. HOLD

Volta Inc (VLTA.WS)

Volta replaced its CEO, chairman and founder Scott Mercer with Brandt Hastings, the company’s chief revenue officer. Hastings is interim for now. His background is leading revenue strategy for iHeartRadio and as an executive in advertising at Clear Channel. A key facet to Volta’s strategy is display advertising that can drive specific customer visits and product sales to retailers near their charging stations. Part of the long-term thesis by Volta is that more EVs mean fewer stops at gas station convenience stores, opening billions of dollars of impulse sales again, for which companies will pay premiums for ads. Volta released its annual report after a long delay and chalked up $32.3 million in sales in 2021 – a big miss of the $43 million it told investors at the SPAC merger announcement more than a year ago. The loss was massive, $277 million, with $171 million coming from equity grants. Station added in the year fell 800 short of what they told investors a year ago. Mercer wasn’t executing. The company now projects 2022 sales about half of pre-merger hype at $70 to $80 million, with first-quarter sales of $8 to $8.5 million. Results and outlook, coupled with the lack of demand for growth stocks right now, suggests we’ll likely be holding our warrants for some time. HOLD

Thank you for being a subscriber. Our regular updates come weeks between issues, with the next being Wednesday, April 27. I welcome your comments and questions any time. Reach me at brendan@cabot.net.

The next Sector Xpress Greentech Advisor issue will be published on May 4, 2022.