This issue we feature an exciting new EV company that has come to market – we believe its warrants offer the best chance for big profits, a trade similar to how we turned 190% profit on Altus Power (AMPS) recently.

Also, we update our portfolios with the latest recommendations – we’re selling a laggard and setting sell-stops on most other holdings in case the market worsens. Still, we’re cautiously optimistic. Our ESG Three and market commentary are included too.

Cabot SX Greentech Issue: October 5, 2022

Greentech’s Outlook

Commentary on current investing conditions and the Greentech Timer

There are mixed signals in the market these days, with plenty of bearishness to go around. While the markets are skewed bearish – every major index is below its moving averages – we continue to see positives in recent action.

Every reversal has to start somewhere, and Monday and Tuesday’s trading after a bad end to last week set some fairly clear reversal signals, at least in the short term. Monday’s trading on the New York Stock Exchange compared to Friday’s made a Tweezers Bottom, the name for a candlestick formation in which the low of a down day is matched by the low of the next session that finishes higher. (The NYSE didn’t have exact low levels, but close enough). It’s a reversal signal, one that is reinforced by what was a follow-through gap higher in many indexes on Tuesday. Leaning on legwork by technical analyst Thomas Bulkowski, who has done exhaustive work on chart formations, I read this Tweezers Bottom as setting the table for a move to 40-day resistance above where the markets are here. What happens at that point is another matter – candlestick formations are by their nature relatively short in predictive power. But it shows the market isn’t as resoundingly bearish as many would believe. The blue bar in the simple daily chart through Monday of the NYSE Composite here shows the formation.

Market resilience is a plus for Greentech, which continues to be a better performer than the whole market, although calling it bullish is overstating it. Recent action hasn’t threatened crucial support levels in Greentech though it has eaten into support levels a touch. Resistance does appear to be significant at 5% to 10% above current levels in Greentech, where there is a confluence of the widely watched moving averages you see in our Timer chart, below. That’s the next mark to watch. A break above is bullish, a failure to crack through would signal continued choppy waters ahead.

Greentech Timer

The Greentech Timer is bearish. Our timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but it’s not essential). Today, we’re under all three of those moving averages. This calls for caution and, ideally, taking profits off the table. Yet we are nearly fully invested in our Real Money Portfolio and the relative resiliency of Greentech gives us reason to hang on to existing positions. We have introduced sell-stops on most of our holdings this week, however, to better position ourselves for potential breaks of market support. See Current Portfolio for more on that.

A look at our subsectors with the moving averages, in order of best looking to worst.

Solar

Invesco Solar ETF (TAN)

Water

Invesco Water Resources ETF (PHO)

Nuclear

VanEck Uranium and Nuclear ETF (NLR)

Wind

FT Global Wind Energy ETF (FAN)

Featured Stock: LiveWire Group (LVWR.WS)

Overview

Electric motorcycles are expected to follow electric automobiles in growth trajectory. Right now the EV (electric vehicle) motorcycle market is at an earlier stage of development than cars, with a global market worth about $3 billion – excluding the large scooter and four wheel (ATV) markets. The most advanced EV motorcycle market is China, where perhaps one in four hogs are electric, followed by Europe with about 2% electric penetration and the U.S. which probably is about 1%. There are a lot of startup players, most notably the private Zero Motorcycles, as well as some established internal combustion engine makers that have been in EVs for a few years, mainly BMW, Honda and Ducati.

Business Model

LiveWire (LVWR) is the EV motorcycle spin-off of Harley-Davidson (HOG). H-D built LiveWire as its EV division starting with a 2010 prototype that led to a formal EV arm in 2015. Since 2021, LiveWire has produced the LiveWire One, which retails for about $23,000 and up. The cycle has gotten very good reviews from motorcycle enthusiasts for its ride and enjoyment factor – it’s said to be a very good touring bike – though criticized for its range of about 149 miles. Mainly, the One has been dinged for not really being like a Harley – Harleys are loud, ponderous and designed for drivers to sit back. The One is quiet – it’s silent at idle and makes a high, techie whine while driving. It also accelerates very quickly and places the driver in a more aggressive, racing-like crouch. To that extent, it makes sense for LiveWire to be its own brand separate from Harley. The One also has Bluetooth connectivity, display screen GPS and a Harley-developed electrical architecture that can accept a number of commonly produced parts, which allows it to sidestep some (but not all) supply chain concerns.

In 2021 LiveWire sold $35.8 million of EVs, losing $68.4 million. In the first half of 2022, it sold $25.7 million at a loss of $16 million. This year appears to be lagging the earlier projected $56 million in 2022 sales, which is due to some supply chain delays. Sales so far have been primarily in the U.S., where management believes it has a 43% EV motorcycle market share (compared to 24% in Europe and less than 1% in Asia).

U.K.-based motorcycle review Bike World spent a month driving the One and gave it an excellent review, which you can watch here: https://www.youtube.com/watch?v=jwTqRipq_Mo .

Business Outlook

Recently, LiveWire began selling its second model, the S2 Del Mar. It’s built on a new architecture different than the One’s. Called the Arrow, it claims improvements in cooling, battery architecture and simplification of electrical components. The Del Mar starts at $17,000. The main development for LiveWire has been its separation from Harley-Davidson. Harley spun LiveWire off last month through a merger with an ESG-focused SPAC named AEA-Bridges Impact. The listing, on the New York Stock Exchange, went live on September 27 at the usual SPAC price of 10.

As with many things SPAC – and many things EV – the deal here is much more about the future than the present. As noted, LiveWire has revenue – it is a rule of ours these days that SPAC companies have some revenue, something especially important in the EV space, which has seen a number of entrants without current sales. LiveWire’s better than projected 2021 sales ($35.8 beat mid-2021 projections of $33 million) and the probably worse-than-expected current year sales pale to what the business expects to be making in years ahead: They claim a path to $209 million sales next year and $1.8 billion by 2026. That would be great – but should be taken with a big grain of salt.

However, LiveWire has positives. In addition to the well-received bikes, it remains majority owned by Harley-Davidson, which invested cash in the transaction as well to finalize the SPAC merger. Harley will build LiveWire’s EVs for the next five years, providing – at least at the start – an asset-light model that will help the business get traction. Another investor in the SPAC merger is Kymco, an Asian producer of scooters. That should provide an easier path to enter the Asia market too. With the going-public action completed, LiveWire has about 231 million shares outstanding, with another 90 million (give or take) in warrants and incentive shares that further dilute the stake. That gives LiveWire a fully diluted market cap of roughly $2.9 billion, and a price-to-2023-sales ratio of 14. However, our approach here is to buy into LiveWire through its warrants, which right now present what is likely a steep discount.

Warrant Analysis

Our recommended trade is the same approach we took with the warrants of Altius Power (AMPS), a trade we closed at 190% profit, and ESS Tech (GWH), a trade that remains open in our Excelsior Portfolio. We believe that LiveWire warrants (LVWR.WS) present a discounted opportunity to make profits in the EV motorcycle maker if you believe the shares can trade at or above 10 for the better part of a month at some point in the next four years, 11 months.

The warrants are part of the initial AEA-Bridges SPAC IPO in 2020. They became tradable in late November 2020 and became potentially exercisable into shares with the company’s debut on the NYSE. SPAC warrants differ from other warrants you may have encountered.

In the case of LiveWire, the warrants have a few parameters to be aware of: They will expire 5 years from the merger, so probably September 27, 2027 (don’t hold them long enough to find out if that date is correct or not). There are two redemption levels at which management can call warrants to be converted to shares. One is if shares trade at $18 for 20 out of any 30-day period, and can require cash of $11.50 plus the warrant to convert to a share. The other is if shares trade at $10 for any 20 of 30 days, provided the company provides a cashless conversion of warrants to shares. It is nearly certain that if LiveWire shares trade over $10 for long enough, management will call for redemption at the earliest point they can. We know this from experience with SPACs (like with Altus). This desire to call warrants ASAP stems from the fact accounting for SPAC warrants wreaks havoc on quarterly earnings, because paper price gains or losses on warrant values are tallied. Management always wants to eliminate warrants as soon as they can to clean up the books and reduce the negative effect of the hangover of potential shares.

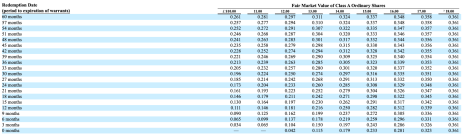

At the $10 redemption share price, warrants convert to shares at a fractional rate that declines the closer the warrants get to expiration. Here is the table for LiveWire’s warrants, from the final prospectus of AEA-Bridges Impact Corp.

What does this tell us? We’re less than one month out from the merger, so we are in month 60. Let’s assume come late December LiveWire shares have traded at $10 enough to trigger the conversion. We’d have 57 months left on the warrants, and at an average share price of $10, a single warrant would equal 0.257 shares. That means it will take four warrants to equal a share (leftover fractions don’t get any consideration). At the recent LiveWire warrant price of 42 cents, that means four warrants would equal one $10 share at the acquisition cost of $1.68 total. They should have a theoretical value at that time of $2.50 a piece, which would be $2.08 profit for each warrant. That is, the market should have warrants trading at or near their conversion value at that time. That is our opportunity.

As another example, let’s assume (but not hope!) the bear market lingers and LiveWire shares don’t trade over $10 until 2025. At that time, they trade at an average price of $13 with 24 months left. The conversion ratio of 0.26 means we need four warrants to convert to one share still. In that situation, the warrants should theoretically be trading around 3.25 to 3.68. That price would be worth the wait on our 42-cent warrants. Be aware the table is a guideline with ratios adjusted to the actual average trading price and specific time remaining on the warrants.

The aim of the trade is to sell our warrants in the market at a profit ahead of the conversion deadline. As with all SPAC-derived warrants, you must take action to sell or convert warrants, or else they expire basically worthless, at 10 cents apiece when the redemption window closes.

There are real risks to this strategy:

- LiveWire shares may never rise and therefore our warrants can never convert and they expire worthless in September 2027.

- The warrant prices never improve because of market bearishness or unforeseen conditions.

- The company may propose a swap of low-priced warrants to shares which forces us to take equity or be forcibly converted at a lower ratio. We just experienced this with Ree (REE).

- LiveWire hits the price hurdle to convert warrants, but in the time period between hitting the redemption price and when conversion can occur (a lag of three days) or when we convert (we have 33 days after notice), shares fall again and we can only book a loss.

• Trading liquidity may be such that we can never exit our position, or can only exit at a loss. - Unforeseen regulatory or corporate actions negate this strategy.

Issues to Consider:

- Harley-Davidson has a niche with loud, lifestyle-centric motorcycles. LiveWires are different types of motorcycles and may not enjoy any corporate halo now that they are apart from H-D.

- LiveWire projections of future sales may be overly optimistic. SPAC mergers often have offered up projections that are too rosy.

- Supply chain problems may further trim 2022 sales.

- Various domestic incentives for EVs, which should include motorcycles, don’t end up providing as much of a boost to sales as anticipated.

Technical Analysis

Technical analysis hasn’t proven to be very effective with SPAC warrants since the severe bear market in SPACs took hold in 2021. Still, we can infer some information from LVWR.WS trading: They gapped much higher to 1.32 in December on news of the merger with LiveWire. That shows some underlying market awareness of the company that we haven’t seen on other lesser-heralded SPAC mergers. Warrants have since weakened with the overall market – it isn’t uncommon to see a decline between merger announcement and closure. LiveWire shares have been volatile in their first days of trading, hitting an intraday low of 6.75 last Wednesday and a post-merger-close intraday high 11.63 on September 27.

What to Do Now

Bear markets can make good companies have bad stocks. The flip side is that they also can reveal value opportunities for those who are willing to be patient. Our Excelsior special opportunities portfolio is meant to take on trades such as this. There’s risk, but we know from Altus Power our strategy can work. BUY

LiveWire Group warrants (LVWR.WS)

Revenue (trailing 12 months): $43.6 million

This is an estimate since LiveWire’s quarterly 2021 results were not broken out by Harley-Davidson.)

Earnings per share (first 6 months of 2022 only): (0.33)

All-time high (intraday, including pre-merger SPAC shares): 12.27

Market cap: $2.9 billion (estimate of fully diluted equity, including public and founder warrants)

Recommendation: Buy

Intended Portfolio: Excelsior

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts. Due to a data provider error, we are unable to provide ESG fund holding amounts this issue.

Vertex Pharmaceuticals (VRTX)

What is it?

A pharmaceutical company.

Why is it ESG?

The largest maker of cystic fibrosis therapies has a robust employee engagement program and has corporate governance on par with global peers.

Why now?

The rollout of Trikafta, a new combination cystic fibrosis therapy, is greatly expanding Vertex’s market. In Q3, Trikafta was 59% of sales, allowing the company to boost full-year guidance by 15%.

McKesson Corp. (MCK)

What is it?

A pharmaceutical and medical supplies distribution business.

Why is it ESG?

Its corporate and board structure are seen as most shareholder-friendly in the industry.

Why now?

McKesson is one of the “big three” pharma distributors in the U.S., so it benefits from the ever-increasing American marketplace for specialty drugs. It is a major supplier to CVS.

General Mills, Inc. (GIS)

What is it?

A packaged food producer.

Why is it ESG?

Mainly U.S. focused means it has low exposure to corruption concerns and the business is making efforts to source lower environmentally stressed crops.

Why now?

Strong quarterly performance vaulted shares to an all-time high last week on excellent volume.

Current Portfolio

Portfolio Changes:

Energy Recovery (ERII) Moves to Hold

Vertex Energy (VTNR) Moves to Sell

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 10/5/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.99 | 9.88 | -1.10% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.01 | 0.17 | 1600.00% | Hold | |

| Clean Earth Rights | CLINR | 3/4/22 | 0.01 | 0.22 | 2100.00% | Hold | |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 31.43 | -5.93% | Hold | Around 28 |

| Energy Recovery | ERII | 9/9/22 | 25.57 | 22.18 | -13.26% | Hold | Near 20 |

| Enovix | ENVX | 8/18/22 | 20.49 | 19.74 | -3.66% | Hold | Around 14.50 |

| Enphase Energy | ENPH | 8/11/22 | 298.56 | 290.07 | -2.84% | Buy | Around 230 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.97 | 9.85 | -1.20% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.01 | 0.06 | 500.00% | Hold | |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.01 | 0.09 | 800.00% | Hold | |

| Li Auto | LI | 7/21/22 | 36.01 | 24.49 | -31.99% | Hold | Around 19 |

| Montauk Resources | MNTK | 8/11/22 | 15.51 | 15.92 | 2.64% | Hold | Around 16.50 |

| Onsemi | ON | 8/11/22 | 67.32 | 68.01 | 1.02% | Hold | Around 59 |

| Ormat Technologies | ORA | 8/1/22 | 86.72 | 89.58 | 3.30% | Hold | Around 85.30 |

| Shoals Technologies | SHLS | 23.44 | Watch | ||||

| Sunrun | RUN | 30.20 | Watch | ||||

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 7.22 | -47.98% | Sell |

*Clean Earth units cost 10.01 each; Growth for Good units 9.99. Buy prices above reflect an allotment for each component after splitting the units.

*Returns don’t include dividends totaling $0.714 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 10/5/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 1.00 | -40% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 87.81 | 37% | Hold | Sell-stop ‘around 77' |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.78 | 47% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.66 | -30% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.10 | -55% | Hold | 1/6th-sized position |

| Ree Automotive | REE | 6/16/21 | 5.50 | 0.71 | -87% | Hold | 1/6th-sized position |

| ReNew Power Warrant | RNWWW | 6/16/21 | 1.81 | 1.16 | -36% | Hold | 1/6th-sized position |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.37 | -83% | Hold | 1/6th-sized position |

* Returns don’t include dividends totaling $0.282 per share for CEG

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 3.07 | 190% | 8/24/22 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. We have 11 full positions right now.

When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long-term.

Real Money Portfolio

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

The SPAC is still searching for a merger, which is a normal quiet period. Rights and warrants are unchanged. Volume is very light. HOLD

Clearway Energy (CWEN/A)

Clearway has bounced from 29 to test the 200-day average around 31.50. That’s natural resistance. No news. Our sell-stop remains ‘around 28.’ HOLD

Energy Recovery (ERII)

ERII broke 40-day support last week and is holding over the next level at 22.50. There is no news. We’re shifting our recommendation from ‘Buy’ to ‘Hold’ on the break of the support level. We also instituting a sell-stop of ‘near 20,’ on a closing basis, which would signal a break of 200-day support. MOVE FROM BUY TO HOLD

Enovix (ENVX)

Chart support has held for the battery maker; now shares are testing 40-day lone resistance, around 20.50. A break through that would mean 25 is the next level to crack. No news worth conveying this week, and sentiment seems generally positive for the shares. We’re setting a sell-stop at ‘around 14.50,’ which would signal a definitive break of support at the 200-day line around 15.19 right now. HOLD

Enphase Energy (ENPH)

ENPH is consolidating in a zone of 270-320. No news. Earnings are expected to be announced October 25. We’re setting a sell-stop of ‘around 230’ as a precaution, with our

recommendation unchanged. BUY

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

The SPAC remains searching for a merger, which is a normal quiet period. Little change in the prices of our securities over the past week, which is also normal. Volume has

been spotty – strong some days, very weak others. HOLD

Li Auto (LI)

Li is bouncing from recent weakness, but volume is unconvincing, which is a concern. September EV deliveries for the Chinese company were up 63% year over year to 11,531 vehicles, putting the business up about 6% for the year-to-date. We’re putting on a sell-stop of ‘around 19.’ HOLD

Montauk Renewables (MNTK)

MNTK was weak Tuesday while other alternative fuel stocks were stronger. No obvious news, but the action suggests some caution is warranted. Overall, we remain in a range between the 16.75-29 area. We are putting a sell-stop on at around ‘16.50.’ HOLD

Onsemi (ON)

Onsemi rolled out three new chips for onboard EV charging that it claims will shorten the charge time by an undisclosed amount given its SiC (silicon carbide) architecture. Shares gapped higher Tuesday to challenge pushback at 68. Support is 60-61. We are putting on a sell-stop of ‘around 59.’. HOLD

Ormat Technologies (ORA)

ORA is mixed, having fallen below support at 93, which is now resistance, while holding well over major support around 80. No news. Our sell-stop is ‘around 85.30.’ HOLD

Shoals Technologies (SHLS)

SHLS is working against resistance at 24-25 here. Volume has been declining as it tries to crack that level. That, with market conditions, tell us to wait to add a position here. WATCH

Sunrun (RUN)

RUN tested 200-day line support at 28 and ate a little bit into gap support that is down toward 24. Shares bounced a little higher, but are under resistance at 33.75-38. WATCH

Vertex Energy (VTNR)

Three strikes and you’re out. Management said last week a contractor delay will cut its production this quarter. It’s the third negative sprung by management in recent weeks, following a delay in the start of renewable diesel production and management’s massive financial screw-up on hedging in Q2. The temptation is to sit on the shares and hope the market bails us out, but shares are battling resistance at the current price, the chart is negative and the risk of continued management missteps is too high, especially in a bear market and one where global economic problems may start to lead to oil and gas demand destruction. We could sell to take the tax write-off, wait 30 days and reenter the trade at a more advantageous price; however, it’s usually not a successful move to reenter a trade gone bad via management mistakes. An advantage of the Real Money Portfolio design is that having 12 equally sized positions means no one bad trade is fatal, even though taking any loss is unpleasant. Our loss here is about 4% of the portfolio. SELL

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June 2021 we purchased six SPAC warrant positions as a basket trade (1/6th a position per warrant): Navitas, Li-Cycle, Origin, ReNew, Ree and Volta. Of these, Li-Cycle was closed at a 4% profit in December 2021. Navitas was closed in February 2022 at a 127% profit.

A note on a past holding: As we predicted, Altus Power (AMPS) is calling its warrants. If you still own the warrants the portfolio sold on August 24, you must sell them or take the steps with your broker to convert them to shares. Otherwise, you will be cashed out at 10 cents a warrant on October 17.

ADS-Tec Energy (ADSEW)

ADS-Tec has partnered with two apps that have footholds in traditional gas stations and with EV users to offer mobile phone payment ability for EV charging. The goal is to convince filling stations of the viability of adding the company’s superfast ChargeBox to locations. Warrants are little changed. HOLD

Constellation Energy (CEG)

Little news – CEG keeps looking good, if still in a consolidation phase. The all-time high of 89.36 is natural resistance. Our sell-stop is ‘around 77.’ HOLD

ESS Technology (GWH.WS)

The warrants are a little stronger at 78 cents, about a 43% profit to our buy price. Given this trade is to take advantage of the conversion ratio of warrants to shares we’re keeping our recommendation at ‘hold,’ unless warrants ease back into the 50-cents area. HOLD

FuelCell Energy (FCEL)

Fuel cell stocks basically trade in line with Greentech, but with more volatility. A bull move in the sector will help FCEL break resistance at 3.84, 4.13 and 4.55. Support is at 3-3.25. No news. This is a half-sized position. HOLD

Origin Materials (ORGNW)

Origin warrants are up about a dime this week. It is likely we may not see much movement until the operational commencement of its first carbon negative plastics plant, on schedule for the end of the year. HOLD

Ree Automotive (REEAW)

Management bought shares in the market this past week, a vote of confidence that’s needed: The EV chassis maker is mired below a dollar. Sales and production announcements would do better. There is some hope for 2023, with U.K. production planned. HOLD

ReNew Energy Global (RNWWW)

Warrants are a bit firmer this week. No news for the India renewable energy owner and operator. HOLD

Volta Inc (VLTA.WS)

Volta is cutting staff, corporate costs, and saying current quarter sales will be around $14 million, below prior guidance of $17 million. Management also pulled full-year sales guidance. Warrants shed about 25% this week to 39 cents, reflective of the poor outlook for the business right now. HOLD

Our next SX Greentech Advisor issue will be published Wednesday, October 19. Weekly updates are published every non-issue Wednesday, and any timely notices get distributed as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabot.net. Thank you for subscribing.

The next Cabot SX Greentech Advisor issue will be published on October 19, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.