Hopes of a massive U.S. cleantech spending bill have been revived and appear to be the catalyst to accelerate the positive moves we’ve been seeing in the sector the past few weeks. The bill isn’t a done deal yet, so we need to be wary of being whipsawed if it fails. We’re setting the stage for success with two familiar stocks this week that promise to be leaders in the next leg higher.

Also: Updates on our portfolios, the ESG Three and a look at our Timer.

Cabot SX Greentech Issue: August 3, 2022

Greentech’s Outlook

Commentary on current investing conditions and the Greentech Timer

Political winds have shifted again, to the surprise of many. Investors are heartened by the apparent progress on the Inflation Reduction Act, which would direct $369 billion to energy security and climate change efforts. Touted as the largest greentech spending bill in the U.S. ever (the 2021 infrastructure bill comes close if you include pollution reduction, water and nuclear earmarks), the bill is projected to cut U.S. greenhouse gas emissions by as much as 44% by 2030 (estimates by various researchers vary but tend to be clustered around 40%), compared to the 2005 benchmark of the Paris climate agreement, in which the U.S. pledged a 50% reduction. Renewable energy is considered deflationary because it becomes cheaper to produce energy over time, rather than relying on depleting, increasingly difficult to produce fossil fuels.

The market has reacted very strongly to the unexpected bill – the Wilderhill Clean Energy ETF (PBW) jumped 17% higher the back half of last week, while the less diverse and more Tesla (TSLA)-heavy Nasdaq Clean Edge Green Energy ETF (QCLN) added 14% in the latter half of last week on the news. The move puts our Greentech Timer into a bullish condition, being over the 20-day and 40-day moving averages, which are themselves uptrending. The PBW is below its 200-day, which means there is some resistance ahead (the QCLN is at its 200-day line).

Greentech Timer

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential).

Despite the Timer’s green light, we’re urging caution here – the Inflation Reduction Act isn’t a done deal. It needs the approval of the Senate parliamentarian to be able to pass by simple majority vote rather than face certain defeat with the usual 60-vote threshold. There are also concerns enigmatic Arizona senator Kyrsten Sinema may scuttle the bill. Failure of the bill likely would spark a return to the exits, and last week’s big jump could become this week’s big plunge.

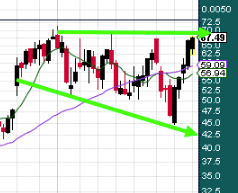

In particular, while the gains last week broke the downtrend line on prices that started with November’s mini peak, Greentech remains below the downtrend line from the February 2021 peak. The green arrow here shows that line, as well as the 40-week (200-day) line in purple. Both signify a bearish overhang to be aware of.

In the major Greentech subsectors, solar is bullish, water is bullish but not as firm as solar, nuclear is mostly bullish, wind is mixed and EVs are more negative than positive.

Featured Stock: Enphase Energy (ENPH)

Overview

U.S. residential solar installations had its biggest quarter ever to start 2022, rising 30% from the year prior to 1.2 gigawatts of installed power. The total market now has 126GW enough to power 22 million American homes, according to the Solar Industries Energy Association.

Since solar panels take sunlight and convert it into direct current (DC), the electricity needs to be shifted to alternating current (AC) to be useable by households. That requires an inverter, which flips the power from DC to AC. String inverters aggregate the power from a roof’s solar panels (or a sizeable batch of around 10 panels) and then convert the power to AC altogether. They’re cheaper up front, generally reliable, but have the downside of being only as efficient as the least-efficient panel. That can be affected by everything from tree shade to bird droppings or simple panel variability. When a string inverter fails, all power from it ceases. Another type of inverter is a microinverter, which are inverters situated with each panel, transforming the power at the source before feeding into the household or its storage system later. They’re close to double the cost a string inverter and roughly 15% of the total cost of a home’s solar system, but they have the benefit of being able to monitor each panel independently and avoid full power shutdowns if a panel or inverter fails. In between those two options, are centralized string inverters with optimizing electronics co-located with the panels.

Business Model

Enphase Energy (ENPH) makes microinverters, competing primarily in the U.S. with SolarEdge (SEDG), a maker of string inverters, as well as a handful of mainly European businesses that have slivers of U.S. market share. Enphase posted sales of $972 million in the first two quarters of the year, up 57% compared to the first half of 2021. Its gross margin was 42.2% in the second quarter, which management reported last week, up 2.6 points from two years ago. The business produced GAAP net income of $77 million in the quarter. The results beat the high end of Wall Street expectations, thanks to good demand for its latest microinverter the IQ8 – an innovation that allows a homeowner’s solar panel to form its own grid to provide power even if the broader utility grid is offline. The company shipped 3.3 million microinverters last quarter, 37% of which were the IQ8. The bulk – 80% – of total sales are in the U.S.

Enphase has been aggressively expanding its product offerings, using its presence with customers to sell more cleantech products into the house, including energy storage batteries (it sold 132.4 megawatt hours of its IQ Batteries in Q2). The company plans to introduce portable energy – to, say, carry to power devices on a long weekend away – as well as EV charging, through the recent acquisition of Clipper Creek, a fellow California company founded in 2006 like Enphase. Management says a typical Enphase customer spent about $2,000 on microinverters for their rooftop solar. The new products and services, such as load management software, will allow them to return to existing customers and see if they can sell a further $6,000 of Enphase products.

Business Outlook

Management told analysts last week that third (current) quarter customer demand is robust, higher than they had previously estimated, and availability of components to produce product to meet demand is better than it has been since the start of the pandemic. Between 130 and 145 megawatts hours of microinverters should be shipped this quarter. For the year, the company should be able to generate $4.01 in earnings per share on $2.2 billion sales.

Enphase now has the capacity to produce 5 million microinverters quarterly through manufacturing capacity agreements around the world (the business has no owned factories). New capacity in Romania will bump capacity to 6 million a quarter starting in 2023.

Longer term, the company seeks to be a whole-home energy management provider, through the products mentioned above – the microinverters, energy storage, related power management and load management software and EV chargers.

The American market has lots of room for growth – there are 140 million houses in the country, meaning just 15% of homes have solar now. Enphase has also begun focusing on international markets, especially Germany, which It feels provides a fertile market for broad whole-home system sales. Germans tend to buy such systems when installing solar and the country has a long track record as a strong solar market. Enphase is planning to expand sales of its IQ8 microinverters to the Netherlands and France this year and is seeing progress, albeit slower, in expansion into Australia.

Over the next two years, by the end of 2024, estimates are that Enphase can grow sales more than 50% to $3.6 billion and generate EPS in the mid-$5 range.

Issues to Consider:

- Enphase’s excellent year shows that demand and growth exist without new government incentives.

- The inflation bill likely will include 10 years of tax credits for homeowner clean energy projects (as well as utility-scale ones). This clearly would benefit U.S. companies like Enphase.

- An expected $7,500 credit for a new EV and $4,000 for used EVs will also boost EV demand, and in turn demand for home chargers Enphase provides.

- The IQ8 microinverter provides larger margins which are starting to be seen in the results, even as the mix of the product in overall sales is still ramping up.

- American concerns over grid unreliability should give the self-grid of the IQ8 a strong appeal in the market (Europe’s grid are more reliable, so consumers have less concern there).

- Battery demand is good but has been held back by supply chain issues on components for that product line, according to management.

Technical Analysis

ENPH gapped higher then had a runaway gap last week to new all-time highs, all bullish signals. The move came out of a rising triangle formation formed from March this year, which suggests ENPH is acting as technical analysis would predict, giving us some more confidence here. That said, the projected move from the triangle, 80 points on top of its upper line at 200, is about exhausted. This implies the “buy the rumor” action of the inflation bill has run its course. The next catalyst has to be actual passage of the bill; lack of passage will likely whipsaw shares to the 200-210 area. We already know shares can be volatile, having swung from a high of 282 in November to a low of 113 by January, stopping us out of a prior position.

What to Do Now

Enphase should be a leader in the next up leg of the long-term Greentech market – it’s a market leader in a fast-growing U.S. solar market that is seeing good acceptance in new international markets. From experience with clean energy politics, back to the end of the second Bush administration, we feel the risk of political implosion is too high to be buyers right now, despite the market and sector having both turned into uptrends. Buy if the inflation bill passes; otherwise, we’ll wait for a more opportune entry closer to the 40-day moving average, which sits at 209. Shares seem overextended compared to their history. WATCH

Enphase Energy (ENPH)

Revenue (trailing 12 months): $1.74 billion

Earnings per share (TTM): 1.44

All-time high (intraday): 295.60

Market cap: $39.8 billion

Recommendation: Watch

Intended Portfolio: Real Money

Featured Stock: Onsemi (ON)

Overview

Greentech requires a lot of high-heat-tolerant components. In particular EVs, EV chargers and renewable energy management systems push traditional silicon chips beyond optimal operation. That is leading to the emergence of alternate chips made from silicon carbide (SiC) or gallium nitride (GaN), both of which can handle the high heat with less loss of electrical efficiency than silicon. The alternative chip market is relatively small right now, with sales of about $3 billion worldwide for SiC and about $300 million of GaN. But they are expected to grow swiftly as EVs, chargers and renewable energy grow.

Business Model

Onsemi (ON) is a chipmaker than is pivoting away from producing lots of commodity-like silicon chips into the higher value silicon carbide market. Its reputation since being spun off by Motorola in 2000 as a more commodity-type producer of chips means Onsemi (known as ON Semiconductor until changing its name a year ago) has often been trading at a discount. Even as the business gains traction in the higher margin SiC market, driven by demand from EV makers and clean energy grid demands, it trades at just a price-to-earnings of 20, under the average S&P 500 index PE of 21 (Onsemi is an S&P component since June). The business is trading hands at just 13 times forward earnings.

In its latest quarter, sales hit $2 billion, a rise of 25% over 2021, with earnings per share of $1.34. The automotive industry was 38% of sales. Onsemi provides a slew of chips to automakers, many traditional silicon-based, and demand for chips keep rising thanks to EVs and energy efficiency, as well as demand for chips for features like blind spot warning systems, lane assist, lidar and other modern conveniences. Industrial applications were 28% of sales, for “intelligent” applications to manage electrical grids, commercial power, smart buildings and the like. These two sectors are Onsemi’s target market, with the balance consisting of flat-growth industries and non-core areas they are seeking to exit that still constitute about $600 million (in the recent quarter) of business. Onsemi has long been a top-10 chip supplier to automakers, providing some 10,000 styles of chips.

Business Outlook

At the end of 2020, a new CEO, Hassane El-Khoury, took the helm of Onsemi with a goal of refocusing the business on higher margin businesses – the company targets a gross margin (non-GAAP) of 48% to 50% and it’s a closely watched figure by Wall Street as a result. The non-core businesses Onsemi is exiting are much lower margins – the remaining $600 million to be exited have a margin of about 40%.

Then future of the business is in large-sized SiC wafers. Gearing up to meet customer demand means the SiC business is dragging margins down somewhat (SiC operations are a percentage point or two below the target zone) but should expand higher next year. The SiC business will primarily come from automakers, with the company estimating every EV customer will use about $700 of chips per car, well above chip sales into traditional vehicles.

For the third (current) quarter, management says demand outstrips their supply in automotive and industrial sectors, with weakness in the non-core business, as is being seen in the industry. The company should post sales of $2.1 billion for the current quarter with the gross margin in the target zone of 48% to 50%

Onsemi has positioned itself as a leading SiC supplier. In late 2021, Onsemi closed a $415 million purchase of GT Advanced Technologies, which produces high quality silicon carbide crystals for the chip industry. That secures Onsemi the raw SiC needed for expansion, and gives it greater ability to sell excess to other fabricators. By the end of this year the company will purchase its 300-millimeter SiC production facility in upstate New York from Globalfoundries. They lease the facility right now.

The capacity moves should result in SiC sales hitting $1 billion in 2023, with a goal of $4 billion longer term. EVs will drive the vast majority of growth in coming years, with renewable energy applications expected to be a longer ramp up but significant as well, in the long term.

For 2022, expectations are for $4.98 per share net income on sales of slightly over $8 billion.

Issues to Consider:

- Onsemi sells into the China EV market, meaning it is exposed to manufacturer stops and starts from that country’s continuing periodic lockdowns over Covid-19.

- Chip sales are economically sensitive and shares have been trading with inflation fears.

- The company’s ramp-up to SiC capacity could be more costly than expected, affecting target gross margin.

- Onsemi’s traditional valuation discount to other chipmakers may persist.

Technical Analysis

ON has an excellent Relative Strength performance to the S&P, with its relative performance hitting a recent high against the market, a sign shares should continue to improve. Shares are in a consolidation zone between 45 and 70, setting up for a potential breakout.

Intriguingly, ON shares are in a broadening top, a chart pattern where a line of resistance – call it about 69 for Onsemi – is the top of a triangle that is widening outward – that is, lower lows as it moves from its starting point, as seen in the weekly chart detail here, with the green arrows, beginning in November 2021.

Based on research by Thomas Bulkowski, a well-regarded technical analyst of chart patterns, an upward breakout from this pattern can be a superb performer in this type of market, – if we really are at the start of a reversal of the sector trend from bearish to bullish. I don’t have much experience trading broadening patterns, so I can’t put much weight on it, but it adds to a confluence of positive indicators for shares and Bulkowski’s research is well built.

What to Do Now

The recent move in shares from a low of 47 at the start of July to a recent 67 is likely a product of the semiconductor manufacturing bill being passed, to encourage domestic building of semiconductors. There is risk in anticipating a breakout for shares here and the safer move would be to wait for the breakout over 71 before buying. We also recommend waiting to see if the Inflation Reduction Act gets passed. WATCH

Onsemi (ON)

Revenue (trailing 12 months): $7.62 billion

Earnings per share (TTM): 17.04

All-time high (intraday): 71.25

Market cap: $28.5 billion

Recommendation: Watch

Intended Portfolio: Real Money

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

McKesson Corp. (MCK)

What is it?

A pharmaceutical and medical supplies distributor.

Why is it ESG?

Low risk of corporate corruption given its main markets are the U.S. and European Union. After the opioid epidemic, management has instituted data mining and analytics to better monitor its controlled substance operations. Board structure is considered the most shareholder friendly among its peer group.

Why now?

The company is selling most of its E.U. operations by the end of 2022, which should improve overall margins. Total prescriptions are starting to rebound to pre-pandemic levels.

Synopsys Inc. (SNPS)

What is it?

A provider of design and automation tools for designing and manufacturing silicon chips.

Why is it ESG?

Strong employee pay and incentive plans along with employee engagement programs to retain workers. The company addresses data and privacy concerns with security training.

Why now?

It’s repurchasing shares and making acquisitions to better position itself among what is seen as a downcycle to come in traditional silicon chipmaking. The stock is among the best relative performers among the most widely held ESG stocks.

Cadence (CDNS)

What is it?

A provider of design systems and tools for electronics manufacturers.

Why is it ESG?

A gender and ethnically diverse board that also exhibits best practices for ethical oversight. Excellent employee benefits and engagement practices.

Why now?

Recent acquisitions will bolster the company’s ability to provide molecular-level tools, a growing frontier of computer chip and electronics design.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 8/3/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.88 | 1.96% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.11 | -52.17% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.10 | -50.00% | Hold | None |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 33.94 | 1.59% | Hold | Around 28 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.78 | 3.60% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.11 | -38.89% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.18 | 5.88% | Hold | None |

| Li Auto | LI | 7/21/22 | 36.01 | 34.12 | -5.25% | Buy | None |

| Montauk Resources | MNTK | 12.63 | Watch | ||||

| Natural Grocers by Vitamin Cottage | NGVC | 16.90 | Watch | ||||

| Ormat Technologies | ORA | 8/1/22 | 86.72 | 87.10 | 0.44% | Buy | None |

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 14.03 | 1.08% | Buy | None |

* Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

* Returns don’t include dividends of $0.3536 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 8/3/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.90 | -46% | Hold | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 1.95 | 84% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 65.84 | 3% | Hold | |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.53 | 0% | Buy | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.70 | -29% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.20 | -51% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.12 | -89% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.29 | -29% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.48 | -78% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

No news on the Greentech SPAC, which is searching for a merger. HOLD

Clearway Energy (CWEN/A)

Clearway results released yesterday saw earnings leap to $4.89 a share due to the one-time gain from the sale of its thermal energy business (heating buildings) for $1.29 billion. Stripping that out, the results were a tad disappointing and sent shares lower on the day, but still over areas of support. The company will pay a dividend of 36.04 cents per share to owners as of September 1. HOLD

Growth for Good Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news from the ESG SPAC, which is searching for a merger. HOLD

Li Auto (LI)

Li reported July deliveries of 10,422 of its ONE EV model, up 21% from the year prior. Shares have weakened since we purchased but generally appear fine. BUY

Montauk Renewables (MNTK)

Shares have moved over their 200-day line as we wanted to see. We are inclined to wait until earnings, out next week, before buying. The company will report earnings on August 9 after the close. Consensus is for earnings of 14 cents per share. WATCH

Natural Grocers by Vitamin Cottage (NGVC)

NGVC remains tight and on support. Earnings are reported Thursday, August 4, after the market closes. Consensus looks for 20 cents a share earnings. WATCH

Ormat Technologies (ORA)

We recommended buying the geothermal power generator Monday with a pre-market special bulletin given it settled over our target breakout price on Friday. The portfolio added ORA at 86.72, the mid-point of the high and low prices for the day. Today after trading the company releases earnings. Expectations are for 20 cents EPS. BUY

Vertex Energy (VTNR)

We’re about break-even on the renewable diesel maker, and shares look generally bullish. Vertex reports earnings August 9 before the open, with consensus seeing $1.24 earnings per share. HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June 2021 we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed in February at a total of a 127% return.

ADS-Tec Energy (ADSEW)

No news for the German fast-EV-charger maker. Our warrants are slightly weaker, while shares are consolidating in the 8 area. HOLD

Altus Power (AMPS/WS)

Altus will report earnings before the market opens on August 15. There is no consensus call on Wall Street; we’re looking for the business to stay on track to generate $120 million sales, which means this quarter and the next two need to average about $33 million. GAAP income will probably be helped by the lower cost of shares and warrants, which due to accounting from the SPAC merger, can muddy the long-term picture. Our warrants are showing good trading. HOLD

Constellation Energy (CEG)

Constellation leapt last week on news that enhanced tax credits for nuclear energy are included in the inflation bill. We don’t have a sell-stop on CEG, but anytime we’re profitable is a good time to put a break-even stop-loss on shares. We will wait to put on a formal stop until we see earnings, being released tomorrow before the open of trading. Consensus is for 55 cents per share earnings. HOLD

ESS Technology (GWH.WS)

ESS would also benefit from the inflation bill, and its shares have improved this past week, while our warrants have improved a little. Q2 earnings will be announced August 11, after the close of trading. Everyone wants to see revenue recognition on installed units in San Diego. Booking the sales has been delayed due to one-off contractual goalposts management hasn’t fully detailed. The warrants here are a bet that shares will eventually improve to over 10, leading to a profit based on the conversion rate of warrants to shares. BUY

FuelCell Energy (FCEL)

There is mention of support for hydrogen in the inflation reduction act, which benefits fuel cell stocks, which use hydrogen to generate electricity. We’re not seeing a great deal of movement in FCEL because the details are still vague. HOLD

Origin Materials (ORGNW)

Management announces quarterly results ahead of trading today August 3, with expectations for a loss of seven cents per share. More importantly is management continuing to report the opening of its first carbon-negative plastics plant is on track for Q4 this year. Shares and our warrants are holding up well going into earnings. HOLD

Ree Automotive (REEAW)

Ree got no lift from showing off the prototype for a walk-in delivery van. Nevertheless, steps toward production can only be a positive for the EV chassis maker. HOLD

ReNew Energy Global (RNWWW)

India’s largest renewable energy owner/operator is weak but fine, with our warrants a little stronger this week and shares stable. HOLD

Volta Inc (VLTA.WS)

EV charger maker Volta would benefit from more emphasis on EVs from the federal government. Shares and our warrants are up about a third the past week as a result, though remain weak. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue is published Wednesday, August 17. Weekly updates are published every non-issue Wednesday, and any timely notices get distributed as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabotwealth.com.

The estimated carbon generated in the production and distribution of this newsletter is offset by CO2 removal with Climeworks at its plant in Iceland.

The next Cabot SX Greentech Advisor issue will be published on August 17, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.